1. What is the projected Compound Annual Growth Rate (CAGR) of the Business Travel Insurance Solution?

The projected CAGR is approximately 15.4%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Business Travel Insurance Solution

Business Travel Insurance SolutionBusiness Travel Insurance Solution by Type (Single Trip Coverage, Annual Multi Trip Coverage, Others), by Application (Insurance Intermediaries, Insurance Company, Bank, Insurance Broker, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

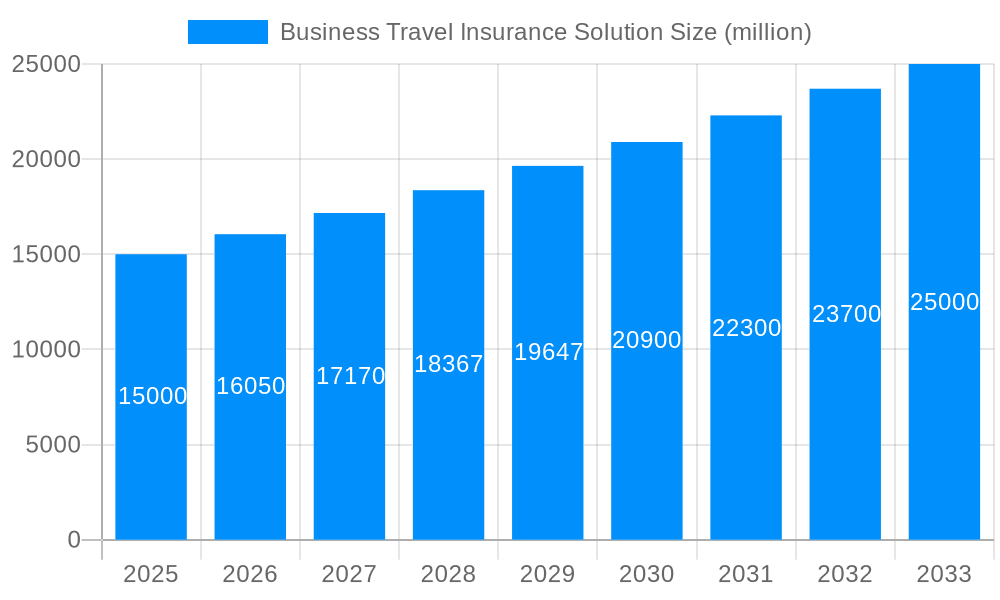

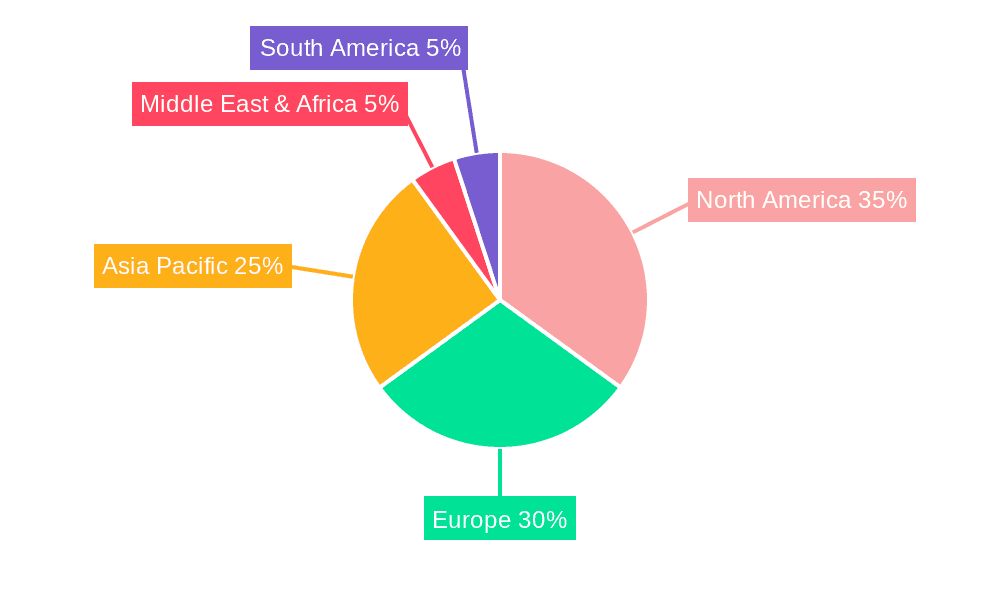

The global business travel insurance market is poised for substantial expansion, driven by increasing international business travel, elevated health and safety concerns, and the growing demand for comprehensive travel protection. The market, projected to reach $26788.56 million by 2025, is anticipated to grow at a Compound Annual Growth Rate (CAGR) of 15.4% from 2025 to 2033. Key growth catalysts include the rising frequency and duration of global business trips, amplified by heightened awareness of traveler vulnerabilities and the necessity for robust insurance following the COVID-19 pandemic. The ease of access through online platforms and digital distribution channels further bolsters market penetration. Analysis indicates a prevailing preference for annual multi-trip coverage over single-trip options, aligning with the needs of frequent business travelers. Insurance intermediaries and direct insurance companies dominate distribution, with banks and brokers gaining prominence. North America and Europe lead market share due to high concentrations of multinational corporations, while the Asia-Pacific region presents significant growth potential, fueled by economic development and increasing business travel in China and India. Potential market restraints include regulatory complexities and global economic volatility.

The competitive environment features established global insurers such as Allianz, AIG, and AXA, alongside specialized regional providers. Competition centers on coverage breadth, pricing strategies, and distribution network effectiveness. Product innovation, focused on evolving business traveler needs, is a critical differentiator. Future market expansion will hinge on insurers' adaptability to changing travel dynamics, the strategic implementation of technological advancements for enhanced service delivery, and the provision of personalized, value-added solutions. Integrating comprehensive coverage with advanced risk management solutions will be paramount for capturing greater market share.

