1. What is the projected Compound Annual Growth Rate (CAGR) of the Air Cargo Insurance?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Air Cargo Insurance

Air Cargo InsuranceAir Cargo Insurance by Type (Airlines Liability Insurance, Air Cargo Transport Insurance, Air Cargo Delay Insurance, Air Cargo Comprehensive Insurance), by Application (Personal, Enterprise), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

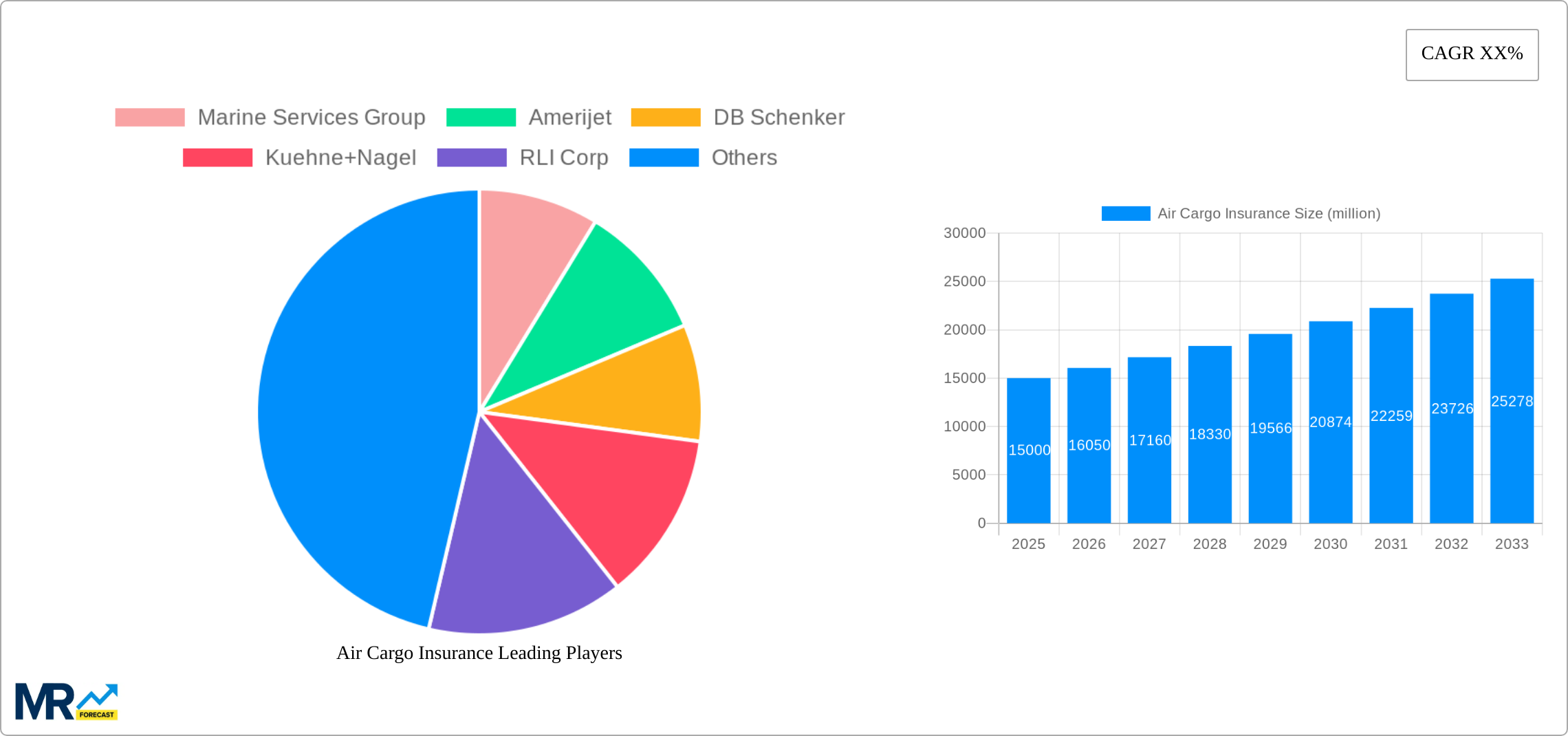

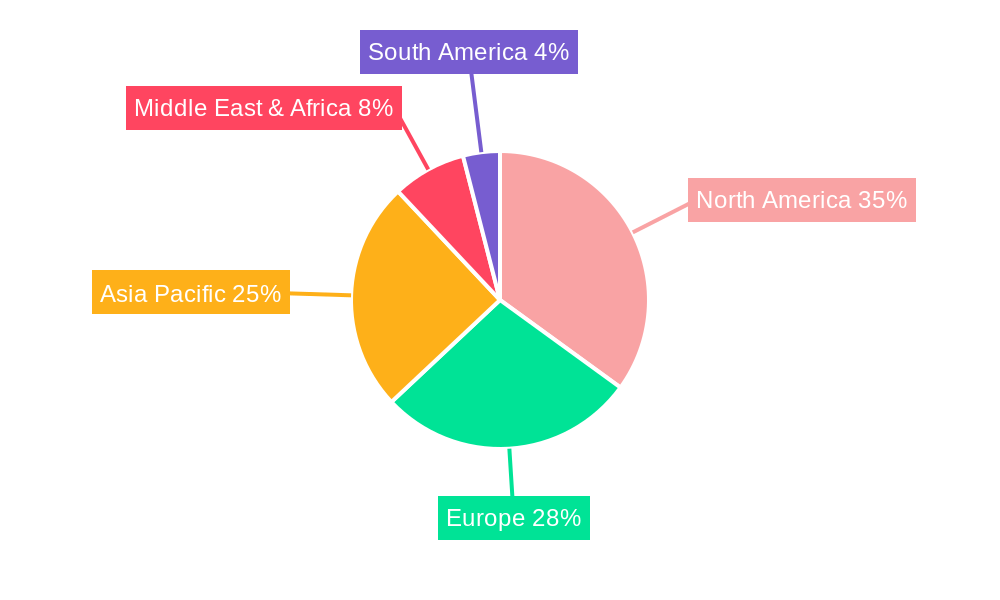

The air cargo insurance market is experiencing robust growth, driven by the increasing globalization of trade and the consequent rise in air freight shipments. The market's expansion is fueled by several key factors, including the growing e-commerce sector, which necessitates reliable insurance coverage for goods in transit. Furthermore, increasing concerns about cargo theft and damage, coupled with stringent regulatory requirements for liability, are compelling businesses to secure comprehensive insurance policies. The market is segmented by insurance type (Airlines Liability, Air Cargo Transport, Air Cargo Delay, Air Cargo Comprehensive) and application (Personal, Enterprise), offering diverse solutions catering to a broad range of stakeholders. Key players in this dynamic market are established logistics providers, insurance specialists, and major airlines, constantly innovating to meet evolving customer needs and adapt to market volatility. The competitive landscape is characterized by partnerships, acquisitions, and the development of technologically advanced insurance solutions. Growth is projected across all regions, with North America and Asia-Pacific expected to be leading contributors due to their robust e-commerce sectors and high volumes of air cargo traffic.

