1. What is the projected Compound Annual Growth Rate (CAGR) of the Aftermarket Domain Names?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Aftermarket Domain Names

Aftermarket Domain NamesAftermarket Domain Names by Type (Domain Backorders, Auction, Domain Brokers), by Application (Enterprise, Individual), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

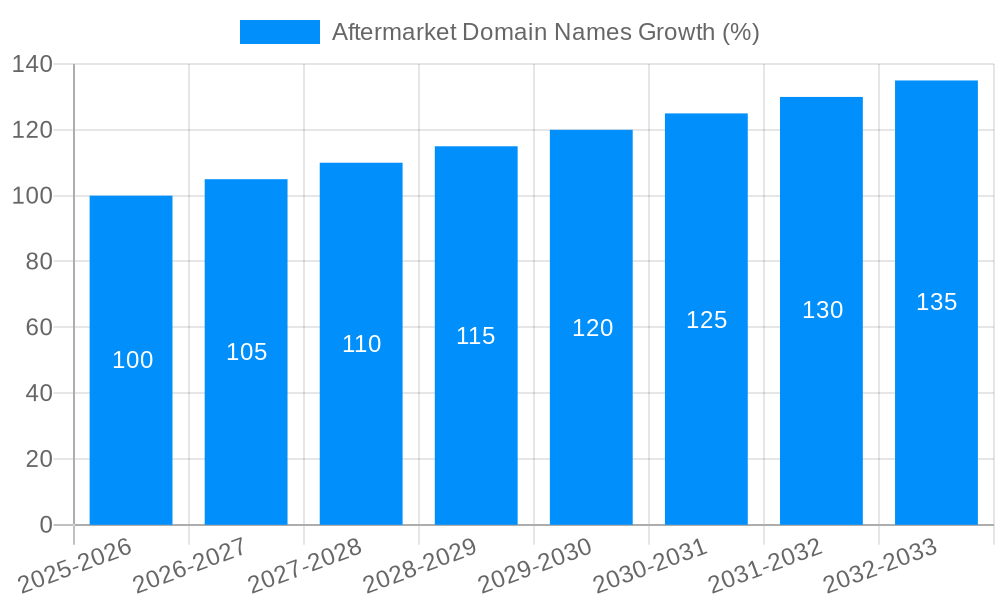

The aftermarket domain name market, encompassing backorders, auctions, and broker services for enterprise and individual users, is a dynamic and growing sector. While precise market size figures for 2025 are unavailable, leveraging the provided study period (2019-2033) and a plausible CAGR (let's assume a conservative 8% based on historical domain market growth and considering economic factors), we can project a significant expansion. Assuming a 2025 market size of $500 million (a reasonable estimate based on industry reports of similar markets), this would indicate considerable growth, driven by factors such as increasing internet penetration, the rising importance of online brand presence, and the limited availability of premium domain names. Key trends shaping the market include the emergence of AI-powered domain valuation tools, an increase in the use of domain name portfolio management services, and a continued focus on security and fraud prevention within domain transactions.

