1. What is the projected Compound Annual Growth Rate (CAGR) of the Backtesting Tools?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Backtesting Tools

Backtesting ToolsBacktesting Tools by Type (/> On-premises, Cloud Based), by Application (/> Large Enterprises, SMEs), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

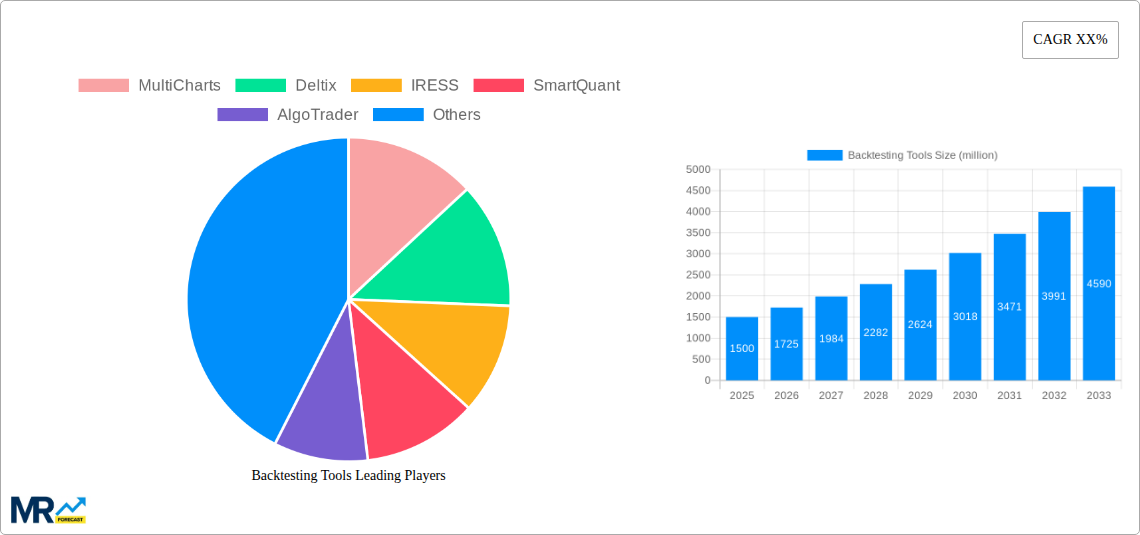

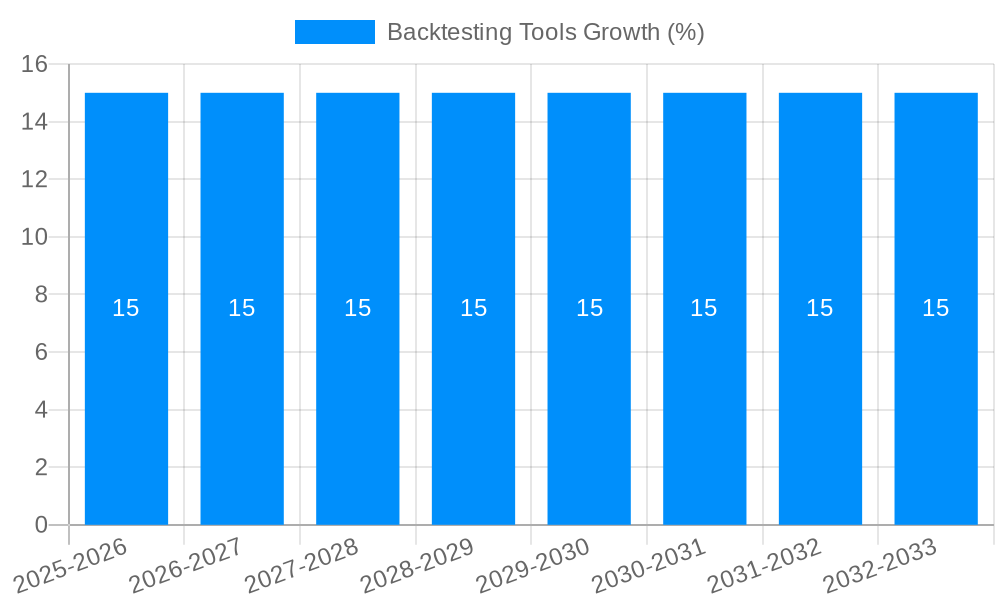

The global Backtesting Tools market is experiencing robust growth, projected to reach an estimated USD 1.5 billion by 2025, with a significant Compound Annual Growth Rate (CAGR) of 15% during the forecast period of 2025-2033. This expansion is primarily fueled by the increasing demand for sophisticated quantitative trading strategies and the need for rigorous performance validation of these strategies before live deployment. Financial institutions, hedge funds, and individual traders are increasingly investing in backtesting tools to analyze historical data, identify profitable patterns, and mitigate risks associated with trading algorithms. The growing complexity of financial markets and the proliferation of algorithmic trading further underscore the critical role of effective backtesting solutions. Moreover, the democratization of trading through online platforms and accessible financial data is broadening the user base for these tools.

The market is segmented into on-premises and cloud-based solutions, with cloud-based offerings gaining traction due to their scalability, flexibility, and reduced upfront investment, appealing to both large enterprises and Small and Medium-sized Enterprises (SMEs). Key drivers include advancements in AI and machine learning for more accurate predictive modeling, the growing volume of financial data requiring powerful analytical capabilities, and the continuous innovation in trading platforms that integrate advanced backtesting features. However, challenges such as the high cost of sophisticated tools, data quality issues, and the need for specialized expertise to interpret results can pose restraints. Leading companies like MultiCharts, Deltix, IRESS, and AlgoTrader are actively innovating to address these challenges and capture market share through enhanced features and user-friendly interfaces.

Here is a comprehensive report description on Backtesting Tools, incorporating your specific requirements:

The global Backtesting Tools market is poised for remarkable expansion, projected to reach an estimated $15,000 million by 2033, a significant leap from its $5,000 million valuation in the base year of 2025. This substantial growth trajectory, spanning a forecast period of 2025-2033, is fueled by an accelerating adoption rate across diverse financial institutions and evolving trading strategies. During the historical period from 2019 to 2024, the market witnessed steady progress, laying the groundwork for the current surge. Key market insights reveal a pronounced shift towards sophisticated algorithmic trading and quantitative analysis, necessitating robust and reliable backtesting capabilities. The increasing complexity of financial markets, coupled with the relentless pursuit of alpha generation, has propelled the demand for tools that can accurately simulate trading strategies against historical data. Furthermore, the democratization of trading, with a growing number of retail investors engaging in more complex strategies, contributes to this trend. The need for validation and risk management before deploying capital in live trading environments has never been more critical. Industry developments indicate a growing emphasis on cloud-based solutions, offering scalability, accessibility, and cost-effectiveness for both large enterprises and Small and Medium-sized Enterprises (SMEs). On-premises solutions continue to hold ground, particularly for institutions with stringent data security requirements, but the agility and reduced infrastructure overhead of cloud platforms are increasingly attractive. The integration of artificial intelligence (AI) and machine learning (ML) into backtesting tools is another transformative trend, enabling more nuanced analysis, pattern recognition, and predictive modeling. This synergy between advanced analytics and historical data simulation is a cornerstone of modern trading strategy development. The competitive landscape is characterized by innovation, with players continuously enhancing their platforms to offer more features, greater accuracy, and seamless integration with execution platforms. The market's trajectory underscores its pivotal role in the modern financial ecosystem, supporting informed decision-making and mitigating potential trading risks.

