1. What is the projected Compound Annual Growth Rate (CAGR) of the Artificial Intelligence in Drug Discovery and Development?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Artificial Intelligence in Drug Discovery and Development

Artificial Intelligence in Drug Discovery and DevelopmentArtificial Intelligence in Drug Discovery and Development by Type (Hardware, Software, Service), by Application (Early Drug Discovery, Preclinical Phase, Clinical Phase, Regulatory Approval), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

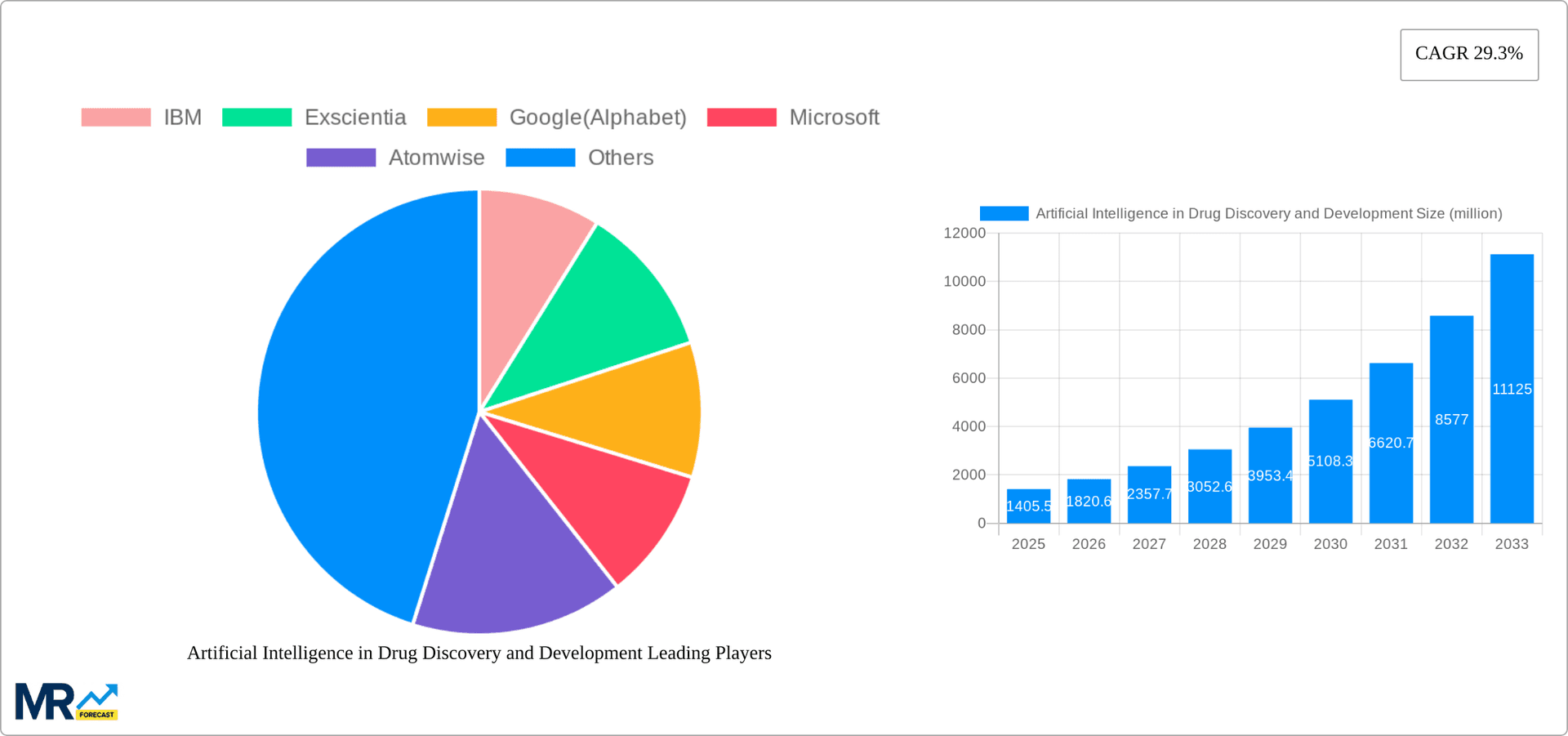

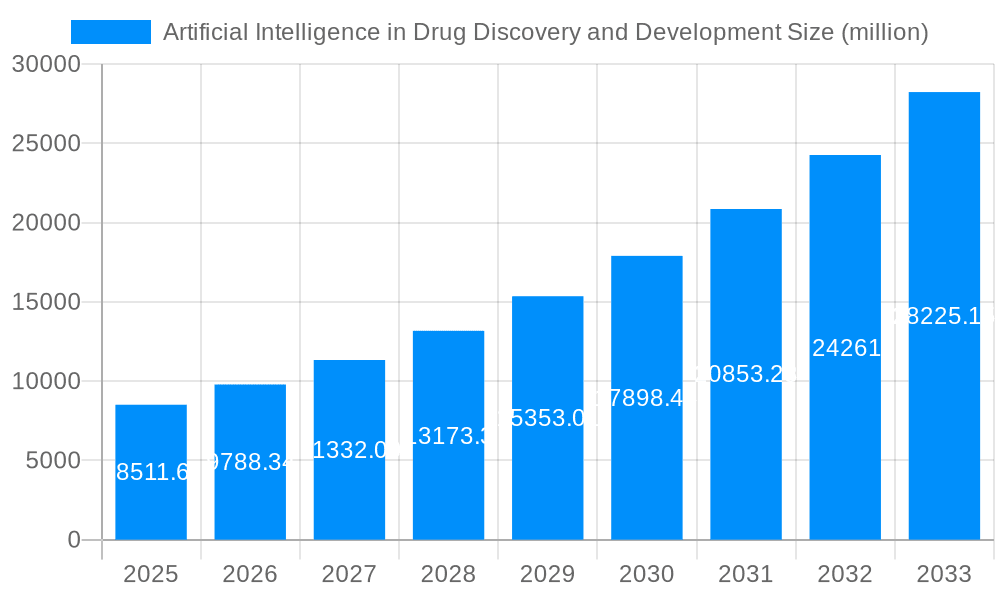

The Artificial Intelligence (AI) in Drug Discovery and Development market is experiencing exponential growth, projected to reach $8511.6 million in 2025. While the precise CAGR isn't provided, considering the rapid advancements in AI and its increasing adoption across the pharmaceutical industry, a conservative estimate would place the CAGR between 15% and 20% during the forecast period (2025-2033). Key drivers include the rising need to reduce drug development costs and timelines, increasing volumes of biological data requiring advanced analytical capabilities, and the ability of AI to accelerate the identification and validation of drug targets. Trends indicate a shift towards cloud-based AI solutions, fostering collaboration and scalability. Furthermore, the integration of AI across the entire drug development lifecycle, from early drug discovery to regulatory approval, is gaining traction. Despite the significant potential, challenges remain, including the need for high-quality data, regulatory hurdles surrounding AI-driven drug approvals, and the ethical considerations surrounding AI's role in healthcare. The market segmentation reveals strong demand across all application phases, with early drug discovery and preclinical phases showing particularly rapid growth driven by AI's proficiency in identifying promising drug candidates and predicting their efficacy. The leading companies, a diverse mix of established tech giants and specialized AI-driven biotech firms, are actively investing in research and development, fueling this market expansion.

