1. What is the projected Compound Annual Growth Rate (CAGR) of the Business Webcams?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Business Webcams

Business WebcamsBusiness Webcams by Type (USB Ports, Wireless), by Application (Common Network Chatting, Video Conference, Remote Medical, Automobile, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

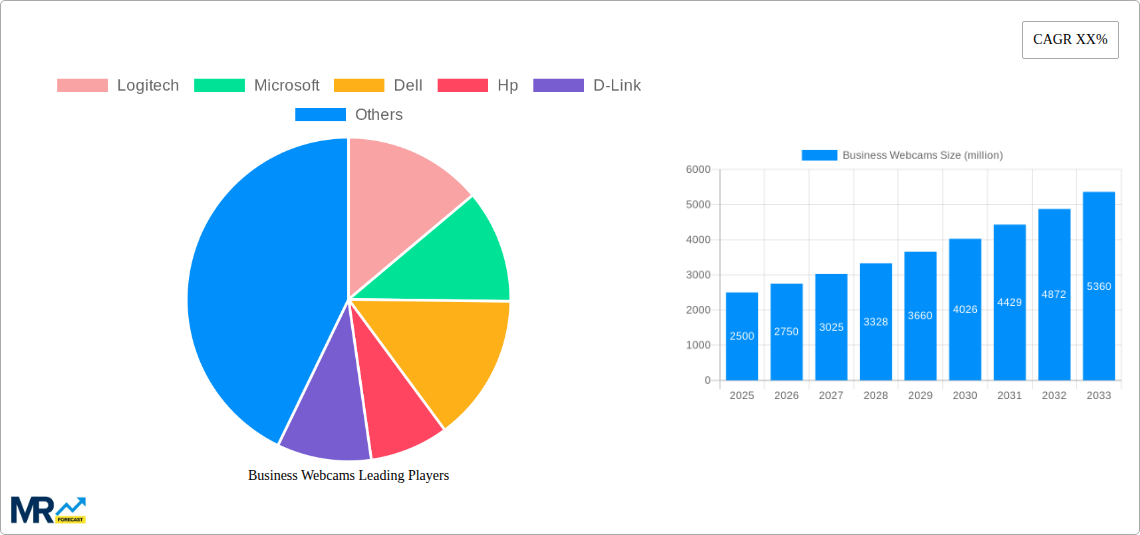

The global business webcam market is experiencing robust growth, driven by the increasing adoption of remote work and hybrid work models. The transition to virtual collaboration and online meetings, accelerated by the recent pandemic, has created a significant demand for high-quality webcams capable of delivering clear audio and video for professional use. This demand is further fueled by advancements in webcam technology, including improved resolution, better low-light performance, and enhanced features such as noise cancellation and auto-framing. The market is segmented by resolution (HD, Full HD, 4K), features (built-in microphone, autofocus, privacy shutter), and application (video conferencing, online education, live streaming). Major players like Logitech, Microsoft, and Dell dominate the market, leveraging their established brand reputation and extensive distribution networks. However, smaller companies are also gaining traction, offering niche products with competitive pricing and specialized features. While the market shows strong growth potential, challenges such as price sensitivity in certain segments and the potential for market saturation in mature regions could act as restraints. The forecast period of 2025-2033 projects continued growth, driven by sustained demand from enterprises and increasing adoption in developing economies. This expansion will likely be influenced by technological innovation, such as the integration of artificial intelligence for enhanced video quality and user experience.

