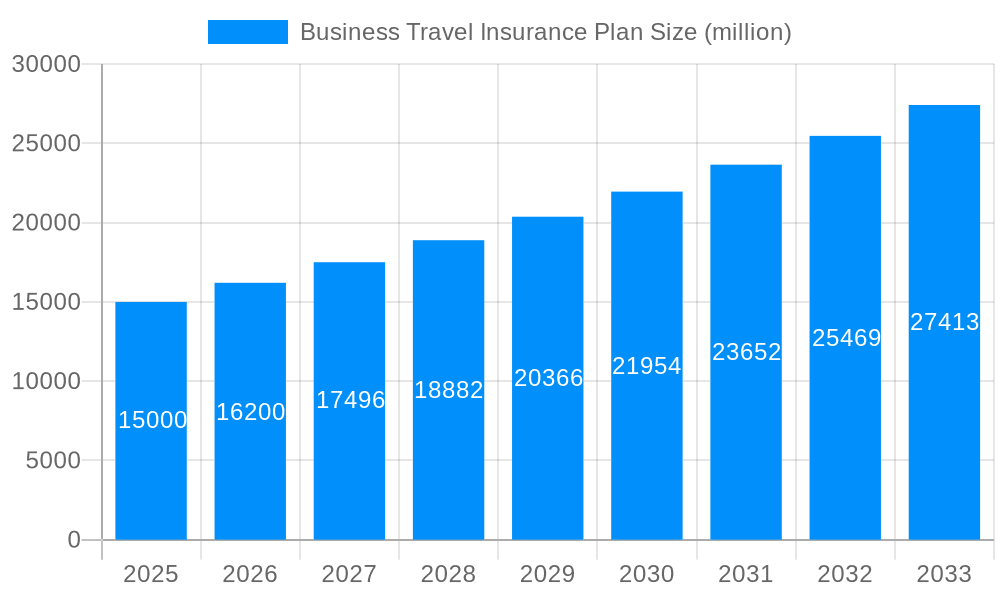

1. What is the projected Compound Annual Growth Rate (CAGR) of the Business Travel Insurance Plan?

The projected CAGR is approximately 3.7%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Business Travel Insurance Plan

Business Travel Insurance PlanBusiness Travel Insurance Plan by Type (Single Trip Coverage, Annual Multi Trip Coverage, Others), by Application (Insurance Intermediaries, Insurance Company, Bank, Insurance Broker, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