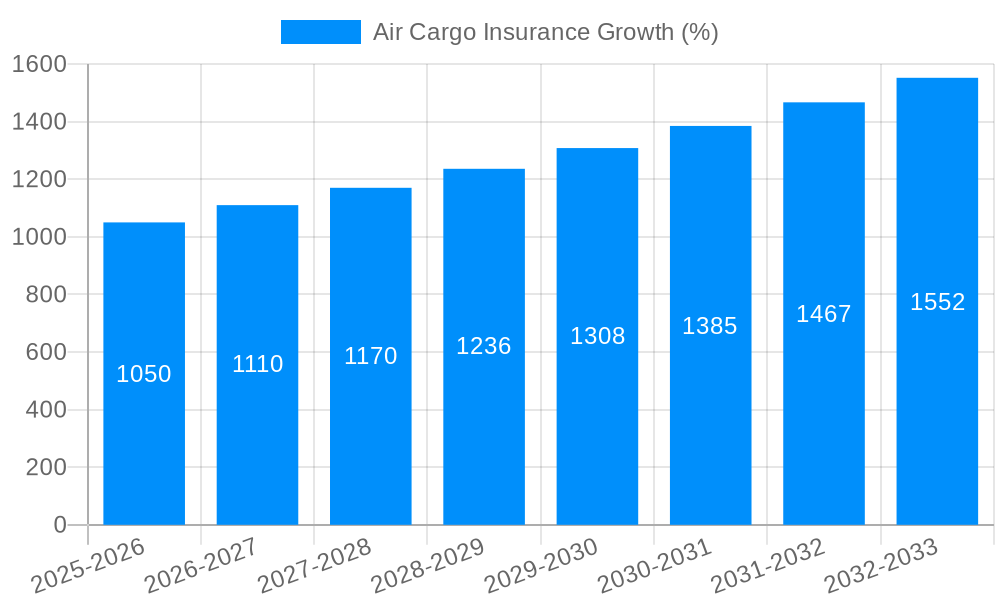

While the precise market size isn't provided, reasonable estimations can be made based on industry reports and trends. Considering a moderate CAGR (let's assume 7% for illustrative purposes – a figure commonly seen in related insurance sectors), a base year of 2025 with a hypothetical market size of $15 billion (this is an educated guess based on the size of related markets like marine insurance and the scale of global air cargo), we project significant expansion through 2033. Factors like geopolitical instability and economic downturns can influence growth, potentially leading to fluctuations within the projected range. However, the long-term outlook remains positive, fueled by the continued growth of global trade and the increasing reliance on air freight for time-sensitive shipments. The competitive landscape will continue to evolve, with a focus on digitalization, data analytics, and customized insurance solutions to cater to specific client needs and risk profiles.

The global air cargo insurance market, valued at $XX billion in 2025, is poised for significant growth, projected to reach $YY billion by 2033, exhibiting a robust CAGR of Z%. The historical period (2019-2024) witnessed fluctuating growth, influenced by global economic conditions and geopolitical events. The base year (2025) provides a stable platform for forecasting market expansion during the forecast period (2025-2033). Key market insights reveal a burgeoning demand driven by the escalating value of air freight shipments, increasing e-commerce activity, and heightened awareness of potential risks associated with air cargo transportation. The rise of specialized logistics providers and the expansion of global supply chains have further contributed to market growth. The insurance landscape is becoming increasingly sophisticated, with insurers offering tailored solutions to address the unique needs of various industries. We observe a growing trend towards digitalization, with online platforms and innovative insurance technologies streamlining the insurance purchasing process and improving risk assessment methods. The market is witnessing the emergence of parametric insurance products, designed to offer quicker and more efficient claims settlements in the event of covered losses, accelerating claim processing times. Furthermore, the increasing adoption of comprehensive insurance policies, encompassing a broader range of risks, suggests a shift towards more robust risk management strategies among businesses. Competition among insurers is intensifying, leading to a wider range of products, competitive pricing, and a focus on customer service enhancements.

Several factors are fueling the expansion of the air cargo insurance market. The exponential growth of e-commerce, demanding faster and more reliable delivery of goods globally, has significantly increased the volume of air freight shipments. This surge in volume directly translates into a heightened demand for insurance coverage to mitigate the financial risks associated with potential losses during transit. Simultaneously, the globalization of supply chains creates intricate and geographically dispersed networks, increasing the exposure to unforeseen events like natural disasters, geopolitical instability, and logistical disruptions. The high value of many air cargo shipments, particularly in sectors like pharmaceuticals and electronics, necessitates robust insurance protection against damage, loss, or delay. Furthermore, stricter regulatory compliance requirements across various jurisdictions necessitate comprehensive insurance policies to ensure compliance and avoid potential penalties. Increased awareness among businesses of the financial implications of uninsured losses, coupled with the accessibility of various insurance products and a better understanding of their benefits, drives the adoption of air cargo insurance. The proactive role of insurance brokers and consultants in guiding businesses toward appropriate coverage further propels market growth.

