1. What is the projected Compound Annual Growth Rate (CAGR) of the AV Receiver?

The projected CAGR is approximately 2.4%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

AV Receiver

AV ReceiverAV Receiver by Type (5.1 &5.2 Sound Channels, 7.1 &7.2 Sound Channels, 9.2 Sound Channels, Others, Residential, Commercial), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

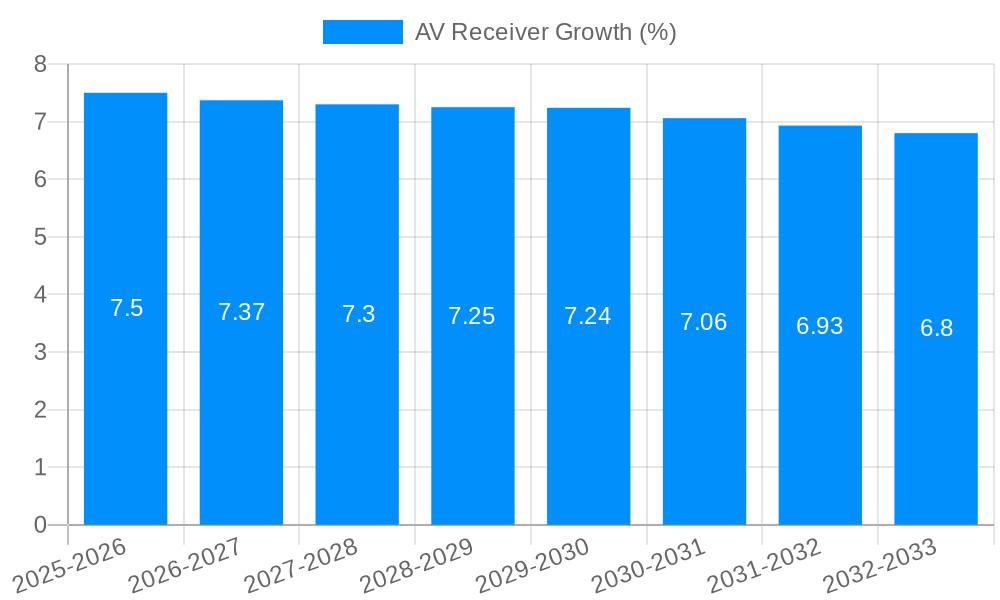

The global AV receiver market, valued at $1278.5 million in 2025, is projected to experience steady growth with a Compound Annual Growth Rate (CAGR) of 2.4% from 2025 to 2033. This moderate growth reflects a market maturing beyond its peak adoption phase, with increasing competition from integrated sound systems within smart TVs and streaming devices. However, the demand for high-quality audio experiences in home theaters and dedicated listening environments continues to drive sales, particularly among consumers seeking immersive surround sound experiences. The market segmentation reveals a strong preference for 5.1 and 7.1 channel systems, indicating a focus on established surround sound configurations. The commercial segment, encompassing installations in businesses and public spaces, contributes significantly to overall market revenue, driven by the need for advanced audio solutions in venues like restaurants, cinemas, and hotels. Key growth drivers include rising disposable incomes in developing economies, increasing adoption of high-definition video content, and the continued popularity of home theater setups. Conversely, market restraints include the aforementioned competition from integrated audio solutions and the increasing adoption of wireless audio technologies, which offer simplified setups at the cost of potential audio fidelity.