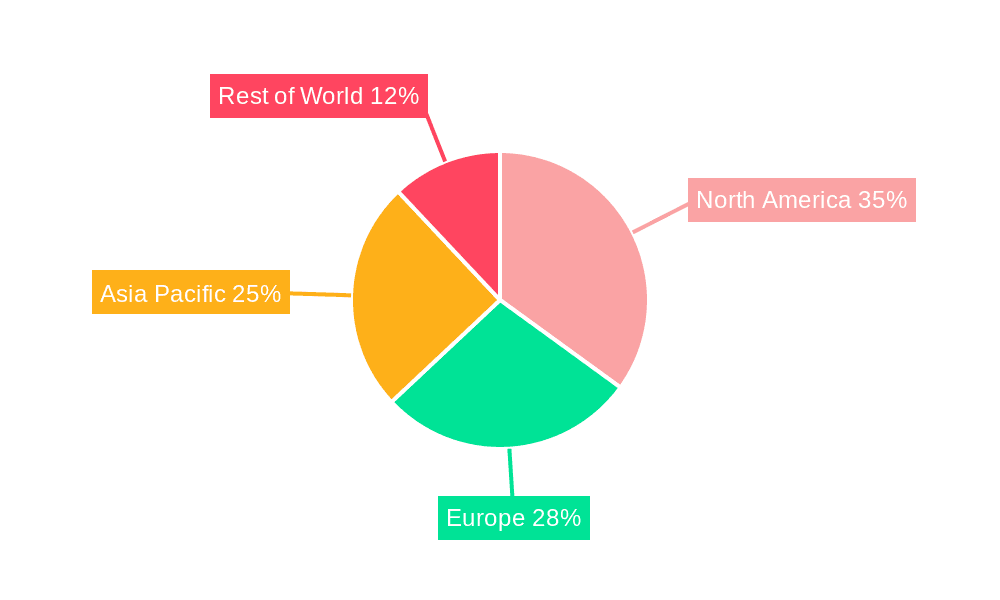

The global business travel insurance market is poised for substantial expansion, driven by the resurgence of business travel, elevated security imperatives, and growing recognition of comprehensive travel protection. The market, valued at $5.8 billion in the base year of 2025, is projected to achieve a Compound Annual Growth Rate (CAGR) of 3.7% from 2025 to 2033, reaching an estimated $8.2 billion by 2033. Key growth drivers include the post-pandemic recovery of international business travel, increased corporate awareness of travel-related financial and reputational risks, and the evolving nature of business travel, including solo trips and travel to emerging markets. The market is segmented by coverage type (single trip, annual multi-trip) and distribution channel (intermediaries, direct insurers, banks, brokers). Annual multi-trip policies are expected to lead, supported by frequent business travelers. Insurance intermediaries and direct insurers currently dominate distribution, with digital platforms and direct-to-consumer sales anticipated to grow. Geographic expansion is projected across all regions, with Asia-Pacific and North America expected to maintain leadership due to high travel volumes and mature insurance sectors.

Market growth may face headwinds from fluctuating exchange rates affecting premiums, economic downturns impacting travel budgets, and varying regional insurance awareness. Nevertheless, ongoing business globalization and innovative solutions like embedded insurance and AI-driven risk assessment are expected to counterbalance these challenges, ensuring sustained market growth. Prominent market participants include global leaders such as Allianz, AIG, and Chubb, alongside regional players like Ping An and AIA. Fierce competition centers on pricing and product innovation.

The global business travel insurance plan market exhibited robust growth during the historical period (2019-2024), fueled by a surge in international business travel and increasing awareness of the risks associated with unforeseen events. The market value, while not explicitly stated in the provided data, can be extrapolated to be in the multi-million dollar range, considering the involvement of major global players like AIG and Allianz. The market's expansion was particularly noticeable in regions with strong economic growth and increasing cross-border business activities. However, the COVID-19 pandemic significantly impacted the market in 2020 and 2021, leading to a temporary contraction as business travel plummeted. The recovery began in 2022, albeit unevenly across different regions and segments. The base year (2025) showcases a stabilization, reflecting renewed confidence in global travel and the importance of risk mitigation strategies for businesses. The forecast period (2025-2033) projects continued market expansion, driven by several factors discussed later in this report. While the single-trip coverage segment has traditionally held a larger market share, we anticipate a growing demand for annual multi-trip coverage, reflecting a shift towards more frequent international business trips among certain companies and demographics. This trend is further underpinned by the increasing adoption of comprehensive insurance packages, pushing the "Others" category into a faster growth trajectory. The market's success will heavily rely on the adaptability of insurance providers to technological changes, shifting business travel patterns, and evolving customer preferences. The competitive landscape is defined by established global players and regional insurers, each vying for market share through innovative product offerings and strategic partnerships.

Several key factors are driving the growth of the business travel insurance plan market. Firstly, the rising frequency and complexity of international business travel creates a heightened need for comprehensive risk protection. Companies are increasingly recognizing the financial and operational disruptions caused by medical emergencies, trip cancellations, lost baggage, and other unforeseen events during business trips. This heightened risk awareness is directly translating into increased demand for robust insurance coverage. Secondly, globalization and the expansion of multinational corporations have fueled the demand for comprehensive insurance solutions that can effectively manage risks across multiple jurisdictions and varying regulatory landscapes. Thirdly, the competitive pressures in the business world necessitate cost-effective yet reliable risk mitigation strategies. Business travel insurance allows companies to efficiently manage these costs and maintain business continuity even during unforeseen circumstances. Finally, government regulations and industry best practices in certain sectors are increasingly mandating travel insurance coverage for employees traveling on company business, further driving market demand. This regulatory push coupled with corporate social responsibility initiatives emphasizes employee safety and well-being, resulting in a more favorable environment for the business travel insurance sector.

