1. What is the projected Compound Annual Growth Rate (CAGR) of the Home Theater AV Receiver?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Home Theater AV Receiver

Home Theater AV ReceiverHome Theater AV Receiver by Type (5.1 &5.2 Sound Channels, 7.1 &7.2 Sound Channels, 9.2 Sound Channels, Others, World Home Theater AV Receiver Production ), by Application (Residential, Commercial, World Home Theater AV Receiver Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

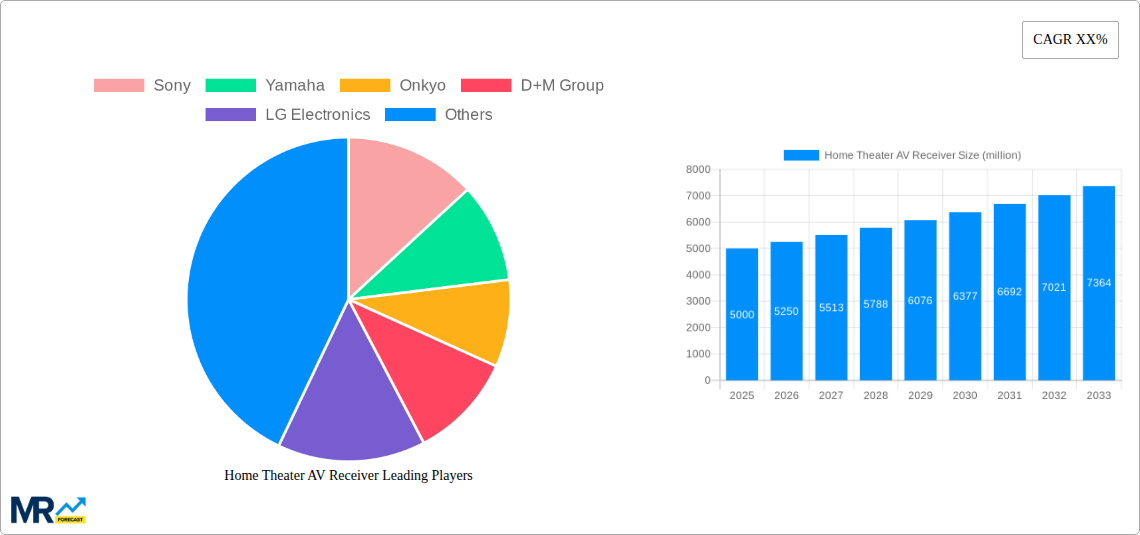

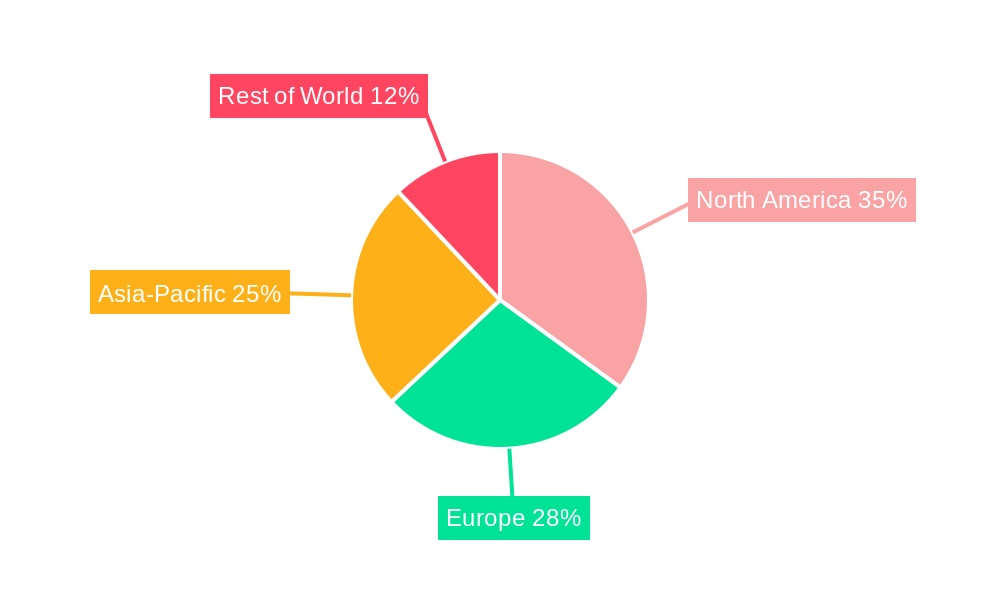

The global home theater AV receiver market is experiencing moderate growth, driven by the increasing demand for high-quality audio-visual experiences in residential settings. While the market faced some challenges in recent years due to the rise of soundbars and streaming services offering integrated audio solutions, the segment remains resilient. Consumers seeking superior audio fidelity and customizable home theater setups continue to favor dedicated AV receivers, particularly those offering advanced features like Dolby Atmos and DTS:X immersive sound. The market is segmented by sound channels (5.1, 7.1, 9.2, and others), reflecting varying consumer budgets and needs. The residential segment dominates the market share, but commercial installations in hotels, cinemas, and entertainment venues also contribute significantly, albeit at a smaller scale. Key players like Sony, Yamaha, and Denon are leveraging technological advancements and brand recognition to maintain their market positions, while emerging players introduce innovative and cost-effective options. Geographical distribution shows strong demand from North America and Europe, with Asia-Pacific emerging as a significant growth region due to increasing disposable incomes and adoption of home entertainment systems. The forecast period anticipates continued growth, fueled by ongoing technological improvements and a persistent desire for premium home entertainment experiences. However, competition from streamlined audio solutions will continue to exert pressure on market expansion.

