1. What is the projected Compound Annual Growth Rate (CAGR) of the Alternative Data Solution?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Alternative Data Solution

Alternative Data SolutionAlternative Data Solution by Type (/> Credit Card Transactions, Email Receipts, Web Traffic, Mobile Application Usage, Other), by Application (/> BFSI, Industrial, IT & Telecommunications, Retail & Logistics, Other Industries), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

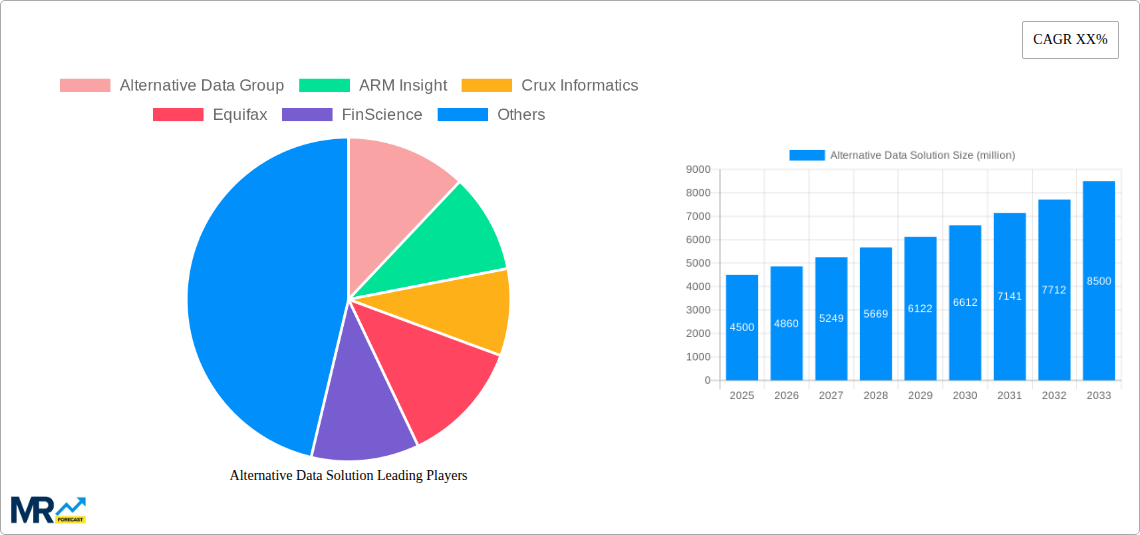

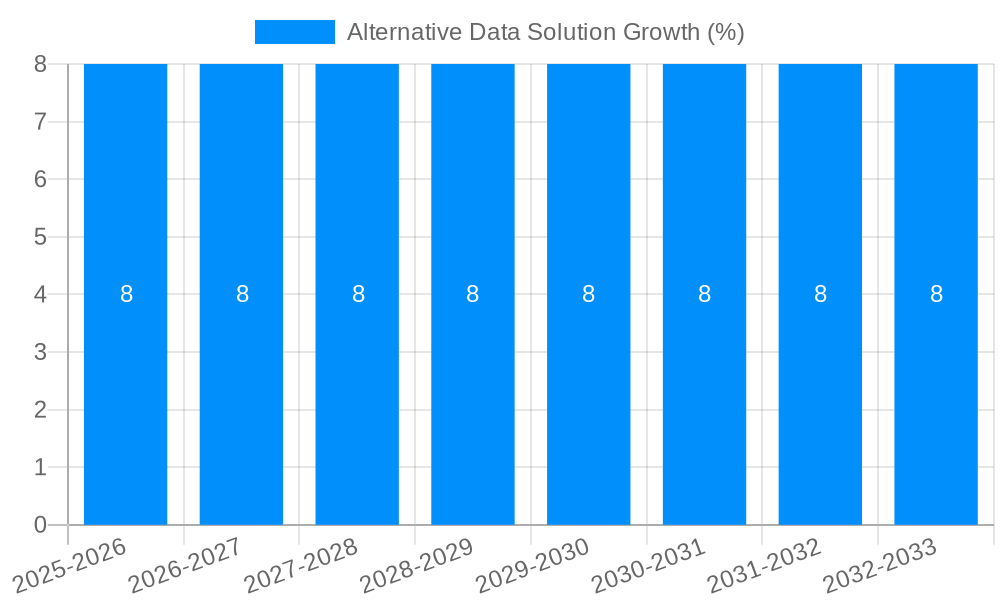

The global Alternative Data Solution market is poised for significant expansion, projected to reach approximately $4,500 million by 2025 and surge to an estimated $8,500 million by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of around 8% during the forecast period (2025-2033). This dynamic growth is propelled by an escalating demand for unique and proprietary data sources that offer a competitive edge in decision-making across various industries. The increasing sophistication of investment strategies, the need for granular insights into consumer behavior, and the drive for operational efficiency are key catalysts. Credit card transactions, web traffic analysis, and mobile application usage are emerging as dominant data types, providing real-time, high-volume information crucial for predictive analytics and risk management. The BFSI sector, a consistent early adopter, continues to lead in the adoption of alternative data for fraud detection, credit scoring, and market trend prediction. However, the Industrial and IT & Telecommunications sectors are rapidly catching up, leveraging alternative data for supply chain optimization, customer churn prediction, and enhanced cybersecurity.

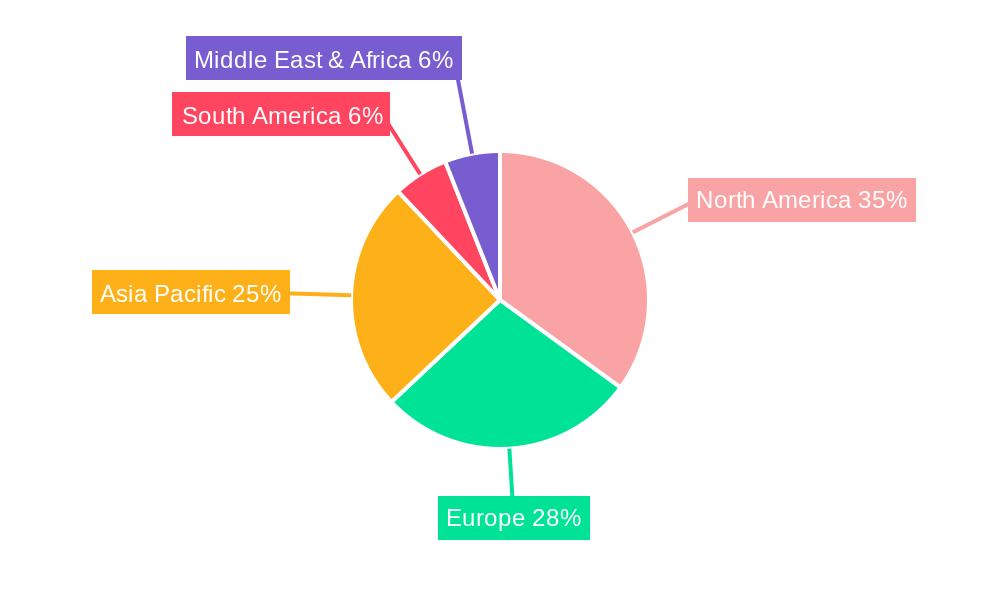

