1. What is the projected Compound Annual Growth Rate (CAGR) of the Auto Black box Insurance?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Auto Black box Insurance

Auto Black box InsuranceAuto Black box Insurance by Type (On-premises, Cloud), by Application (Business Users, Individual Users), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

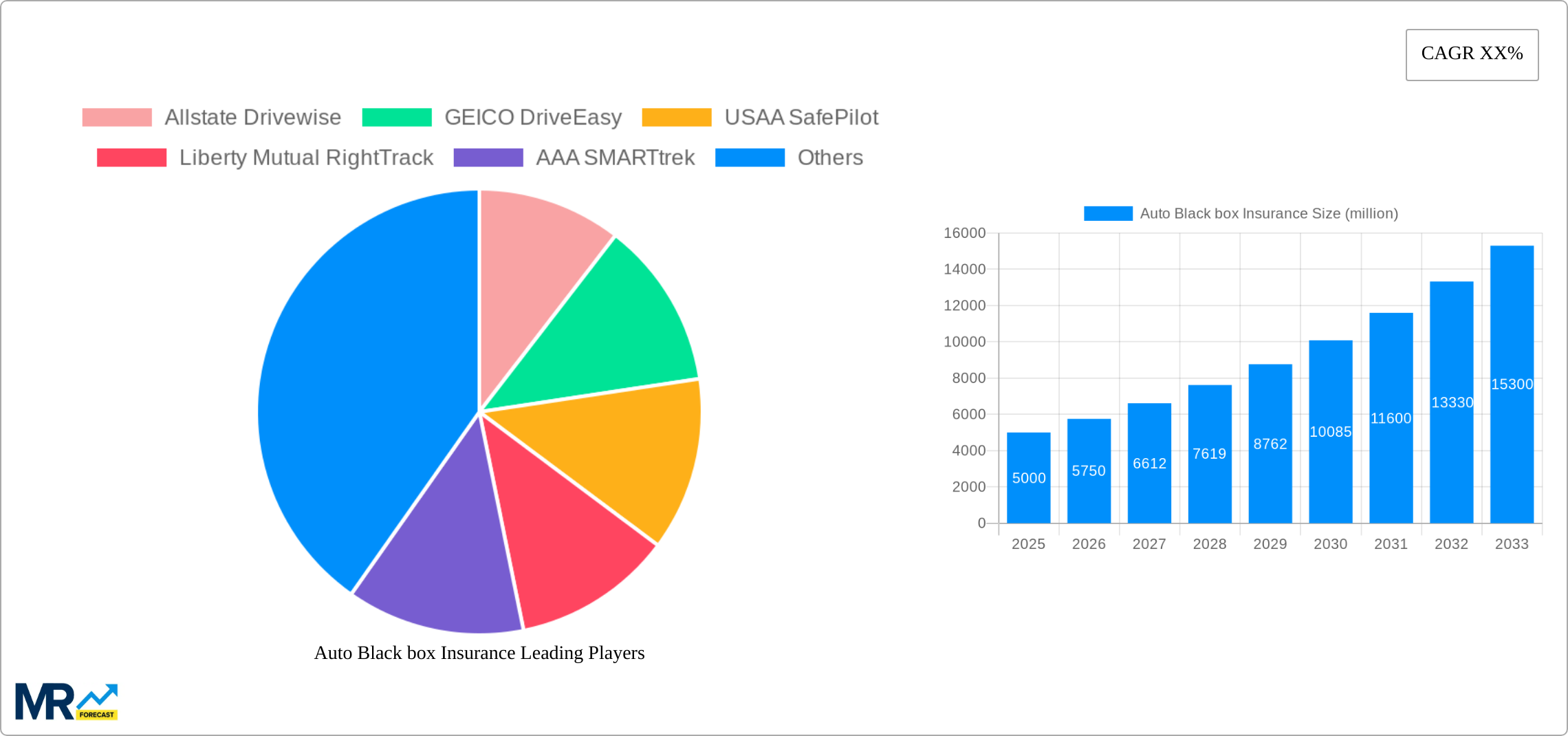

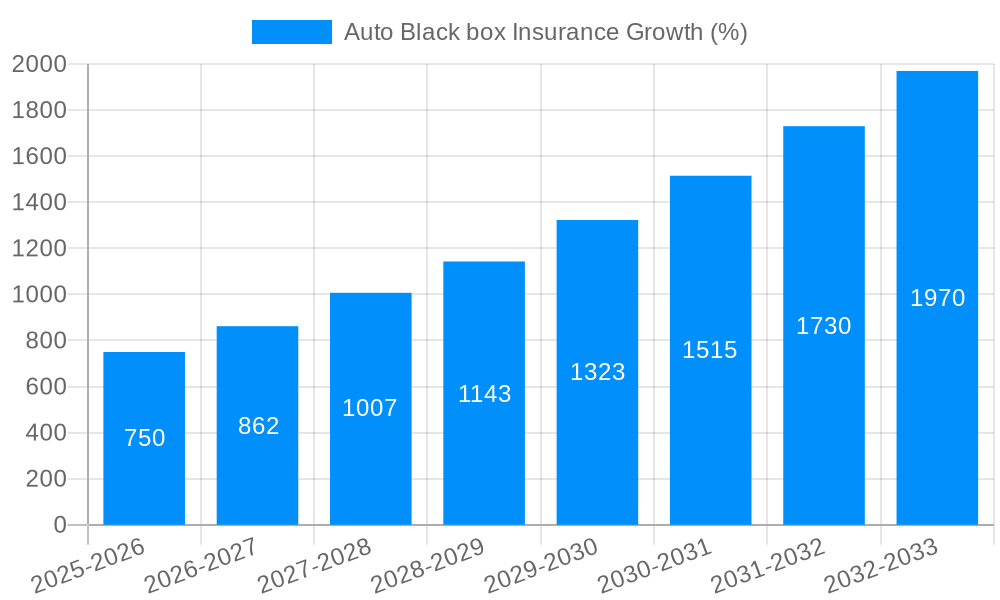

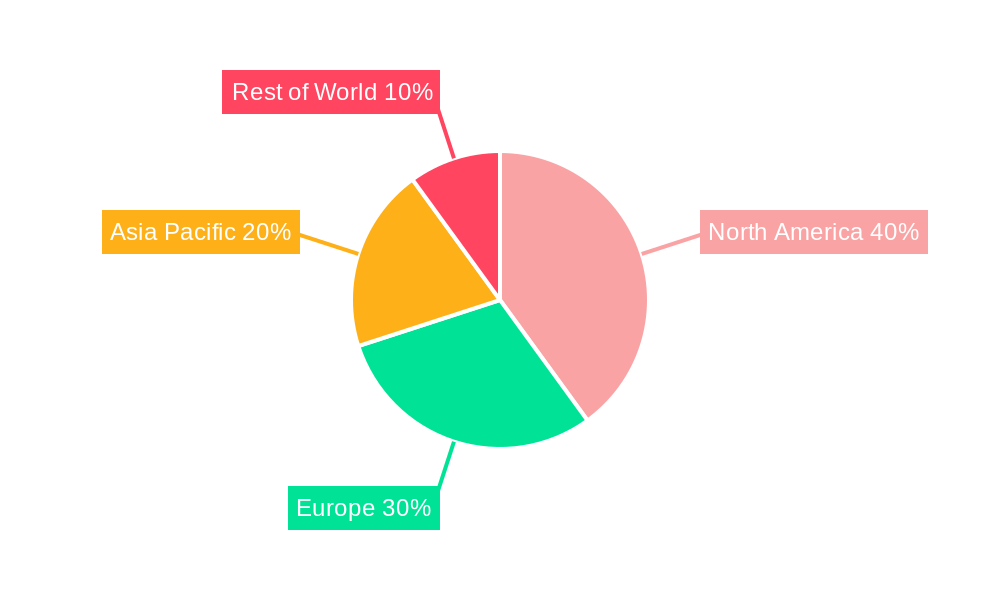

The global auto black box insurance market is experiencing robust growth, driven by the increasing adoption of telematics and the desire for personalized insurance premiums. The market, estimated at $5 billion in 2025, is projected to exhibit a Compound Annual Growth Rate (CAGR) of 15% from 2025 to 2033, reaching approximately $15 billion by 2033. This growth is fueled by several key factors. Firstly, the widespread availability of affordable smartphone-based telematics solutions is making black box technology accessible to a broader consumer base. Secondly, insurers are increasingly leveraging black box data to offer usage-based insurance (UBI) programs that reward safe driving behavior with discounted premiums, attracting price-conscious consumers. Thirdly, advancements in technology are leading to more sophisticated black box devices capable of capturing richer data sets, enabling finer-grained risk assessment and more accurate pricing models. The market is segmented by deployment (on-premises and cloud) and user type (business and individual). The cloud segment is expected to dominate due to its scalability and cost-effectiveness. Geographically, North America currently holds a significant market share, followed by Europe and Asia Pacific. However, the Asia Pacific region is anticipated to witness the fastest growth due to increasing vehicle ownership and the rising adoption of connected car technologies. Restraints to market growth include privacy concerns surrounding data collection and potential technology malfunctions. However, industry initiatives to ensure data security and the increasing reliability of telematics devices are mitigating these concerns.

The competitive landscape is characterized by both established insurance providers and emerging telematics companies. Major players like Allstate, GEICO, USAA, and Liberty Mutual are actively integrating black box technology into their offerings to enhance their UBI programs and gain a competitive edge. The ongoing innovation in data analytics and artificial intelligence further fuels market expansion, allowing insurers to derive deeper insights from telematics data for improved risk assessment and fraud detection. Future growth will depend on consumer acceptance of data-driven insurance models, advancements in data security and privacy regulations, and the continuing development of sophisticated telematics technologies. The market presents significant opportunities for insurers, telematics providers, and data analytics firms to capitalize on the growing demand for personalized and data-driven insurance solutions.

