1. What is the projected Compound Annual Growth Rate (CAGR) of the Aerial Imaging and Mapping?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Aerial Imaging and Mapping

Aerial Imaging and MappingAerial Imaging and Mapping by Type (/> Unmanned Aerial Vehicles, Helicopters, Fixed-Wing Aircraft, Others), by Application (/> Government Agencies, Military & Defense, Energy Sector, Agriculture and Forestry, Civil Engineering, Commercial Enterprises, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

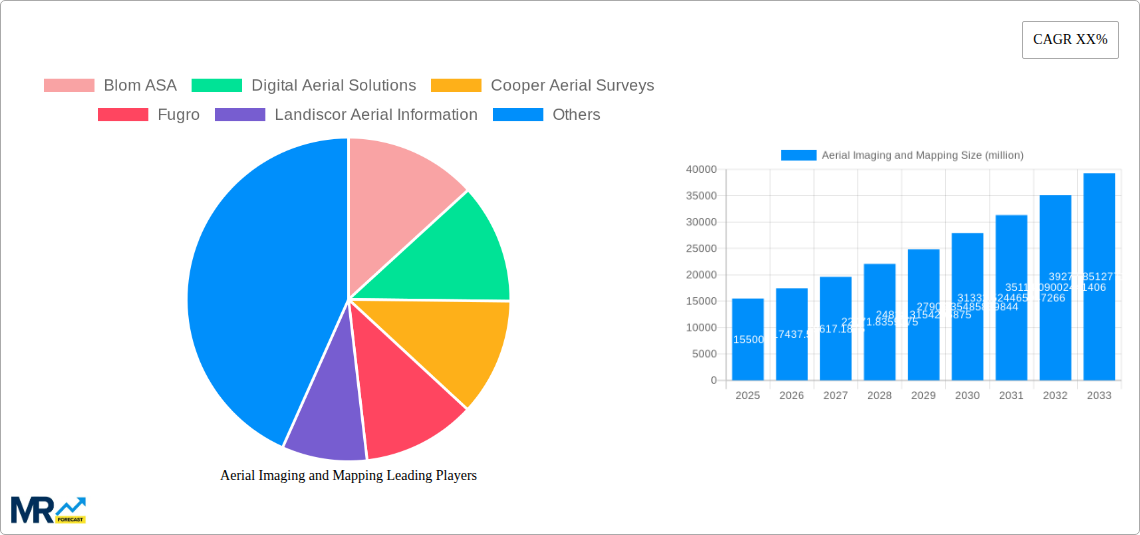

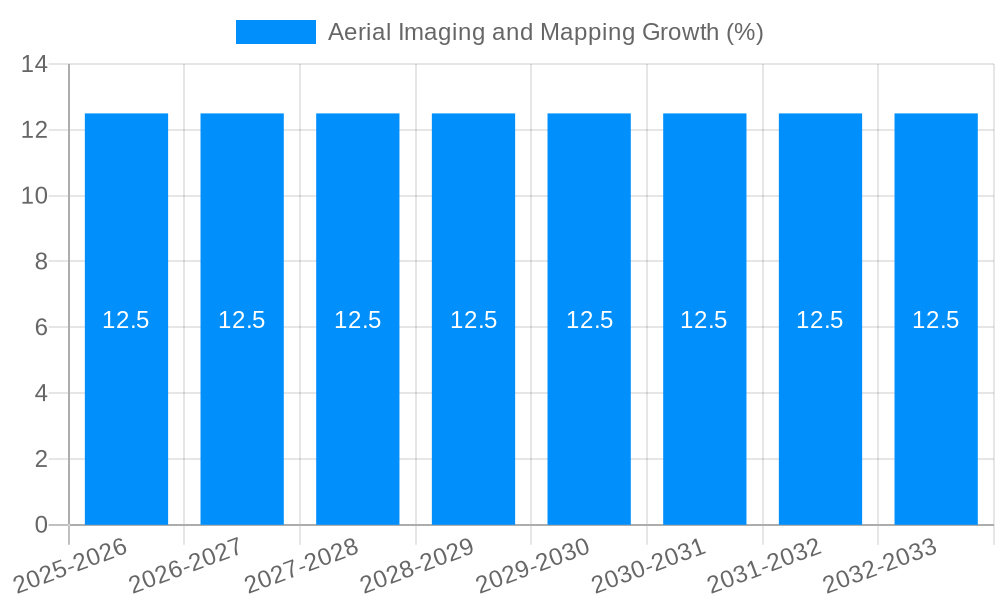

The Aerial Imaging and Mapping market is poised for significant expansion, projected to reach an estimated $15.5 billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of 12.5% through 2033. This growth is propelled by a confluence of advancements in technology and an increasing demand across diverse sectors. Unmanned Aerial Vehicles (UAVs), with their agility and cost-effectiveness, are revolutionizing data acquisition, complementing traditional fixed-wing aircraft and helicopters. Key drivers include the escalating need for detailed geospatial data in government and defense for security and infrastructure management, and in the energy sector for exploration, monitoring, and maintenance of vital assets. Furthermore, the agriculture and forestry industries are leveraging aerial imaging for precision farming, crop health monitoring, and sustainable land management, while civil engineering benefits from enhanced site assessment and progress tracking. The commercial enterprise segment is also recognizing the value of aerial data for market analysis, urban planning, and insurance claim verification.

The market's trajectory is further shaped by evolving trends such as the integration of Artificial Intelligence (AI) and Machine Learning (ML) for automated image analysis, object detection, and data interpretation, leading to quicker insights and operational efficiencies. The increasing adoption of high-resolution sensors, LiDAR, and multispectral imaging is enabling more granular and accurate data capture. However, certain restraints, including stringent regulatory frameworks surrounding drone operation in specific regions