1. What is the projected Compound Annual Growth Rate (CAGR) of the Cabin Air Filter Service?

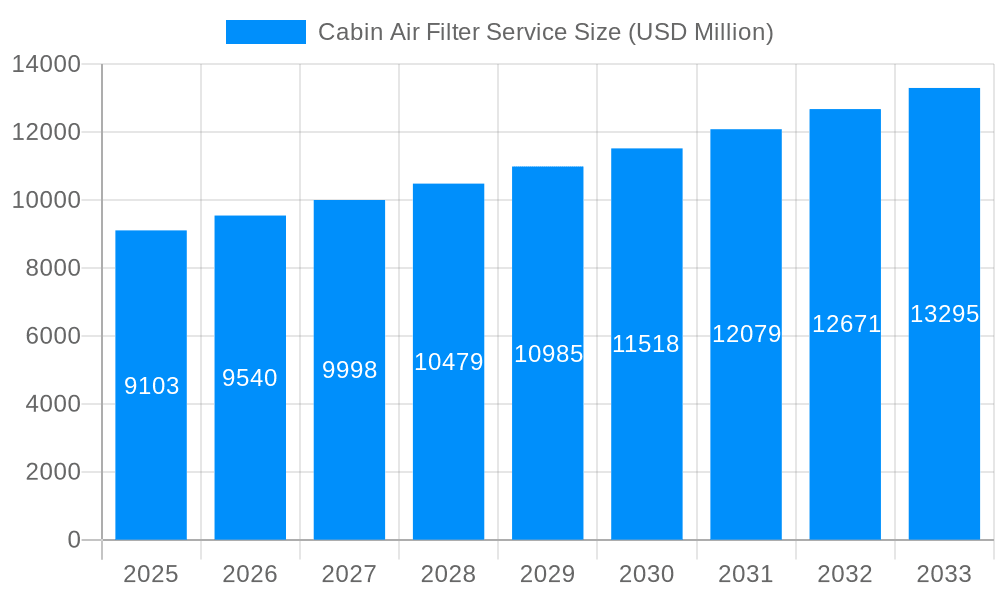

The projected CAGR is approximately 4.8%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Cabin Air Filter Service

Cabin Air Filter ServiceCabin Air Filter Service by Type (Cabin Filter, Workshop Air Filter, Oil Filter, Fuel Filter), by Application (Passenger Car, Commercial Vehicle), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

The global cabin air filter service market is experiencing robust growth, driven by increasing vehicle ownership, heightened consumer awareness of air quality, and stricter emission regulations. The market's expansion is further fueled by the rising prevalence of allergies and respiratory illnesses, prompting drivers to prioritize cabin air filtration. While precise figures for market size and CAGR are unavailable, based on industry trends and the growth observed in related automotive service sectors, a reasonable estimate for the 2025 market size could be in the range of $2-3 billion USD. This figure is projected to expand at a compound annual growth rate (CAGR) of approximately 5-7% through 2033, reaching an estimated $3.5 - $5 billion USD by the end of the forecast period. Growth will be influenced by factors such as technological advancements in filter technology (e.g., HEPA filters, activated carbon filters), increasing integration of cabin air filtration systems into new vehicles, and the growth of the aftermarket service sector.

