1. What is the projected Compound Annual Growth Rate (CAGR) of the Agriculture E-commerce?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Agriculture E-commerce

Agriculture E-commerceAgriculture E-commerce by Type (/> Snacks, Nuts, Specialties, Aquatic products, Meat, Fruits and Vegetables, Drinks, Traditional Tonic Products, Grain and Oil, Rice and Flour, Dry Goods, Flowers, Green Plants, Gardening, Others), by Application (/> Household, Hotel, Restaurant, School, Hospital, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

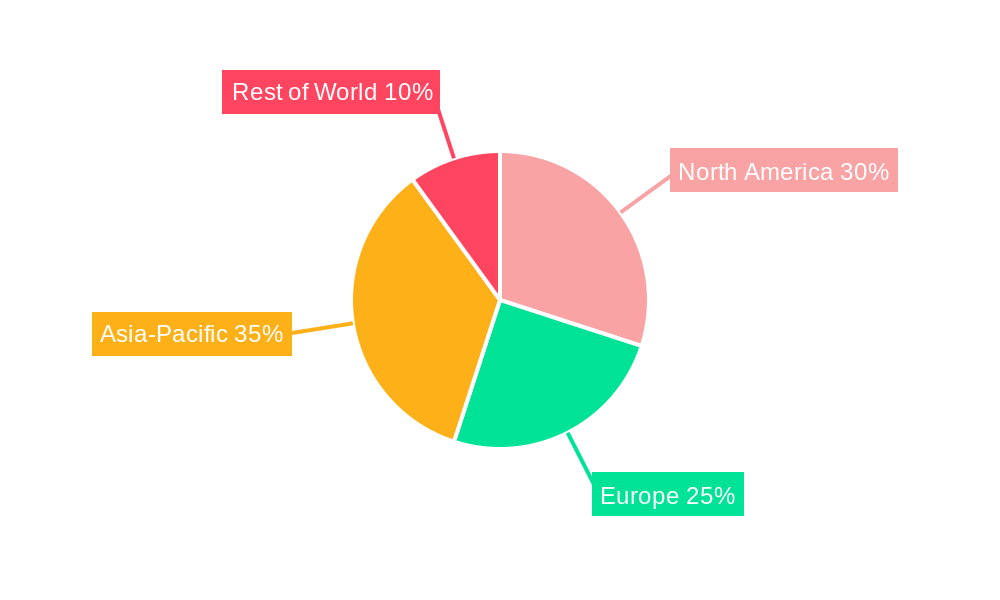

The global agriculture e-commerce market is experiencing robust growth, driven by increasing internet penetration, rising smartphone usage, and a growing preference for online grocery shopping among consumers. Technological advancements, such as improved logistics and cold chain infrastructure, are further facilitating the expansion of this sector. The market is segmented by various factors, including product type (fresh produce, processed food, seeds, fertilizers), business model (B2B, B2C), and region. Key players such as Alibaba, Amazon, and Walmart are strategically investing in this market to capitalize on its immense potential. The competitive landscape is characterized by both established e-commerce giants and emerging agri-tech startups vying for market share. Regional variations in market growth are observed, with regions like North America and Europe showing relatively mature markets, while developing economies in Asia and Africa exhibit significant growth potential fueled by expanding consumer bases and government initiatives promoting agricultural modernization. This dynamic market presents opportunities for both established players and innovative entrants to explore niche segments and leverage emerging technologies. The forecast period (2025-2033) suggests continued expansion, with market size expected to reach substantial figures driven by consumer demand for convenience, transparency in the supply chain, and access to a wider variety of agricultural products. Challenges such as maintaining product freshness, addressing logistical complexities, and ensuring food safety remain crucial areas requiring continuous improvement and investment.

The market's growth trajectory is influenced by several factors. Consumer preferences are shifting towards online channels for purchasing agricultural products due to convenience, competitive pricing, and access to a broader range of options. Government initiatives aimed at promoting digitalization in agriculture, including initiatives focused on infrastructure development and support for agri-tech startups, are playing a significant role in market growth. The rising adoption of mobile technologies in rural areas is also contributing to the expanding reach of agriculture e-commerce platforms. However, challenges remain, such as inadequate cold chain infrastructure in many regions, concerns regarding product quality and authenticity, and the digital literacy gap among some farming communities. Overcoming these challenges will be crucial for realizing the full potential of this rapidly evolving market. The forecast period suggests a continuous expansion of the market, indicating a promising outlook for the future of agriculture e-commerce.

The global agriculture e-commerce market is experiencing explosive growth, projected to reach tens of billions of dollars by 2033. The study period from 2019-2033 reveals a dramatic shift in how agricultural products are bought and sold, driven by technological advancements and evolving consumer preferences. During the historical period (2019-2024), we witnessed a steady increase in online adoption, particularly in regions with robust internet penetration and established logistics networks. The estimated market value for 2025 showcases a significant leap, highlighting the accelerating pace of market expansion. This growth is not uniform across all segments; some, like fresh produce e-commerce, are experiencing disproportionately high growth rates compared to others, such as grains and livestock. The forecast period (2025-2033) anticipates continued expansion, fueled by factors such as increased smartphone penetration, rising urban populations demanding convenient access to fresh produce, and the growing adoption of e-commerce platforms by both farmers and consumers. Key market insights indicate a strong preference for online channels among younger demographics and a growing trend towards subscription-based services for regular deliveries of agricultural products. Furthermore, the rise of data analytics and precision agriculture is enabling more efficient supply chains and improved quality control, enhancing the overall consumer experience. The market is also witnessing a surge in innovative business models such as farm-to-table delivery services and the emergence of online marketplaces specifically catering to agricultural products. This signifies a significant paradigm shift from traditional wholesale and retail channels. The base year 2025 serves as a crucial benchmark, reflecting the culmination of these trends and providing a solid foundation for future projections. The market's dynamism necessitates continuous monitoring and adaptation for companies seeking to thrive in this competitive landscape.