The competitive landscape is characterized by established brands and emerging players. Established brands leverage their brand equity and technological expertise to dominate market share. However, emerging brands are challenging incumbents with innovative designs and competitive pricing strategies. Growth in the market will likely be driven by the continuous development of high-resolution audio codecs and the integration of smart home capabilities into AV receivers. The increasing availability of 4K and 8K video content also necessitates high-quality audio systems, supporting the demand for advanced AV receivers. Regional growth will vary, with developed markets showing stable growth and developing markets experiencing a more rapid expansion. Government regulations concerning energy consumption and environmental standards may also impact the market’s trajectory in the years ahead.

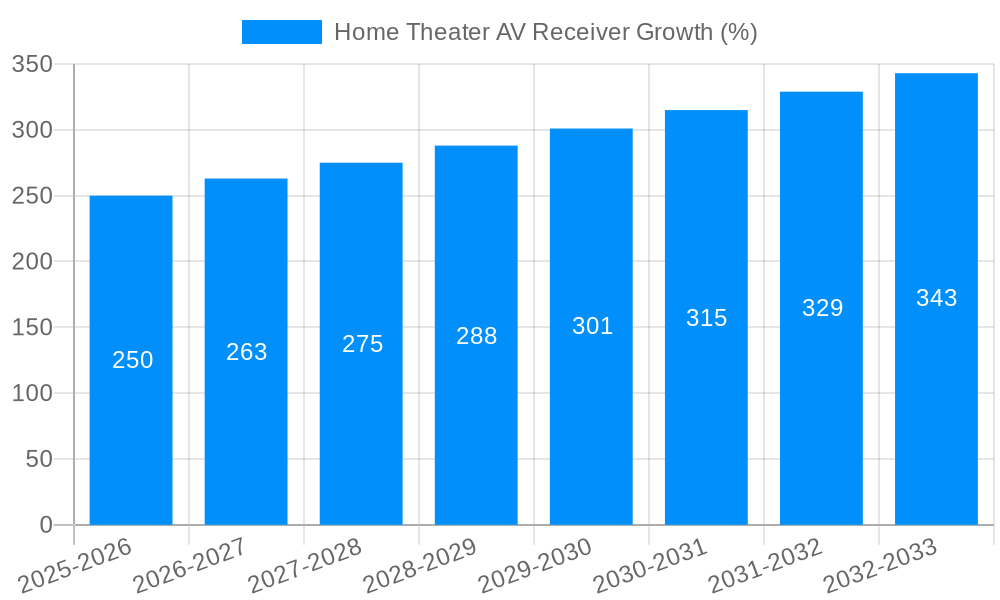

The global home theater AV receiver market, valued at X million units in 2024, is projected to experience significant growth throughout the forecast period (2025-2033). This growth is fueled by several converging trends. The increasing affordability of high-quality audio-visual components, coupled with the rise of streaming services offering high-resolution audio and video content, has driven consumer demand for immersive home entertainment experiences. Consumers are increasingly seeking to replicate the cinematic experience within their homes, pushing the demand for advanced receiver functionalities like Dolby Atmos and DTS:X support. The market is also seeing a shift towards network-connected receivers, allowing for seamless integration with smart home ecosystems and facilitating convenient access to music streaming services. Furthermore, the emergence of 8K video resolution, while still in its nascent stage, is anticipated to stimulate further demand for future-proof receivers capable of handling the higher bandwidth requirements. However, competition from soundbar systems and the increasing integration of audio capabilities directly into televisions pose challenges to the traditional AV receiver market. This necessitates manufacturers to continuously innovate, offering improved functionalities, better connectivity options, and more streamlined user interfaces to maintain their market share. The historical period (2019-2024) demonstrated consistent growth, albeit at a slower pace than projected for the forecast period, indicating a burgeoning market ready for an upswing driven by the aforementioned trends. The base year for this analysis is 2025, with estimations for 2025 and a detailed forecast until 2033. The study period covers 2019-2033, providing a comprehensive overview of the market's evolution.

