1. What is the projected Compound Annual Growth Rate (CAGR) of the Blockchain?

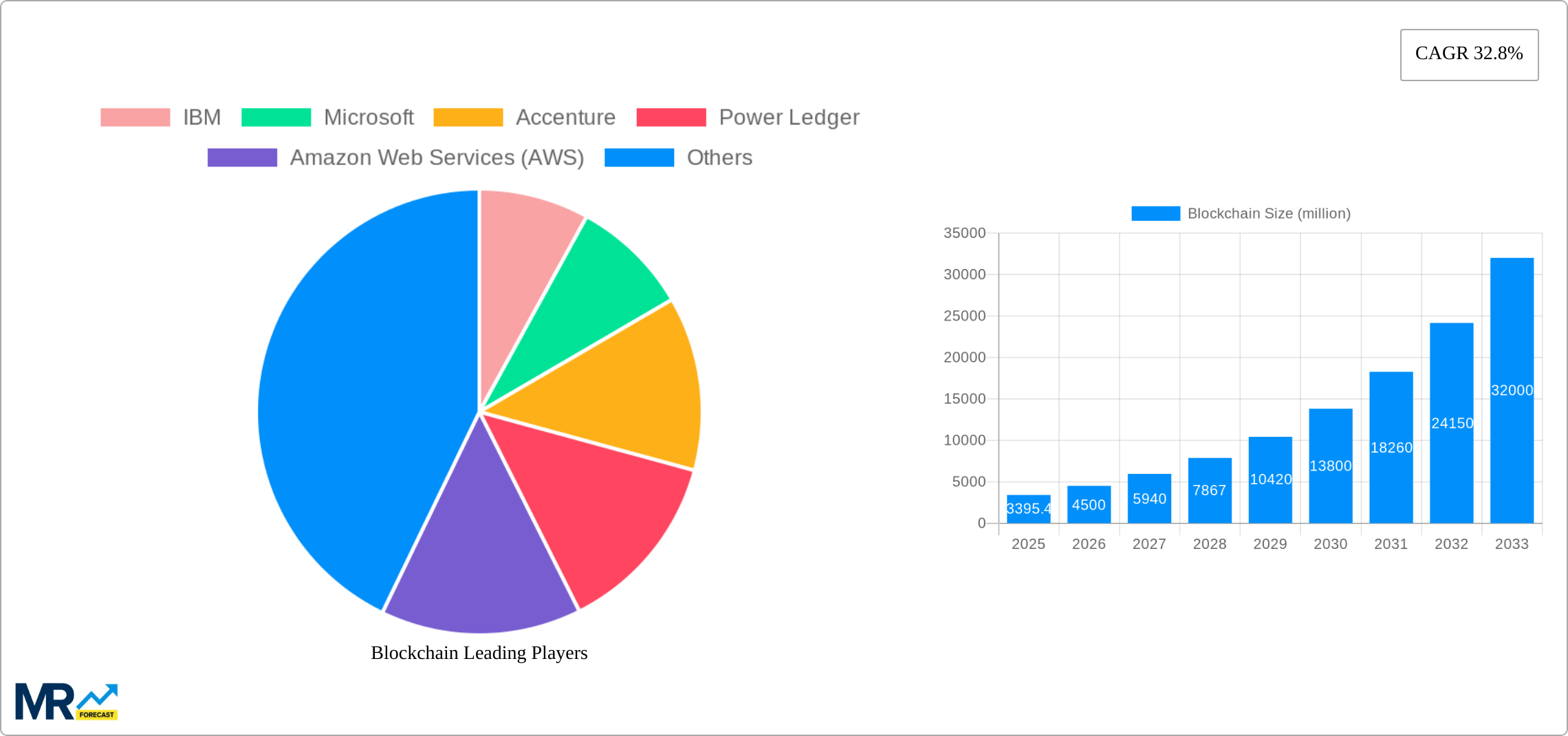

The projected CAGR is approximately 32.8%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Blockchain

BlockchainBlockchain by Type (Hybrid Blockchain, Private Blockchain), by Application (Financial Services, Non-financial Sector), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

