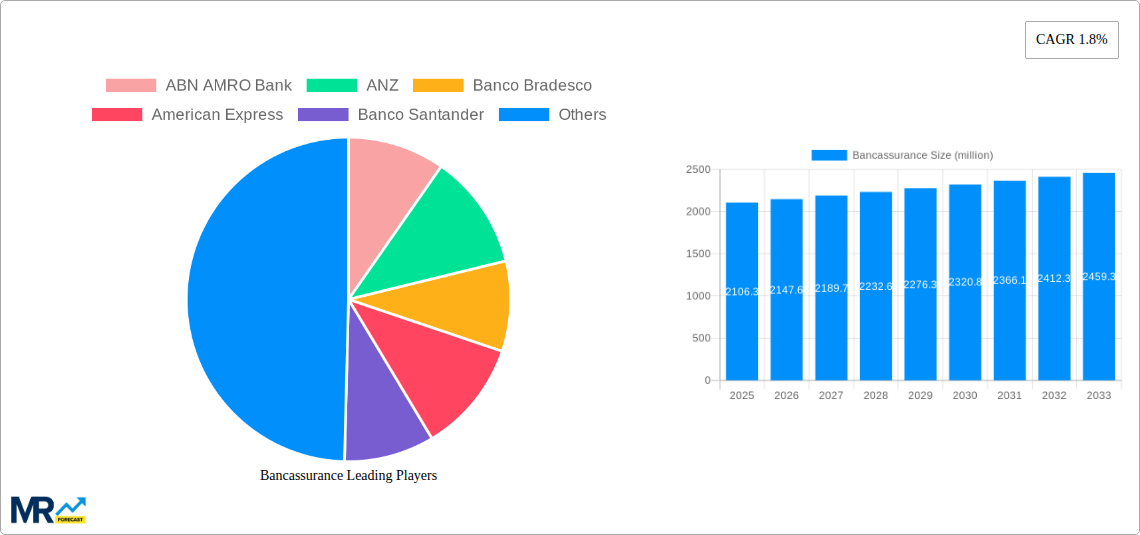

1. What is the projected Compound Annual Growth Rate (CAGR) of the Bancassurance?

The projected CAGR is approximately 1.8%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Bancassurance

BancassuranceBancassurance by Type (Life Bancassurance, Non-Life Bancassurance, Adults, Kids, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

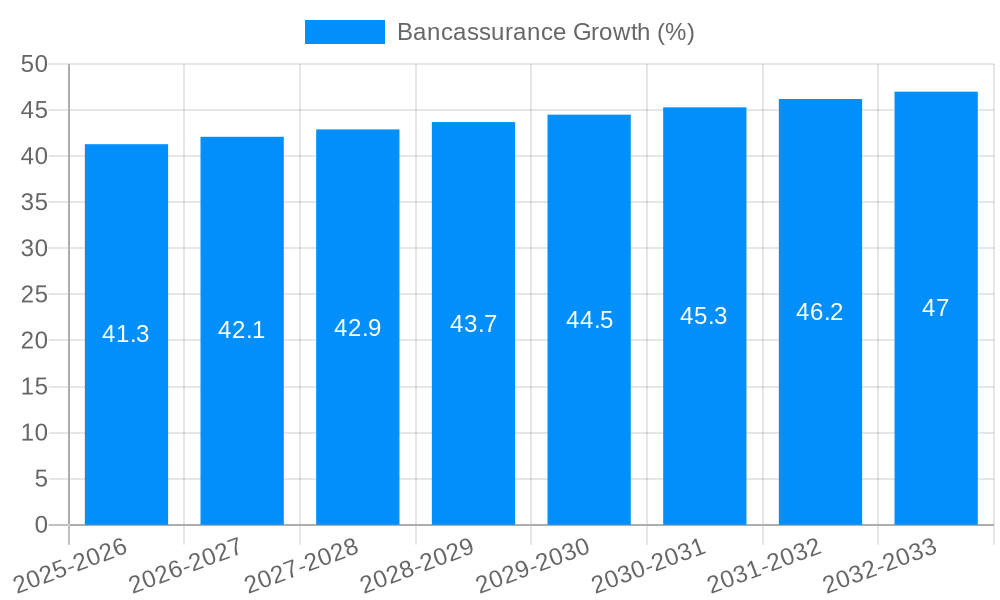

The global bancassurance market, valued at $2106.3 million in 2025, is projected to exhibit a compound annual growth rate (CAGR) of 1.8% from 2025 to 2033. This relatively modest growth reflects a mature market, yet significant opportunities remain for expansion within specific segments and regions. Drivers include increasing demand for bundled financial products offering convenience and cost-effectiveness to customers. Growing digitalization and the adoption of innovative technologies such as Insurtech solutions are further fueling market growth, allowing for streamlined processes and personalized customer experiences. However, factors such as stringent regulatory environments and intense competition among established players and fintech disruptors pose challenges to market expansion. The life bancassurance segment is expected to dominate, fueled by the rising demand for retirement planning and long-term financial security products. Geographic expansion into emerging markets with growing middle classes and increasing financial literacy presents a substantial opportunity for growth. Key players, including ABN AMRO Bank, ANZ, Banco Bradesco, and others, are leveraging strategic partnerships and technological advancements to enhance their market position and cater to evolving customer needs.