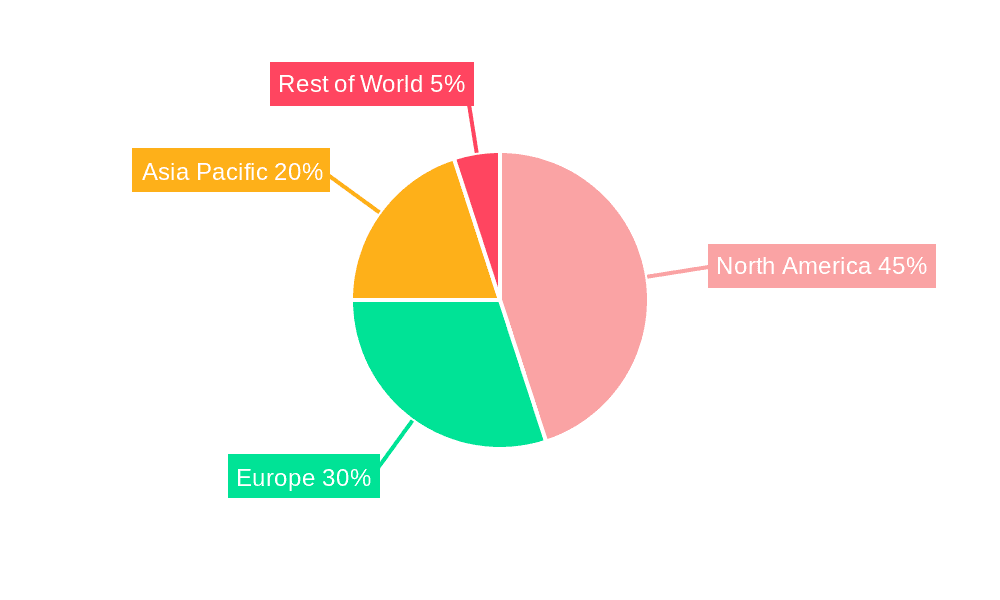

The geographical distribution of the market shows a concentration in North America and Europe initially, owing to the presence of established pharmaceutical companies and robust regulatory frameworks. However, the Asia-Pacific region is projected to experience significant growth, driven by increasing investments in R&D and a rising prevalence of chronic diseases. The competitive landscape is dynamic, with both established players and emerging startups vying for market share. Strategic collaborations and mergers & acquisitions are expected to further shape the market landscape. The long-term outlook remains highly positive, driven by continuous technological advancements in AI and a growing recognition of its transformative potential within the pharmaceutical industry. Successful navigation of regulatory hurdles and addressing ethical concerns will be key to unlocking the full potential of AI in revolutionizing drug discovery and development.

The artificial intelligence (AI) revolution is profoundly reshaping the pharmaceutical landscape, accelerating drug discovery and development processes that traditionally spanned decades. The market, valued at $XXX million in 2025, is projected to reach $XXX million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of XX%. This explosive growth is fueled by several factors, including the increasing availability of large datasets (genomics, proteomics, clinical trial data), advancements in machine learning algorithms, and a growing need to reduce the time and cost associated with bringing new drugs to market. The integration of AI across various stages—from early drug discovery to regulatory approval—is streamlining workflows, enhancing prediction accuracy, and identifying novel drug targets with unprecedented efficiency. This report, covering the period 2019-2033 (base year 2025), provides a comprehensive analysis of this dynamic market, highlighting key trends, driving forces, challenges, and prominent players. The shift towards AI-powered drug discovery is no longer a futuristic concept; it's a rapidly evolving reality, impacting nearly every aspect of the pharmaceutical industry. This transformation is being driven by both large pharmaceutical companies seeking to leverage AI for competitive advantage and numerous agile AI-focused startups pioneering innovative solutions. The market is witnessing significant investments, collaborations, and partnerships, further accelerating its growth and broadening its impact on healthcare. The future promises even more sophisticated AI applications, potentially leading to personalized medicine and therapies for currently untreatable diseases.

Several powerful forces are propelling the rapid expansion of AI in drug discovery and development. Firstly, the exponentially growing volume of biological data—genomic sequences, protein structures, clinical trial results, and electronic health records—provides a rich training ground for sophisticated machine learning models. These models can identify patterns and relationships that would be impossible for humans to detect manually, significantly improving target identification and lead optimization. Secondly, advancements in AI algorithms, particularly deep learning and reinforcement learning, are continuously enhancing the predictive power of AI tools, enabling more accurate predictions of drug efficacy, toxicity, and pharmacokinetics. Thirdly, the decreasing cost of computing power and the increasing availability of cloud computing resources make AI-powered drug discovery more accessible to researchers and pharmaceutical companies of all sizes. Finally, the increasing pressure to reduce the cost and time associated with drug development, coupled with the unmet medical needs of numerous diseases, is pushing the industry towards the adoption of AI as a means to improve efficiency and accelerate innovation. The potential for AI to revolutionize healthcare is a key driver, attracting substantial investment and fostering collaboration across industry, academia, and government.