The global business travel insurance solution market exhibited robust growth during the historical period (2019-2024), exceeding USD XXX million in 2024. This surge is primarily attributable to the increasing frequency of international business travel, coupled with growing awareness of potential risks associated with unforeseen events like medical emergencies, trip cancellations, and lost luggage. The rising adoption of comprehensive travel insurance policies by corporations to safeguard their employees during business trips significantly fueled market expansion. The estimated market value for 2025 stands at USD XXX million, reflecting continued positive momentum. The forecast period (2025-2033) projects a compound annual growth rate (CAGR) of X%, indicating a substantial market expansion to reach USD XXX million by 2033. This projection is supported by the anticipated growth in global business travel, particularly in emerging economies, and the continued development of innovative insurance products tailored to the evolving needs of businesses and travelers. Furthermore, technological advancements such as online platforms and mobile applications are simplifying the insurance purchasing process, further contributing to market growth. The competitive landscape is characterized by both established players and emerging insurers, leading to heightened innovation and competitive pricing. The market segmentation reveals a strong preference for annual multi-trip coverage, driven by the cost-effectiveness for frequent travelers. However, the "Others" segment, encompassing specialized and niche offerings, is expected to experience significant growth due to evolving business travel patterns and risk profiles. The increasing demand for customized solutions and embedded insurance further shapes the market's dynamic evolution.

Several key factors propel the growth of the business travel insurance solution market. The foremost driver is the escalating frequency of business travel globally. As globalization intensifies and international collaborations become more commonplace, businesses are sending employees on increasingly more trips, creating a higher demand for protective coverage. Furthermore, the rising awareness among companies and individuals regarding unforeseen risks associated with international travel, such as medical emergencies, natural disasters, and political instability, is a significant driving force. Companies are increasingly recognizing the potential financial and reputational damage resulting from uninsured events involving their employees, leading to greater investment in comprehensive travel insurance solutions. The proliferation of technologically advanced insurance platforms and mobile applications has simplified the purchase and management of travel insurance, making it more accessible to a wider range of businesses and individuals. The increasing availability of customized and flexible insurance packages caters to the diverse needs of different companies and travelers, making insurance more attractive and relevant. Finally, the growing focus on employee wellbeing and duty of care is prompting organizations to provide enhanced travel insurance benefits to ensure the safety and security of their personnel on international assignments.

Despite the positive growth trajectory, the business travel insurance solution market faces several challenges. One significant constraint is the fluctuating global economic conditions. Economic downturns can reduce business travel budgets, leading to decreased demand for insurance. The highly competitive landscape, with numerous established and emerging players, puts pressure on pricing and profitability. Insurers need to constantly innovate and offer competitive products to maintain their market share. The complexity of global regulations and compliance requirements in the insurance sector adds another layer of difficulty, requiring considerable investment in regulatory compliance. The accurate assessment and pricing of risk, particularly in regions with high levels of political instability or natural disaster frequency, remains a challenge. Moreover, effectively managing fraud and claims management is also crucial for maintaining the financial health of insurers within this sector. Finally, ensuring sufficient coverage for rapidly emerging risks, such as cybersecurity threats impacting travelers, poses a continuing challenge.

Annual Multi-Trip Coverage: This segment is poised for significant growth due to its cost-effectiveness for frequent business travelers. Companies with employees regularly traveling internationally find annual policies more economical and administratively efficient than purchasing single-trip coverage for each journey. This translates into higher premiums for insurers and robust market growth.

Application: Insurance Intermediaries: Insurance intermediaries, including brokers and agents, play a crucial role in distributing business travel insurance solutions. Their extensive networks and expertise in risk assessment allow them to effectively reach businesses and tailor insurance packages to their specific needs. The commission-based model incentivizes intermediaries to aggressively promote insurance, leading to high sales volumes and market dominance.

North America: The region's strong economy and high frequency of business travel contribute to significant demand for comprehensive business travel insurance. The established insurance industry and advanced infrastructure further enhance the market's growth potential.

Europe: The significant number of multinational corporations in Europe, combined with the high volume of intra-European and international business travel, fuels robust demand for insurance solutions.

Asia-Pacific: Rapid economic growth and rising disposable incomes in several Asian countries are driving up business travel. While still growing, the market in this region is more fragmented, with different local preferences and regulatory frameworks.

The combined effect of high demand for Annual Multi-Trip Coverage and the significant influence of Insurance Intermediaries in distribution, especially within North America and Europe, ensures the dominance of these segments in the forecast period.

The business travel insurance industry is experiencing accelerated growth due to several key factors. The increasing global interconnectedness and rise in business travel are major drivers. Companies are placing more emphasis on employee well-being and risk mitigation, increasing their reliance on robust insurance solutions. Technological advancements such as online platforms and mobile apps simplify access to insurance. Furthermore, the development of innovative, customized insurance products catering to specific business needs further fuels market expansion.

The business travel insurance market is experiencing robust growth, driven by increased international business travel, greater risk awareness, and technological advancements. Innovative product offerings, coupled with effective distribution strategies, are shaping market dynamics. The market's future growth hinges on adapting to evolving risks, embracing technological innovation, and providing customized solutions that cater to the specific needs of businesses and individual travelers.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.4% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 15.4%.

Key companies in the market include Pin An, AIG, PICC, Allianz, CPIC, AIA, AXA, TaiKang, Chubb, .

The market segments include Type, Application.

The market size is estimated to be USD 26788.56 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Business Travel Insurance Solution," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Business Travel Insurance Solution, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.