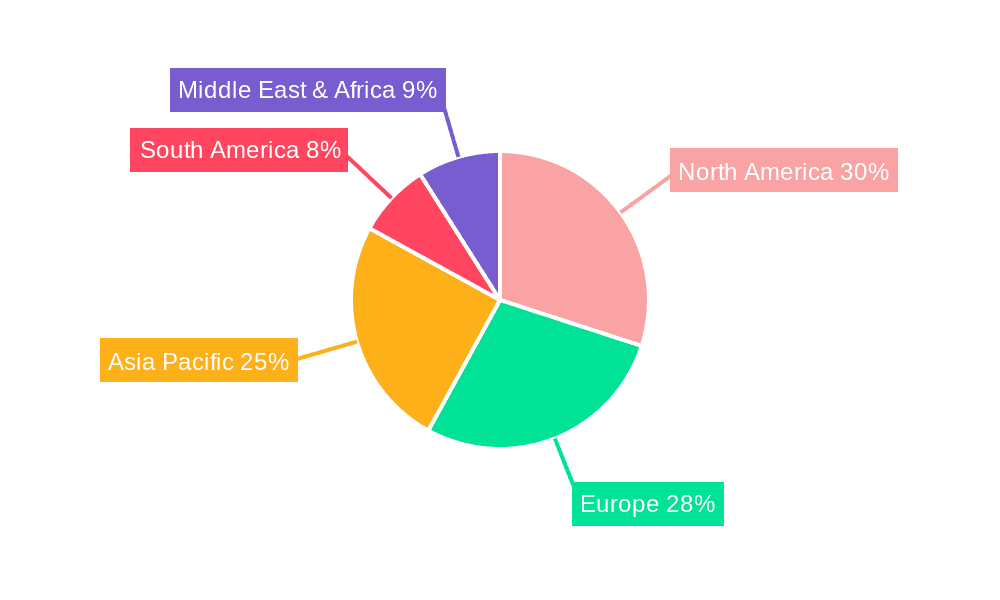

Significant regional variations are anticipated, with North America and Europe currently holding substantial market shares due to high vehicle ownership rates and well-established automotive service infrastructures. However, rapid economic growth and rising vehicle sales in Asia-Pacific regions, particularly in countries like China and India, are poised to fuel significant market expansion in these areas over the next decade. Market segmentation by filter type (cabin, workshop, oil, fuel) and vehicle application (passenger car, commercial vehicle) offers further insights into specific growth trajectories. The passenger car segment is likely to remain dominant, due to higher vehicle ownership compared to commercial vehicles. However, increasing awareness of air quality in commercial vehicles, especially for fleets and public transport, will contribute to growth in this segment. Restraints to market growth may include price sensitivity in certain markets and competition from less costly, lower-quality filters.

The global cabin air filter service market exhibited robust growth during the historical period (2019-2024), exceeding 200 million units serviced annually by 2024. This expansion is projected to continue throughout the forecast period (2025-2033), driven by several interconnected factors. Increasing vehicle ownership, particularly in developing economies, fuels demand for regular maintenance, including cabin air filter replacements. Simultaneously, rising consumer awareness of air quality and its impact on health is prompting more frequent service intervals. The shift towards cleaner and more efficient vehicles also contributes to the market's growth, as modern engines and air conditioning systems rely on effectively functioning cabin air filters. This trend is further amplified by the increasing prevalence of allergies and respiratory illnesses, prompting individuals to prioritize cleaner cabin air. While the market demonstrated significant resilience during economic fluctuations, potential future economic downturns could mildly affect service frequency, but the underlying demand for healthier in-car environments is expected to remain strong. The market is witnessing a shift towards specialized filters offering advanced features like antibacterial and anti-viral properties, further driving up the average service value. This report analyzes the market’s performance and potential, providing insights into key players, regional variations, and future growth projections. The estimated market size in 2025 is projected to be around 250 million units serviced, representing a substantial increase from the base year.

Several key factors are propelling the growth of the cabin air filter service market. Firstly, the increasing awareness of indoor air quality and its impact on health is a significant driver. Consumers are becoming increasingly conscious of the pollutants and allergens present in the air, leading to a greater demand for clean and healthy cabin environments. This is particularly true in regions with high levels of air pollution. Secondly, the rising number of vehicles on the road globally, especially in developing countries, is expanding the overall market size. More vehicles translate directly into a greater need for regular maintenance services, including cabin air filter replacements. Thirdly, technological advancements in cabin air filters are adding value to the service. The introduction of filters with enhanced filtration capabilities, like those with antimicrobial properties, is attracting consumers willing to pay a premium for improved air quality. Finally, the growing popularity of extended warranties and service packages offered by dealerships and independent garages is encouraging more customers to opt for regular maintenance, including cabin air filter changes. These combined factors create a powerful synergy driving significant growth within the cabin air filter service sector.