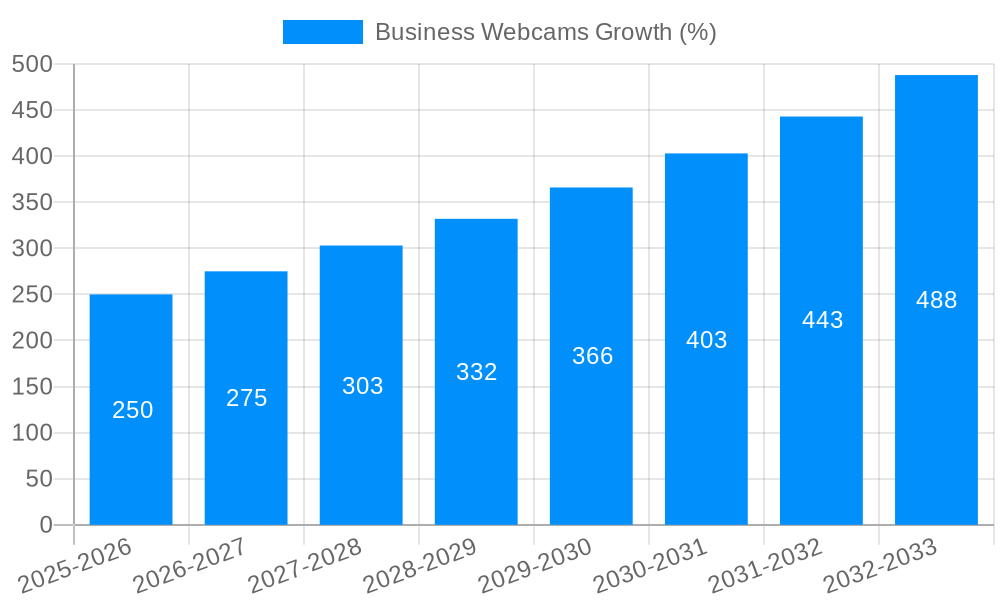

The market's CAGR (assuming a reasonable estimate of 10% based on industry trends in similar tech sectors) indicates a substantial increase in market value over the forecast period. This growth is underpinned by the ongoing trend of remote work, which is expected to remain a significant aspect of the business landscape for the foreseeable future. Furthermore, the rising popularity of online education and virtual events contributes to the expansion of the business webcam market. However, economic fluctuations and the potential for substitution with integrated laptop cameras could pose challenges to sustained growth. Continuous innovation in webcam technology, coupled with effective marketing strategies by key players, will play a critical role in shaping the future of this market.

The global business webcam market exhibited robust growth throughout the historical period (2019-2024), driven primarily by the widespread adoption of remote work and virtual collaboration tools. The sudden shift to remote work during the COVID-19 pandemic acted as a significant catalyst, boosting demand exponentially. While the market experienced some normalization post-pandemic, the ingrained shift towards hybrid and remote work models ensured sustained growth, exceeding initial projections. The estimated market size in 2025 is projected to reach several million units, reflecting the continued reliance on video conferencing for business communication. This trend is expected to persist, with various industry segments, including education, healthcare, and finance, increasingly relying on high-quality video conferencing solutions. The market is witnessing a clear shift towards higher-resolution webcams with advanced features such as autofocus, noise cancellation, and improved low-light performance. Businesses are investing in superior video conferencing equipment to enhance the overall experience and ensure seamless communication. This preference for premium features is driving average selling prices upward, contributing to market value growth. However, economic fluctuations and changing work patterns could influence future market dynamics, requiring close monitoring of key macroeconomic indicators. The forecast period (2025-2033) promises further expansion, albeit at a potentially moderated pace compared to the rapid growth observed during the pandemic's peak. The market will witness increasing competition, innovation, and a focus on delivering cost-effective yet high-performing solutions to cater to a broader range of businesses. The integration of AI-powered features like automatic framing and background blurring is expected to further enhance the market appeal and drive higher adoption rates.

The surge in remote work and hybrid work models stands as the primary driver of the business webcam market's expansion. Businesses across various sectors recognized the critical need for effective virtual communication to maintain productivity and collaboration amidst geographical dispersion. This necessity fueled significant investments in webcam technology, driving demand for both high-end and budget-friendly options. The parallel growth of video conferencing platforms like Zoom, Microsoft Teams, and Google Meet further solidified this trend, creating an ecosystem where high-quality webcams are essential components. Moreover, the increasing adoption of online training, distance learning, and virtual healthcare further expanded the market's addressable audience. The rising need for clear and reliable visual communication in these sectors contributed to significant market growth. Furthermore, technological advancements, including improved image quality, enhanced features like noise cancellation and auto-framing, and the integration of AI capabilities, have made business webcams more appealing and functional. Businesses are increasingly aware of the positive impact of superior video communication on their overall operational efficiency and brand image, prompting them to invest in state-of-the-art equipment.

Despite the strong growth trajectory, the business webcam market faces several challenges. Price sensitivity, particularly among small and medium-sized enterprises (SMEs), can limit the adoption of higher-end models with advanced features. Businesses operating on tighter budgets often opt for more affordable solutions, which may compromise on image quality and functionality. Competition in the market is also intensifying, with numerous players vying for market share. This competitive landscape necessitates continuous innovation and differentiation to maintain a strong position. Furthermore, the cyclical nature of technology adoption and the potential for rapid technological obsolescence pose challenges for manufacturers. Staying ahead of the curve in terms of technological advancements and ensuring product longevity are crucial for sustained success. Economic downturns or shifts in remote work policies could also impact demand, creating uncertainty in market projections. Finally, supply chain disruptions and component shortages, as witnessed during recent global events, can significantly affect production capabilities and product availability, impacting market growth.