The auto black box insurance market is experiencing significant growth, projected to reach multi-million unit installations by 2033. This surge is driven by a confluence of factors, including the increasing affordability of telematics technology, heightened consumer awareness of usage-based insurance (UBI) benefits, and a growing demand for personalized insurance premiums. The market's evolution showcases a shift from primarily on-premises systems towards cloud-based solutions, offering scalability and enhanced data analytics capabilities for both insurance providers and individual users. Over the historical period (2019-2024), we witnessed a gradual adoption, primarily fueled by early adopters and pilot programs. However, the forecast period (2025-2033) anticipates exponential growth, as more insurance companies integrate black box technology into their core offerings and consumers become more comfortable sharing driving data for potential premium discounts. This trend is particularly evident in the individual user segment, where the promise of lower premiums directly translates into tangible benefits. The estimated market value in 2025 is substantial, demonstrating the burgeoning acceptance of this technology. Key market insights reveal that the competitive landscape is increasingly dynamic, with both established players and new entrants vying for market share through innovative features and competitive pricing strategies. The market's success hinges on addressing consumer privacy concerns and building trust around data security, which are crucial for sustained growth. Furthermore, the evolving regulatory landscape surrounding data collection and usage will significantly influence the trajectory of the market in the coming years. The base year for our analysis is 2025, providing a solid benchmark for future projections.

Several key factors are propelling the growth of the auto black box insurance market. Firstly, the decreasing cost of telematics hardware and software makes it increasingly feasible for insurance companies to offer UBI programs at competitive price points. This affordability is a crucial element in expanding market penetration. Secondly, consumers are becoming more receptive to the idea of personalized insurance pricing, recognizing that safer driving habits can lead to significant premium reductions. The transparency offered by black box technology, where driving data is clearly linked to premium adjustments, fosters greater trust and engagement. Thirdly, the ability to collect and analyze vast amounts of driving data enables insurance companies to refine their risk assessment models, leading to more accurate and equitable premium calculations. This data-driven approach improves profitability for insurers while offering fairer pricing for consumers. Finally, the increasing integration of advanced driver-assistance systems (ADAS) and connected car technologies creates a synergistic ecosystem where black box data can be combined with other vehicle data to provide a holistic picture of driving behavior and vehicle health. This comprehensive data analysis opens new opportunities for tailored insurance products and services, further boosting market growth.

Despite the significant growth potential, several challenges and restraints hinder the widespread adoption of auto black box insurance. Firstly, concerns around data privacy and security remain paramount. Consumers are hesitant to share their driving data if they are not confident that their information will be protected from misuse or unauthorized access. Robust security measures and transparent data handling policies are essential to alleviate these concerns. Secondly, the installation and maintenance of black box devices can be a barrier to entry for some consumers, particularly those who are less tech-savvy. User-friendly installation processes and readily available customer support are vital for seamless adoption. Thirdly, the regulatory landscape surrounding data collection and usage varies significantly across different regions, creating complexities for insurance companies operating internationally. Navigating these diverse regulations requires significant investment in compliance and legal expertise. Lastly, there's a potential for consumer backlash if they perceive the pricing algorithms to be unfair or biased. Transparency in the pricing methodology is crucial to maintain consumer trust and prevent negative perceptions. Addressing these challenges will be critical for realizing the full market potential of auto black box insurance.

The individual user segment is poised to dominate the auto black box insurance market. This is primarily because the direct benefit – lower premiums for safer driving – resonates strongly with this demographic. The focus on individual savings and personalized insurance makes this segment incredibly attractive.

While both on-premises and cloud-based solutions are present, the cloud-based approach is gaining traction due to its scalability, cost-effectiveness, and enhanced data analytics capabilities. The ability to process and analyze large datasets in real-time enables more sophisticated risk assessment models and more precise pricing strategies.

Geographically, North America and Europe are expected to lead the market, driven by strong regulatory frameworks, high technological adoption rates, and a significant number of individuals with privately owned vehicles.

The auto black box insurance industry is experiencing robust growth due to several key catalysts. These include the decreasing cost of telematics technology, making UBI programs more accessible; increased consumer awareness of the benefits of usage-based insurance, leading to greater adoption rates; and the development of more sophisticated data analytics techniques enabling insurers to refine risk assessment and personalize pricing. The industry's growth is also boosted by supportive regulatory frameworks in various regions and the integration of black box technology with advanced driver-assistance systems.

The auto black box insurance market is poised for significant growth, driven by the convergence of affordable telematics, consumer demand for personalized premiums, and advanced data analytics capabilities. This report provides a comprehensive overview of the market, including trends, driving forces, challenges, leading players, and key regional developments, offering valuable insights for stakeholders across the insurance and technology sectors.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Allstate Drivewise, GEICO DriveEasy, USAA SafePilot, Liberty Mutual RightTrack, AAA SMARTtrek, Travelers IntelliDrive ®, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Auto Black box Insurance," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Auto Black box Insurance, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.