1. What is the projected Compound Annual Growth Rate (CAGR) of the Adobe Channel Partner?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Adobe Channel Partner

Adobe Channel PartnerAdobe Channel Partner by Type (Reseller, Service Provider, Agent), by Application (Large Enterprises, SMEs), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

The Adobe Channel Partner market, encompassing resellers, service providers, and agents catering to large enterprises and SMEs, is experiencing robust growth. While the exact market size in 2025 is not provided, considering the global software market's expansion and Adobe's strong position, a reasonable estimation for the 2025 market value could be in the range of $5-7 billion USD. This is supported by the presence of numerous significant players, ranging from multinational IT giants like CDW and SHI International to specialized regional partners like Cad Gulf and MNJ Technologies. The market's growth is fueled by increasing demand for Adobe's creative cloud solutions across various industries, coupled with the rising adoption of cloud-based software and digital transformation initiatives. Furthermore, the diverse range of applications and deployment models offered by Adobe's channel partners cater to a broad customer base, creating opportunities for growth within both large enterprise and SME segments. The continued development of Adobe's product suite and its expanding ecosystem of integrations will only serve to further propel market expansion.

The market is segmented by partner type (Reseller, Service Provider, Agent) and customer type (Large Enterprises, SMEs). The reseller segment likely constitutes the largest portion of the market, given its role in direct sales and distribution. However, service providers are rapidly gaining prominence due to increasing demand for customized solutions, integration services, and ongoing support. Geographic distribution shows strong representation across North America, Europe, and Asia Pacific, with North America and Europe likely maintaining larger market shares due to higher adoption of advanced software solutions and well-established digital ecosystems. Potential restraints include economic downturns impacting IT spending, competition from open-source alternatives, and the increasing complexity of managing diverse software ecosystems. However, these are expected to be outweighed by the significant opportunities stemming from the ongoing expansion of digital businesses and the rising need for creative and productivity tools.

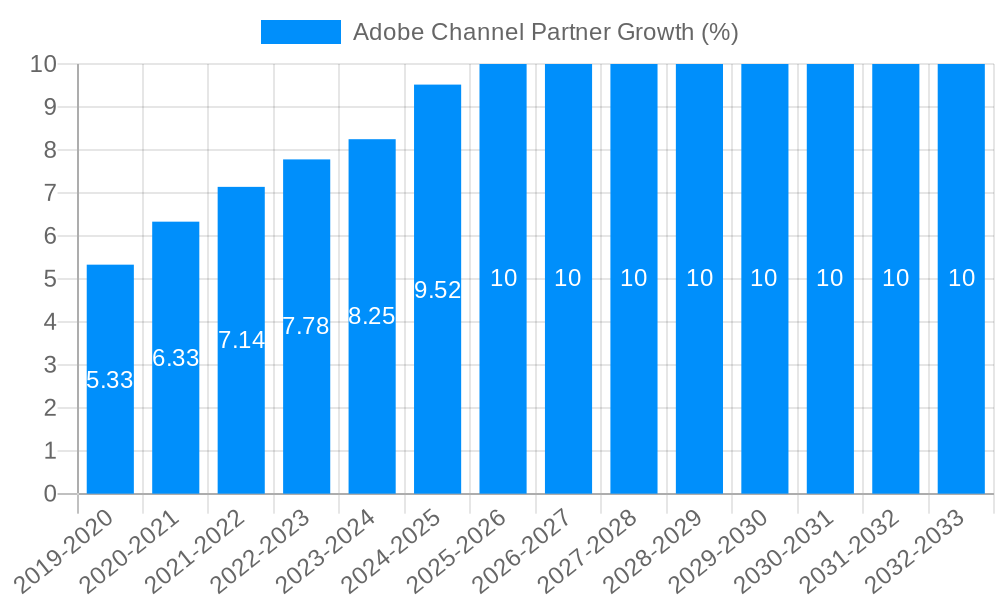

The Adobe Channel Partner ecosystem, encompassing resellers, service providers, and agents catering to large enterprises and SMEs, is projected to experience substantial growth, reaching a market value exceeding $XX billion by 2033. The historical period (2019-2024) witnessed a steady expansion driven by the increasing adoption of Adobe Creative Cloud and Document Cloud suites across various industries. The estimated market value in 2025 is pegged at $YY billion. This growth trajectory is anticipated to continue throughout the forecast period (2025-2033), fueled by several key factors including the rising demand for cloud-based solutions, the increasing need for digital transformation across businesses of all sizes, and the continuous innovation within Adobe's product portfolio. The shift towards remote work and digital collaboration further accelerated the adoption of Adobe's collaborative tools, boosting partner revenue streams. However, competitive pressures from other software providers and the need for continuous partner skill development remain crucial aspects to navigate. Geographic expansion, particularly in developing economies with burgeoning digital adoption, presents significant untapped potential for channel partners. The market is also witnessing a gradual shift towards specialized service offerings, with partners focusing on niche industries or specific Adobe solutions to achieve better market penetration and gain a competitive edge. Strategic partnerships and collaborations among partners are also becoming increasingly common to leverage complementary strengths and enhance service offerings. The increasing importance of data analytics and customer experience management has made specialized data-driven solutions a significant growth driver for channel partners.

