1. What is the projected Compound Annual Growth Rate (CAGR) of the Business Broker Service?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Business Broker Service

Business Broker ServiceBusiness Broker Service by Type (Business Sale, Lease Negotiations, Franchise, Others), by Application (Large Enterprise, SMEs), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

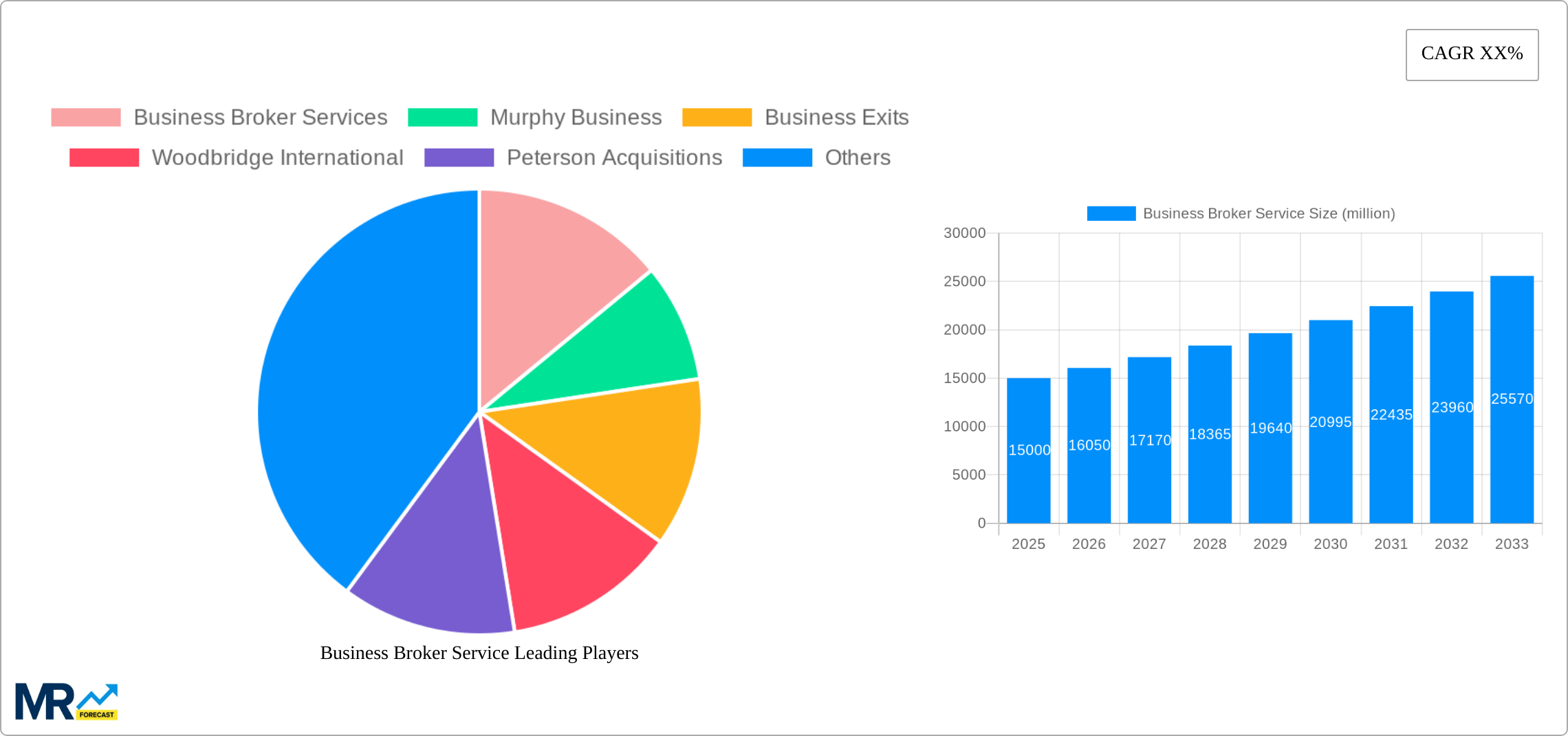

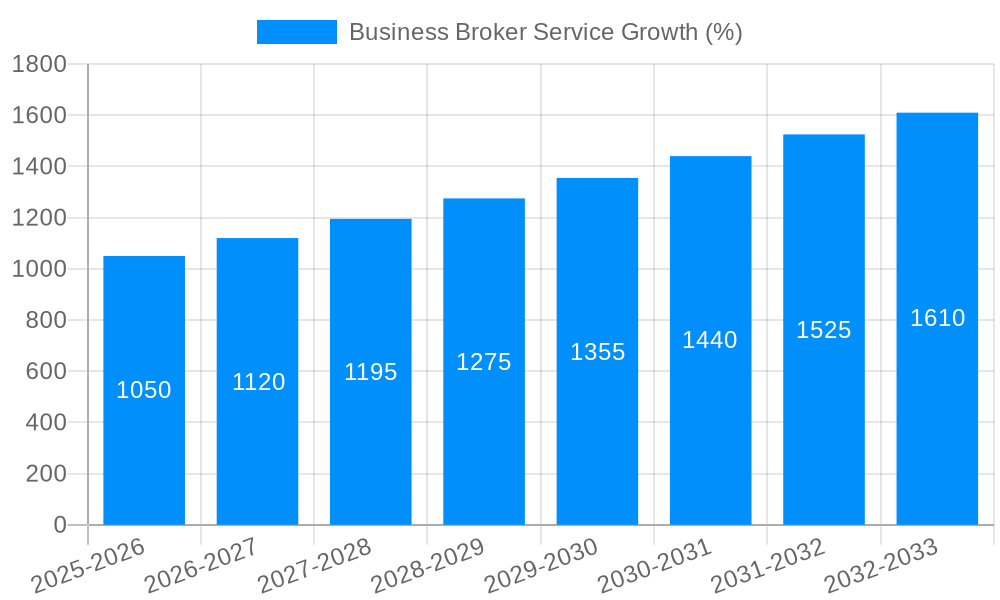

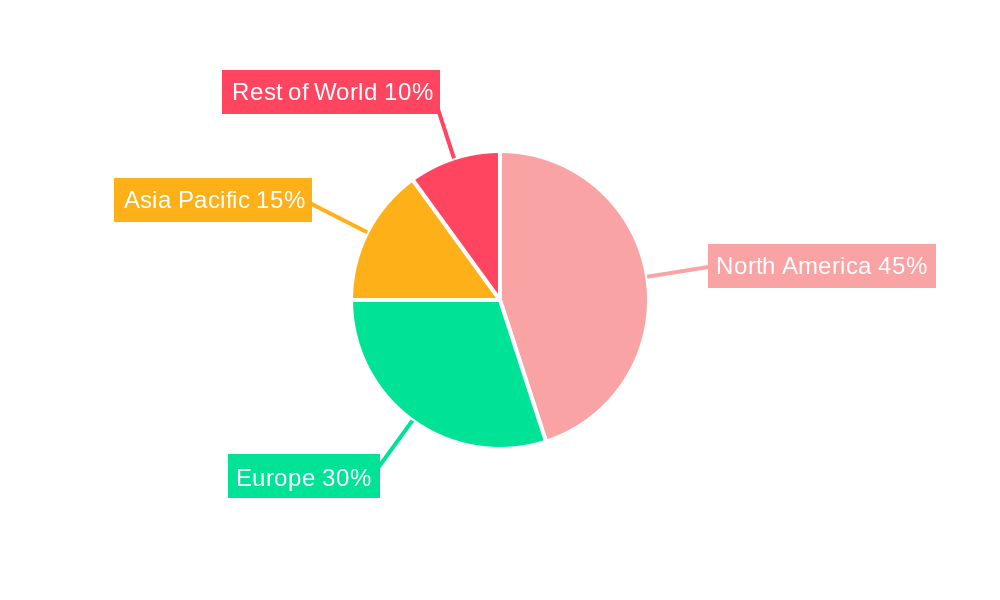

The global business brokerage service market is experiencing robust growth, driven by a surge in mergers and acquisitions (M&A) activity, increasing entrepreneurial activity, and a rising need for professional guidance in business transactions. The market, estimated at $15 billion in 2025, is projected to exhibit a Compound Annual Growth Rate (CAGR) of 7% from 2025 to 2033, reaching approximately $25 billion by 2033. This growth is fueled by several key factors. Firstly, the increasing complexity of business transactions necessitates the expertise of business brokers, particularly for SMEs lacking internal resources. Secondly, the rise of private equity and venture capital investments is boosting demand for business brokerage services to facilitate acquisitions and divestments. Thirdly, the growing prevalence of franchise models continues to contribute to the market's expansion, as franchisees require support in navigating the buying and selling process. The market is segmented by transaction type (business sale, lease negotiations, franchise, others) and business size (large enterprise, SMEs), with SMEs currently representing the larger segment due to their higher numbers and reliance on external expertise. Geographic variations exist, with North America and Europe dominating the market share, attributed to established economies and a high density of businesses.

However, certain restraints influence the market's trajectory. Economic downturns can significantly impact M&A activity, resulting in decreased demand for brokerage services. Furthermore, the competitive landscape, characterized by a multitude of both large and small players, can lead to price pressures. Regulatory changes and evolving legal frameworks within the business transaction space also pose challenges to the industry. Despite these factors, the long-term outlook remains positive, as the fundamental drivers—increasing business transactions and the need for specialized professional services—are expected to remain strong. The market's evolution will likely be marked by increased technological adoption, with online platforms and data analytics playing a greater role in facilitating transactions and providing market insights. This will further increase efficiency and transparency in the business brokerage sector.

