1. What is the projected Compound Annual Growth Rate (CAGR) of the Bitcoin Mining Servers?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Bitcoin Mining Servers

Bitcoin Mining ServersBitcoin Mining Servers by Application (Energy, Banking, Financial Services and Insurance (BFSI), Others), by Type (Hardware, Software), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

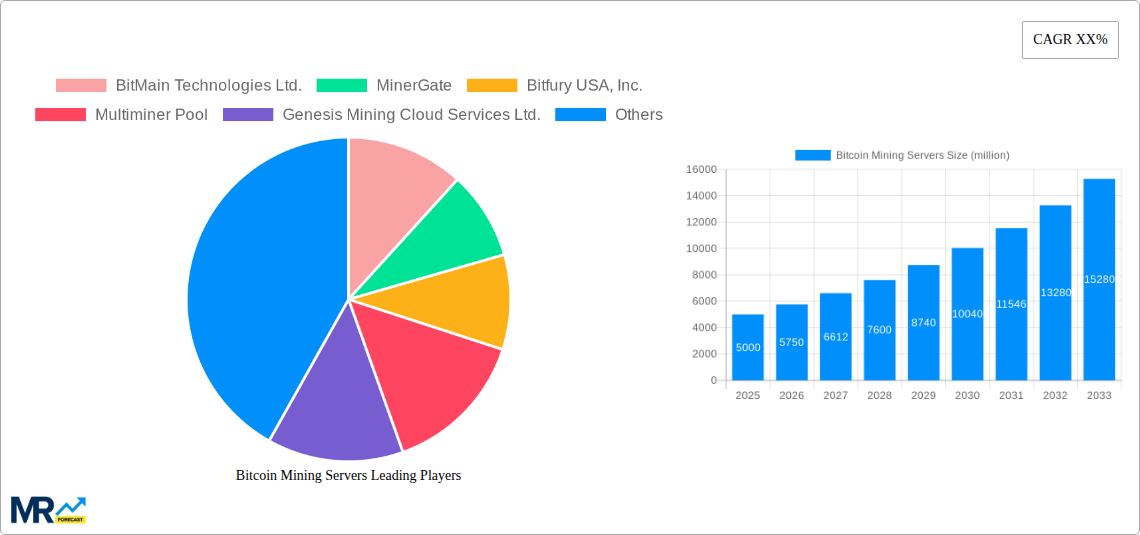

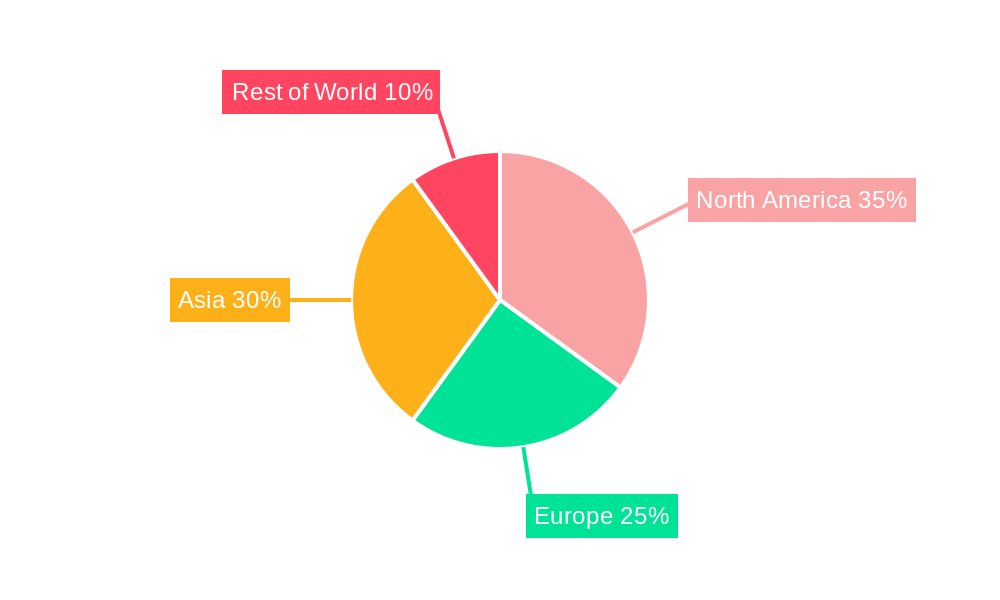

The Bitcoin mining server market is experiencing robust growth, driven by increasing Bitcoin adoption and price volatility. The market's value, while not explicitly stated, can be reasonably estimated based on industry reports and the provided CAGR. Assuming a conservative CAGR of 15% and a 2025 market size of $5 billion (a plausible figure considering the substantial investments in the sector), the market is projected to reach approximately $10 billion by 2033. Key drivers include the ongoing decentralization of Bitcoin mining, the increasing sophistication of mining hardware (ASICs), and the rise of large-scale mining farms. Trends such as cloud-based mining services are gaining traction, offering accessibility to individuals and smaller businesses, while the increasing regulatory scrutiny around energy consumption presents a significant challenge. The market segmentation reveals hardware dominance, followed by software solutions enabling mining operations' management and optimization. The BFSI sector's growing involvement as investors and institutional participants contributes to the market expansion, alongside the energy sector's influence due to its close relationship with mining's energy demands. Geographic analysis shows a concentration of mining activity in North America and Asia Pacific, driven by factors like established infrastructure and access to cheap electricity.