and the high initial investment costs for advanced equipment, could moderate the growth pace. Despite these challenges, the market's inherent value proposition – providing comprehensive, accurate, and actionable aerial intelligence – ensures its continued upward momentum. Leading companies like Blom ASA, EagleView Technology, and Fugro are at the forefront, innovating and expanding their service offerings to cater to the burgeoning global demand for sophisticated aerial imaging and mapping solutions.

The global Aerial Imaging and Mapping market is experiencing a substantial growth trajectory, projected to reach an impressive $6.5 billion by the end of the forecast period in 2033. This surge is underpinned by a confluence of technological advancements, expanding applications, and increasing investments across various sectors. During the historical period from 2019 to 2024, the market demonstrated a robust CAGR of 12.2%, laying a strong foundation for future expansion. The Base Year of 2025 sets the stage for further acceleration, with the market estimated to be valued at approximately $3.2 billion. This growth is not monolithic but rather a complex interplay of evolving methodologies and demand from diverse end-users.

Key market insights reveal a significant shift towards high-resolution imagery and sophisticated data processing techniques. The increasing adoption of Unmanned Aerial Vehicles (UAVs), also known as drones, has revolutionized data acquisition, offering unprecedented flexibility, cost-effectiveness, and accessibility. This has democratized aerial mapping, making it viable for smaller businesses and niche applications. Furthermore, advancements in sensor technology, including LiDAR, multispectral, and hyperspectral imaging, are enabling the capture of richer, more detailed datasets. These datasets are crucial for advanced analytics, predictive modeling, and informed decision-making across industries. The integration of Artificial Intelligence (AI) and Machine Learning (ML) algorithms is further amplifying the value proposition of aerial imagery, allowing for automated feature extraction, object recognition, and change detection, thereby streamlining workflows and enhancing accuracy.

