1. What is the projected Compound Annual Growth Rate (CAGR) of the Art Funds?

The projected CAGR is approximately 5.6%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Art Funds

Art FundsArt Funds by Type (Public Art Funds, Private Art Funds), by Application (Financial Investment, Art Development), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

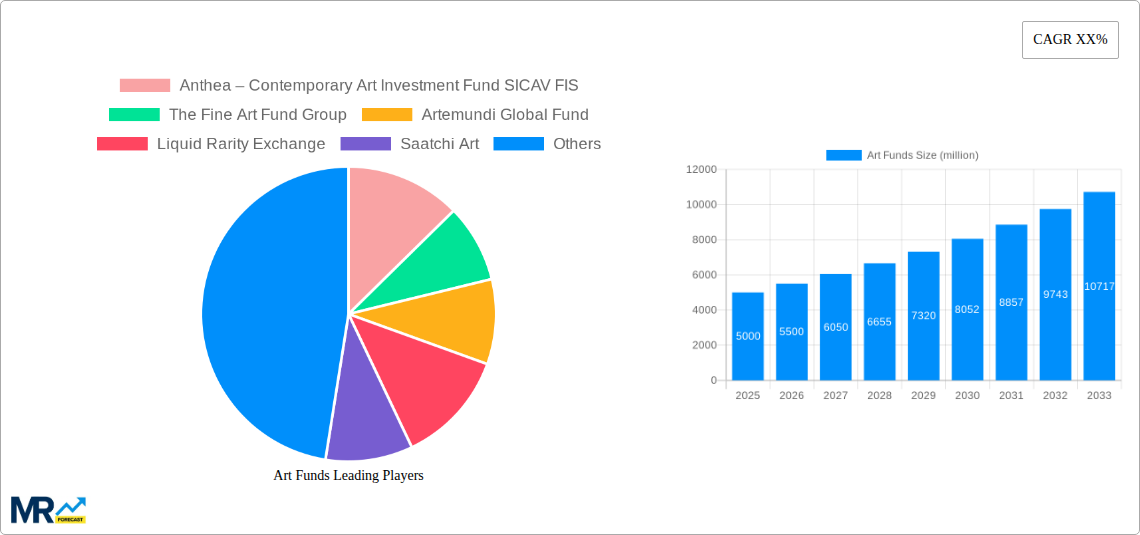

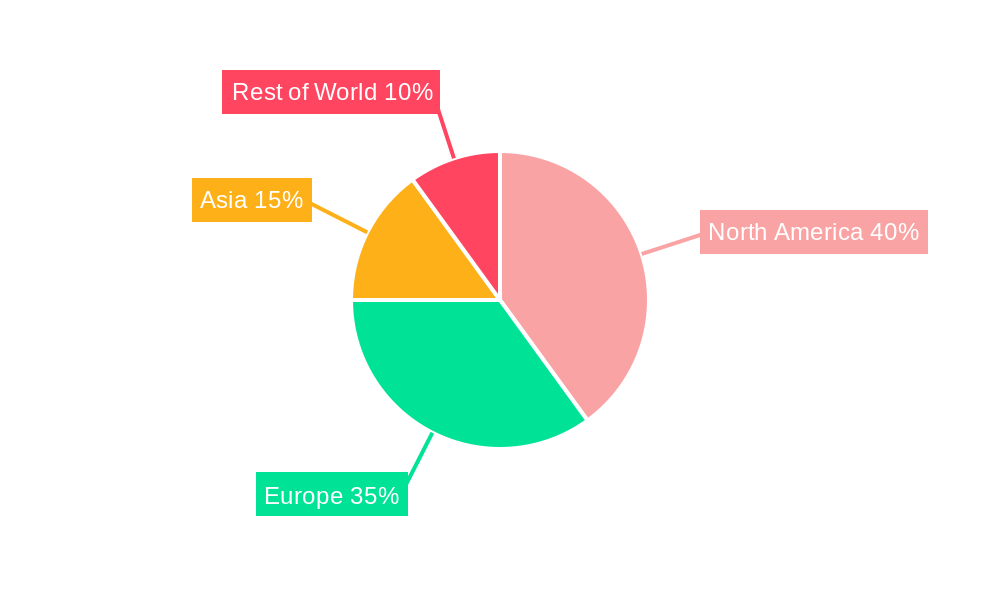

The global art fund market, valued at $829.3 million in 2025, is projected to experience robust growth, driven by several key factors. Increasing high-net-worth individuals (HNWIs) seeking alternative investment avenues, coupled with a growing interest in art as an asset class, fuels market expansion. The diversification benefits offered by art funds, alongside their potential for capital appreciation and inflation hedging, attract investors looking beyond traditional financial instruments. Furthermore, the rise of online art marketplaces and investment platforms is streamlining access to the art market, lowering the barrier to entry for both investors and artists. This digital transformation is fostering greater transparency and liquidity, enhancing the overall attractiveness of art funds. The market segmentation reveals a significant presence of both public and private art funds, with financial investment and art development as primary applications. Private art funds tend to target sophisticated investors seeking exclusive opportunities, while public funds offer more accessible investment options. Geographical distribution showcases strong presence in North America and Europe, with significant growth potential in Asia-Pacific, fuelled by the increasing wealth and art appreciation in burgeoning economies like China and India.

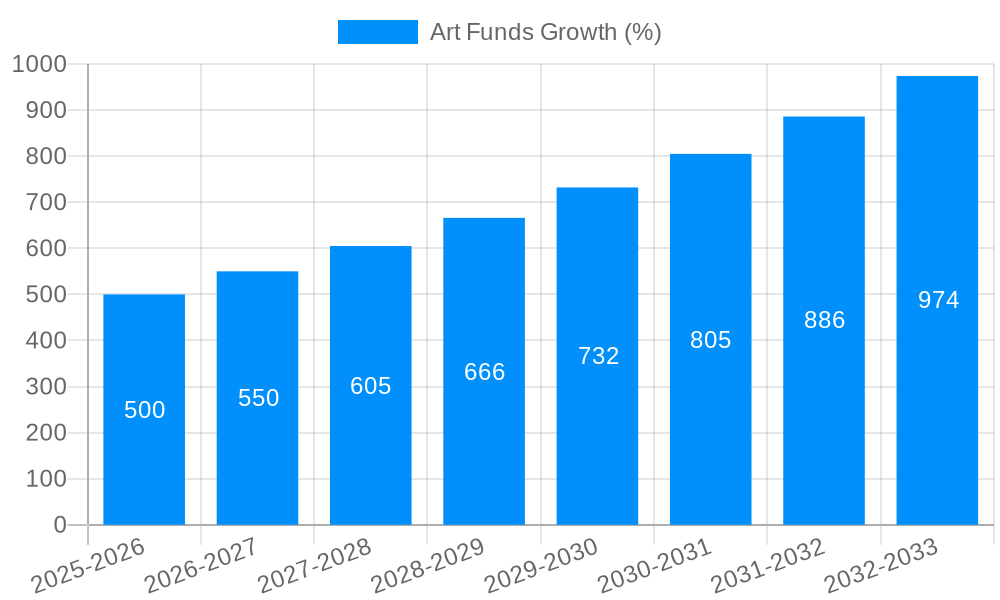

The market's 5.6% CAGR signifies a consistent upward trajectory, projected to continue throughout the forecast period (2025-2033). However, market growth might be subject to macroeconomic fluctuations, regulatory changes impacting investment vehicles, and the inherent volatility associated with the art market itself. Factors such as authentication challenges and the lack of standardized valuation methods present ongoing obstacles. Despite these challenges, the continued expansion of the global art market, driven by increasing demand from both institutional and individual investors, suggests a positive