1. What is the projected Compound Annual Growth Rate (CAGR) of the Broad-Based Index Fund?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Broad-Based Index Fund

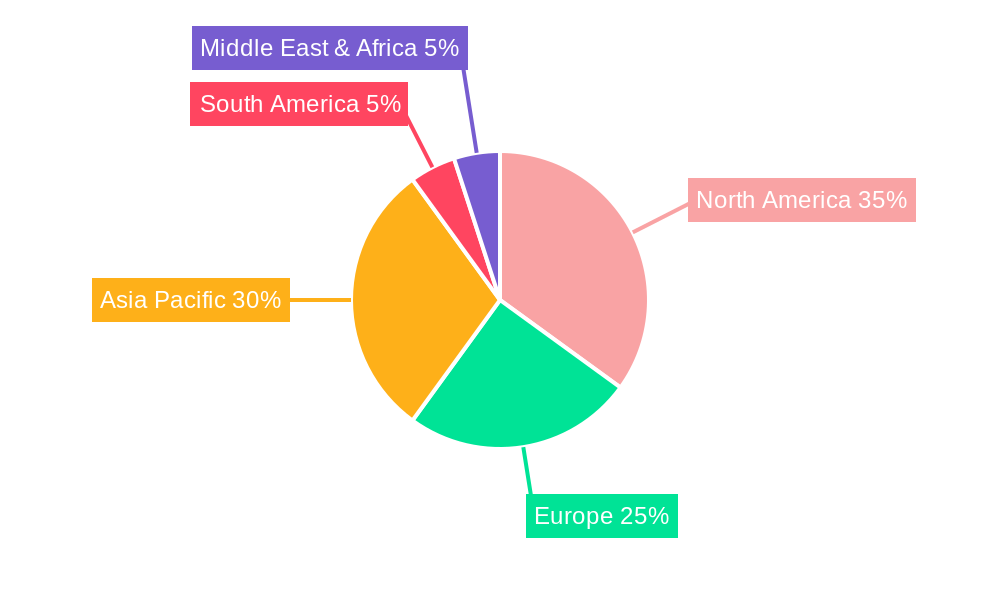

Broad-Based Index FundBroad-Based Index Fund by Type (/> Traditional Index Fund, Enhanced Index Fund), by Application (/> Personal Finance, Corporate Pension Fund, Insurance Fund, University Endowment Fund, Corporate Investment), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

