1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Cybersecurity Solution?

The projected CAGR is approximately 15.5%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Automotive Cybersecurity Solution

Automotive Cybersecurity SolutionAutomotive Cybersecurity Solution by Type (Key Management Security Solution, Data Security Management Solution, Access Control Security Solutions, Transmission Link Security Management Solution, Others), by Application (Passenger Cars, Commercial Vehicles), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

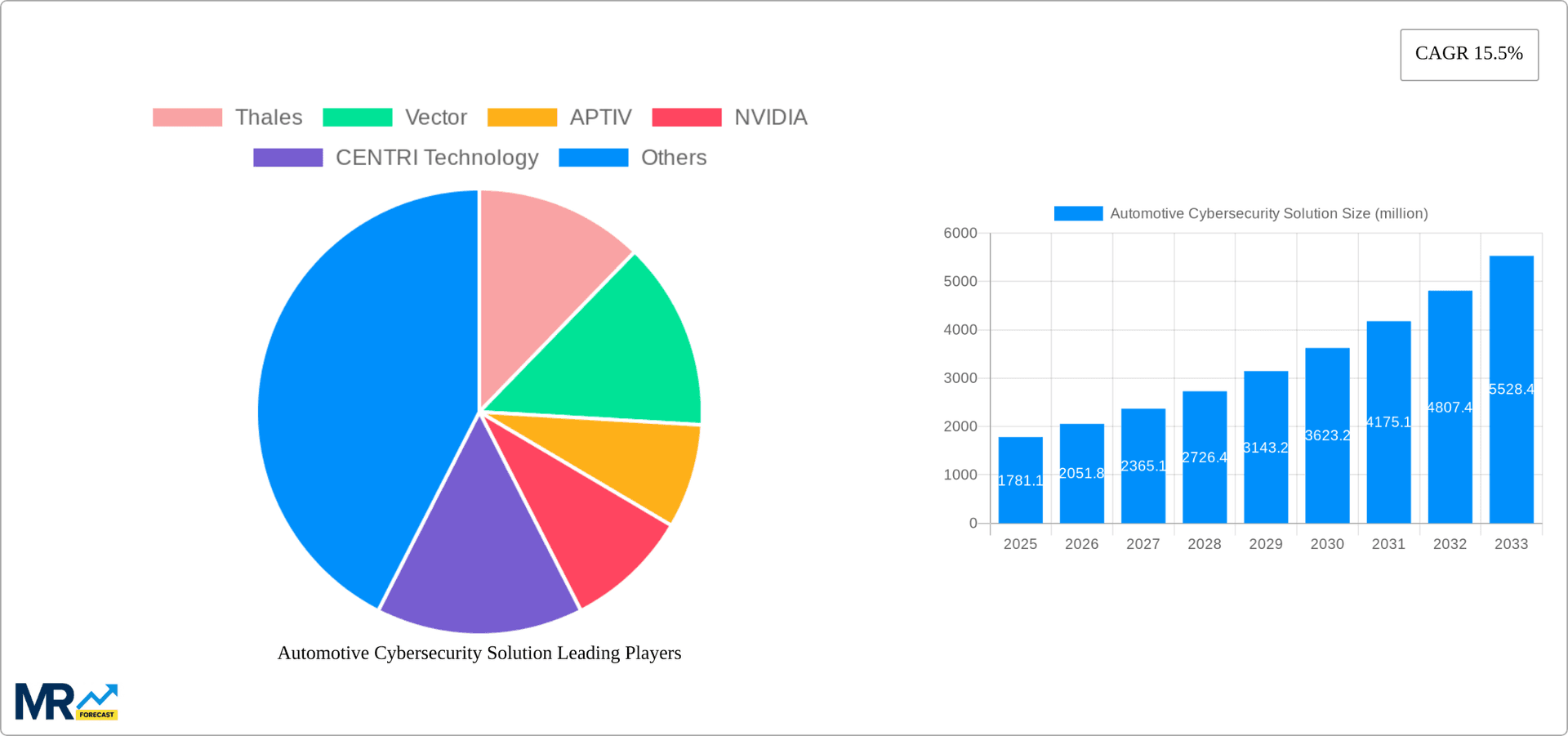

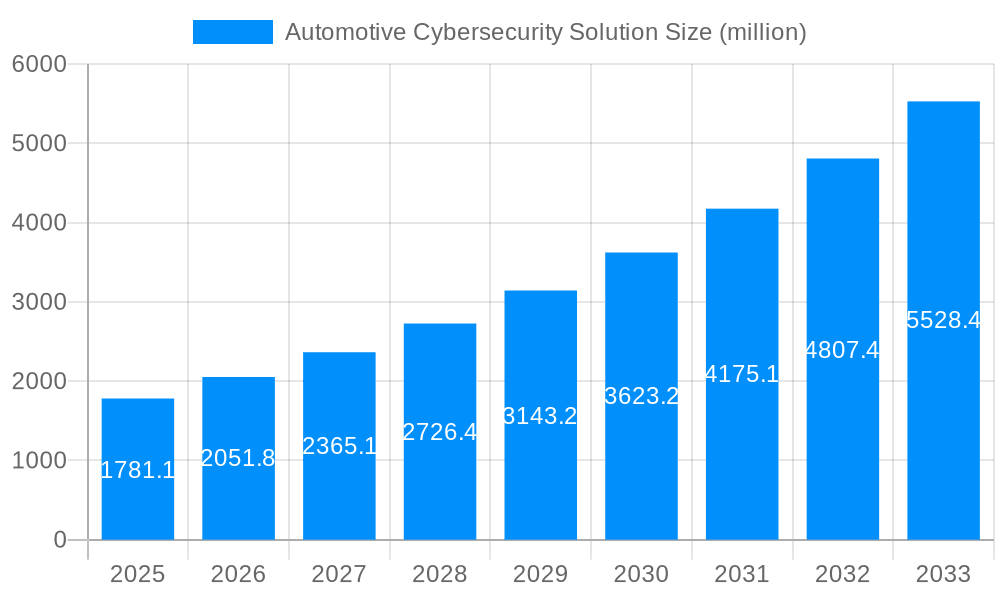

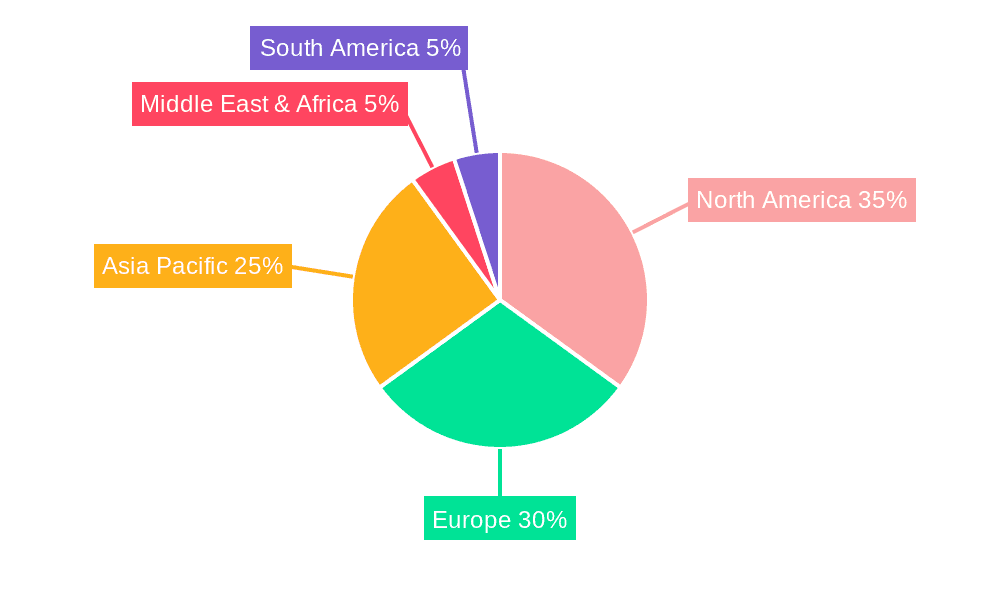

The automotive cybersecurity solutions market is experiencing rapid growth, projected to reach \$1781.1 million in 2025 and exhibiting a robust Compound Annual Growth Rate (CAGR) of 15.5% from 2025 to 2033. This expansion is driven by several key factors. The increasing connectivity of vehicles through the Internet of Things (IoT) and the adoption of advanced driver-assistance systems (ADAS) and autonomous driving technologies significantly expands the attack surface, creating a heightened need for robust cybersecurity measures. Furthermore, stringent government regulations and rising consumer awareness of data privacy and security are compelling automakers and suppliers to prioritize cybersecurity investments. The market is segmented by solution type (Key Management Security, Data Security Management, Access Control, Transmission Link Security, and Others) and application (Passenger Cars and Commercial Vehicles). North America and Europe currently hold significant market share, owing to early adoption of advanced automotive technologies and stringent data protection regulations. However, the Asia-Pacific region is anticipated to witness substantial growth fueled by increasing vehicle production and technological advancements in emerging economies like China and India. The competitive landscape is characterized by a mix of established players like Thales, Bosch, and Siemens, alongside emerging technology companies specializing in cybersecurity for connected vehicles. This dynamic ecosystem fosters innovation and competition, leading to continuous advancements in automotive cybersecurity solutions.

