1. What is the projected Compound Annual Growth Rate (CAGR) of the Anime Streaming Tool?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Anime Streaming Tool

Anime Streaming ToolAnime Streaming Tool by Type (Windows Systems, Android Systems, IOS Systems, Others), by Application (TV-Y, TV-Y7, TV-G, TV-PG, TV-14, TV-MA), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

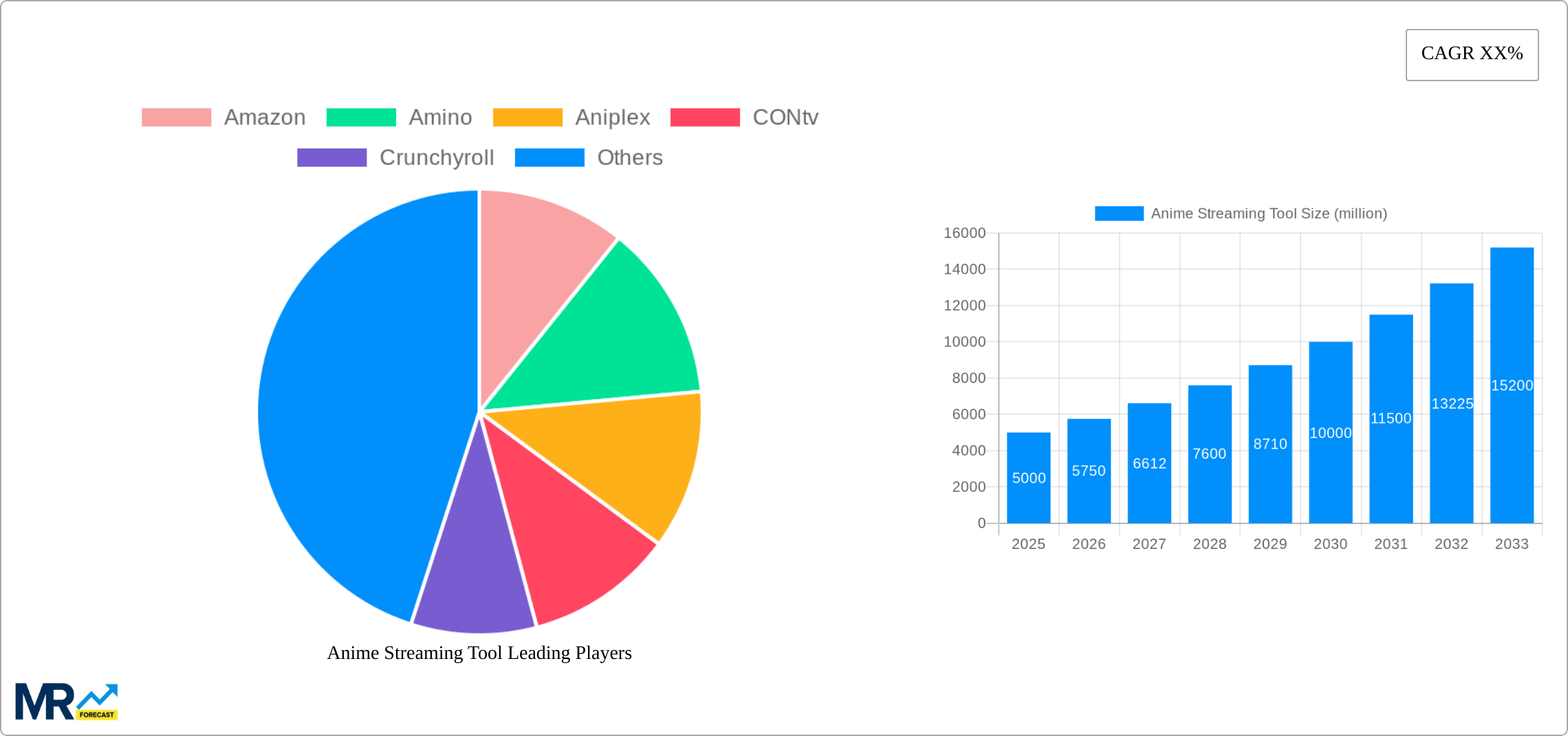

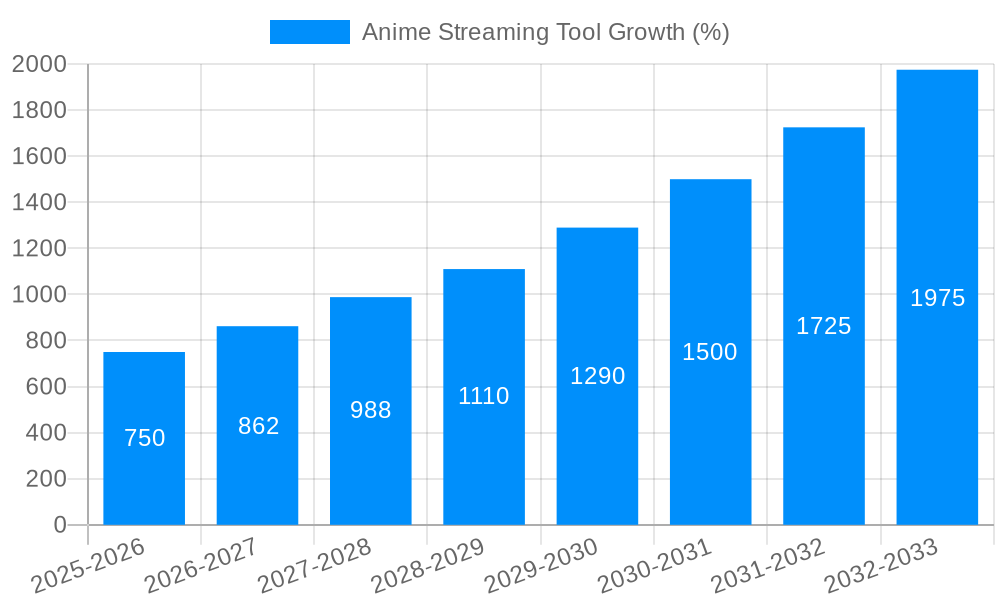

The anime streaming market, a vibrant sector fueled by the global popularity of Japanese animation, is experiencing robust growth. While precise figures for market size and CAGR are not provided, a reasonable estimate, considering the significant investment and expansion of major players like Crunchyroll and Netflix in this space, would place the 2025 market size at approximately $5 billion USD. A conservative compound annual growth rate (CAGR) of 15% over the forecast period (2025-2033) seems plausible, considering consistent audience growth, increasing production of anime content, and the ongoing expansion of streaming services into new global markets. This growth is driven by several factors, including increased internet penetration, particularly in emerging economies, the rise of mobile streaming, and the increasing accessibility and affordability of subscription-based streaming services. The shift from traditional broadcast and