The market landscape is characterized by a growing ecosystem of specialized companies, including Alternative Data Group, ARM Insight, Crux Informatics, Equifax, FinScience, OmniSci, Preqin, Quandl, QuantCube Technology, RavenPack, Sentieo, and Thasos Group, all contributing to the innovation and accessibility of diverse alternative data sets. While the growth trajectory is overwhelmingly positive, certain restraints are present. These include data privacy concerns, regulatory hurdles associated with data usage and storage, and the challenge of data quality and integration, which requires sophisticated analytical tools and expertise. Despite these challenges, the continuous advancement in data processing technologies, machine learning algorithms, and cloud infrastructure is mitigating these restraints, paving the way for wider adoption. The Asia Pacific region, driven by its burgeoning economies and increasing digital penetration, is expected to emerge as a significant growth hub, alongside established markets in North America and Europe, indicating a global shift towards data-driven strategic planning.

This comprehensive report offers an in-depth analysis of the global Alternative Data Solution market, providing invaluable insights for stakeholders seeking to navigate this rapidly evolving landscape. Spanning the Study Period (2019-2033), with a keen focus on the Base Year (2025) and the Forecast Period (2025-2033), this report leverages a robust Historical Period (2019-2024) analysis to project future trends and opportunities. The market is segmented by Type including Credit Card Transactions, Email Receipts, Web Traffic, Mobile Application Usage, and Other data sources. Furthermore, the report examines the application of these solutions across key industries such as BFSI, Industrial, IT & Telecommunications, Retail & Logistics, and Other Industries. With an estimated market size in the multi-million dollar range, this report delves into the intricate dynamics, drivers, challenges, and growth catalysts shaping the alternative data ecosystem.