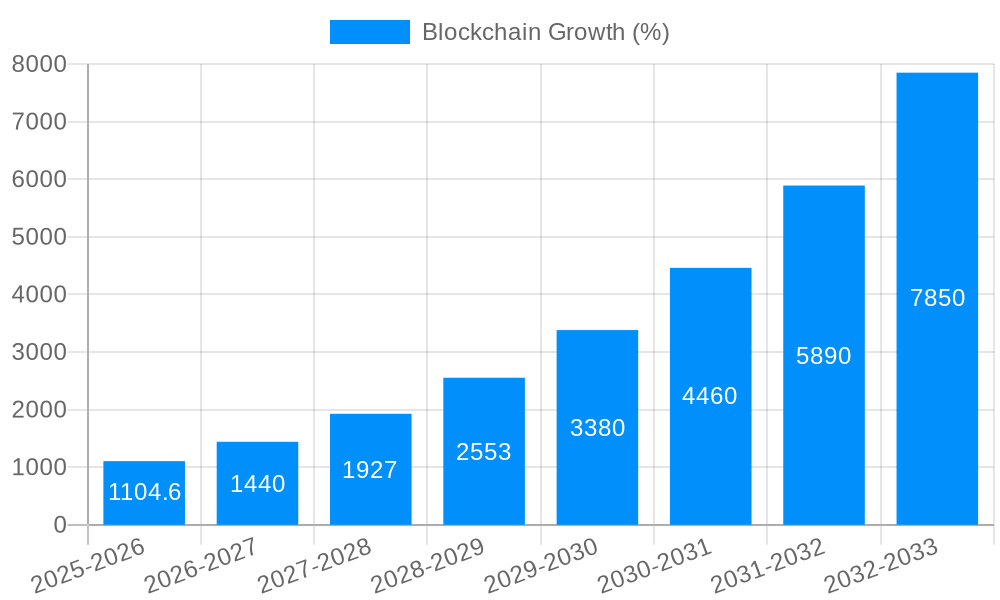

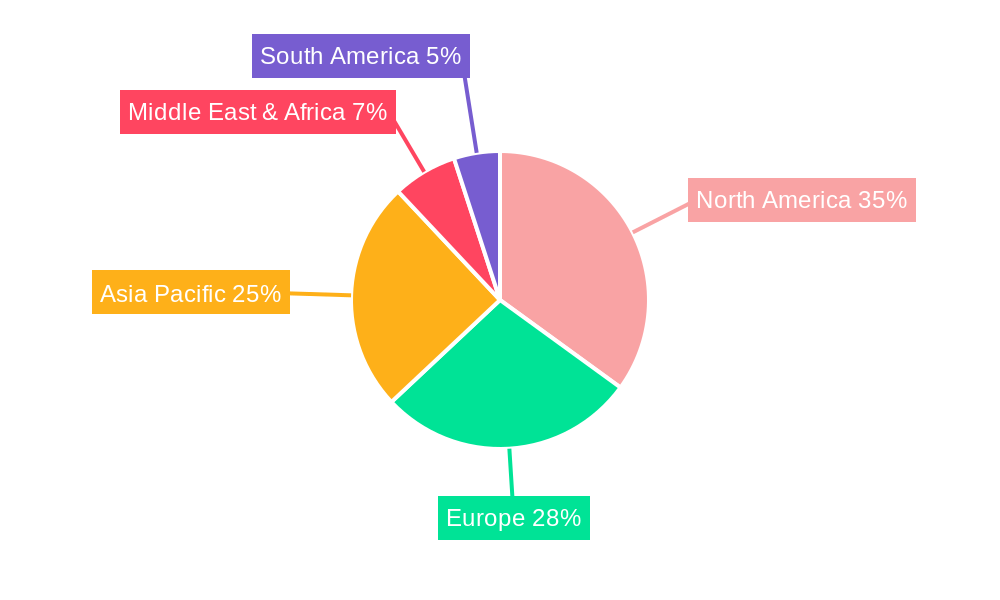

The blockchain technology market is experiencing explosive growth, projected to reach $3395.4 million in 2025 and maintain a robust Compound Annual Growth Rate (CAGR) of 32.8% from 2025 to 2033. This expansion is fueled by several key drivers. Increased adoption across financial services, driven by the need for enhanced security, transparency, and efficiency in transactions, is a major contributing factor. The non-financial sector is also embracing blockchain for supply chain management, digital identity verification, and data security, further propelling market growth. Hybrid and private blockchain solutions are gaining traction due to their ability to balance decentralization with controlled access and performance. Technological advancements, such as improved scalability and interoperability solutions, are addressing previous limitations and broadening blockchain's applicability. Leading players like IBM, Microsoft, and Accenture, alongside specialized blockchain companies, are actively driving innovation and expanding market penetration across diverse geographical regions. North America currently holds a significant market share, but Asia Pacific is poised for rapid growth due to increasing technological adoption and government support in countries like China and India.

However, challenges remain. Regulatory uncertainty in certain jurisdictions continues to impede widespread adoption. Concerns about scalability, energy consumption, and the potential for misuse need to be addressed to ensure sustainable growth. Despite these hurdles, the overall market trajectory remains positive, indicating a strong future for blockchain technology as it matures and finds broader application in various sectors. The market segmentation highlights the strategic focus on both technology type (Hybrid and Private Blockchains) and application (Financial Services and Non-Financial Sectors). This allows for targeted investment and development across different industry needs. The geographical distribution reflects the global nature of the market with significant potential for future growth in emerging economies. Continuous innovation, improved regulatory clarity, and successful integration into existing systems are vital for realizing the full potential of this transformative technology.

The blockchain market is experiencing explosive growth, projected to reach multi-billion dollar valuations by 2033. Our study, covering the period 2019-2033 with a base year of 2025, reveals a compelling narrative of technological advancement and market expansion. Key market insights point towards a shift from nascent experimentation to widespread adoption across diverse sectors. The historical period (2019-2024) saw significant investment in research and development, laying the groundwork for the rapid expansion anticipated during