Despite the positive growth trajectory, the cabin air filter service market faces several challenges. One significant hurdle is the competitive pricing landscape, with various service providers vying for customers, often leading to price wars that can compress profit margins. Furthermore, the dependence on vehicle ownership levels makes the market susceptible to economic downturns. During periods of economic uncertainty, consumers may delay non-essential maintenance like cabin air filter replacement, impacting service volumes. The availability of DIY options presents another challenge; many individuals choose to replace their cabin air filters independently, reducing the demand for professional services. This is especially true for easily accessible filters in some vehicle models. Additionally, the market's success is tied to maintaining a consistent consumer awareness campaign emphasizing the importance of regular filter replacements for respiratory health and overall vehicle performance. Neglecting this could lead to a decline in demand. Finally, variations in regulatory requirements across different regions can complicate the market's expansion and standardization.

The passenger car segment is expected to dominate the cabin air filter service market throughout the forecast period. This is primarily due to the significantly larger number of passenger vehicles compared to commercial vehicles on the road globally. Within this segment, North America and Europe are projected to be the leading regions, driven by high vehicle ownership rates, strong consumer awareness of air quality, and established service infrastructures. However, the Asia-Pacific region is poised for substantial growth, fueled by rising vehicle ownership and increasing disposable incomes. Specifically, rapidly developing economies within Asia-Pacific, such as China and India, are anticipated to witness a significant rise in demand for cabin air filter services.

Passenger Car Segment Dominance: The sheer volume of passenger vehicles on the road globally makes this segment the largest contributor to the market's overall size. The ease of access to filters and relatively shorter replacement intervals compared to commercial vehicles also contribute.

North America and Europe's Mature Markets: These regions benefit from established service networks, high consumer awareness, and strong regulatory frameworks promoting vehicle maintenance.

Asia-Pacific's Emerging Growth: Rapid economic development and increasing car ownership in countries like China and India are creating significant growth opportunities.

Commercial Vehicle Segment's Steady Growth: Although smaller than the passenger car segment, the commercial vehicle sector is expected to witness consistent growth driven by fleet maintenance requirements and the growing focus on driver health and safety in commercial operations.

The growth of the cabin air filter service industry is significantly catalyzed by the rising awareness of air quality's impact on health, combined with the increasing vehicle population, especially in developing nations. Technological advancements in filter technology, creating high-efficiency and specialized filters (e.g., those with anti-allergen properties), also play a vital role. Furthermore, the growing integration of service packages and extended warranties provided by automotive dealerships and service centers further drives routine maintenance and cabin air filter replacements.

This comprehensive report provides an in-depth analysis of the cabin air filter service market, encompassing historical data, current market trends, and future projections. It covers key segments, regional breakdowns, and profiles leading market players, offering invaluable insights into this dynamic and growing sector. The report’s data-driven approach provides a clear understanding of the factors driving growth, the challenges faced, and the opportunities available to businesses in the cabin air filter service industry.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.8% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 4.8%.

Key companies in the market include Jiffy Lube, Certified Service, Lindsay Volkswagen, Goodyear Auto Service, Toyota Direct, Ontario Motor Sales, Stone Mountain Volkswagen, Victory Chevrolet, Premier Hyundai, Stanley Subaru, Spitzer Lincoln DuBois, Eccles Auto Service, Burlington Kia, Carlsbad Auto Service, Burlington Volkswagen, Bimmex, AAMCO Pickering, Feldman Chevrolet of Livonia, Pal Auto Service & Body Shop, Mossy Volkswagen, LEXUS OF CALGARY, MacPhee Ford, TIRECRAFT, Sherwood Ford.

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in N/A.

Yes, the market keyword associated with the report is "Cabin Air Filter Service," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Cabin Air Filter Service, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.