XXX the global Alternative Data Solution market is experiencing a seismic shift, driven by an insatiable demand for richer, more granular insights that transcend traditional data sources. The market, projected to reach substantial figures in the tens of millions by the Forecast Period (2025-2033), is characterized by an escalating adoption of non-traditional data streams across diverse industries. A significant trend is the maturation and integration of various data types, moving beyond nascent exploration to sophisticated application. For instance, Credit Card Transactions, once a niche segment, are now a cornerstone for retail analytics and credit scoring, with market penetration expected to surge by over 15% between 2025 and 2033. Similarly, Web Traffic data, continuously evolving from simple page views to complex user journey mapping and sentiment analysis, is becoming indispensable for e-commerce and marketing strategies, anticipating a compound annual growth rate (CAGR) of approximately 12% during the same timeframe. The increasing sophistication of data processing and analytics tools, including advancements in AI and machine learning, is enabling businesses to derive actionable intelligence from previously unmanageable datasets. This trend is further amplified by the growing realization that alternative data can provide a competitive edge, offering predictive capabilities and early warning signals that traditional methods often miss. The market is also witnessing a rise in specialized data providers focusing on niche segments like environmental, social, and governance (ESG) data, reflecting a broader trend towards responsible investing and sustainable business practices. The ability to correlate disparate data sources, such as combining Mobile Application Usage patterns with social media sentiment, is creating unprecedented opportunities for hyper-personalization and targeted marketing campaigns, with projected market growth in this area exceeding 18% by 2033. The focus is shifting from simply collecting data to effectively interpreting and integrating it into core business strategies, leading to a more dynamic and responsive operational environment. Furthermore, the increasing regulatory scrutiny around data privacy is inadvertently fostering innovation in anonymized and aggregated data solutions, ensuring continued growth while adhering to ethical considerations. The overall market trajectory suggests a sustained period of robust expansion as businesses across all sectors recognize the transformative power of alternative data in an increasingly data-driven world.

The propulsion of the Alternative Data Solution market is a multi-faceted phenomenon, fundamentally driven by the increasing limitations of traditional data sources in providing a holistic view of market dynamics and consumer behavior. In an era where speed and precision are paramount, businesses are actively seeking supplementary data streams that offer real-time insights and predictive power. The burgeoning BFSI sector, for example, is a significant driver, leveraging Credit Card Transactions and Web Traffic data to enhance credit risk assessment, fraud detection, and customer segmentation. This sector alone is projected to contribute over 35% to the overall market revenue by 2033. The rapid digital transformation across all industries, from Retail & Logistics to IT & Telecommunications, has generated an unprecedented volume of digital footprints, which are readily convertible into valuable alternative data. This digital proliferation, coupled with the increasing affordability and accessibility of advanced analytical tools, has lowered the barrier to entry for utilizing these data sources. Furthermore, the growing demand for alpha generation in investment management, where every fractional advantage counts, is compelling hedge funds and asset managers to explore alternative data for uncovering market inefficiencies. The ability to gain an information edge through non-traditional data, such as analyzing Email Receipts for consumer spending trends or Mobile Application Usage for product adoption rates, is a powerful incentive. The pursuit of a more comprehensive understanding of customer intent, sentiment, and behavior is also a key driver, with companies investing heavily in solutions that can provide these nuanced insights. The increasing acceptance and integration of alternative data into mainstream business intelligence and decision-making processes, supported by successful case studies and a growing ecosystem of data providers and solution vendors, further solidifies its growth trajectory. The desire for a more dynamic and responsive business strategy, capable of adapting quickly to market shifts, is fueling the adoption of alternative data solutions.