Market restraints primarily involve the significant energy consumption of Bitcoin mining, leading to environmental concerns and potential regulatory limitations. The volatility of Bitcoin's price, affecting profitability and investment decisions, is another crucial factor. The competitive landscape is defined by prominent players like BitMain Technologies and Bitfury, along with smaller operators and cloud mining providers. These companies are constantly innovating to enhance mining efficiency and reduce energy consumption to maintain competitiveness. Future growth will depend on technological advancements, regulatory frameworks, and Bitcoin's overall market trajectory. Further research into the precise financial figures will allow for a more comprehensive and detailed market analysis.

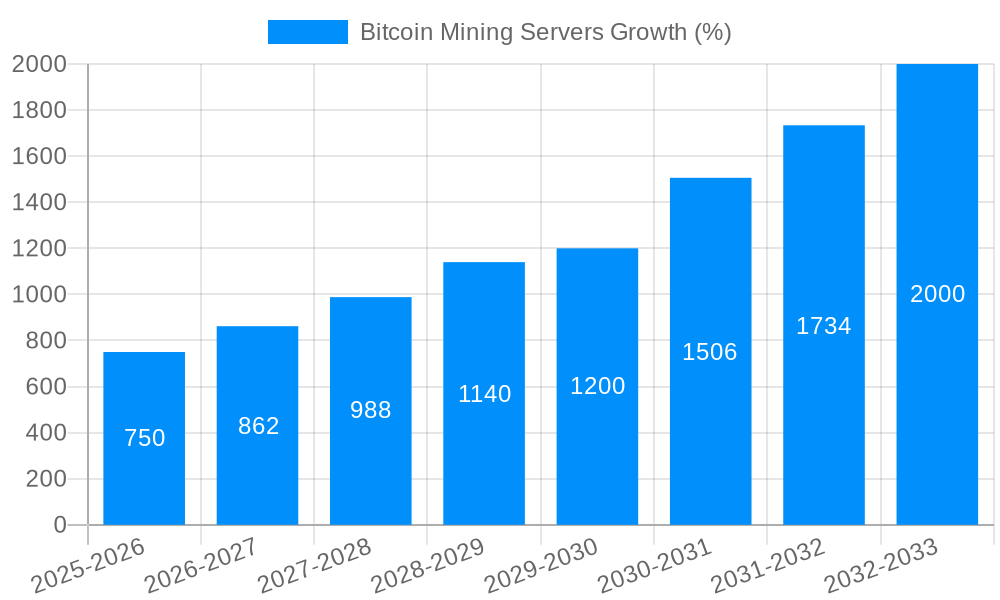

The global Bitcoin mining server market exhibited robust growth during the historical period (2019-2024), exceeding several million units in deployment. This surge is primarily attributed to the increasing popularity and value of Bitcoin, attracting significant investment into mining operations. The market witnessed a shift towards more energy-efficient hardware, driven by rising electricity costs and environmental concerns. While the Base Year (2025) shows a slight plateau, the forecast period (2025-2033) projects continued expansion, albeit at a more moderate pace. This tempered growth anticipates a degree of market saturation and a potential slowdown in Bitcoin's price volatility. However, technological advancements, such as the development of more efficient ASIC chips and improved cooling systems, are expected to stimulate demand within the hardware segment. The software segment, encompassing mining pools and management tools, also shows promising growth potential due to its role in enhancing mining efficiency and profitability. The market is largely driven by the constant innovation in hardware and software, with competition among manufacturers pushing the boundaries of computational power and energy efficiency. The integration of mining servers into larger data centers and the exploration of renewable energy sources for powering these servers are also notable trends. Several million units are expected to be shipped annually throughout the forecast period, reflecting the enduring interest in Bitcoin mining despite market fluctuations. The estimated year 2025 values already demonstrate the market's impressive scale, setting the stage for sustained, albeit possibly more balanced, expansion in the coming years. The ongoing evolution of Bitcoin's underlying technology and its expanding ecosystem will play a crucial role in shaping the long-term trajectory of the Bitcoin mining server market, impacting the deployment of millions of new units across the globe.