Despite the enormous potential, several challenges hinder the widespread adoption of AI in drug discovery. Data quality and accessibility remain significant hurdles. The availability of large, high-quality, annotated datasets is crucial for training robust AI models, yet access to such data can be limited due to privacy concerns, data silos, and inconsistencies in data formats. Furthermore, the interpretability and explainability of AI models remain a concern. Understanding how complex AI models arrive at their predictions is crucial for building trust and ensuring regulatory compliance, but many current models lack transparency. The validation and verification of AI-driven predictions also pose significant challenges. While AI can generate hypotheses, ultimately experimental validation remains crucial in the drug development process. Finally, the integration of AI into existing workflows and the development of appropriate infrastructure and expertise within pharmaceutical companies require substantial investment and effort. Addressing these challenges will be critical to fully realizing the transformative potential of AI in drug discovery.

The North American market, specifically the United States, is expected to dominate the AI in drug discovery and development market throughout the forecast period (2025-2033). This dominance stems from the region's concentration of leading pharmaceutical companies, AI research institutions, and venture capital funding. Furthermore, the robust regulatory framework and supportive government initiatives in the US create a favorable environment for AI innovation.

Software Segment: The software segment is poised for significant growth, driven by the increasing adoption of AI-powered platforms for drug design, target identification, and clinical trial optimization. Software solutions offer scalability and flexibility, allowing for efficient analysis of massive datasets and iterative improvements in drug development processes. The ease of integration with existing laboratory information management systems (LIMS) also contributes to the strong adoption of software solutions.

Early Drug Discovery Application: The application of AI in early drug discovery is expected to experience substantial growth due to the ability to identify potential drug candidates more effectively and efficiently than traditional methods. AI can analyze vast datasets to pinpoint promising drug targets, predict their efficacy, and design novel drug molecules, drastically reducing the time and cost associated with the initial phases of drug development. This early intervention significantly improves the success rate of progressing to later clinical stages.

United States: The U.S. leads in AI research, development, and investment, fostering a thriving ecosystem of companies and research institutions dedicated to AI-driven drug discovery. This dominance is further reinforced by the presence of major pharmaceutical players and significant venture capital funding.

Europe: Europe is witnessing considerable growth in the AI in drug discovery market, driven by increasing investments in research and development, along with the emergence of several innovative AI startups. The regulatory landscape in Europe is also becoming more supportive of AI applications in healthcare.

The significant investments made by major pharmaceutical companies and technology firms are also driving market expansion. Furthermore, the increasing focus on personalized medicine is creating a high demand for AI-powered solutions capable of tailoring therapies to individual patients’ genetic profiles and medical histories.

The convergence of several factors is accelerating growth within the AI drug discovery industry. Firstly, the increasing availability of large, high-quality datasets is crucial for training sophisticated machine learning models. Secondly, advancements in AI algorithms, particularly deep learning and reinforcement learning, continuously improve prediction accuracy and efficiency. Thirdly, declining computing costs and the rise of cloud computing make AI-powered solutions more accessible. Finally, the urgent need for faster and more cost-effective drug development processes fuels the adoption of AI across the pharmaceutical industry. These catalysts are working synergistically to drive substantial growth and innovation.

This report provides a thorough analysis of the AI in drug discovery market, covering historical data (2019-2024), the current market landscape (2025), and detailed forecasts up to 2033. It includes a deep dive into market trends, growth drivers, challenges, and regional dynamics. The report also profiles key market players, analyzing their strategies, technologies, and market share. This comprehensive coverage provides valuable insights for stakeholders, investors, and researchers seeking to understand and participate in this rapidly evolving field. The detailed segmentation allows for targeted analysis of specific market segments, enabling informed decision-making.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of XX% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include IBM, Exscientia, Google(Alphabet), Microsoft, Atomwise, Schrodinger, Aitia, Insilico Medicine, NVIDIA, XtalPi, BPGbio, Owkin, CytoReason, Deep Genomics, Cloud Pharmaceuticals, BenevolentAI, Cyclica, Verge Genomics, Valo Health, Envisagenics, Euretos, BioAge Labs, Iktos, BioSymetrics, Evaxion Biotech, Aria Pharmaceuticals, Inc, .

The market segments include Type, Application.

The market size is estimated to be USD 8511.6 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Artificial Intelligence in Drug Discovery and Development," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Artificial Intelligence in Drug Discovery and Development, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.