the forecast period (2025-2033). While initial adoption focused primarily on cryptocurrencies and financial services, the estimated value of the market in 2025 already indicates diversification into supply chain management, healthcare, and digital identity verification. This diversification is driven by the inherent security, transparency, and immutability offered by blockchain technology. Companies like IBM, Microsoft, and Accenture are playing pivotal roles in this expansion, providing enterprise-grade blockchain solutions and driving market maturity. The increasing adoption of hybrid and private blockchain networks, coupled with the burgeoning non-financial sector applications, further fuels the market's optimistic outlook. The projected growth signifies not just technological advancement but also a fundamental shift in how businesses operate, manage data, and interact with their stakeholders. This shift is underpinned by a growing awareness of blockchain's potential to streamline processes, enhance security, and foster greater trust and transparency across various industries. The millions of dollars invested in R&D and the numerous successful pilot projects worldwide clearly point to a robust and evolving market poised for significant future growth. By 2033, we anticipate the market will reach values exceeding several billion dollars, representing a significant return on investment for early adopters and developers alike.

Several factors are propelling the rapid growth of the blockchain market. Firstly, the inherent security and transparency of blockchain technology are highly attractive to businesses seeking to enhance data integrity and protect sensitive information. The immutability of the blockchain ledger offers an unparalleled level of security, reducing the risk of fraud and data breaches. Secondly, the increasing demand for decentralized applications (dApps) is boosting the adoption of blockchain. dApps offer a more efficient and secure alternative to traditional centralized applications, leading to improved user experiences and streamlined business processes. The development of sophisticated blockchain platforms, such as Hyperledger Fabric and Ethereum, is further facilitating this growth. Thirdly, government initiatives and regulatory frameworks are starting to emerge, providing a more supportive environment for blockchain adoption. Regulatory clarity reduces uncertainty and encourages businesses to invest in and adopt blockchain technologies. Finally, the growing understanding and awareness of blockchain’s potential benefits across various sectors, from supply chain management to healthcare, are driving wider adoption. The combined effect of these factors is creating a robust and dynamic ecosystem, fostering innovation and propelling the market towards sustained and significant growth in the coming years, potentially reaching values in the billions by 2033.