Several key factors are driving the rapid expansion of the agriculture e-commerce market. Firstly, the increasing penetration of the internet and smartphones, particularly in developing economies, is enabling farmers and consumers to access online marketplaces with ease. This digital accessibility democratizes market access, particularly beneficial for smallholder farmers who often lack access to traditional distribution channels. Secondly, the rising urban population and changing consumer lifestyles are fueling demand for convenient and efficient access to fresh produce and other agricultural products. Consumers are increasingly time-constrained and prefer the convenience of online ordering and home delivery. Thirdly, technological advancements, such as improved cold chain logistics and sophisticated inventory management systems, are addressing the challenges associated with the perishable nature of agricultural goods. This allows for reliable and timely delivery, enhancing consumer trust and satisfaction. Fourthly, the emergence of innovative business models, including farm-to-table delivery services, subscription boxes, and online marketplaces specializing in agricultural products, is creating new opportunities and driving market growth. These platforms leverage technology to streamline processes, reduce costs, and provide a seamless shopping experience. Finally, government initiatives promoting digitalization and e-commerce in the agricultural sector are providing further impetus to market expansion, particularly in countries actively seeking to modernize their agricultural value chains.

Despite the significant growth potential, several challenges and restraints hinder the widespread adoption of agriculture e-commerce. Firstly, the perishable nature of many agricultural products poses a significant logistical challenge. Maintaining the quality and freshness of produce throughout the supply chain requires investments in cold chain infrastructure and sophisticated logistics management. Secondly, the lack of reliable internet connectivity and digital literacy, especially in rural areas, limits access to online marketplaces for both farmers and consumers. This digital divide needs to be addressed through investments in infrastructure and digital literacy programs. Thirdly, concerns about food safety and quality control are crucial considerations. Robust traceability systems and stringent quality checks are necessary to ensure consumer confidence in online agricultural products. Fourthly, the lack of standardized grading and quality assessment protocols makes it difficult to ensure consistency and transparency in online transactions. Standardization is vital for building trust and facilitating efficient trading. Fifthly, payment infrastructure and financial inclusion remain challenges, particularly in developing economies, where access to digital payment systems might be limited. Addressing these payment-related limitations is essential for broadening market participation.

Asia: Countries like China and India, with their vast populations and rapidly growing middle classes, are expected to dominate the market. The sheer scale of these markets presents immense opportunities for growth. The increasing smartphone penetration and burgeoning e-commerce infrastructure are propelling this growth. Alibaba and JD.com in China, and BigBasket and Grofers in India, represent significant players reflecting this dominance.

North America: The U.S. and Canada represent mature e-commerce markets, with well-established logistics networks and high consumer adoption rates. Companies such as Amazon and Walmart are significantly invested in this segment, leveraging their existing infrastructure and customer base.

Europe: While not experiencing the same explosive growth as Asia, Europe's market shows steady expansion, driven by increasing demand for convenient food delivery services and the growing popularity of online grocery shopping. Companies like Carrefour and Sainsbury's are actively adapting their strategies to capitalize on these trends.

Segments:

Fresh Produce: This segment is expected to be the fastest-growing, fueled by consumer preference for convenience and the increasing demand for fresh, high-quality produce. However, the challenges related to perishability remain significant.

Processed Foods: This segment benefits from longer shelf lives and easier logistics compared to fresh produce. However, competition from established offline players is greater in this segment.

Livestock and Poultry: Online sales of livestock and poultry are still relatively nascent, primarily owing to the complexities of logistics and live animal handling. However, increasing integration of technology is likely to lead to future market penetration.

The dominance of specific regions and segments is interconnected. For example, Asia’s dominance is largely driven by its rapidly expanding fresh produce segment. Conversely, North America sees substantial growth across various segments due to established e-commerce infrastructure and consumer behavior. This highlights the necessity for tailored strategies based on both regional nuances and specific product characteristics.

The agriculture e-commerce industry is poised for substantial growth, fueled by several key factors. Increasing internet and smartphone penetration, particularly in developing economies, enables broader access to online marketplaces. This coupled with the rise of urban populations and their preference for convenience, drives the demand for efficient online delivery services for agricultural products. Furthermore, the development and adoption of sophisticated cold chain logistics solutions effectively addresses the challenges presented by the perishable nature of many agricultural products. This, together with government initiatives promoting digitalization in the agricultural sector, further accelerates market expansion and strengthens the overall industry.

This report provides a detailed analysis of the global agriculture e-commerce market, covering key trends, driving forces, challenges, and leading players. The report offers valuable insights into market dynamics, growth opportunities, and potential risks, providing a comprehensive understanding of this rapidly evolving sector. This analysis encompasses both historical data and future projections, enabling businesses to make informed decisions and effectively navigate the complexities of this dynamic market. The report also analyzes regional variations and segment-specific trends, offering a granular view of the market landscape.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Alibaba Group, JD, Amazon, Walmart, Carrefour, Womai, Sainsbury’s, Chronodrive, Sfbest, Benlai, Tootoo, FreshDirect, EfoodDepot, LeShop, Publix, Agrihelp, Ninjacart, WayCool, Crofarm, KrishiHub, Kisan Network, Grofers, Big Basket.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Agriculture E-commerce," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Agriculture E-commerce, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.