1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Fleet Leasing?

The projected CAGR is approximately 5.6%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Automotive Fleet Leasing

Automotive Fleet LeasingAutomotive Fleet Leasing by Type (/> Open Ended, Close Ended), by Application (/> Passenger Cars, LCV, HCV), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

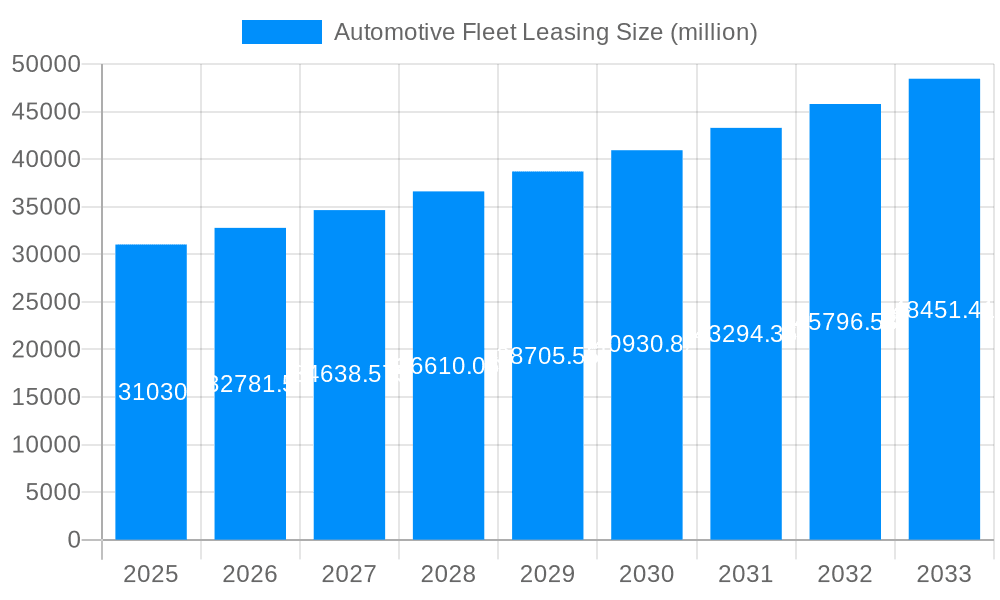

The global automotive fleet leasing market is projected to reach $50.38 billion by 2032, exhibiting a robust compound annual growth rate (CAGR) of 5.6% from the base year 2025. This growth is driven by businesses prioritizing operational efficiency and cost-effectiveness in vehicle management. The increasing adoption of electric and alternative fuel vehicles, coupled with the rise of subscription-based mobility models and the demand for flexible fleet solutions, are key catalysts. Technological advancements in telematics and fleet management software further streamline operations and enhance efficiency. Government initiatives promoting sustainability are also stimulating the adoption of eco-friendly vehicles within corporate fleets, presenting significant opportunities for market participants amidst intensifying competition.

While economic downturns and fluctuating fuel prices pose potential restraints, the long-term market outlook remains positive, underpinned by global economic expansion and the critical role of efficient logistics. Key market segments include vehicle type, lease term, industry vertical, and geographic region. Understanding these segments is crucial for competitive positioning and market share acquisition. The growing demand for sustainable transportation necessitates adaptation by leasing companies, with a focus on expanding electric vehicle offerings and comprehensive sustainability reporting to meet evolving customer requirements.