outlook for the art fund sector. The emergence of innovative investment strategies, including fractional ownership and art-backed securities, further contributes to the sector's dynamism and evolution. Companies such as Masterworks and Arthena are leading the charge in democratizing access to the art market, while established players like The Fine Art Group leverage their expertise in managing large art portfolios. This blend of established players and innovative startups promises a competitive but exciting future for the art fund landscape.

The global art funds market, valued at $XX million in 2025, is poised for significant growth, projected to reach $YY million by 2033, exhibiting a CAGR of Z% during the forecast period (2025-2033). This burgeoning market reflects a confluence of factors, including increased institutional and high-net-worth individual (HNWI) interest in art as an alternative investment asset class, technological advancements facilitating fractional ownership and enhanced market transparency, and a growing recognition of art's potential for diversification and inflation hedging. Analysis of the historical period (2019-2024) reveals a steady upward trajectory, albeit with fluctuations influenced by global economic conditions and market sentiment. The estimated year 2025 showcases a robust market position, built upon the foundation of increased accessibility through platforms like Masterworks and Arthena, which have democratized access to high-value artworks. The rising popularity of contemporary art and the increasing sophistication of art investment strategies are further driving market expansion. Furthermore, the integration of blockchain technology and NFTs is opening new avenues for art investment and fractional ownership, leading to enhanced liquidity and attracting a younger generation of investors. Private art funds continue to dominate the market, owing to their flexibility and ability to cater to specialized investment strategies. However, a growing number of public art funds are emerging, increasing accessibility for a broader range of investors. The evolving regulatory landscape, while presenting some challenges, is also driving greater transparency and standardization within the industry, fostering increased investor confidence. This multifaceted growth is underpinned by strong underlying trends which indicate a sustained and robust future for the art funds market.