The business brokerage service market, valued at approximately $XX billion in 2025, is experiencing robust growth, projected to reach $YY billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of ZZ%. This expansion is driven by a confluence of factors, including an aging entrepreneurial population seeking exits, a burgeoning number of small and medium-sized enterprises (SMEs) seeking acquisitions or mergers, and increased activity in franchise sales. The historical period (2019-2024) showed a steady, albeit slower, growth trajectory, laying the foundation for the accelerated expansion forecast for the period 2025-2033. Increased availability of online resources and streamlined business valuation methods have also played a significant role, making the process more efficient and accessible. This has attracted a wider range of clients, from first-time entrepreneurs to large corporations looking to divest non-core assets. The market is also witnessing a shift towards specialized brokerage services, catering to specific industry niches, further enhancing efficiency and expertise. Moreover, the increasing adoption of technology within the business brokerage process, from virtual valuations to enhanced due diligence platforms, is fostering transparency and speeding up transactions, attracting more players into this lucrative market. This dynamic landscape suggests a promising future for business brokerage services, with continued growth fueled by evolving market conditions and technological advancements. The year 2025 serves as a pivotal point, marking the transition from the historical growth phase to a period of accelerated expansion.

Several key factors are propelling the growth of the business brokerage service market. Firstly, the increasing number of baby boomers reaching retirement age is leading to a significant wave of business owners looking to sell their enterprises. This creates a high demand for skilled brokers who can effectively manage the complexities of business valuations, negotiations, and transfer of ownership. Secondly, the robust M&A activity, particularly among SMEs, fuels the need for intermediary services. Businesses looking to expand, diversify, or streamline operations frequently leverage the expertise of business brokers to navigate mergers and acquisitions. The rise in franchise opportunities further adds to the market's dynamism. Individuals seeking entrepreneurial ventures but lacking the experience or resources to build a business from scratch increasingly turn to franchise models, creating a considerable market for brokers specializing in franchise sales. Finally, the increasing complexity of business transactions, encompassing legal, financial, and tax considerations, underscores the critical role of experienced business brokers in ensuring smooth and successful transactions. These brokers offer valuable guidance and expertise, navigating the intricate details to facilitate a seamless transfer of ownership and safeguarding the interests of both buyers and sellers.

Despite the promising outlook, the business brokerage service market faces certain challenges. One major obstacle is the fluctuating economic climate. Recessions or periods of economic uncertainty can significantly impact the number of businesses for sale and the willingness of buyers to invest. The need for specialized expertise in different industry sectors can also be a constraint. A lack of sufficient industry-specific knowledge can hinder the effectiveness of brokers in certain transactions, potentially impacting transaction success rates. Regulatory changes and compliance requirements can also pose significant challenges, demanding brokers stay abreast of evolving rules and regulations. Competition from independent brokers and larger firms, particularly those with considerable financial backing and market reach, is another significant pressure. This intense competition requires brokerage firms to offer specialized niche services to stand out. Furthermore, finding appropriately qualified buyers and sellers for certain businesses, particularly those operating in niche sectors or with limited market appeal, can prove to be a significant challenge, impacting the efficiency of the business transaction process.

The SME segment is poised to dominate the business brokerage service market throughout the forecast period (2025-2033). This is fueled by several factors:

Geographic Dominance: While precise data regarding geographic dominance requires detailed market research, North America and Western Europe are projected to maintain their leading positions due to the high concentration of SMEs and established business brokerage firms in these regions. However, developing economies in Asia and Latin America show promising growth potential, offering new opportunities for expansion for business brokers. The high entrepreneurial activity in these regions coupled with favorable governmental regulations is expected to contribute to this growth.

The business brokerage service industry is experiencing significant growth driven by several key catalysts. The rise in entrepreneurial activity, particularly among younger generations, fuels the demand for skilled brokers to navigate business sales and acquisitions. Technological advancements, such as online valuation tools and enhanced data analytics platforms, are streamlining the process, making it more efficient and accessible. Governmental initiatives aimed at supporting small businesses and fostering entrepreneurial growth also play a pivotal role, bolstering the market. Moreover, increased awareness of the benefits of professional business brokerage services, including better valuations and smoother transaction processes, encourages business owners to engage these services, contributing to market expansion.

This report offers a comprehensive analysis of the business brokerage service market, covering historical data (2019-2024), a base year (2025), and forecast projections (2025-2033). It delves into market trends, driving forces, challenges, and key players, providing a detailed understanding of the market's dynamics and future prospects. The report includes segment-specific analysis (SMEs, large enterprises, etc.) and geographic breakdowns, offering valuable insights for businesses operating in or seeking to enter this industry. The extensive coverage provides a complete picture of the market, equipping stakeholders with critical information for informed decision-making.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Business Broker Services, Murphy Business, Business Exits, Woodbridge International, Peterson Acquisitions, Synergy Business Brokers, Transworld, Sunbelt, Calhoun, Beacon, Siguiente Capital, Raincatcher, Worldwide Business Brokers, Hilton Smythe, Kingsbrook, Fx Dynamics, Colliers, Benchmark Business Group, Lloyds Corporate, FirmGains, Verified Businesses, ProNova Partners, businessDEPOT, Mission Peak Brokers, ICI Source, Viking, BayState Business Brokers, Comer Business Brokers, Point To Home, Bristol Group, Peak Properties, GoldStar, The Finn Group, Turner Butler, Tennessee Business Brokers, Certified Business Brokers, Hornblower Business, Lion Business Brokers, KBS Corporate, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Business Broker Service," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Business Broker Service, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.