The market is characterized by a growing demand for real-time or near-real-time data, especially in sectors like disaster management, infrastructure monitoring, and precision agriculture. This necessitates the development of more efficient data transmission and processing pipelines. The increasing availability of cloud-based platforms and sophisticated software solutions is also facilitating easier access to and analysis of aerial data, democratizing its use and fostering innovation. Moreover, government initiatives promoting digital infrastructure and smart city development are acting as significant catalysts, driving the adoption of aerial imaging and mapping for urban planning, resource management, and public safety. The ongoing research and development in drone autonomy, sensor miniaturization, and data fusion techniques are poised to unlock even greater potential in the coming years, further solidifying the market's upward trend.

The surge in the Aerial Imaging and Mapping market is fundamentally driven by the relentless pursuit of efficiency, accuracy, and cost-effectiveness across a myriad of industries. The unparalleled ability of aerial platforms to capture vast amounts of high-resolution data from an elevated perspective provides a unique vantage point for analysis and decision-making. This is particularly evident in sectors like infrastructure development and maintenance, where detailed aerial surveys enable precise planning, progress monitoring, and early detection of potential issues, thereby preventing costly overruns and ensuring safety.

The rapid evolution of technology has been a paramount driving force. The advent and proliferation of Unmanned Aerial Vehicles (UAVs) have democratized access to aerial data acquisition. Their lower operational costs compared to traditional manned aircraft, coupled with their agility and ability to operate in confined or hazardous environments, have made aerial mapping accessible to a broader spectrum of users. Concurrently, advancements in sensor technology, including the miniaturization and increased capabilities of LiDAR, multispectral, and hyperspectral sensors, allow for the capture of incredibly detailed and diverse data, unlocking new analytical possibilities. This technological synergy fuels demand as organizations seek to leverage these capabilities for competitive advantage.

Furthermore, the increasing emphasis on data-driven decision-making across both public and private sectors is a significant propellant. Governments are utilizing aerial mapping for enhanced urban planning, environmental monitoring, and disaster response, while commercial enterprises are employing it for asset management, site selection, and inventory tracking. The growing awareness of the benefits of precise spatial data for applications ranging from precision agriculture to energy infrastructure management is also contributing to market expansion.

Despite the robust growth, the Aerial Imaging and Mapping market faces several significant challenges and restraints that could temper its expansion. One of the primary hurdles is the complex and evolving regulatory landscape. Obtaining permits and adhering to flight restrictions, particularly for operations involving larger aircraft or sensitive areas, can be time-consuming and costly, impacting the speed of project deployment. Privacy concerns also pose a significant restraint. The ability of aerial platforms to capture detailed imagery raises ethical questions about data collection and usage, leading to public apprehension and potential legal challenges that require careful navigation.

The high initial investment required for sophisticated equipment and software can also be a barrier to entry, especially for smaller businesses or organizations with limited capital. While UAVs have reduced costs, the acquisition of advanced sensors and processing capabilities still represents a substantial expenditure. Furthermore, the technical expertise required to operate advanced aerial systems and interpret the collected data effectively is not always readily available. This skills gap necessitates significant investment in training and development, which can be a constraint for some organizations.

Data processing and management present another significant challenge. The sheer volume of data generated by high-resolution aerial imaging requires substantial storage capacity and processing power. Developing efficient workflows for data ingestion, quality control, analysis, and dissemination is crucial. Cybersecurity threats to stored geospatial data also represent a growing concern, demanding robust security measures. Finally, adverse weather conditions can disrupt aerial operations, leading to project delays and increased costs, impacting the reliability and predictability of data acquisition schedules.