Several factors contribute to the continuous expansion of the Bitcoin mining server market. The inherent value proposition of Bitcoin, as a decentralized digital currency, remains a primary driver. As the cryptocurrency's popularity and acceptance grow, so too does the incentive for individuals and organizations to participate in the mining process, necessitating the deployment of millions of servers globally. Furthermore, the ongoing development and refinement of mining hardware, particularly ASIC (Application-Specific Integrated Circuit) chips designed specifically for Bitcoin mining, are significantly improving efficiency and profitability. This leads to a self-reinforcing cycle where better technology attracts more miners, fueling demand for even more advanced hardware. The emergence of sophisticated mining pool operations, providing economies of scale and risk mitigation for smaller miners, also plays a crucial role. These pools aggregate computational power, improving the chances of successfully mining a block and distributing the rewards. Finally, although subject to volatility, the fluctuating price of Bitcoin itself directly influences investment in mining operations. Periods of high Bitcoin value incentivize increased mining activity, driving demand for more mining servers, while periods of lower value lead to adjustments in the market, potentially creating a dynamic and evolving landscape in the millions of deployed units.

Despite the positive trends, the Bitcoin mining server market faces several significant challenges. The most prominent is the considerable energy consumption associated with mining. This leads to high operating costs and growing environmental concerns. Increasingly stringent regulations around energy consumption are being implemented, potentially restricting the deployment of large-scale mining operations. Furthermore, the inherent volatility of Bitcoin's price poses a substantial risk. Periods of low value can render mining unprofitable, leading to decreased demand for servers and even forcing some operations to shut down. Competition amongst mining hardware manufacturers is fierce, creating downward pressure on prices and potentially squeezing profit margins. This necessitates constant innovation and a rapid pace of technological advancement to remain competitive. The increasing difficulty of Bitcoin mining, as more computational power joins the network, requires ever-more powerful and energy-efficient hardware, driving up the initial investment costs. Finally, the regulatory landscape surrounding Bitcoin mining varies considerably across different jurisdictions. Changes in regulations, whether favorable or unfavorable, can significantly impact investment decisions and overall market growth, affecting the number of servers deployed in the millions.

The Bitcoin mining server market's geographical distribution reflects access to cheap electricity and favorable regulatory environments.

China: While its regulatory landscape has shifted significantly impacting large-scale operations, historically, China was a dominant player due to readily available and affordable electricity.

United States: The US is witnessing increasing investment in Bitcoin mining, particularly in regions with access to renewable energy sources like hydro and wind.

Kazakhstan: Possessing a relatively low electricity cost, Kazakhstan also attracted a considerable share of Bitcoin mining operations.

Canada: Similar to the US, Canada’s abundant hydroelectricity resources make it an attractive location for mining activities.

Dominant Segments:

Hardware: This segment holds the largest share of the market, driven by the constant demand for more powerful and energy-efficient ASIC miners. Millions of ASIC units are deployed and the forecast indicates continued dominance as technological advancements continue. The hardware segment is characterized by high capital expenditure, rapid technological obsolescence and intense competition.

Software: This segment encompasses mining pools and management software. While not directly visible in the millions of physical units deployed, its value is significant. Sophisticated software improves the efficiency and profitability of mining operations, making it a crucial part of the ecosystem. Improved management tools enable optimization of energy consumption, reducing operating costs and enhancing overall return on investment.

The hardware segment's dominance is likely to persist, as the underlying technology of Bitcoin mining requires physical equipment. However, the software segment will continue to grow in importance as optimization and management become increasingly crucial to profitability in a competitive environment.

The continuous growth of the cryptocurrency market beyond Bitcoin, alongside increasing institutional adoption of Bitcoin itself, serves as a significant catalyst for expansion. Technological advancements, especially in ASIC chip design and cooling technologies, improve mining efficiency and profitability, further driving the demand for advanced mining servers. The development of more sustainable energy sources to power mining operations addresses environmental concerns, fostering wider acceptance and facilitating growth.

This report provides a comprehensive overview of the Bitcoin mining server market, offering detailed insights into market trends, drivers, restraints, key players, and significant developments. It provides valuable information for investors, industry participants, and anyone interested in understanding the dynamics of this rapidly evolving sector. The forecast encompasses multiple millions of units throughout the projected period, highlighting the continued importance and growth potential of the market despite inherent challenges. The report offers a granular analysis of both the hardware and software segments, emphasizing their interdependency and the role of technological innovation in shaping market dynamics.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include BitMain Technologies Ltd., MinerGate, Bitfury USA, Inc., Multiminer Pool, Genesis Mining Cloud Services Ltd., .

The market segments include Application, Type.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Bitcoin Mining Servers," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Bitcoin Mining Servers, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.