The global automotive fleet leasing market is experiencing robust growth, projected to reach multi-million unit figures by 2033. The period from 2019 to 2024 (historical period) showcased steady expansion, driven by several factors including the increasing adoption of leasing by businesses of all sizes, a shift towards operational efficiency, and the rising preference for flexible vehicle usage models. The base year, 2025, reflects a significant market size, with estimations indicating continued upward trajectory during the forecast period (2025-2033). This growth is not uniform across all segments; certain vehicle types, like electric vehicles (EVs), are experiencing disproportionately high adoption rates within the leasing sector. The increasing complexity of vehicle technology and the rising importance of Total Cost of Ownership (TCO) calculations are influencing leasing strategies. Companies are increasingly seeking comprehensive fleet management solutions that go beyond basic vehicle provision, incorporating services like maintenance, repair, insurance, and telematics. This trend is bolstering demand for sophisticated fleet leasing packages that offer integrated services and predictable monthly costs. Furthermore, regulatory changes promoting sustainable transportation, coupled with the decreasing total cost of ownership of electric vehicles, are significantly impacting the market, creating opportunities for specialized leasing programs focused on environmentally friendly fleets. The market is also witnessing an increasing adoption of digital platforms for fleet management, streamlining operations and improving efficiency. This digital transformation is fostering transparency, enhancing data-driven decision-making, and improving overall fleet management. The competitive landscape is dynamic, with both established players and new entrants vying for market share, leading to innovation and more competitive pricing. Overall, the automotive fleet leasing market is poised for continued growth, driven by technological advancements, evolving business needs, and increasing environmental awareness.

Several key factors are fueling the expansion of the automotive fleet leasing market. Firstly, the increasing preference for operational efficiency among businesses is a significant driver. Leasing allows companies to eliminate the burden of vehicle ownership, freeing up capital for core business activities. Predictable monthly payments offer better budgeting control, while also offloading responsibilities like maintenance, repairs, and insurance to leasing providers. Secondly, the rising popularity of flexible vehicle usage models, such as short-term leases and subscription services, is contributing to market growth. These options provide businesses with greater adaptability to fluctuating operational demands, allowing them to easily adjust their fleet size according to changing needs. Thirdly, technological advancements, particularly in telematics and fleet management software, are enhancing efficiency and enabling data-driven decision-making. These tools provide valuable insights into vehicle usage, maintenance needs, and driver behavior, optimizing operational costs and improving safety. Finally, government incentives and regulations promoting sustainable transportation, including tax breaks for EVs and stricter emissions standards, are significantly impacting the market. Businesses are increasingly turning to fleet leasing as a convenient way to adopt environmentally friendly vehicles, fulfilling their sustainability goals while benefiting from potential cost savings. The combined effect of these factors points towards a robust and sustained expansion of the automotive fleet leasing market in the coming years.

Despite the positive growth outlook, the automotive fleet leasing market faces several challenges. Fluctuations in fuel prices and vehicle manufacturing costs can significantly impact lease rates and profitability, creating uncertainty for both leasing companies and clients. The increasing complexity of vehicle technology, particularly in electric and autonomous vehicles, presents new challenges in terms of maintenance, repair, and insurance. This necessitates specialized expertise and potentially higher operational costs for leasing providers. Furthermore, stringent regulatory compliance requirements, varying across different jurisdictions, impose additional administrative burdens and costs on leasing companies. Managing risks associated with vehicle theft, accidents, and driver liability also poses significant challenges. The need for robust risk management strategies and insurance solutions is crucial for maintaining profitability. Finally, competition in the market is intense, with established players and new entrants constantly vying for market share, leading to price pressures and the need for continuous innovation in service offerings. Successfully navigating these challenges will require leasing companies to demonstrate operational efficiency, technological adaptability, and a strong understanding of evolving regulatory landscapes.