The market’s growth trajectory suggests a consistent need for innovative solutions addressing evolving threats. The integration of Artificial Intelligence (AI) and Machine Learning (ML) is expected to play a pivotal role in enhancing threat detection and response capabilities. The future will likely see greater collaboration between automakers, cybersecurity companies, and regulatory bodies to develop comprehensive cybersecurity standards and frameworks. Specific segments like Data Security Management solutions are poised for particularly strong growth, mirroring the rising importance of securing sensitive vehicle data. The expansion into commercial vehicles will also be a significant driver, driven by the increasing adoption of fleet management systems and connected logistics. Overall, the automotive cybersecurity market exhibits a promising outlook, shaped by technological advancements, regulatory pressures, and growing consumer awareness.

The automotive cybersecurity solution market is experiencing explosive growth, projected to reach multi-billion dollar valuations by 2033. The study period of 2019-2033 reveals a dramatic shift in market dynamics, driven by the increasing connectivity and sophistication of modern vehicles. The base year of 2025 serves as a crucial benchmark, highlighting a market already exceeding several billion dollars in value. The estimated year 2025 figures demonstrate significant penetration of cybersecurity solutions across various vehicle segments, reflecting the growing awareness of vulnerabilities and the potential consequences of cyberattacks. The forecast period (2025-2033) anticipates a compound annual growth rate (CAGR) in the double digits, fueled by the convergence of several key factors. These factors include the proliferation of connected car technologies, the rise of autonomous driving systems, and increasingly stringent regulatory requirements mandating robust cybersecurity measures. The historical period (2019-2024) laid the foundation for this growth, showcasing a steadily increasing demand for sophisticated solutions. This