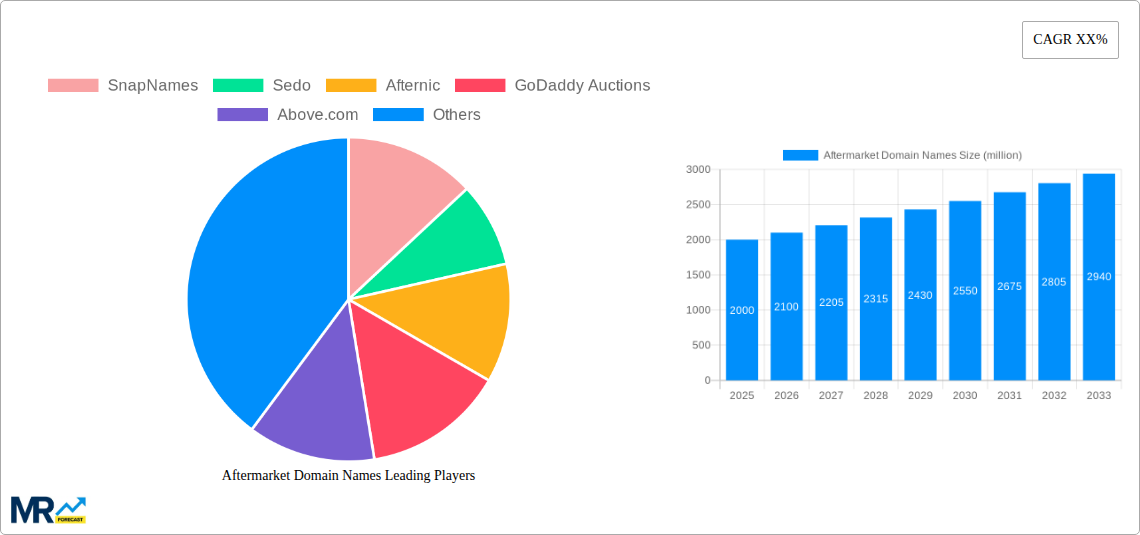

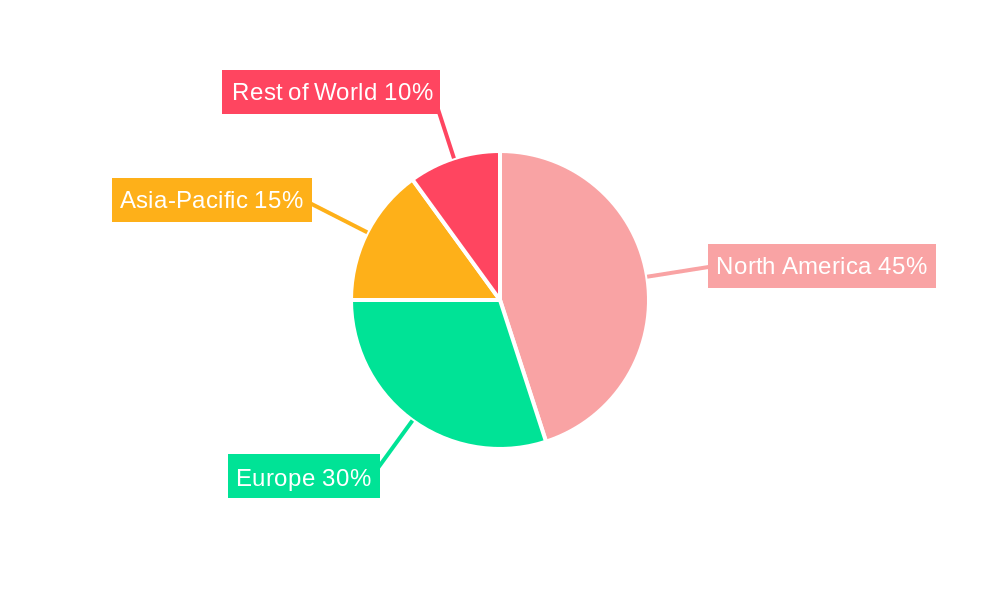

The market segmentation, with both application and type, reveals distinct opportunities. The enterprise segment drives a substantial portion of revenue due to the need for strong online identities and branding. However, the individual segment offers substantial growth potential, fueled by entrepreneurs and individual brand building. While factors like economic downturns and increased competition from new domain extensions can act as restraints, the overall market outlook remains optimistic. The competitive landscape is characterized by both established players like GoDaddy and Sedo, and niche players catering to specific domain types or auction mechanisms. Geographical distribution of the market reflects internet usage patterns, with North America and Europe currently holding significant market share, while Asia-Pacific shows high growth potential due to rapidly expanding internet access and e-commerce. Looking forward, continued technological advancements, improved market transparency, and better regulatory frameworks will be crucial for further market expansion.

The aftermarket domain name market, valued at $XX million in 2025, is experiencing robust growth, projected to reach $YY million by 2033, exhibiting a CAGR of Z%. This growth is fueled by the increasing demand for established, brandable domain names, especially amongst businesses seeking a strong online presence. The historical period (2019-2024) witnessed a steady rise in transactions, driven by factors such as increased internet penetration, the rise of e-commerce, and a growing understanding of the importance of a well-chosen domain name for branding and SEO. The estimated value for 2025 reflects a significant jump compared to previous years, signifying a maturing market with increased investor confidence. This report, covering the study period of 2019-2033, analyzes this dynamic market, encompassing various transaction types – from auctions and backorders to broker-mediated sales – and applications spanning individual users to large enterprises. The diverse range of platforms facilitating these transactions, from established players like GoDaddy Auctions to specialized marketplaces such as Sedo and Afternic, further contributes to the market's complexity and growth. The forecast period (2025-2033) predicts continued expansion, though potential challenges and shifts in market dynamics will influence the final trajectory. The base year of 2025 provides a crucial benchmark for understanding the market's current state and projecting future performance. This report delves deeper into the key drivers and challenges shaping this lucrative industry.