Several powerful forces are collectively driving the significant growth observed in the Backtesting Tools market. Foremost among these is the escalating complexity and volatility of global financial markets. As traders and institutions grapple with an increasingly intricate web of interdependencies, macroeconomic factors, and rapidly changing sentiment, the need to rigorously test trading strategies before deployment becomes paramount. This necessitates sophisticated tools that can accurately simulate performance against vast datasets, allowing for the identification of potential weaknesses and optimization opportunities. Furthermore, the proliferation of algorithmic and quantitative trading strategies is a monumental driver. These data-intensive approaches rely heavily on historical performance validation, making robust backtesting capabilities indispensable. The pursuit of alpha, the excess return of an investment relative to a benchmark, remains a constant objective for financial professionals, and effective backtesting tools are crucial for discovering and refining strategies that can achieve this goal. The increasing accessibility of sophisticated trading platforms and the growing participation of retail investors in more advanced trading strategies also contribute to the demand. These individuals and smaller firms require accessible yet powerful tools to test their hypotheses and manage risk effectively. Finally, regulatory pressures and the growing emphasis on risk management within financial institutions are compelling them to adopt more rigorous validation processes. Backtesting serves as a critical component of this risk management framework, providing quantitative evidence of a strategy's potential performance and drawdown characteristics.

Despite the robust growth, the Backtesting Tools market faces several significant challenges and restraints that could temper its expansion. A primary concern revolves around the inherent limitations of historical data and the "overfitting" phenomenon. Strategies meticulously optimized to perform exceptionally well on past data may fail to translate into real-world success due to unseen future market conditions, regime changes, or unforeseen events. This creates a constant battle against creating strategies that are too tailored to historical noise rather than genuine predictive patterns. Another considerable challenge is the accuracy and completeness of historical data itself. Inaccurate, incomplete, or biased data can lead to flawed backtesting results, undermining the credibility of the entire process. Sourcing high-quality, granular data, especially for niche markets or longer historical periods, can be expensive and time-consuming. Furthermore, the computational power required for extensive and sophisticated backtesting, particularly for complex models and large datasets, can be a significant barrier. While cloud-based solutions mitigate this to some extent, the initial investment in powerful on-premises infrastructure or recurring cloud costs can still be a restraint for some SMEs. The rapid evolution of trading technologies and strategies also presents a challenge, requiring constant updates and adaptations of backtesting tools to remain relevant and effective. Keeping pace with new asset classes, derivatives, and algorithmic techniques demands continuous innovation from tool developers. Finally, the perceived complexity of using advanced backtesting tools can deter less technically inclined users, creating a need for more intuitive interfaces and user-friendly designs.

