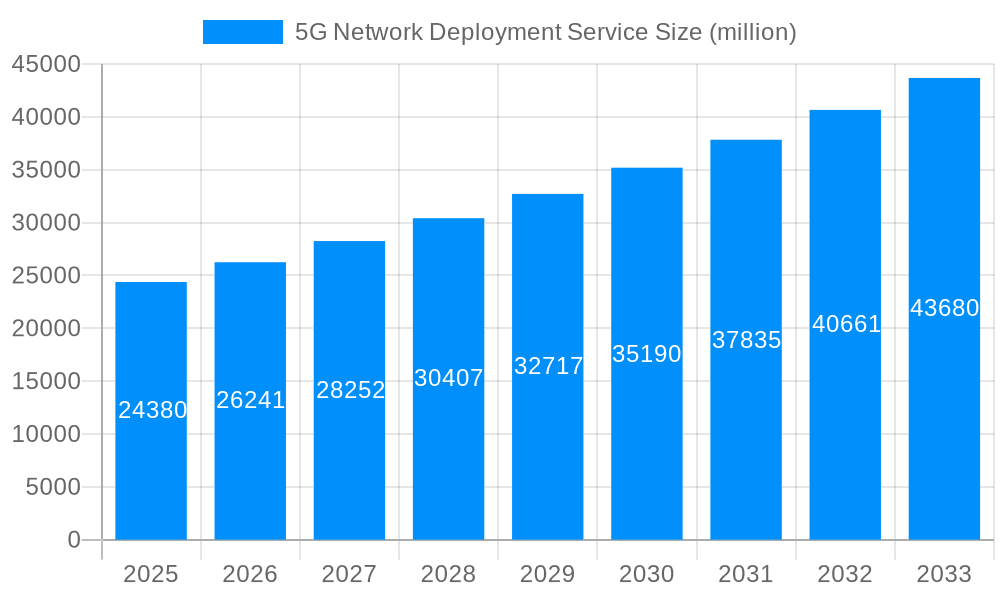

1. What is the projected Compound Annual Growth Rate (CAGR) of the 5G Network Deployment Service?

The projected CAGR is approximately 7.6%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

5G Network Deployment Service

5G Network Deployment Service5G Network Deployment Service by Type (Small Cell, 5G Mobile Core Network, Radio Access Network), by Application (Business Broadband Users, Residential Broadband Users, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

The global 5G Network Deployment Service market is poised for significant expansion, projected to reach a substantial valuation in the coming years. Driven by the relentless demand for enhanced mobile broadband, ultra-reliable low-latency communication, and massive machine-type communications, the market is witnessing accelerated investments from both telecommunications operators and enterprises. The widespread adoption of 5G technology is fundamentally reshaping industries, enabling innovations in areas such as the Internet of Things (IoT), smart cities, autonomous vehicles, and advanced manufacturing. This surge in demand for faster, more responsive, and highly connected experiences is a primary catalyst for the robust growth anticipated in 5G network deployment services.

The market's trajectory is further bolstered by strategic initiatives and ongoing technological advancements. Significant investments in the expansion of 5G infrastructure, including the rollout of small cells, the densification of radio access networks (RAN), and the development of robust 5G core networks, are creating substantial opportunities for service providers. Key players are actively engaged in developing and implementing sophisticated deployment strategies, leveraging innovations in network virtualization, software-defined networking (SDN), and edge computing to optimize performance and cost-effectiveness. While challenges such as spectrum availability, regulatory hurdles, and the need for skilled professionals exist, the overwhelming benefits and transformative potential of 5G are expected to drive sustained growth and innovation within the 5G Network Deployment Service market throughout the forecast period.

This comprehensive report delves into the dynamic and rapidly evolving 5G Network Deployment Service market, offering a detailed analysis of its trajectory from the historical period of 2019-2024 to a projected outlook extending to 2033. With a base year established at 2025, the study provides an in-depth examination of market dynamics, growth drivers, challenges, and key regional and segment-specific trends, all valued in the multi-million dollar unit. The report leverages extensive data and expert insights to paint a clear picture of the opportunities and complexities inherent in rolling out next-generation wireless infrastructure.

The global 5G Network Deployment Service market is experiencing an unprecedented surge, driven by an insatiable demand for faster, more reliable, and lower-latency connectivity. Over the study period of 2019-2033, with a specific focus on the estimated year of 2025 and the forecast period of 2025-2033, the market is witnessing a substantial escalation in investments. The historical period (2019-2024) laid the groundwork, characterized by initial pilot projects and the gradual rollout of non-standalone (NSA) 5G networks. However, the transition towards standalone (SA) 5G, a more robust and feature-rich architecture, is a significant trend that will dominate the coming years. This shift is critical for unlocking the full potential of 5G, enabling advanced use cases such as massive IoT deployments, enhanced mobile broadband (eMBB) for immersive experiences, and ultra-reliable low-latency communication (URLLC) for critical applications like autonomous vehicles and remote surgery.