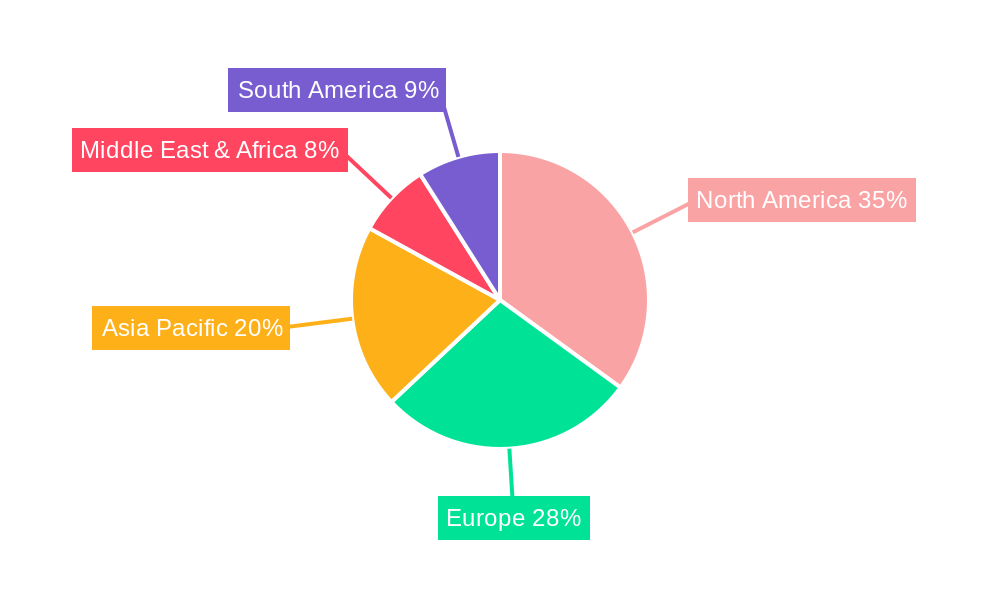

The Aerial Imaging and Mapping market is characterized by the dominance of specific regions and segments, driven by a combination of technological adoption, governmental initiatives, and industry-specific demand.

Key Regions/Countries:

Key Segments:

The convergence of these dominant regions and segments, particularly the widespread adoption of UAVs by government agencies and within the civil engineering sector, will continue to shape the trajectory and expansion of the global Aerial Imaging and Mapping market.

The growth of the Aerial Imaging and Mapping industry is significantly catalyzed by rapid technological advancements, particularly in the realm of Unmanned Aerial Vehicles (UAVs). The decreasing cost of drone technology, coupled with enhanced payload capabilities for higher resolution cameras and advanced sensors like LiDAR, makes aerial data acquisition more accessible and cost-effective. Furthermore, the increasing sophistication of AI and machine learning algorithms is unlocking new possibilities for automated data analysis, feature extraction, and predictive modeling, thereby enhancing the value proposition of aerial imagery for diverse applications. The growing awareness and adoption of geospatial data for informed decision-making across sectors like agriculture, infrastructure, and environmental monitoring are also driving demand.

This comprehensive report offers an in-depth analysis of the global Aerial Imaging and Mapping market, providing crucial insights for stakeholders. The study covers the historical period from 2019 to 2024, the base year of 2025, and projects market trends through the forecast period of 2025 to 2033. It delves into the various types of aerial platforms, including Unmanned Aerial Vehicles, Helicopters, Fixed-Wing Aircraft, and Others, and examines their market penetration and adoption rates. The report meticulously details the application of aerial imaging and mapping across key sectors such as Government Agencies, Military & Defense, Energy Sector, Agriculture and Forestry, Civil Engineering, Commercial Enterprises, and Others, highlighting the specific needs and growth drivers within each. With an estimated market valuation reaching $6.5 billion by 2033, this report provides an unparalleled understanding of market dynamics, technological advancements, key players, and future opportunities within this rapidly evolving industry.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Blom ASA, Digital Aerial Solutions, Cooper Aerial Surveys, Fugro, Landiscor Aerial Information, EagleView Technology, Nearmap, Kucera International, Quantum Spatial, Getmapping, SkyIMD.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Aerial Imaging and Mapping," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Aerial Imaging and Mapping, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.