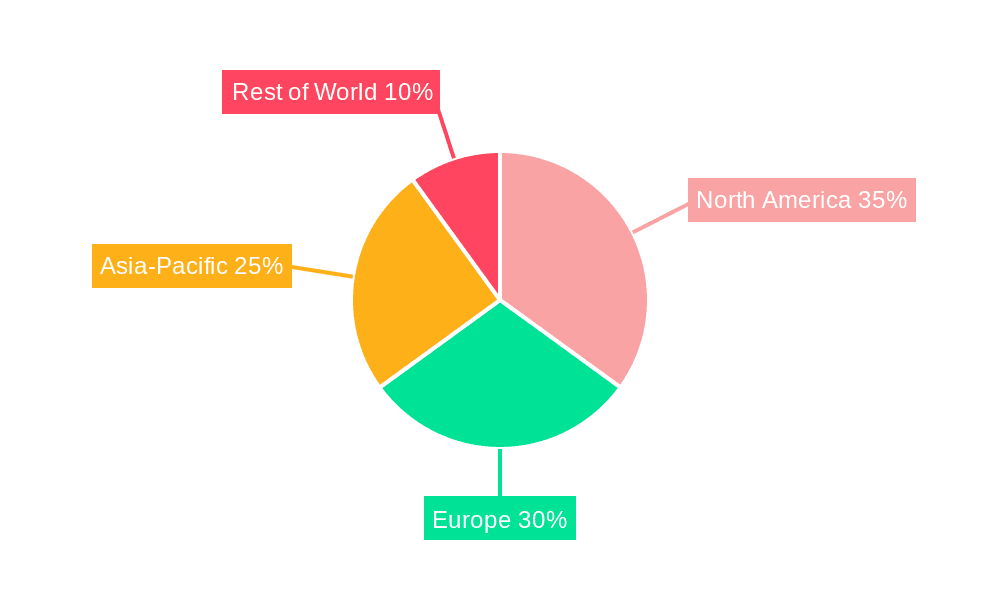

The automotive fleet leasing market shows significant regional variations in growth potential. North America and Europe, particularly Germany and the UK, are expected to maintain their dominance throughout the forecast period (2025-2033). These regions benefit from established automotive industries, strong economic growth (in certain areas), and a high concentration of businesses that rely heavily on vehicle fleets. Within these regions, the segments experiencing the most robust growth are:

Paragraph: The North American and European markets are likely to continue to dominate because of their mature economies, established fleet management infrastructure, and high vehicle ownership rates. The shift toward sustainability and the increasing adoption of electric vehicles is significantly impacting market segments within these regions, driving demand for specialized leasing solutions catering to EV fleets. The rising popularity of flexible leasing models like subscriptions is further fueling market growth by enabling businesses to optimize their fleet sizes based on operational requirements. Competition within these regions is fierce, with companies constantly innovating to offer comprehensive services and competitive pricing. The growing emphasis on data-driven fleet management and the integration of telematics further contribute to the dynamism and growth within these key markets.

Several factors are accelerating the growth of the automotive fleet leasing industry. The increasing focus on operational efficiency among businesses is a major catalyst, with companies seeking to optimize costs and free up capital for core business activities. Government incentives and regulations promoting sustainable transportation, such as tax benefits for EVs and stricter emission standards, are also significantly driving market expansion. The rise of innovative leasing models, including subscription-based services and short-term leases, provides businesses with greater flexibility and adaptability to changing operational needs. Finally, technological advancements in telematics and fleet management software are enhancing efficiency and enabling data-driven decision-making, improving overall fleet optimization and cost reduction. These factors collectively contribute to a positive outlook for the growth of the automotive fleet leasing industry.

This report provides a comprehensive overview of the automotive fleet leasing market, covering historical data (2019-2024), current estimates (2025), and future forecasts (2025-2033). It delves into key market trends, driving forces, challenges, and growth opportunities, offering in-depth analysis of major market segments and key players. The report also provides a detailed regional breakdown, highlighting growth potentials in key regions and countries. This data-rich analysis is invaluable for businesses operating in the automotive fleet leasing sector, investors seeking investment opportunities, and anyone interested in gaining a better understanding of this dynamic and evolving market.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.6% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 5.6%.

Key companies in the market include Glesby Marks, LeasePlan, AutoFlex AFV, Velcor Leasing, Caldwell fleet leasing, Wheel, PRO Leasing Services, Jim Pattison Lease, Sixt Leasing SE.

The market segments include Type, Application.

The market size is estimated to be USD 50.38 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in billion.

Yes, the market keyword associated with the report is "Automotive Fleet Leasing," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Automotive Fleet Leasing, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.