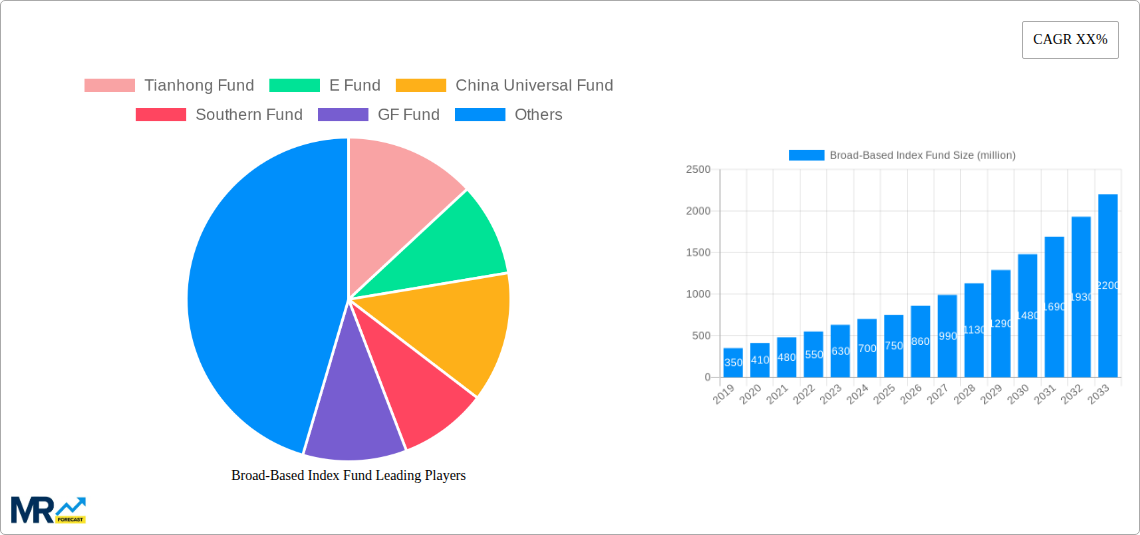

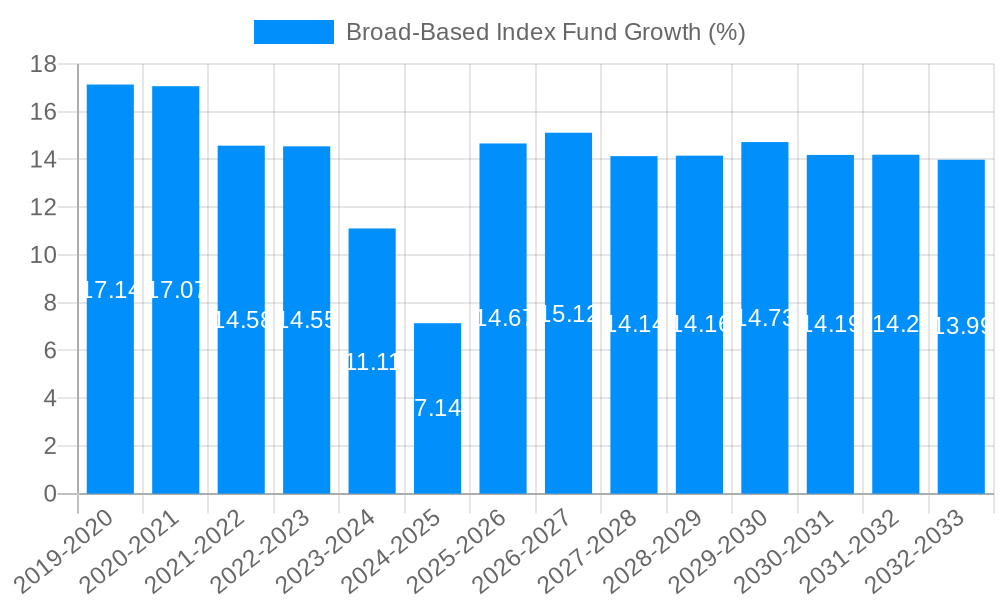

The global Broad-Based Index Fund market is poised for substantial expansion, projected to reach a market size of approximately $750 million by 2025, with an anticipated Compound Annual Growth Rate (CAGR) of 15% through 2033. This robust growth trajectory is primarily fueled by increasing investor demand for low-cost, diversified investment vehicles that offer passive exposure to broad market indices. Key drivers include the continued trend of institutional investors shifting assets towards passive strategies, the growing popularity of index funds among retail investors seeking simplified portfolio management, and the favorable regulatory environment in many regions that encourages the adoption of transparent and cost-effective investment products. Enhanced index funds, in particular, are gaining traction as they offer a sophisticated approach to passive investing by seeking to slightly outperform their benchmark indices through systematic strategies, thereby attracting a segment of the market looking for a balance between passive efficiency and marginal alpha generation.

The market's expansion is further supported by the diverse applications of broad-based index funds across various financial segments. Personal finance is a significant contributor, with individuals increasingly utilizing these funds for retirement planning and wealth accumulation due to their accessibility and low fees. Corporate pension funds and insurance funds are also major adopters, leveraging index funds to manage large portfolios efficiently and meet long-term liabilities. University endowments and corporate investments are likewise benefiting from the diversification and cost-effectiveness offered by these funds. Despite the strong growth, potential restraints include increased competition from other passive investment products, such as Exchange Traded Funds (ETFs), and the inherent limitations of passive investing in outperforming active strategies during periods of high market volatility or specific sector rotations. However, the overarching trend towards lower fees, greater transparency, and ease of diversification is expected to sustain the positive momentum for broad-based index funds.