Despite the positive growth outlook, several challenges hinder the market's progress. One significant factor is the cyclical nature of the business travel industry; economic downturns or global uncertainties can drastically reduce business travel and, consequently, demand for insurance. The COVID-19 pandemic serves as a prime example of this vulnerability. Furthermore, the intense competition among numerous insurance providers requires companies to constantly innovate and offer competitive pricing and comprehensive coverage to attract and retain clients. This necessitates significant investments in product development, marketing, and technological upgrades. Another significant constraint is the complexity of international regulations and varying claim processes across different countries. Navigating these legal and administrative complexities can increase operational costs and potentially slow down claim settlements, leading to customer dissatisfaction. Finally, effectively communicating the value proposition of business travel insurance to clients and accurately assessing risk profiles to ensure appropriate pricing remains an ongoing challenge.

Annual Multi-Trip Coverage: This segment is projected to experience the fastest growth during the forecast period (2025-2033). Businesses with employees who frequently travel internationally are increasingly adopting annual plans for cost-effectiveness and convenience. The shift towards a more mobile and globally connected workforce directly correlates with this trend. This eliminates the administrative burden of purchasing separate policies for each trip. This segment’s increasing popularity reflects a broader trend of companies prioritizing comprehensive, long-term risk management strategies. The projected market value for annual multi-trip coverage is expected to reach hundreds of millions, significantly contributing to the overall market growth.

Insurance Intermediaries: Insurance intermediaries, including brokers and agents, play a crucial role in distributing business travel insurance plans. Their expertise in navigating the complexities of insurance products and understanding the specific needs of businesses makes them a vital link between insurers and clients. They provide personalized advice, assisting businesses in choosing suitable coverage and processing claims. Their established networks and relationships within the business community facilitate wider market penetration for insurance providers. This segment is expected to hold a substantial market share, particularly as businesses rely on professional guidance to manage their insurance needs effectively. Their expertise in tailored solutions and streamlined processes are especially valuable for businesses operating internationally.

Paragraph: The convergence of these two dominant factors — the preference for annual multi-trip coverage and the vital role of insurance intermediaries — is a key driver of market growth. The ability of intermediaries to effectively promote and sell annual plans directly impacts the expansion of this lucrative segment. The simplification of purchasing processes coupled with customized coverage packages designed to address the unique challenges of frequent business travel has created a synergistic effect, propelling both segments towards significant market dominance during the forecast period. The combination of these two factors makes it a particularly attractive sector for investment and growth. This synergistic relationship is driving the overall expansion of the business travel insurance market, positioning it for substantial growth in the years to come.

The business travel insurance market is poised for significant growth driven by increased awareness of risks associated with international travel, a rise in corporate travel budgets for enhanced employee safety, and technological advancements that streamline insurance purchase and claims processing. The rising demand for customized and flexible insurance packages tailored to specific business needs further fuels this expansion.

The business travel insurance plan market is primed for robust growth, driven by the interplay of increasing global business travel, heightened risk awareness among corporations, and the innovation of insurance providers. The market's trajectory reflects not only the expansion of the global economy but also a greater understanding of the importance of risk mitigation and employee well-being. This report, based on extensive market research, provides a detailed analysis of the key trends, drivers, challenges, and opportunities within this dynamic sector, offering valuable insights to businesses and stakeholders involved in the industry.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.7% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 3.7%.

Key companies in the market include Pin An, AIG, PICC, Allianz, CPIC, AIA, AXA, TaiKang, Chubb, .

The market segments include Type, Application.

The market size is estimated to be USD 5.8 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in billion.

Yes, the market keyword associated with the report is "Business Travel Insurance Plan," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Business Travel Insurance Plan, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.