physical media consumption to on-demand streaming is a major contributing factor to this expansion. Furthermore, the diverse range of anime genres, from action-packed adventures to heartwarming romances, appeals to a broad demographic, further solidifying the market's appeal.

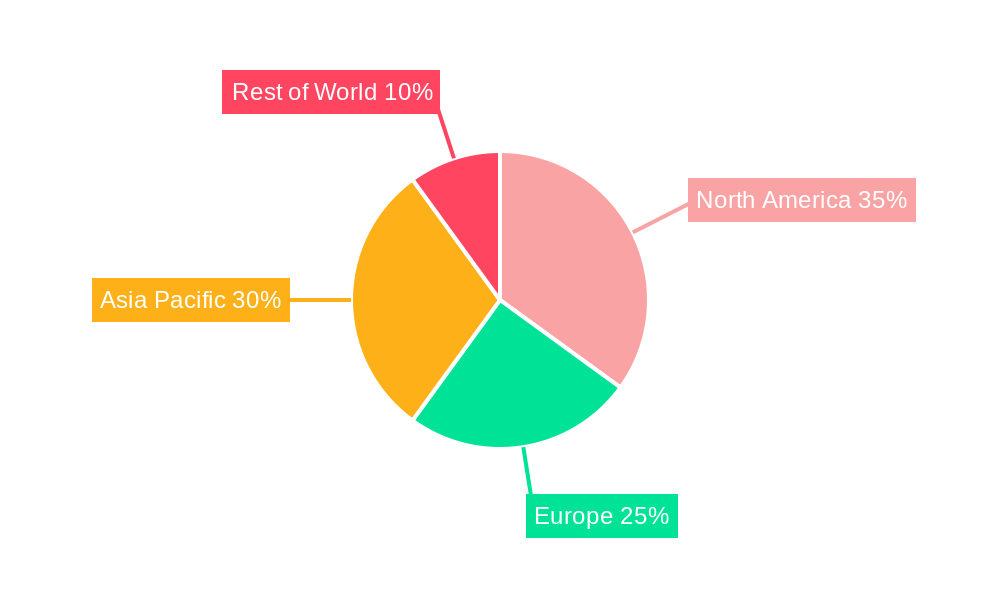

However, challenges persist. Competition among established streaming platforms is fierce, leading to price wars and the necessity for constant innovation in content acquisition and user experience. Licensing complexities and regional restrictions remain significant hurdles to global expansion. Furthermore, piracy continues to pose a considerable threat, undermining legitimate streaming services' revenue streams. Despite these restraints, the continued popularity of anime, coupled with technological advancements and innovative marketing strategies, suggests a strong future for the anime streaming market. The segment breakdown shows a strong preference for easily accessible platforms like Android and iOS, while content classification (TV-Y to TV-MA) caters to diverse age groups, broadening the market's reach. The geographical spread highlights the global nature of the anime fanbase, with North America, Europe, and Asia Pacific representing significant market shares. The continued expansion into emerging markets across Asia and Latin America will be crucial for future growth.