Despite its immense potential, the widespread adoption of blockchain technology faces several challenges. Scalability remains a major concern; existing blockchain networks struggle to handle high transaction volumes efficiently, limiting their applicability for large-scale deployments. The high energy consumption associated with some blockchain protocols, particularly proof-of-work mechanisms, raises environmental concerns and hinders broader adoption. Furthermore, the regulatory landscape surrounding blockchain remains fragmented and uncertain across jurisdictions, creating obstacles for businesses seeking to implement blockchain solutions internationally. The lack of skilled developers and professionals with expertise in blockchain technology also limits the pace of innovation and deployment. Security, while a major advantage, is a double-edged sword. The complexity of blockchain systems can make them vulnerable to sophisticated attacks, requiring robust security measures. Finally, interoperability issues between different blockchain platforms hinder seamless data exchange and integration, reducing efficiency and limiting the potential for broader ecosystem development. These hurdles, while significant, are not insurmountable, and ongoing research and development are addressing many of these challenges. Overcoming these obstacles is crucial for unlocking the full potential of blockchain technology and realizing its projected growth in the coming years.

The Financial Services segment is expected to dominate the blockchain market throughout the forecast period. This dominance is driven by the inherent suitability of blockchain technology for financial transactions. Its capacity to enhance security, transparency, and efficiency in areas like cross-border payments, trade finance, and securities trading is propelling its adoption within the sector.

Financial Services: This segment is expected to account for a significant portion of the market revenue, projected to be in the hundreds of millions by 2025 and growing exponentially towards billions by 2033. The use of blockchain in areas like KYC/AML compliance, digital asset management, and decentralized finance (DeFi) will drive this segment's growth. North America and Europe are expected to be key regions for this segment’s expansion, driven by the presence of established financial institutions and robust regulatory frameworks.

Private Blockchain: Private blockchains offer greater control and customization, making them attractive to enterprises seeking to leverage blockchain technology within their internal operations. This segment will witness strong growth, particularly in industries where data security and privacy are paramount, such as healthcare and government. The ease of integration with existing IT infrastructure and the flexibility to tailor the blockchain to specific organizational needs further enhance its appeal.

The significant investment from major players such as IBM, Microsoft, and Accenture in building and supporting private blockchain solutions further indicates the market's potential. The projected growth for private blockchains is substantial, with estimations reaching hundreds of millions of dollars by 2025, increasing considerably by 2033, reaching possibly billions of dollars. The potential for significant cost savings, improved efficiency and increased trust among participants further bolster this segment's growth potential. Asia-Pacific, driven by the increasing adoption of technology in emerging economies, could also see significant growth in the private blockchain market.

The blockchain industry's growth is fueled by increasing technological advancements, expanding regulatory clarity, and growing enterprise adoption across diverse sectors. Enhanced scalability solutions, improvements in interoperability, and the emergence of user-friendly development tools are driving wider adoption. Simultaneously, government support and more defined regulatory frameworks are reducing uncertainty and encouraging investment. As more businesses recognize the potential benefits of blockchain in streamlining operations and enhancing security, the market’s momentum will continue to accelerate, leading to substantial market expansion in the coming years.

This report provides a comprehensive overview of the blockchain market, analyzing trends, drivers, challenges, and growth catalysts. It offers granular insights into key market segments and identifies the leading players shaping the industry's future. The report’s detailed projections, based on rigorous market research and analysis, provide valuable insights for businesses seeking to understand and participate in this rapidly evolving technological landscape. The data presented provides a strong foundation for strategic decision-making and investment in the blockchain space.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 32.8% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 32.8%.

Key companies in the market include IBM, Microsoft, Accenture, Power Ledger, Amazon Web Services (AWS), Oracle, SAP, ConsenSys, Ripple, Rubix by Deloitte, Distributed Ledger Technologies, Oklink, Ant Financial, Chronicled, Embleema, FarmaTrust, Guardtime Federal, .

The market segments include Type, Application.

The market size is estimated to be USD 3395.4 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Blockchain," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Blockchain, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.