Several key factors are propelling the growth of the art funds market. Firstly, art is increasingly recognized as an alternative investment asset, offering potential for diversification and inflation hedging in portfolios dominated by traditional assets. The rising wealth of HNWIs and institutional investors fuels demand for such alternative investments, leading to significant capital inflow into the art funds sector. Secondly, technological advancements, such as online platforms and fractional ownership models offered by companies like Arthena and Masterworks, are democratizing access to art investment, broadening the investor base beyond traditional collectors. These platforms also enhance transparency and efficiency in the market, reducing barriers to entry. Thirdly, the growing sophistication of art investment strategies, including data-driven approaches and the use of sophisticated valuation models, is attracting professional investors seeking higher returns and better risk management. Finally, the evolving regulatory landscape, while presenting certain challenges, is also creating greater transparency and standardization, boosting investor confidence and attracting a wider range of participants. The combination of these forces creates a powerful momentum behind the expanding art funds market.

Despite the significant growth potential, the art funds market faces several challenges and restraints. Firstly, the inherent illiquidity of art as an asset class remains a significant hurdle. While platforms are improving liquidity, selling art assets quickly at desirable prices can still be difficult. Secondly, accurate valuation of art remains a complex and subjective process, making it challenging to determine the true market value and potential returns. The lack of standardized valuation methodologies contributes to price volatility and potential for mispricing. Thirdly, the regulatory environment is still evolving and differs across jurisdictions, creating complexities for fund managers operating internationally. Varying regulations can affect fund structuring, compliance, and overall operational efficiency. Furthermore, the market is susceptible to economic downturns and shifts in market sentiment, which can significantly impact investment returns and investor confidence. Finally, the lack of transparency in some parts of the art market can deter potential investors concerned about fraud or manipulation. Addressing these challenges is crucial for sustained growth and fostering greater confidence in the art funds market.

The Private Art Funds segment is expected to dominate the market throughout the forecast period (2025-2033). This is primarily due to their flexibility in investment strategies and ability to target specific niche areas of the art market. Private funds can invest in a wider array of art assets, ranging from established masterpieces to emerging artists, tailoring their approach to specific investor risk profiles and return objectives. They offer a level of customization not always possible with public funds.

Financial Investment application is also a dominant segment. This segment encompasses investors seeking primarily financial returns from their art investments. They are less focused on the artistic merit or cultural impact, but rather on the asset's potential for appreciation in value.

The combination of private fund structure and the financial investment application is a powerful engine of growth within the art funds market.

Several factors are catalyzing the growth of the art funds industry. Increased wealth concentration among HNWIs and institutional investors provides a larger pool of capital actively seeking alternative investment opportunities. Technological advancements like online platforms for fractional ownership and blockchain-based verification enhance accessibility, transparency, and liquidity. The rising acceptance of art as an asset class capable of diversification and inflation hedging attracts a wider range of investors, and the evolution of sophisticated investment strategies using data analytics refines risk management and return optimization. These factors collectively fuel the rapid expansion of the art funds market.

The art funds market is experiencing significant expansion driven by several interconnected factors. Rising wealth, technological advancements fostering accessibility and transparency, and the increasing sophistication of investment strategies are all contributing to this growth. The market is ripe with opportunities for investors and fund managers alike, yet it also presents significant challenges related to valuation, liquidity, and regulation. Understanding these dynamics is crucial for navigating this dynamic and rapidly evolving sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.6% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 5.6%.

Key companies in the market include Anthea – Contemporary Art Investment Fund SICAV FIS, The Fine Art Group, Artemundi Global Fund, Liquid Rarity Exchange, Saatchi Art, Dejia Art Fund, Arthena, Masterworks, The Arts Fund, Castlestone Management, Deloitte Art & Finance, Art Fund Group, Ascribe Capital, .

The market segments include Type, Application.

The market size is estimated to be USD 829.3 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Art Funds," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Art Funds, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.