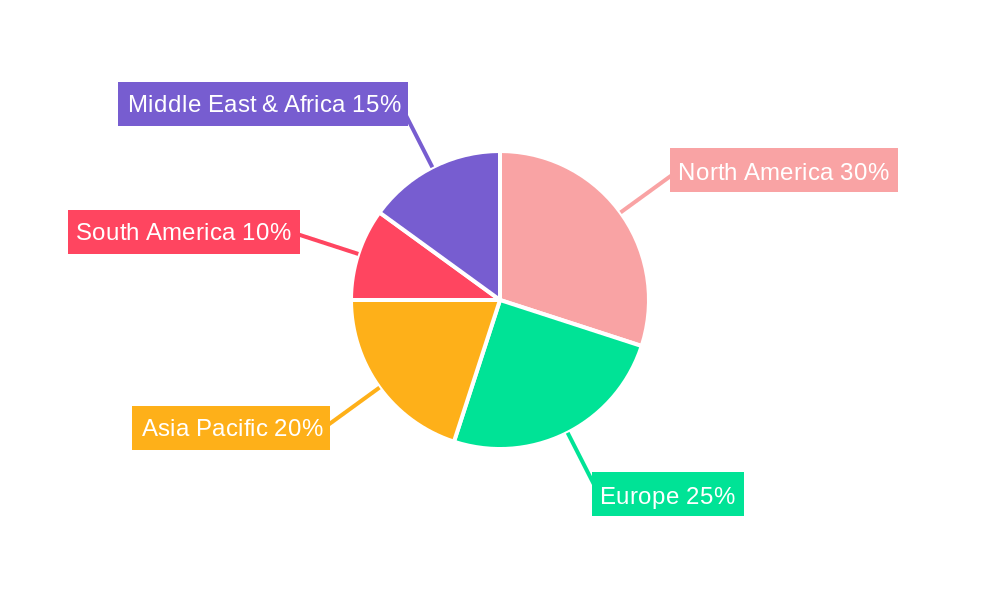

North America is poised to be a dominant region in the Backtesting Tools market, driven by its established financial infrastructure, a high concentration of sophisticated trading firms, and a strong culture of quantitative finance. The United States, in particular, hosts a vast number of hedge funds, asset management firms, and proprietary trading desks that are early adopters of cutting-edge trading technologies. These entities consistently invest in advanced backtesting solutions to gain a competitive edge in highly liquid and complex markets. The presence of major financial centers like New York and Chicago further solidifies North America's leadership.

Within this dominant region, the Large Enterprises segment is expected to command the largest market share. These institutions, including major investment banks, hedge funds with substantial assets under management, and institutional asset managers, possess the financial resources and the strategic imperative to invest heavily in comprehensive and robust backtesting solutions. Their trading operations often involve highly complex algorithms, multi-asset class strategies, and extensive risk management protocols, all of which necessitate sophisticated backtesting capabilities. They are often the first to adopt new technologies and demand highly customizable platforms that can integrate seamlessly with their existing trading infrastructure and data sources. The sheer volume of trades executed and the significant capital at risk incentivize these large enterprises to allocate substantial budgets towards ensuring the efficacy and reliability of their trading strategies through meticulous backtesting.

The Cloud Based segment is also anticipated to witness substantial growth and likely dominate the market in the long run. Cloud solutions offer unparalleled scalability, allowing enterprises of all sizes to access powerful backtesting engines without the substantial upfront investment in hardware and IT infrastructure. This agility is particularly attractive in the fast-paced financial world where strategies need to be tested and iterated rapidly. Furthermore, cloud platforms simplify data management, updates, and collaboration, enabling teams to work more efficiently. The subscription-based model of cloud services also offers predictable operational expenses, making it a more attractive option for budgeting. For large enterprises, cloud solutions provide the flexibility to scale computational resources up or down based on demand, while for SMEs, they democratize access to high-performance backtesting capabilities that were previously only affordable for larger players. The inherent security features and compliance certifications offered by reputable cloud providers are also addressing the initial concerns some institutions had about data security in the cloud.

The Backtesting Tools industry is experiencing significant growth catalysts that are propelling its market forward. The increasing complexity of financial markets and the relentless pursuit of alpha by investors are primary drivers, necessitating robust tools for strategy validation. The rapid advancement and adoption of algorithmic and quantitative trading strategies demand precise historical performance simulation. Furthermore, the growing trend towards AI and machine learning integration in trading strategies significantly amplifies the need for advanced backtesting capabilities to evaluate these sophisticated models. The democratization of trading, with more retail and smaller institutional traders engaging in complex strategies, also contributes to the demand for accessible yet powerful backtesting solutions.

This report provides an in-depth and comprehensive analysis of the global Backtesting Tools market, offering invaluable insights for stakeholders. Spanning a detailed study period from 2019 to 2033, with a base year of 2025, the report meticulously examines historical trends, current market dynamics, and forecasts future growth. It delves into the driving forces behind market expansion, including the increasing adoption of algorithmic trading and the demand for sophisticated risk management. Conversely, it also addresses significant challenges such as data accuracy limitations and the risk of overfitting. The report offers granular segmentation analysis, identifying key regions and countries poised for dominance, and dissects market segments like On-premises and Cloud Based solutions, and their impact on Large Enterprises and SMEs. Furthermore, it highlights crucial growth catalysts and provides a detailed overview of leading players and their contributions. This comprehensive coverage ensures readers gain a strategic understanding of the Backtesting Tools landscape, enabling informed decision-making and strategic planning within this dynamic sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include MultiCharts, Deltix, IRESS, SmartQuant, AlgoTrader, TradeStation Group, AmiBroker, FXCM, Axioma, Trading Blox, NinjaTrader Group, Build Alpha.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Backtesting Tools," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Backtesting Tools, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.