1. What is the projected Compound Annual Growth Rate (CAGR) of the Asset Securitization?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Asset Securitization

Asset SecuritizationAsset Securitization by Type (Credit Asset Securitization, Corporate Asset Securitization, Asset Backed Note Securitization, Others), by Application (Joint Stock Enterprise, Partnership, Financial Institutions, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

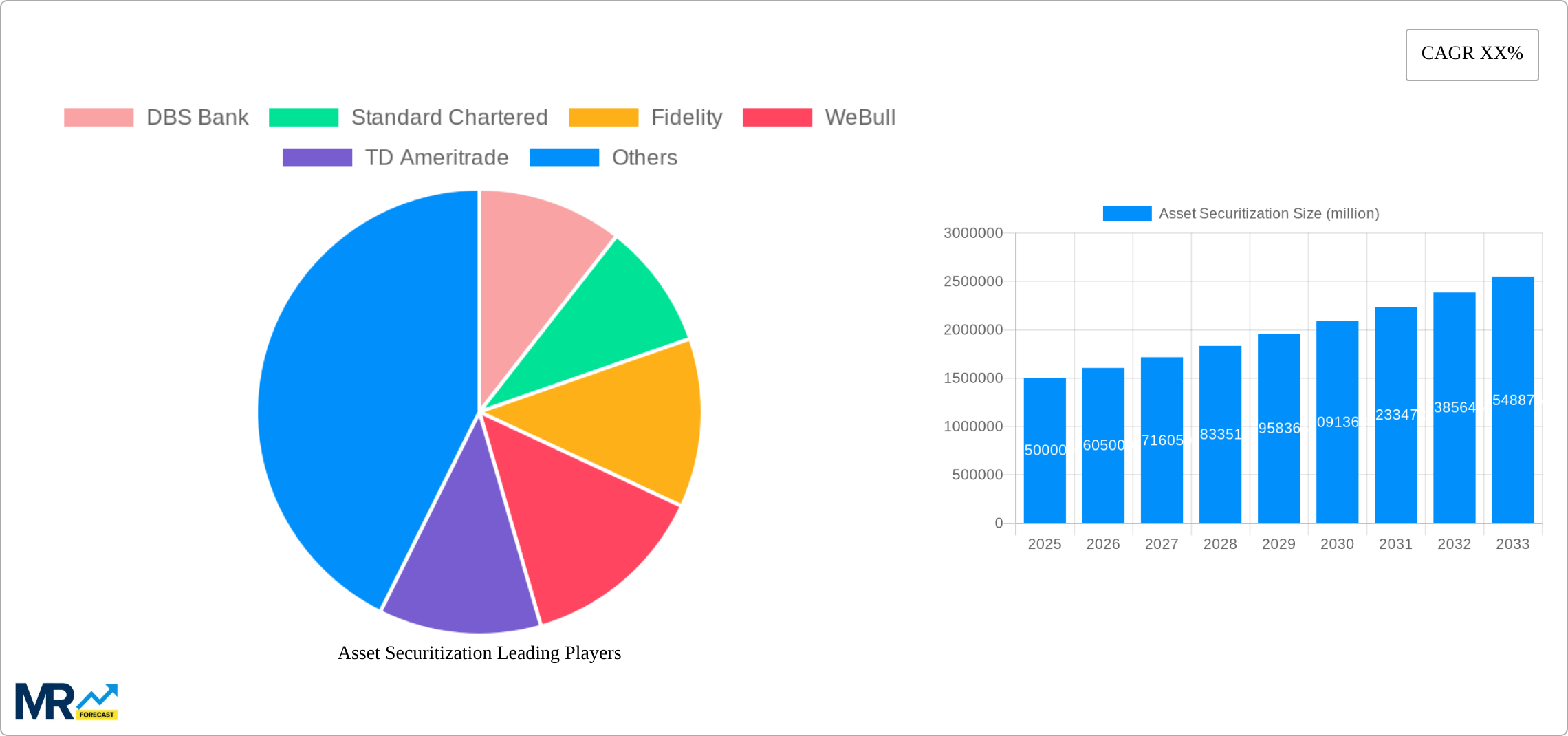

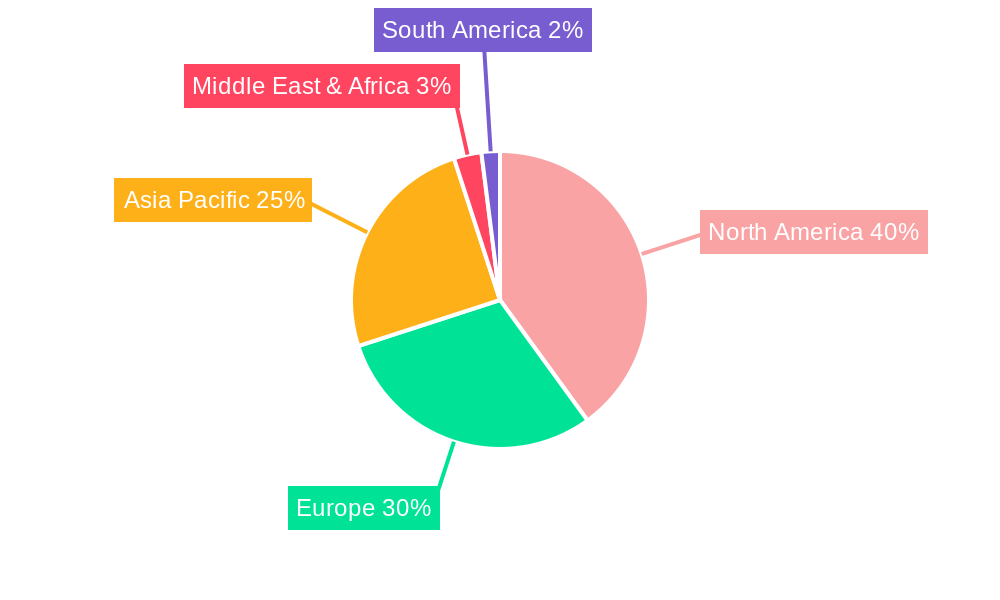

The asset securitization market is experiencing robust growth, driven by increasing demand for credit and liquidity in various sectors. The market's expansion is fueled by a rising need for efficient capital management among corporations and financial institutions, particularly in developed economies like North America and Europe. The prevalence of asset-backed securities (ABS) offers a structured mechanism for transferring credit risk, making them attractive investment vehicles. Specific drivers include the expansion of the fintech sector, fostering innovation in lending and credit origination, and the increasing adoption of regulatory frameworks designed to enhance market transparency and investor confidence. While the market presents significant opportunities, challenges remain, including potential volatility linked to underlying asset performance and macroeconomic fluctuations. Segments like credit asset securitization and corporate asset securitization are expected to show substantial growth, mirroring the overall market expansion. The involvement of major players like DBS Bank, Goldman Sachs, and CITIC Securities underscores the market's maturity and the strategic importance of asset securitization within the global financial landscape. The Asia-Pacific region, particularly China and India, shows immense potential due to increasing financialization and a growing middle class.