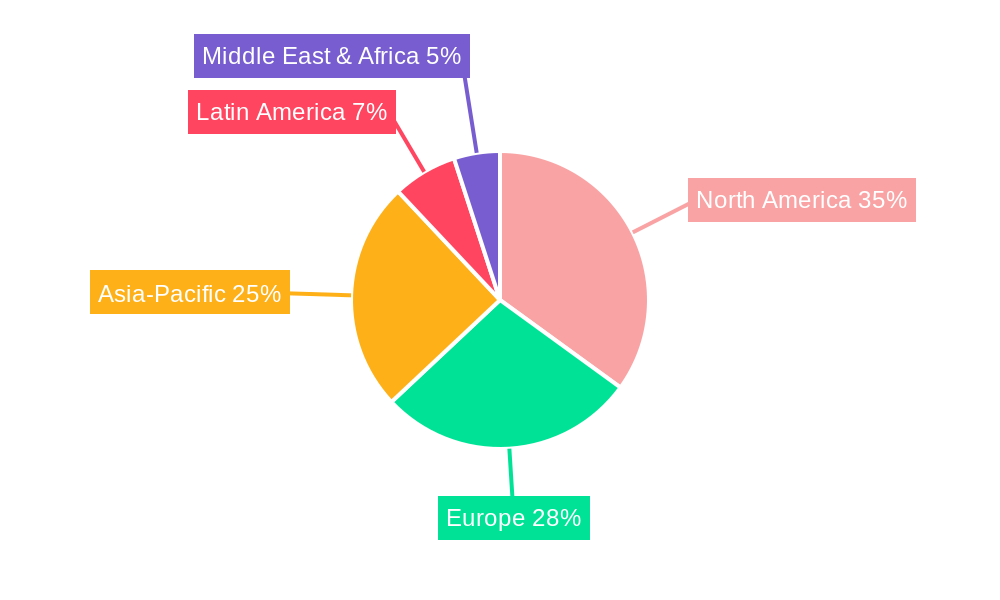

The segmentation of the bancassurance market reveals strong potential in different customer demographics and product types. The adult segment will likely maintain a significant market share due to their higher disposable income and greater awareness of financial planning needs. The growth of the kids segment hinges on increased parental awareness of child-specific insurance products and the rising middle class in emerging economies. Regional variations in market growth are expected, with North America and Europe maintaining a dominant presence due to high insurance penetration and established financial infrastructure. However, Asia-Pacific, particularly India and China, presents a significant growth opportunity, driven by rapid economic development and a burgeoning middle class. The strategic adoption of diversified product portfolios, effective customer relationship management strategies, and expansion into untapped markets will be crucial for continued growth in the bancassurance sector.

The global bancassurance market, encompassing life and non-life insurance products distributed through banks, is experiencing robust growth, projected to reach XXX million by 2033. The study period of 2019-2033 reveals a dynamic landscape shaped by evolving consumer preferences, technological advancements, and strategic partnerships. The base year of 2025, with an estimated market value of XXX million, serves as a crucial benchmark for understanding current market dynamics. The forecast period (2025-2033) suggests continued expansion, driven by factors such as increasing financial literacy, the rising prevalence of digital distribution channels, and a growing demand for comprehensive financial solutions. Analysis of the historical period (2019-2024) highlights a significant shift towards personalized insurance products and a greater emphasis on customer experience. Key market insights reveal a rising preference for bundled insurance packages offered alongside banking services, along with a surge in demand for digital insurance platforms providing greater accessibility and convenience. The expansion into underserved markets and the integration of innovative technologies like AI and big data analytics are also major contributors to the market's growth trajectory. Furthermore, regulatory changes in several regions are fostering greater transparency and promoting customer protection, thereby building trust and confidence in bancassurance offerings. This positive trend is expected to continue through 2033, promising substantial growth for stakeholders across the value chain. Specific regional variations, influenced by factors such as economic development, insurance penetration rates, and regulatory frameworks, are analyzed in detail in subsequent sections.