Despite the positive growth trajectory, the air cargo insurance market faces certain challenges. Fluctuating global economic conditions can impact the demand for air cargo and consequently, the demand for insurance. Geopolitical uncertainties and trade wars create instability and disrupt supply chains, increasing the complexity of risk assessment and potentially hindering market growth. The accurate valuation of air cargo shipments can be difficult, especially for high-value or specialized goods, leading to discrepancies in claim settlements and potentially impacting insurer profitability. Fraudulent claims pose a significant challenge, requiring robust claim investigation processes and potentially impacting the overall cost of insurance. Competition among insurers can lead to pressure on pricing and profitability, necessitating innovative risk management strategies and potentially impacting the ability of insurers to offer competitive premiums. The complexity of international regulations and legal frameworks across different jurisdictions can create complexities in claim handling and increase the administrative burden on both insurers and policyholders. Finally, the lack of standardized insurance products across the globe can hinder efficient cross-border trade and increase transaction costs.

The air cargo insurance market demonstrates significant regional variations. North America and Asia-Pacific are expected to be the key regions driving market growth, due to the high volume of air freight shipments and the presence of major global logistics hubs. Europe also holds a substantial market share.

Within market segments, Air Cargo Transport Insurance is projected to dominate due to its comprehensive coverage of various risks associated with air cargo transport. The Enterprise application segment is also anticipated to experience strong growth due to the higher insurance needs of large businesses handling substantial air cargo volumes.

Detailed Segment Analysis:

Air Cargo Transport Insurance: This segment offers broad coverage encompassing risks like loss, damage, theft, and pilferage, making it the most preferred option. The rising value of goods transported necessitates comprehensive protection against various perils.

Air Cargo Delay Insurance: This provides coverage for financial losses resulting from delayed deliveries, particularly crucial for time-sensitive goods like pharmaceuticals and perishable items. Market growth is linked to the increase in demand for just-in-time delivery.

Air Cargo Comprehensive Insurance: This all-encompassing policy covers a wider range of risks, including those not covered by other specific policies, creating an appeal to risk-averse businesses.

Airlines Liability Insurance: This policy covers the liability of airlines for damage or loss of cargo during transit. With increasingly stringent regulations, this type of insurance is expected to witness significant growth.

Personal Application: This segment accounts for a smaller share compared to the enterprise segment but has the potential for steady growth, mainly driven by the increased usage of air freight services for personal deliveries.

Enterprise Application: This segment holds a substantial share and is likely to exhibit high growth due to the necessity of risk management within large businesses that engage extensively in air cargo transportation.

The air cargo insurance market's expansion is fueled by several factors: the continuing growth of e-commerce, the rising value of air freight, increasing awareness of risk management, and the ongoing development of innovative insurance products and services, including parametric insurance, that provide more efficient and faster claims settlement.

This report provides a detailed analysis of the air cargo insurance market, encompassing market size, segmentation, regional trends, key players, and future growth prospects. It offers valuable insights for stakeholders, including insurers, logistics providers, and businesses involved in air cargo transportation, enabling informed decision-making and strategic planning within this dynamic market. The forecast period provides a clear outlook for the years to come.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Marine Services Group, Amerijet, DB Schenker, Kuehne+Nagel, RLI Corp, Flexport,Inc, Lufthansa Cargo, Maersk, Crane Worldwide Logistics, Dedola Global Logistics, Packair, Craters & Freighters, Munich Re Specialty Insurance (UK) Limited, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Air Cargo Insurance," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Air Cargo Insurance, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.