Several key factors are driving the growth of the home theater AV receiver market. The rising disposable incomes in developing economies, particularly in Asia and Latin America, are making high-quality home entertainment systems more accessible to a wider consumer base. This increased purchasing power fuels demand for advanced AV receivers capable of delivering immersive sound experiences. The simultaneous proliferation of streaming services offering high-definition audio and video content is a crucial factor. Services like Netflix, Amazon Prime Video, and Disney+ provide high-quality content that consumers want to enjoy with optimal audio fidelity, driving demand for receivers capable of handling various audio codecs and high-resolution formats. Technological advancements in audio processing technologies, such as Dolby Atmos and DTS:X, are crucial in shaping the market. These technologies provide three-dimensional surround sound experiences, significantly enhancing the immersion and enjoyment of home theater setups. Finally, the integration of smart home technologies and network connectivity in modern AV receivers is a major draw for consumers, allowing them seamless control and integration with other smart home devices.

Despite the positive growth trajectory, the home theater AV receiver market faces several challenges. The increasing popularity of soundbar systems presents a significant competitive threat. Soundbars offer a more compact and aesthetically pleasing alternative, especially for consumers with limited space. The integration of advanced audio capabilities directly into modern televisions also diminishes the need for a separate AV receiver in many setups. Furthermore, the complexity of setting up and configuring a traditional AV receiver system can be daunting for some consumers, potentially hindering adoption. The high cost of high-end AV receivers limits market penetration in price-sensitive segments. Finally, evolving consumer preferences and lifestyle changes, particularly among younger demographics who may prioritize portability and convenience over high-fidelity audio systems, pose challenges to the long-term growth of the traditional AV receiver market.

Dominant Segment: The 7.1 & 7.2 Sound Channels segment is projected to maintain its dominant position within the market throughout the forecast period. This is due to the widespread adoption of this configuration as it provides a balanced compromise between immersive sound and system complexity. While 9.2 channel systems offer even more immersive experiences, their higher cost and the perceived diminishing returns in audio fidelity beyond 7.2 channels limit their market penetration. 5.1 & 5.2 channel systems are still relevant, particularly in budget-conscious segments, but their market share is predicted to decline gradually as consumers upgrade to more immersive setups. The “Others” segment includes niche configurations that will experience limited growth compared to the dominant channel configurations.

Dominant Application: Residential applications will continue to represent the vast majority of the home theater AV receiver market. While commercial installations exist (hotels, cinemas, etc.), they comprise a significantly smaller segment due to the specialized requirements and larger scale of such projects, often favoring custom-installed audio solutions.

Dominant Region: North America and Western Europe are anticipated to continue driving significant market demand for high-end AV receivers during the forecast period. These regions boast higher disposable incomes and established home theater cultures compared to other regions globally. However, emerging economies in Asia (particularly China and India) are expected to show significant growth potential in the coming years, with a growing middle class increasingly investing in premium home entertainment systems.

The overall growth trajectory suggests a continued dominance for 7.1 & 7.2 channel receivers within the residential market across key regions, indicating a focus on a balance between immersive audio and practical implementation.

The confluence of factors like increasing affordability of high-end components, the expansion of high-resolution streaming services, and the continued development of more advanced audio technologies like Dolby Atmos and DTS:X ensures that the market will continue to thrive. These catalysts, coupled with rising disposable incomes and a shift towards premium home entertainment experiences, contribute significantly to the market's positive outlook.

This report provides a comprehensive analysis of the global home theater AV receiver market, encompassing historical data, current market trends, and future growth projections. It covers key market segments, including different sound channel configurations, applications, and geographical regions. Detailed profiles of major players, analysis of driving and restraining forces, and key industry developments are also included, giving a complete understanding of this dynamic market landscape and its potential.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Sony, Yamaha, Onkyo, D+M Group, LG Electronics, Harman Kardon, Inkel Corporation, NAD, Rotel, Anthem AV Solutions Limited, Pyle, Cambridge Audio, Arcam, Denon, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Home Theater AV Receiver," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Home Theater AV Receiver, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.