period saw significant investments in R&D, the emergence of new players, and a greater focus on collaborative efforts between automotive manufacturers and cybersecurity specialists. Overall, the market trends indicate a continued upward trajectory, with the potential for further acceleration as the automotive industry embraces technological advancements and navigates evolving cybersecurity threats. This report analyzes the market based on type (key management, data security, access control, transmission link security, and others), application (passenger cars and commercial vehicles), and key players. Millions of units of automotive cybersecurity solutions are being deployed annually, highlighting the significant scale of this market. The market is expected to cross the 10 million unit mark by 2033.

Several converging factors propel the growth of the automotive cybersecurity solution market. The increasing connectivity of vehicles, facilitated by the integration of advanced driver-assistance systems (ADAS) and the rise of connected car technologies, creates a larger attack surface. This expanded attack surface makes vehicles vulnerable to various cyber threats, ranging from data breaches and theft to manipulation of vehicle controls, highlighting the critical need for robust cybersecurity measures. The increasing complexity of vehicle electronics, including the proliferation of embedded systems and software-defined functions, further amplifies the vulnerability. The automotive industry's proactive response to these challenges, coupled with increasingly stringent regulatory frameworks, mandates the implementation of robust cybersecurity solutions to mitigate potential risks. Governments worldwide are implementing stricter regulations concerning vehicle cybersecurity, forcing automakers to invest heavily in protective measures. Consumers' growing awareness of cybersecurity risks and their demand for safer and more secure vehicles further fuels the market. Finally, the substantial investment by automotive manufacturers and technology companies in research and development underscores the industry's commitment to developing innovative and effective cybersecurity solutions.