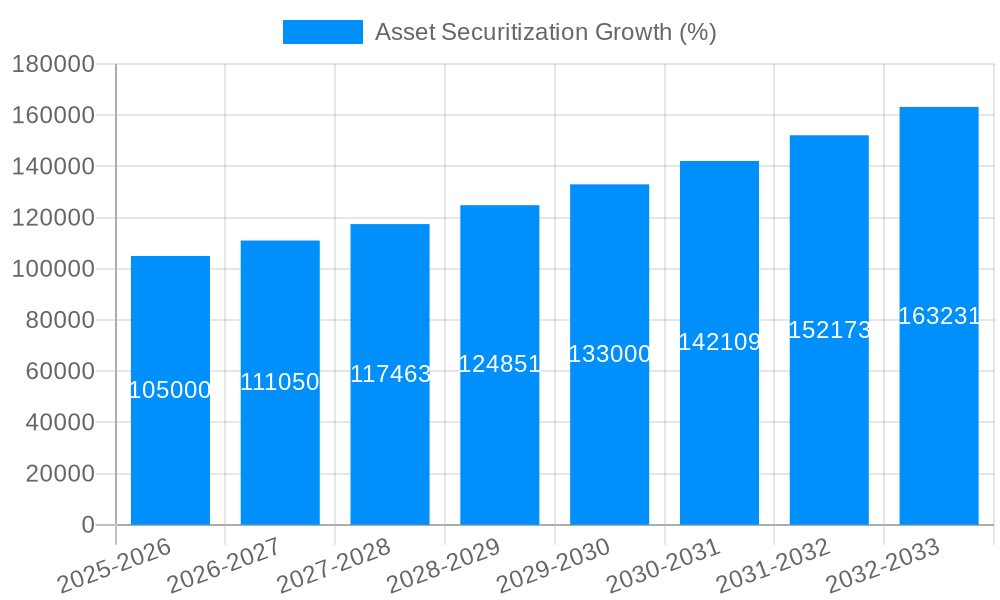

Looking ahead, the asset securitization market is projected to maintain a healthy Compound Annual Growth Rate (CAGR), though the exact figure depends on macroeconomic factors and regulatory developments. Further diversification into new asset classes and geographical regions is likely. The evolution of technology, including blockchain and AI, will impact market efficiency and transparency. Competition is expected to intensify among established players and new entrants, leading to innovative product offerings and pricing strategies. Risk management will remain a critical focus, necessitating robust due diligence processes and sophisticated risk assessment models. The continuous evolution of regulatory frameworks will play a crucial role in shaping the market's future trajectory, ensuring stability and promoting responsible growth.

The global asset securitization market is experiencing a period of dynamic growth, driven by evolving financial landscapes and innovative approaches to risk management. The study period, spanning 2019-2033, reveals a compelling narrative of expansion, with significant shifts in market share across various asset classes and geographical regions. The base year, 2025, provides a snapshot of the current market dynamics, indicating a robust valuation in the billions. The forecast period, 2025-2033, projects continued expansion, fueled by factors like increasing demand for liquidity among financial institutions, regulatory changes encouraging securitization, and the growing sophistication of asset-backed securities (ABS). However, the historical period, 2019-2024, also highlights periods of volatility influenced by global economic events and regulatory adjustments. The market demonstrates a notable concentration in specific regions, with certain asset types exhibiting faster growth rates than others. For instance, while Credit Asset Securitization historically dominated, Corporate Asset Securitization is witnessing an accelerated rise, particularly in emerging markets. Furthermore, the growing adoption of technology is streamlining the securitization process, leading to increased efficiency and reduced costs. This trend is significantly impacting market participants, forcing adaptation and innovation to maintain competitiveness. The projected growth throughout the forecast period reflects a positive outlook, provided that certain regulatory and economic conditions remain favorable. Overall, the market is characterized by its complexity, sensitivity to economic cycles, and potential for substantial returns when managed effectively. In 2025, the estimated market value is projected to surpass several billion, representing a significant increase from previous years. This growth is largely attributed to the increasing reliance on securitization as a mechanism for managing and mitigating risk within the financial system.

Several key factors are driving the robust growth of the asset securitization market. The need for increased liquidity among financial institutions is a major propellant. Securitization offers a powerful tool for converting illiquid assets into readily tradable securities, improving their financial flexibility and enabling them to manage their capital more effectively. Regulatory changes, both globally and regionally, often encourage the use of securitization, recognizing its potential for fostering economic growth and facilitating credit flow within economies. Furthermore, the innovation of increasingly sophisticated asset-backed securities (ABS) has broadened the range of assets eligible for securitization, opening new avenues for investment and risk management. The expanding availability of data analytics and advanced technological solutions are improving the efficiency and transparency of the securitization process. These innovations are not only reducing operational costs but also enhancing the overall quality of securitized products, making them more attractive to investors. The growing sophistication of the ABS market and the wider adoption of innovative securitization structures reflect a dynamic and ever-evolving market landscape.