The anime streaming tool market is experiencing explosive growth, projected to reach tens of millions of users by 2033. This surge is driven by several factors, including the increasing global popularity of anime, improved internet access worldwide, and the development of sophisticated streaming platforms offering high-quality viewing experiences. The historical period (2019-2024) witnessed a steady climb in market size, laying the foundation for the significant expansion predicted for the forecast period (2025-2033). Key market insights reveal a clear preference for mobile streaming (Android and iOS systems), reflecting the ubiquitous nature of smartphones and tablets. The availability of anime across various content rating categories (TV-Y to TV-MA) caters to a broad audience, from children to adults. Competition is fierce, with established players like Netflix and Crunchyroll vying for market share alongside newer entrants. The estimated market size for 2025 shows a substantial increase from previous years, signifying the accelerating growth trajectory. However, challenges remain, including piracy, regional licensing restrictions, and the need for consistent high-quality streaming infrastructure. The market is also witnessing diversification, with platforms increasingly incorporating interactive elements and community features to enhance user engagement. This dynamic environment demands continuous adaptation and innovation from streaming service providers to remain competitive and capitalize on the significant growth potential. The success hinges on providing a seamless, reliable, and engaging experience across diverse devices and platforms, catering to the evolving preferences of a global anime fanbase.

Several factors contribute to the rapid expansion of the anime streaming tool market. Firstly, the global popularity of anime continues to rise, attracting new viewers across demographics and geographical locations. This growing demand necessitates readily accessible streaming platforms. Secondly, improvements in internet infrastructure and the increasing affordability of data plans have broadened access to high-quality streaming services, particularly in emerging markets. Thirdly, the rise of mobile streaming has been instrumental. Smartphones and tablets offer unparalleled convenience, making anime accessible anytime, anywhere. Fourthly, the strategic partnerships between streaming platforms and anime production studios ensure a constant supply of new and exclusive content, attracting and retaining subscribers. Finally, the introduction of innovative features, such as subtitles in multiple languages, interactive elements, and robust community features, further enhance user experience and encourage engagement. These combined factors are creating a synergistic effect, propelling the market towards unprecedented growth in the coming years.

Despite the significant growth potential, several challenges hinder the full realization of the anime streaming tool market’s potential. Piracy remains a significant threat, undermining legitimate streaming services’ revenue streams. Strict regional licensing restrictions can limit content availability in certain regions, frustrating users and hindering platform expansion. The need to maintain consistent high-quality streaming infrastructure is crucial for user satisfaction; any disruptions or technical issues can lead to subscriber churn. Furthermore, competition is intense, with numerous platforms vying for market share, necessitating continuous innovation and investment in content acquisition and technological upgrades. The varying preferences of viewers across different age groups and cultural backgrounds necessitate platform diversification. The cost of licensing high-demand anime titles can be exorbitant, placing a strain on smaller platforms' budgets. Effectively addressing these challenges requires a multi-pronged approach, encompassing aggressive anti-piracy measures, strategic partnerships to overcome licensing limitations, robust technological infrastructure, and a focus on tailoring content and features to specific target demographics.

The anime streaming tool market demonstrates significant regional variations, with certain regions and segments exhibiting stronger growth than others. Within the application segment, the TV-PG and TV-14 categories are projected to dominate the market, reflecting the mature content preferred by a large section of anime enthusiasts. These categories often feature complex storylines, intense action sequences, and mature themes, attracting a broad audience.

TV-PG (Parental Guidance Suggested): This category encompasses anime suitable for most parents, with some content potentially unsuitable for young children. The wide range of storylines and characters appeal to a vast audience.

TV-14 (Parents Strongly Cautioned): This category includes anime with more mature content that may not be suitable for all audiences under 14 years old, often featuring themes of violence, sexuality, or complex social issues.

Android Systems: The ubiquity of Android devices and the affordability of Android smartphones contributes significantly to its dominance within the "Type" segment. A majority of users access anime streaming through their Android devices.

North America & Asia: North America is expected to remain a dominant market due to the large and growing fanbase. Meanwhile, Asia, specifically Japan, South Korea and China, will continue to be key markets, given the origin and high popularity of anime within these regions.

The paragraphs above point to a complex relationship between various segments. While the TV-PG/TV-14 categories draw large audiences, the accessibility of Android systems greatly influences its delivery. The geographic spread highlights the global nature of the anime market, indicating a future of diverse growth opportunities.

The anime streaming tool market's growth is significantly boosted by the increasing global accessibility of high-speed internet, enabling seamless streaming experiences. The continuous rise in anime popularity, fueled by successful anime series and films, expands the user base for streaming platforms. Finally, the emergence of new and improved streaming platforms offering exclusive content and innovative features enhances user engagement and fuels market expansion.

The anime streaming tool market is poised for continued exponential growth, driven by rising global popularity, improved technology, and the expansion of streaming platforms. A comprehensive report would provide in-depth analysis of market trends, competitive landscape, and future growth projections, allowing stakeholders to make informed decisions. The market's multifaceted nature—covering various devices, content ratings, and geographical locations—requires a detailed breakdown to accurately assess the market's full potential.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Amazon, Amino, Aniplex, CONtv, Crunchyroll, Funimation Productions, Kitsu, Netflix, VIZ, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Anime Streaming Tool," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Anime Streaming Tool, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.