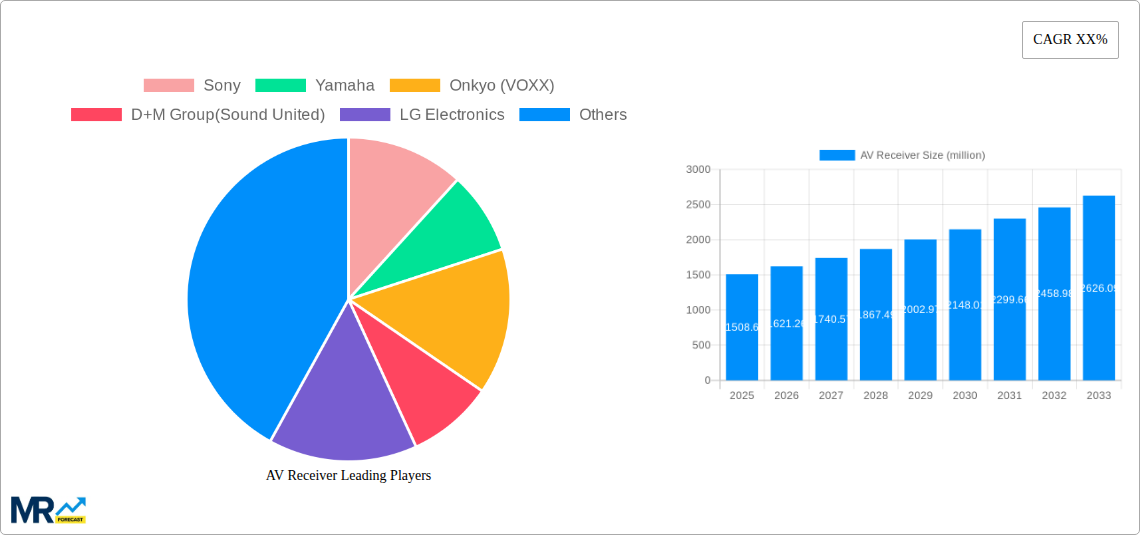

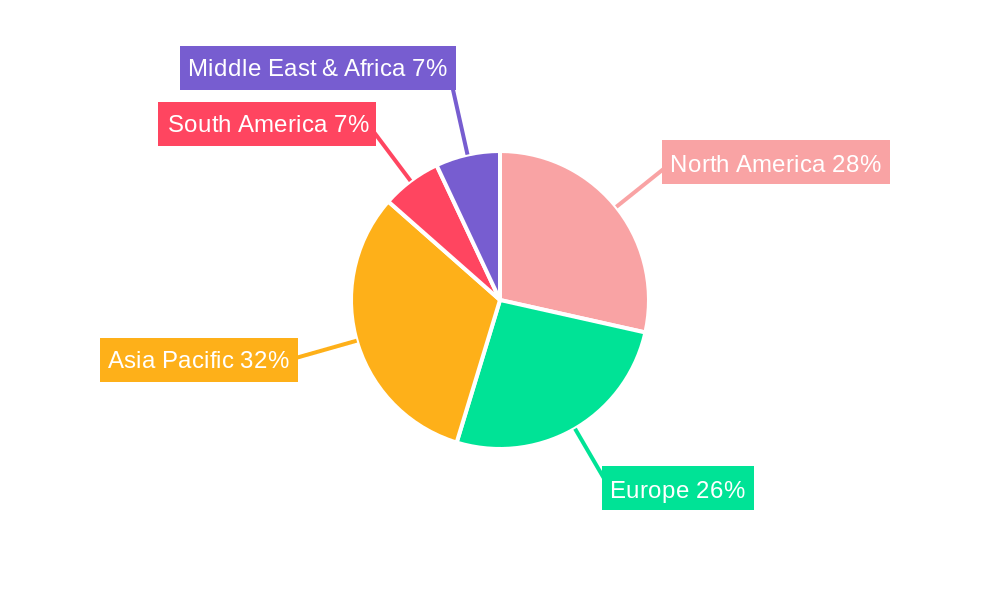

The leading players in the AV receiver market, including Sony, Yamaha, and Onkyo, are actively adapting their product portfolios to meet evolving consumer preferences. This involves focusing on features such as improved network connectivity, support for high-resolution audio formats, and seamless integration with smart home ecosystems. Regional variations are expected, with North America and Europe maintaining significant market shares due to higher per capita income levels and established home theater cultures. The Asia-Pacific region, however, is anticipated to showcase substantial growth potential in the coming years driven by expanding urbanization and the rising adoption of home entertainment systems. Successful players will likely leverage strategic partnerships, product innovation, and effective marketing to secure their position within this competitive landscape.

The global AV receiver market, valued at approximately X million units in 2024, is poised for significant transformation during the forecast period (2025-2033). While the historical period (2019-2024) witnessed a decline in unit sales due to the rise of integrated sound systems in televisions and streaming devices, the market is showing signs of stabilization and even modest growth. This resurgence is primarily driven by a shift in consumer preferences towards higher-quality audio experiences, particularly within the home theater segment. Consumers are increasingly seeking immersive sound beyond what built-in TV speakers can offer, creating renewed demand for AV receivers capable of handling advanced surround sound formats like Dolby Atmos and DTS:X. This trend is further amplified by the growing adoption of high-resolution audio formats and the increasing availability of streaming services offering lossless audio. The market is also witnessing innovation in receiver designs, with manufacturers incorporating features like enhanced connectivity options (e.g., HDMI 2.1, Wi-Fi 6), smart home integration capabilities, and support for multi-room audio systems. While the overall market size in terms of units might remain relatively stable compared to peak years, the average selling price (ASP) is expected to increase, reflecting the added value proposition of these enhanced functionalities. Key players are strategically focusing on developing premium models catering to audiophiles and home theater enthusiasts, resulting in a more niche but potentially more lucrative market segment. The competitive landscape is characterized by both established brands like Sony and Yamaha and emerging players focusing on specific market needs and price points.