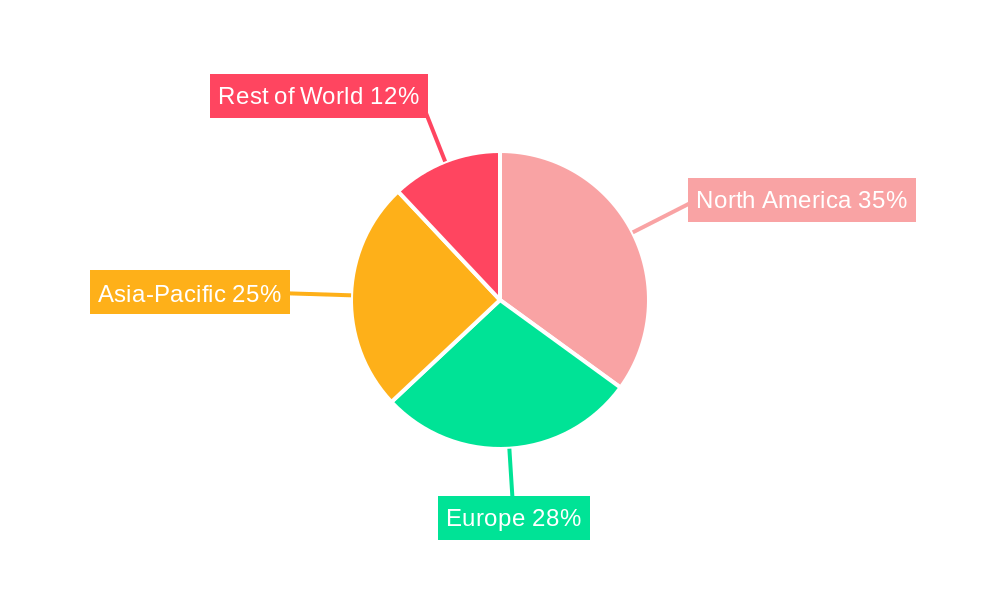

North America: This region is expected to maintain a dominant position due to high technological adoption rates, a substantial number of businesses operating in the hybrid work model, and a strong focus on digital transformation initiatives. The presence of major players in the technology sector further strengthens this region's market leadership.

Europe: Significant growth is projected for Europe driven by similar trends to North America—increased adoption of remote and hybrid work, rising investments in digital infrastructure, and substantial growth in the video conferencing sector.

Asia-Pacific: Rapid economic growth and increasing internet penetration, particularly in countries like China and India, are fueling significant market expansion in the Asia-Pacific region. This is coupled with a burgeoning SME sector and the increasing adoption of advanced technologies by businesses.

Segments: The enterprise segment, encompassing large corporations and multinational organizations, will likely contribute significantly to market growth. These organizations are more likely to invest in premium webcams with advanced features to improve communication and collaboration across their globally dispersed teams.

The high-resolution segment will also see robust expansion, driven by the increasing demand for superior video quality for online meetings, presentations, and training sessions. Users are less willing to compromise on clarity and image quality in professional settings.

The paragraph above highlights the key regions and segments, emphasizing the dominant positions held by North America and the enterprise and high-resolution segments. The other regions and segments show promising growth trajectories but will still be working towards catching up with the current market leaders.

The continuing shift towards hybrid and remote work models, the rapid expansion of video conferencing platforms, and ongoing technological advancements (AI-powered features, enhanced resolution, and improved audio quality) are all significant growth catalysts for the business webcam industry. These factors synergistically drive the need for high-quality, reliable video communication solutions. Furthermore, increased adoption in education, healthcare, and financial sectors further propels market growth.

This report provides an in-depth analysis of the business webcam market, covering market trends, driving forces, challenges, key players, and future growth projections for the period 2019-2033. The detailed insights into key segments and geographic regions offer a comprehensive understanding of this dynamic market, providing valuable information for businesses operating in or planning to enter this space. The data presented, covering historical performance, current market status, and future forecasts, allows for informed strategic decision-making.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Logitech, Microsoft, Dell, Hp, D-Link, Lenovo, Philips, Ausdom, KYE Systems, Motorola, Kinobo, A4Tech, TeckNet, Axtel, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Business Webcams," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Business Webcams, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.