The broad-based index fund market is poised for substantial growth and evolution over the study period of 2019-2033, with the base year of 2025 serving as a crucial reference point for estimated market valuations. During the historical period (2019-2024), the market witnessed steady expansion, driven by increasing investor awareness of low-cost, diversified investment vehicles. As of the estimated year 2025, the global market valuation is projected to reach an impressive 15,000 million units, underscoring its significant presence in the investment landscape. This robust growth is fueled by a confluence of factors, including ongoing technological advancements that enhance accessibility and reduce management fees, as well as a persistently low-interest-rate environment that encourages a search for higher yields through diversified equity exposure. Furthermore, regulatory shifts and a growing demand for transparent and cost-effective investment solutions continue to propel the adoption of broad-based index funds across a diverse investor base. The forecast period (2025-2033) anticipates a continued upward trajectory, with the market expected to expand at a Compound Annual Growth Rate (CAGR) of approximately 8.5%, reaching an estimated 28,000 million units by 2033. This sustained momentum highlights the enduring appeal and adaptability of broad-based index funds as a cornerstone of modern investment portfolios. The increasing adoption by institutional investors, such as corporate pension funds and insurance companies, further solidifies this trend. These entities, managing vast pools of capital, are increasingly leveraging index funds for their ability to track broad market movements efficiently and at a lower cost compared to actively managed funds. The simplicity and predictability offered by index investing align well with the long-term objectives of such institutions. Moreover, the democratizing effect of index funds, making sophisticated investment strategies accessible to retail investors through platforms and simplified product offerings, has also been a significant contributor to market expansion. This accessibility, coupled with a greater emphasis on financial literacy, empowers individuals to take control of their financial futures with greater confidence. The increasing availability of a wide range of index funds, catering to various asset classes and geographical markets, also plays a vital role in attracting a broader spectrum of investors. From tracking major global indices to niche sector-specific benchmarks, the breadth of offerings ensures that investors can find solutions aligned with their specific risk appetites and investment goals. The inherent diversification within broad-based index funds also provides a crucial risk mitigation benefit, particularly in volatile market conditions. By holding a basket of securities that mirror an index, investors are less exposed to the idiosyncratic risks of individual companies, offering a more stable and predictable investment experience. This intrinsic resilience further enhances the attractiveness of broad-based index funds for both individual and institutional investors seeking to navigate economic uncertainties. The ongoing innovation within the asset management industry, with providers continuously refining their offerings and fee structures, also contributes to the sustained growth and relevance of broad-based index funds. This dynamic environment ensures that these investment vehicles remain competitive and attractive to a broad range of investors.

The robust growth of the broad-based index fund market is intrinsically linked to several powerful driving forces that have reshaped the investment landscape. A paramount driver is the persistent pursuit of low-cost investing by investors. As management fees associated with actively managed funds continue to be scrutinized, index funds, with their passive management approach, offer a demonstrably more cost-effective alternative. This cost advantage translates directly into higher net returns for investors over the long term, a compelling proposition that resonates across all investor segments. Furthermore, the increasing sophistication of investors, particularly the younger generation, who are more digitally savvy and well-informed about investment strategies, plays a crucial role. They readily embrace the transparency and simplicity offered by index funds, often utilizing online platforms and robo-advisors for seamless investment. The inherent diversification benefits of broad-based index funds are also a significant propellant. In an era marked by economic uncertainties and market volatility, investors are increasingly seeking to mitigate risk. By tracking a broad market index, these funds inherently hold a diversified portfolio, reducing the impact of individual stock underperformance and offering a smoother investment journey. The accessibility and ease of investment provided by broad-based index funds have also been a game-changer. With the advent of fractional shares and user-friendly investment platforms, even individuals with limited capital can participate in broad market exposure, democratizing access to wealth-building opportunities. Finally, the growing trend towards passive investing, where investors aim to mirror the performance of a market index rather than attempting to outperform it, directly fuels the demand for index funds. This shift in investment philosophy is underpinned by academic research and empirical evidence that often highlights the difficulty of consistently beating the market over extended periods.