Despite the significant growth potential, the asset securitization market faces several challenges and restraints. Regulatory uncertainties and evolving compliance requirements pose considerable hurdles for market participants. The complexities of regulatory frameworks across jurisdictions can increase operational costs and create compliance risks. Furthermore, economic downturns and periods of market volatility can significantly impact the performance of securitized assets, potentially leading to losses for investors and increasing the risk profile of these instruments. The perception of risk associated with certain types of securitized assets can limit their attractiveness to investors, particularly in times of economic uncertainty. The challenge lies in effectively communicating the value and risk-mitigation aspects of securitization to investors. This often necessitates greater transparency and robust data reporting to build investor confidence. Lastly, the potential for mispricing and the emergence of systemic risks associated with securitization require ongoing monitoring and regulatory oversight. Balancing the benefits of securitization with effective risk management is crucial for the sustainable growth of the market.

The Financial Institutions segment within the Credit Asset Securitization type is projected to dominate the market during the forecast period (2025-2033).

Financial Institutions' Dominance: Financial institutions, including banks and other lending entities, are the primary originators and users of credit asset securitization. Their large portfolios of loans and other receivables make them ideal candidates for this type of financing. The ability to securitize these assets frees up capital, allowing for further lending and expansion. This is particularly crucial in a market characterized by cyclical changes in credit availability. Moreover, the risk-mitigation aspects of securitization are highly attractive to these institutions, allowing them to offload some risk associated with their loan portfolios.

Credit Asset Securitization's Predominance: Credit asset securitization, focused on loans, receivables, and other credit-related assets, generally presents a larger and more mature market compared to other types. This established nature offers a degree of comfort and familiarity to investors, leading to greater liquidity and potentially lower funding costs for issuers. The substantial volume of credit-based assets globally continues to fuel this sector’s significant growth.

Geographical Concentration: While the precise regional dominance may vary based on economic factors and regulatory environments, developed economies with robust financial sectors are expected to show strong performance within this segment. These regions often possess the necessary infrastructure, investor base, and regulatory frameworks to support large-scale securitization activity. Emerging markets are also witnessing a rise in this segment, albeit at a potentially slower pace due to developing regulatory frameworks and market infrastructure.

In summary: The combination of Financial Institutions as the primary application and Credit Asset Securitization as the primary type creates a synergistic effect, leading to its projected market dominance. This dominance will likely persist throughout the forecast period, although other segments may experience noteworthy growth. The estimated market share for this dominant segment in 2025 is projected to be significantly high, reflecting its importance in the broader asset securitization market. Furthermore, consistent technological advancements will only serve to solidify its position.

Several factors are catalyzing growth in the asset securitization industry. Increased demand for liquidity among financial institutions drives the need for efficient capital management. Regulatory changes promoting securitization create a more favorable environment for market participants. Technological advancements streamline processes and reduce costs, enhancing efficiency. Lastly, the expansion of eligible asset types diversifies investment opportunities and stimulates market growth.

This report provides a detailed analysis of the asset securitization market, covering historical trends, current market dynamics, and future projections. It offers a granular examination of key segments, regional markets, and leading players, highlighting growth catalysts and potential challenges. The report's comprehensive scope makes it an invaluable resource for market participants, investors, and regulators seeking a deep understanding of this evolving landscape.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include DBS Bank, Standard Chartered, Fidelity, WeBull, TD Ameritrade, Tiger Brokers, Citi Bank, Goldman Sachs, CITIC SECURITIES, CHINA MERCHANTS GROUP, CICC, GUOTAI JUNAN, HUATAI SECURITIES ASSET MANAGEMENT, GF SECURITIES, COFCO TRUST, ZHONGHAI TRUST, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Asset Securitization," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Asset Securitization, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.