Several factors are propelling the growth of the AV receiver market despite the challenges posed by integrated sound systems. The rising popularity of home theater systems remains a crucial driver, with consumers increasingly seeking immersive audio experiences beyond the limitations of built-in TV speakers. The increasing affordability of high-resolution audio sources and streaming services offering lossless audio further fuels this trend. Technological advancements are playing a significant role, with manufacturers continuously improving audio processing capabilities, integrating advanced surround sound formats (Dolby Atmos, DTS:X), and incorporating seamless connectivity features like HDMI 2.1 and Wi-Fi 6. The convergence of smart home technology and AV receivers is also attracting consumers, enabling voice control, seamless integration with other smart devices, and multi-room audio capabilities. Moreover, the increasing demand for superior audio quality in gaming experiences, particularly with the rise of next-generation consoles, is contributing to market growth. Finally, the continued emphasis on premium audio experiences within the high-end home theater segment is driving the demand for sophisticated and feature-rich AV receivers, even in a market characterized by evolving trends.

The AV receiver market faces significant headwinds. The most prominent challenge is the increasing integration of sophisticated sound systems directly into televisions and streaming devices. This trend reduces the perceived need for a separate AV receiver, especially among casual users. The rising cost of components and the complexities of manufacturing high-quality AV receivers, particularly those supporting advanced surround sound formats, impact profitability and pricing. The shift towards smaller living spaces in many urban environments can also present a challenge, as the bulkier nature of some AV receivers might not always align with modern design aesthetics. Competition from soundbar systems that offer relative convenience and affordability poses another considerable threat. Soundbars have been successful in capturing the budget-conscious consumer segments that would have traditionally considered AV receivers. Furthermore, the emergence of simpler and compact alternatives that can still provide improved audio quality compared to built-in TV speakers present additional market share challenges. Finally, the changing consumer behaviour towards digital streaming and the integration of sound within other entertainment devices contributes to a more complex landscape for the traditional AV receiver.

The residential segment will continue to dominate the AV receiver market throughout the forecast period. This dominance stems from the widespread adoption of home theater systems and the growing preference for high-quality audio experiences in home environments.

North America: This region is expected to maintain a strong market share due to higher disposable income, a preference for premium audio products, and a mature home theater market.

Europe: Europe will contribute significantly, driven by similar consumer preferences for superior audio quality and a strong home entertainment culture.

Asia-Pacific: This region is projected to witness considerable growth, fueled by rising disposable incomes, increased urbanization, and a growing middle class with a penchant for high-quality home entertainment. The increasing awareness and adoption of advanced audio formats, and the rising preference for premium home entertainment systems will greatly impact growth.

While 5.1 and 7.1 channel systems still represent a considerable market share, the demand for 9.2 channel systems, and those supporting immersive formats like Dolby Atmos and DTS:X, is steadily increasing. These immersive sound systems enhance the realism and overall experience, particularly for home theater enthusiasts and gamers, representing a significant growth driver within the premium segments of the market. The "Others" segment, encompassing emerging technologies and niche applications, presents an intriguing space for future market expansion, driven by continuous technological innovation and new product launches.

The integration of advanced technologies such as AI-powered sound optimization and multi-room audio systems will significantly boost market growth. Furthermore, the development of increasingly compact and aesthetically pleasing designs that suit modern living spaces, alongside the focus on improved usability and seamless integration with smart home ecosystems, will stimulate market expansion. The continuous rollout of high-resolution audio formats and services, along with strong support from key players in the entertainment ecosystem, creates a powerful synergy that pushes market growth.

This report provides a comprehensive overview of the AV receiver market, analyzing historical trends, current market dynamics, and future growth projections. It offers detailed insights into key market segments, leading players, driving factors, and challenges. The report helps businesses understand the evolving consumer preferences, technological advancements, and competitive landscapes of this dynamic market, facilitating informed decision-making and strategic planning. Furthermore, the report includes granular segment-wise data, allowing for accurate prediction of the future of the AV receiver market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.4% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 2.4%.

Key companies in the market include Sony, Yamaha, Onkyo (VOXX), D+M Group(Sound United), LG Electronics, Harman Kardon, Inkel Corporation, NAD, Rotel, Anthem AV Solutions Limited, Pyle, Cambridge Audio, Arcam, .

The market segments include Type.

The market size is estimated to be USD 1278.5 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "AV Receiver," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the AV Receiver, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.