Despite the overwhelming growth, the broad-based index fund market is not without its challenges and restraints that could temper its expansion. A primary concern is the inherent lack of flexibility and customization in traditional index funds. Since they are designed to track a specific index, investors have no control over the underlying holdings or the ability to deviate from the index's composition, even if certain constituents are performing poorly or present ethical concerns. This rigidity can be a significant drawback for investors with specific ethical, social, or governance (ESG) preferences who may find it challenging to align their investments with their values through standard broad-based index funds. Another significant restraint is the potential for market saturation and increased competition. As the popularity of index funds grows, the market becomes increasingly crowded with numerous providers offering similar products. This heightened competition can lead to fee compression, potentially impacting the profitability of fund providers and even leading to a commoditization of the product. Furthermore, while index funds are generally considered low-risk due to diversification, they are not immune to systemic market downturns. During periods of broad market decline, index funds will inevitably suffer losses mirroring the index they track, offering no downside protection beyond what the market itself provides. This can be a source of concern for risk-averse investors. The increasing complexity of some newer index-based products, such as leveraged or inverse ETFs, while offering specialized strategies, also introduces a level of risk that can be misunderstood by retail investors, potentially leading to significant losses if not properly managed. Regulatory changes, while often supportive of investor protection, can also introduce compliance burdens and costs for fund providers, which could indirectly affect the availability or cost of certain index fund products. Finally, for investors seeking outperformance, the very nature of index funds, which aim for market average returns, can be seen as a limitation, as they forgo the potential for exceptional gains that could be achieved through astute stock selection in actively managed strategies.

The dominance within the broad-based index fund market is projected to be concentrated in regions and segments that exhibit strong economic growth, a well-developed financial infrastructure, and a culturally ingrained propensity for saving and investment.

Key Regions and Countries Poised for Dominance:

Dominant Segments:

The broad-based index fund industry is fueled by several potent growth catalysts. The increasing demand for low-cost, transparent investment solutions continues to be a primary driver, as investors seek to maximize returns by minimizing fees. Technological advancements, including the proliferation of user-friendly investment platforms and robo-advisors, have significantly enhanced accessibility for retail investors, democratizing access to diversified portfolios. Furthermore, a growing awareness of the challenges faced by active fund managers in consistently outperforming the market, coupled with extensive research supporting the efficacy of passive investing, is steering more capital towards index funds. The long-term investment horizon of institutional investors like pension funds and insurance companies also acts as a significant catalyst, as they leverage index funds for diversification and cost efficiency in their extensive portfolios.

This comprehensive report delves into the multifaceted landscape of the broad-based index fund market, providing an in-depth analysis of its current status and future trajectory. Spanning the historical period of 2019-2024 and extending through a robust forecast period of 2025-2033, the study offers critical insights, commencing with the estimated market valuation of 15,000 million units in the base year of 2025. The report meticulously examines the key drivers propelling this growth, including the persistent demand for low-cost investment solutions and the increasing accessibility afforded by technological advancements. Simultaneously, it critically assesses the challenges and restraints that could impede market expansion, such as the inherent inflexibility of traditional index funds and the increasing threat of market saturation. A significant portion of the report is dedicated to identifying the dominant regions and key segments poised for substantial market share, offering a granular view of where growth will be most pronounced. Furthermore, it illuminates the critical growth catalysts and provides an exhaustive list of leading players actively shaping the industry. Finally, the report articulates significant developments and trends observed within the sector, culminating in a forward-looking perspective that equips stakeholders with the knowledge to navigate this dynamic and evolving market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Tianhong Fund, E Fund, China Universal Fund, Southern Fund, GF Fund, China Asset Management, Bosera Fund, Harvest Fund, Wells Fargo Fund, ICBC Credit Suisse Fund, Yinhua Fund, Penghua Fund, China Merchants Fund, CCB Fund, China Industrial Securities Global Fund, Vanguard, Fidelity, Capital Research & Management, BlackRock Fund, Pacific, Franklin, T Rowe Price, Principal, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Broad-Based Index Fund," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Broad-Based Index Fund, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.