Several key factors are driving the expansion of the bancassurance market. Firstly, the synergistic relationship between banks and insurance companies allows for cross-selling opportunities, broadening customer reach and generating higher revenues for both parties. Banks leverage their extensive customer base to distribute insurance products efficiently, while insurance companies gain access to a reliable distribution network. Secondly, the increasing demand for bundled financial products offers customers convenience and simplifies their financial management. Customers appreciate the one-stop-shop approach, accessing banking and insurance services from a single provider. Thirdly, technological advancements, including the rise of digital platforms and mobile applications, are revolutionizing the way bancassurance products are sold and managed. This enhances customer experience, speeds up policy acquisition, and reduces operational costs for providers. Fourthly, the growing awareness of financial security and the increasing need for risk mitigation are compelling more people to invest in insurance products, stimulating demand across various segments. This is particularly true in emerging markets where insurance penetration remains relatively low, presenting substantial growth potential for bancassurance providers. Finally, favorable regulatory environments in many countries are supporting the growth of the bancassurance sector by promoting transparency, streamlining the licensing process, and protecting customer interests. These combined factors create a powerful impetus for the continued expansion of the bancassurance market in the years to come.

Despite the promising outlook, the bancassurance market faces certain challenges. One significant hurdle is the intense competition among established players and new entrants, leading to price wars and margin pressures. Maintaining profitability in a highly competitive environment requires effective cost management and innovative product differentiation strategies. Another challenge stems from regulatory complexities and compliance requirements that vary across different jurisdictions, adding to operational costs and complexity for companies operating across multiple regions. Building and maintaining trust with customers is crucial, particularly given concerns regarding potential conflicts of interest between banks and insurance providers. Ensuring transparent communication and ethical sales practices are vital for maintaining customer confidence and mitigating risks. Additionally, integrating different systems and technologies from banking and insurance platforms can be complex and costly, requiring significant investment in infrastructure and expertise. Furthermore, effectively managing customer data and ensuring its security in the face of growing cybersecurity threats is paramount, demanding investment in robust data protection measures. Finally, adapting to evolving consumer preferences and technological advancements requires ongoing investment in research and development, placing pressure on companies to remain agile and innovative.

The Life Bancassurance segment is poised to dominate the market due to increasing awareness of long-term financial security needs, particularly among the adult population.

Adults: This segment represents the largest market share within life bancassurance, driven by increased disposable income, rising life expectancy, and the growing prevalence of chronic diseases requiring significant healthcare expenditure. The demand for life insurance policies, retirement planning solutions, and health insurance bundled with banking services is significantly high.

Geographic Dominance: Developed economies in North America and Europe currently hold a significant portion of the market due to high insurance penetration rates and a mature financial infrastructure. However, rapid growth is expected in developing Asian countries as rising incomes and increasing financial awareness drive demand for life insurance products. Specific countries like China and India, with their massive populations and expanding middle class, offer considerable growth potential for life bancassurance providers.

Market Drivers: Several factors contribute to life bancassurance's dominance. Increasing awareness of the benefits of life insurance, the rising need for retirement planning, and government incentives for life insurance adoption are all key drivers. Furthermore, banks’ ability to easily cross-sell these products to their existing customer base makes it a highly attractive and efficient market segment for expansion.

The paragraph above details the dominant segment (Life Bancassurance, Adults) and dominant regions based on current trends and future projections. The detailed market analysis, incorporating data and projections for each region, further substantiates these findings. The report provides a thorough breakdown of the specific market share held by each region and segment, quantified in millions of units.

The bancassurance industry’s growth is fueled by several key catalysts. The increasing adoption of digital technologies is streamlining operations, broadening reach, and personalizing customer experiences. Strategic partnerships between banks and insurers are creating synergistic opportunities, enhancing product offerings, and extending market penetration. The rising demand for bundled financial solutions caters to consumer preference for convenience, leading to increased adoption of integrated banking and insurance services. Finally, favorable regulatory environments are facilitating market expansion and fostering competition while ensuring ethical practices and consumer protection.

This report offers a comprehensive analysis of the bancassurance market, providing detailed insights into market trends, driving forces, challenges, and growth opportunities. It features in-depth regional and segment-specific analyses with granular data and projections, allowing for informed strategic decision-making. The report also includes profiles of key players, outlining their strategies and market positions, alongside an evaluation of significant industry developments. The information presented is based on thorough research and analysis, making it a valuable resource for industry stakeholders.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 1.8% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 1.8%.

Key companies in the market include ABN AMRO Bank, ANZ, Banco Bradesco, American Express, Banco Santander, BNP Paribas, ING Group, Wells Fargo, Barclays, Intesa Sanpaolo, Lloyds Bank, Citigroup, HSBC, NongHyup Financial Group, Nordea Bank, .

The market segments include Type.

The market size is estimated to be USD 2106.3 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Bancassurance," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Bancassurance, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.