Several key factors are driving the expansion of the Adobe Channel Partner ecosystem. The widespread adoption of cloud-based software-as-a-service (SaaS) models is a primary driver, offering businesses scalable and cost-effective access to Adobe's powerful creative and productivity tools. This shift reduces the need for significant upfront investments in software licenses and hardware infrastructure, leading to greater accessibility for SMEs and smaller organizations. Furthermore, the continuous innovation and feature enhancements within Adobe's product portfolio, such as enhanced collaboration features and AI-powered tools, are consistently attracting new customers and expanding the addressable market. The growing demand for digital marketing and content creation solutions across diverse sectors further fuels the growth of the channel partner network. Partners play a crucial role in delivering tailored solutions, training, and support to end-users, creating a robust ecosystem capable of providing a wide range of services, from basic software implementation and training to advanced consultancy and custom development services. The increasing emphasis on digital transformation initiatives within organizations also presents significant opportunities for Adobe partners to play a strategic role in helping businesses optimize their digital workflows and enhance their overall efficiency.

Despite the considerable growth opportunities, the Adobe Channel Partner ecosystem faces various challenges. Intense competition from other software providers offering similar solutions is a significant restraint. Maintaining competitiveness requires ongoing investments in training and skill development to stay abreast of the latest Adobe technologies and market trends. The complexity of Adobe's product portfolio can present a steep learning curve for partners, requiring substantial effort to master and effectively deliver solutions. Managing customer expectations and providing excellent post-sales support are crucial for customer satisfaction and retention, which requires efficient and responsive service mechanisms. Furthermore, ensuring compliance with Adobe's partner program requirements and maintaining the necessary certifications are essential for partner success, but can demand significant administrative and operational resources. Finally, economic downturns or industry-specific challenges can directly impact customer spending on software solutions, potentially affecting partner revenue and profitability.

The North American market is expected to dominate the Adobe Channel Partner ecosystem throughout the forecast period. Its large, well-established IT infrastructure, high level of digital adoption, and strong presence of major enterprises contribute significantly to this dominance. Furthermore, the high concentration of Adobe partners in this region ensures extensive market coverage and diverse service offerings.

Large Enterprises: This segment will continue to be a major revenue generator for Adobe channel partners. Their need for enterprise-grade solutions, high-volume licensing, and extensive support services generates substantial demand. The higher average revenue per user (ARPU) also makes this segment highly attractive.

Resellers: Resellers will maintain a significant share of the market, driven by their established distribution networks, extensive customer bases, and specialized sales expertise in procuring and delivering Adobe's products. The reseller channel is crucial for reaching a broader customer base, particularly within SMEs.

Other significant regions/segments: While North America leads, Europe and Asia-Pacific are projected to experience strong growth, primarily driven by increasing digitalization efforts and expansion of SME businesses within these regions. The SME segment is a rapidly expanding market, though individual transactions may be smaller, the sheer volume of customers offsets the lower ARPU. Service providers focused on specialized implementation and consultancy will witness significant growth as businesses increasingly require expert guidance in optimizing their use of Adobe products.

Several factors catalyze growth within the Adobe Channel Partner industry. The increasing focus on digital transformation initiatives across all business sectors requires the support of experienced partners, creating a need for specialized services beyond simple software sales. The expanding portfolio of Adobe cloud solutions offers a vast array of opportunities for partners to specialize in niches and provide valuable, customized services to specific market segments. The ongoing investment in training and certification programs further empowers partners to meet the evolving needs of their customers and deliver high-quality solutions. Finally, the continuous innovation and improvement of Adobe's product suite creates a dynamic market that attracts new customers and generates demand for advanced services, driving sustained growth for partners.

This report provides a comprehensive overview of the Adobe Channel Partner ecosystem, analyzing market trends, driving forces, challenges, key players, and significant developments. It offers insights into the growth potential of various segments and regions, helping businesses and stakeholders understand the dynamics of this rapidly evolving sector. The forecasts presented are based on robust market research and analysis, delivering valuable insights to aid informed decision-making within the Adobe Channel Partner landscape. This comprehensive analysis can guide strategic planning and resource allocation, allowing companies to capitalize on growth opportunities and navigate the challenges in this competitive market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include CDW, Cad Gulf, Crayon A/S, Insight, JourneyEd, SHI International, MeetingOne, MicroAge, A2K Technologies, ACES Direct, Bell Techlogix, Buyitdirect, Bytes Software Services, Computer Services And Support, Creation Engine, Data#3, Micromail, MNJ Technologies, Sirius Computer Solutions, SoftwareONE, Zones, 21st Centurysoft, a&f systems ag, Academia, Academic & Collegiate Software, Acestar, AD Computer Company, Aequilibrium, Aevitas, AlphaConverge, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Adobe Channel Partner," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Adobe Channel Partner, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.