Despite the immense potential, the Alternative Data Solution market grapples with several significant challenges and restraints that temper its unbridled growth. A primary concern revolves around data quality and reliability. Unlike traditional, regulated data sources, alternative data can be prone to inaccuracies, biases, and inconsistencies, necessitating extensive validation and cleansing processes, which can be time-consuming and costly. For instance, the interpretability of Web Traffic data can be skewed by sophisticated bot activity, requiring advanced filtering mechanisms. The ethical and privacy implications associated with collecting and utilizing personal data, such as Credit Card Transactions or Mobile Application Usage, remain a substantial hurdle. Strict data privacy regulations like GDPR and CCPA necessitate robust compliance frameworks and can lead to hesitancy in adoption, particularly in regions with stringent data governance. The significant cost associated with acquiring, processing, and analyzing large volumes of alternative data can also be a deterrent for smaller enterprises, limiting market penetration. Furthermore, the integration of disparate alternative data sources with existing enterprise systems can be technically complex and resource-intensive, often requiring specialized expertise. The lack of standardization in data formats and reporting across various providers further complicates this integration process. Another restraint is the potential for data saturation and information overload, where the sheer volume of data can obscure actionable insights if not managed effectively. The “black box” nature of some advanced analytical models used to process alternative data can also lead to a lack of transparency and trust among end-users, hindering widespread adoption. The evolving nature of data sources and the constant threat of data obsolescence require continuous investment in data acquisition and model updates, adding to the operational expenditure. The market also faces the challenge of a limited talent pool with the specialized skills required for alternative data analysis and interpretation.

The global Alternative Data Solution market is poised for substantial growth, with certain regions and segments emerging as dominant forces. North America, particularly the United States, is expected to spearhead market dominance throughout the Forecast Period (2025-2033). This leadership is attributed to a mature technological infrastructure, a strong presence of leading financial institutions and technology companies, and a proactive regulatory environment that, while emphasizing privacy, also fosters innovation in data utilization. The sheer volume of digital transactions and online activities within North America generates a vast reservoir of alternative data, making it a fertile ground for solution providers.

Among the key segments driving this dominance, Credit Card Transactions are projected to hold a significant market share, estimated to reach over \$5,000 million by 2033. This segment's dominance is primarily fueled by its extensive application within the BFSI sector. Financial institutions are increasingly relying on granular credit card transaction data for:

The BFSI application is intrinsically linked to the dominance of Credit Card Transactions, but also extends its influence across other data types. The industry's robust need for predictive analytics, compliance monitoring, and operational efficiency makes it a prime adopter of alternative data. Beyond BFSI, the Retail & Logistics sector is also anticipated to be a major contributor to market growth, leveraging Web Traffic and Mobile Application Usage data. The insights derived from these segments are crucial for:

Furthermore, the IT & Telecommunications sector is a significant adopter, utilizing Web Traffic and Mobile Application Usage data for network optimization, service personalization, and identifying emerging technological trends. The growing emphasis on data-driven decision-making across all industries, coupled with the increasing availability and sophistication of alternative data solutions, solidifies North America’s leading position and the pivotal roles of the BFSI and Retail & Logistics sectors in shaping the global market landscape. The synergy between these regions and segments is expected to drive significant innovation and market expansion in the coming years.

The Alternative Data Solution industry is experiencing robust growth fueled by several key catalysts. The insatiable demand for real-time, granular insights that traditional data alone cannot provide is a primary driver. Advancements in Artificial Intelligence (AI) and Machine Learning (ML) are making it feasible to process and extract actionable intelligence from complex, unstructured alternative data sources, such as social media sentiment or satellite imagery. The increasing digital transformation across all sectors has generated a wealth of untapped data, from Web Traffic to Mobile Application Usage, offering new avenues for competitive advantage. Furthermore, the pursuit of alpha in financial markets by hedge funds and asset managers, seeking any informational edge, is a significant propellant. Growing investor interest in ESG (Environmental, Social, and Governance) factors is also creating demand for specialized alternative data related to sustainability and corporate responsibility.

This report provides a holistic view of the Alternative Data Solution market, extending its analytical prowess beyond market size and segmentation. It delves into the intricate web of drivers and restraints, offering a nuanced understanding of the forces shaping the industry's trajectory. The report meticulously outlines the key regions and countries poised for dominance, while simultaneously highlighting the specific data types and industry applications that will spearhead this growth. Furthermore, it illuminates the critical growth catalysts that are propelling the market forward, from technological advancements to evolving investor demands. With detailed profiles of leading players and a comprehensive overview of significant industry developments, this report equips stakeholders with the knowledge to make informed strategic decisions, identify emerging opportunities, and navigate the complexities of the alternative data landscape throughout the Study Period (2019-2033).

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Alternative Data Group, ARM Insight, Crux Informatics, Equifax, FinScience, OmniSci, Preqin, Quandl, QuantCube Technology, RavenPack, Sentieo, Thasos Group, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Alternative Data Solution," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Alternative Data Solution, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.