Despite the rapid growth, several challenges and restraints hinder the market's expansion. The high cost of implementation and integration of automotive cybersecurity solutions represents a significant barrier for smaller manufacturers, particularly in developing economies. The complexity of integrating these solutions into existing vehicle architectures and the need for specialized expertise can be daunting, causing delays and increasing implementation costs. Maintaining and updating these systems requires ongoing investment, adding to the overall cost of ownership. The rapidly evolving nature of cyber threats necessitates continuous upgrades and adaptation of cybersecurity solutions, demanding substantial resources and expertise. The lack of standardization and interoperability across different cybersecurity solutions poses a further challenge, impeding seamless integration and efficient management. Moreover, concerns about data privacy and the ethical implications of data collection by connected vehicles remain important considerations that may influence consumer adoption and regulatory frameworks. Finally, the geographical disparities in cybersecurity awareness and regulations may create market variations.

The automotive cybersecurity solution market shows strong regional variations. North America and Europe are currently leading the market due to the high adoption of advanced driver-assistance systems (ADAS) and connected car technologies, coupled with stringent regulatory frameworks. However, Asia-Pacific is emerging as a significant growth region, driven by rapid technological advancements, increasing vehicle production, and a growing focus on cybersecurity within the automotive industry.

Passenger Cars Segment: This segment currently dominates the market due to the high volume of passenger car production globally and the increasing adoption of advanced technologies within passenger vehicles. Millions of units are sold annually, creating a significant demand for effective cybersecurity solutions. The continued growth of the passenger car segment is directly linked to the expansion of the overall market.

Data Security Management Solutions: This segment is experiencing particularly rapid growth, driven by the increasing volume of data generated and transmitted by connected vehicles. The need to protect sensitive driver and vehicle data from unauthorized access and breaches fuels demand for robust data security management solutions. This segment is expected to maintain strong growth due to the expansion of data collection and usage in connected cars.

Key Management Security Solutions: This segment plays a crucial role in securing digital keys and cryptographic materials essential for access control and secure communication within vehicles. The rising adoption of keyless entry systems and remote vehicle access functionalities enhances the importance of effective key management, driving demand for these solutions. Its importance will grow even further as the car’s security will increasingly rely on these management solutions.

The market size of these segments is measured in millions of units, indicating a vast and rapidly growing market with ample opportunities for various players, each catering to specific requirements and focusing on niche segments. These segments are expected to continue their dominance due to their fundamental role in securing modern vehicles.

The automotive cybersecurity solution industry is experiencing significant growth driven by the convergence of multiple factors. The increasing integration of advanced driver-assistance systems (ADAS) and the proliferation of connected car technologies are major drivers, expanding the attack surface and necessitating enhanced security measures. Government regulations and industry standards focused on cybersecurity for vehicles are further accelerating market adoption. The rising consumer awareness of cybersecurity risks and their desire for secure vehicles contribute to increased demand. The ongoing advancements in cybersecurity technologies and the development of innovative solutions further fuel the market's growth.

This report provides a comprehensive overview of the automotive cybersecurity solution market, including detailed analysis of market trends, driving forces, challenges, and opportunities. It presents key insights into market segments, geographic regions, and leading players, providing valuable information for industry stakeholders, investors, and policymakers. The report also includes forecasts and predictions for the market’s future growth, enabling strategic decision-making and investment planning. This in-depth analysis offers a 360-degree perspective of the automotive cybersecurity landscape, highlighting the critical role of security in the ever-evolving automotive industry.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.5% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 15.5%.

Key companies in the market include Thales, Vector, APTIV, NVIDIA, CENTRI Technology, Dellfer, Garrett, Argus Cyber Security, GuardKnox, Harman, AWS, Siemens, AVL List GmbH, Intel, Cisco Systems, Upstream Security, UL Solutions, Dekra, AliCloud, Huawei Cloud, Baidu Apollo, Seczone, Sansec, Tencent Cloud, Beijing Zhizhangyi, China Automotive Technology and Research Center, Reachauto, Hengbao Co, .

The market segments include Type, Application.

The market size is estimated to be USD 1781.1 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Automotive Cybersecurity Solution," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Automotive Cybersecurity Solution, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.