Several key factors are driving the growth of the aftermarket domain name market. Firstly, the increasing number of businesses and individuals establishing an online presence fuels demand for high-quality, memorable domain names. These names are crucial for branding, SEO optimization, and building customer trust. Secondly, the rise of e-commerce and online marketing strategies has made domain names a valuable asset. Businesses are willing to invest significantly to acquire premium domains that align with their brand identity and enhance their online visibility. The development of sophisticated domain name marketplaces and auction platforms has streamlined the buying and selling process, making it more accessible to a wider range of participants. These platforms offer greater transparency and security, encouraging higher levels of participation. Furthermore, the growing awareness of the long-term value of a well-chosen domain name among businesses and investors is a key factor driving market growth. This is particularly evident in the increasing participation of larger enterprises which are investing in domain portfolios as strategic assets. Finally, the scarcity of premium domain names drives up their value, making them attractive investments.

Despite the strong growth potential, the aftermarket domain name market faces certain challenges. Price volatility is a significant factor, with domain prices fluctuating based on market demand and individual domain characteristics. This unpredictability can make it difficult for both buyers and sellers to accurately assess value. Furthermore, the market is susceptible to speculation and bubbles, leading to periods of rapid price increases followed by corrections. The complexity of domain name valuation and the lack of standardized pricing mechanisms pose another challenge. Determining a fair market value can be subjective and depends on various factors, including the domain's length, keywords, and overall brandability. This lack of standardization can lead to disputes and uncertainties in transactions. Moreover, legal and regulatory issues, including cybersquatting and trademark infringement, can create risks for both buyers and sellers. Finally, the increasing use of new top-level domains (TLDs) presents competition to traditional .com and .net domains, potentially diluting the value of established names within the aftermarket.

The Enterprise segment is projected to dominate the aftermarket domain name market over the forecast period. This is due to the significant investment power of large corporations seeking to strengthen their online branding, expand their digital reach, and establish a strong presence in the online marketplace.

North America and Europe are expected to be the leading regions in terms of market size and growth. This is primarily driven by high internet penetration rates, a robust entrepreneurial landscape, and a sophisticated understanding of the value of premium domain names.

The Auction segment is expected to contribute significantly to the market's growth, owing to the transparent and competitive nature of the auction process. This segment attracts a wide array of buyers and sellers, fostering a dynamic and liquid marketplace.

Domain Brokers play a crucial role in facilitating transactions, particularly for high-value domains. Their expertise in valuation, negotiation, and legal compliance makes them essential players within the ecosystem.

Individual buyers also constitute a significant portion of the market. While their purchases may be smaller in value compared to enterprise transactions, their aggregate contribution is substantial. Individual buyers are often looking to establish online businesses, create personal brands, or invest in potential future value.

In summary: While other segments contribute significantly, the combination of high spending capacity and strategic importance to brand building within the Enterprise segment, coupled with the robust and transparent processes offered by the Auction segment makes these the dominant forces in driving market growth. The geographical concentration in North America and Europe stems from the historical development of the internet and the established digital economies within these regions.

Several factors will continue to fuel growth in the aftermarket domain names industry. The expansion of the internet and the increasing adoption of e-commerce are key drivers, alongside the rising recognition of the importance of a strong online presence. This translates into a continuous and growing demand for memorable and relevant domain names. Furthermore, innovations in online marketing strategies, emphasizing brand building and SEO optimization, are expected to bolster demand, encouraging investment in high-quality domain names as crucial assets.

This report provides a comprehensive analysis of the aftermarket domain name market, offering valuable insights for businesses, investors, and individuals involved in this dynamic industry. It details market trends, driving forces, challenges, key players, and significant developments, enabling informed decision-making and strategic planning. The report's in-depth segmentation allows for a granular understanding of various market segments and their respective growth trajectories, offering a complete picture of this expanding sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include SnapNames, Sedo, Afternic, GoDaddy Auctions, Above.com, Odys, Active.Domains, Web.com, 22net, Alibaba Cloud, Register.TO, Aftermarket.com, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Aftermarket Domain Names," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Aftermarket Domain Names, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.