The service landscape is becoming increasingly sophisticated, moving beyond basic infrastructure installation to encompass a wider range of specialized offerings. Network virtualization and cloud-native architectures are transforming how 5G networks are built and managed, leading to greater flexibility, scalability, and cost-efficiency. This involves the deployment of 5G Mobile Core Network components, along with the crucial Radio Access Network (RAN) build-outs, often incorporating advanced technologies like Open RAN to foster greater vendor diversity and innovation. Furthermore, the proliferation of Small Cell deployments is a crucial trend, especially in dense urban environments and indoor spaces, to augment macro network coverage and capacity. The market is also witnessing a growing emphasis on network slicing, allowing for the creation of dedicated virtual networks tailored to specific application requirements, thereby catering to diverse user segments including Business Broadband Users, Residential Broadband Users, and a broad spectrum of "Others" encompassing industrial IoT and public safety. The market's valuation, running into hundreds of millions of dollars, underscores the immense scale of this technological transformation.

Several powerful forces are converging to propel the 5G Network Deployment Service market into a period of accelerated growth. The relentless evolution of digital technologies and the increasing reliance on data-intensive applications are fundamental drivers. Consumers are demanding higher bandwidth for streaming high-definition content, immersive gaming, and seamless video conferencing, a need that existing 4G networks are struggling to meet. Similarly, businesses are recognizing the transformative potential of 5G for enhancing operational efficiency, enabling new business models, and improving customer experiences. The proliferation of connected devices, ranging from smartphones and wearables to industrial sensors and autonomous systems, is creating an exponential demand for ubiquitous, high-speed connectivity. Governments worldwide are actively supporting 5G deployment through spectrum allocation, regulatory incentives, and national digital transformation initiatives, recognizing its strategic importance for economic competitiveness and innovation. The development of new 5G-enabled applications and services, such as augmented reality (AR), virtual reality (VR), and the Internet of Things (IoT), acts as a powerful pull factor, incentivizing operators and infrastructure providers to invest in the necessary network capabilities. This synergistic interplay of technological advancement, consumer and enterprise demand, and supportive governmental policies is creating a robust ecosystem that is fundamentally reshaping the telecommunications landscape and driving significant multi-million dollar investments into 5G network deployment services.

Despite the immense potential, the 5G Network Deployment Service market is not without its formidable challenges and restraints. The sheer scale and complexity of deploying 5G infrastructure across vast geographical areas require substantial capital investment, often running into hundreds of millions of dollars for individual operators and infrastructure providers. Securing adequate funding and managing the return on investment remain critical concerns. The availability and allocation of suitable spectrum bands are also crucial. Regulatory hurdles, including obtaining permits for tower construction, site acquisition, and fiber backhaul deployment, can lead to significant delays and increased costs. The ongoing evolution of 5G standards and technologies necessitates continuous upgrades and investments, creating a risk of obsolescence if not managed strategically. Furthermore, the intricate integration of new 5G components with existing legacy networks presents technical complexities and requires specialized expertise. Public perception and concerns regarding potential health impacts of radio frequency emissions, though largely unsubstantiated by scientific consensus, can sometimes lead to local opposition and deployment slowdowns. The cybersecurity landscape for 5G networks is also a significant concern, requiring robust security measures to protect against sophisticated threats. The shortage of skilled labor with expertise in 5G technologies and deployment can also act as a bottleneck, impacting project timelines and operational efficiency.

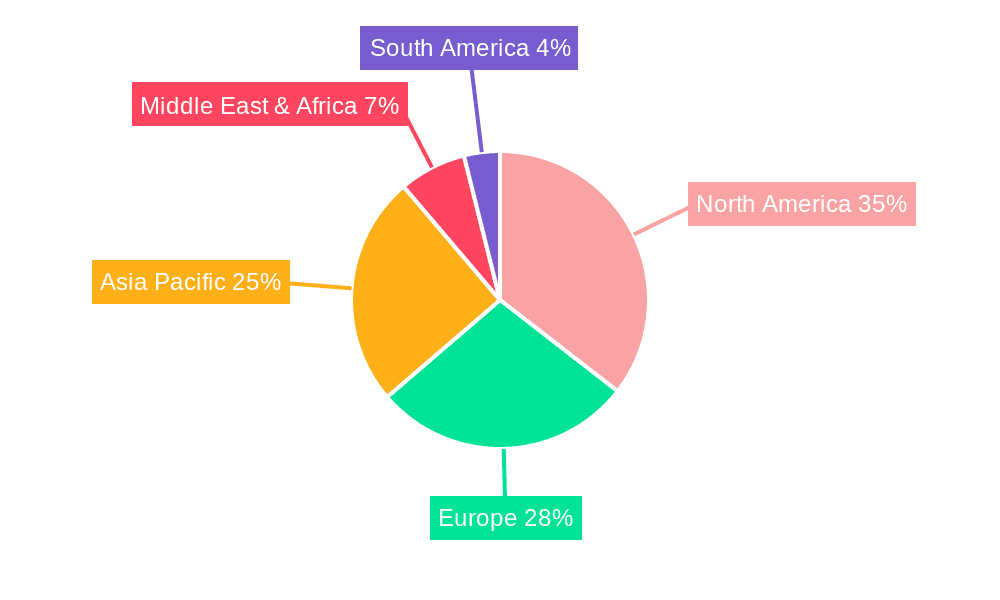

The Radio Access Network (RAN) segment, particularly in North America and Asia-Pacific, is poised to dominate the 5G Network Deployment Service market, driving significant multi-million dollar investments throughout the forecast period (2025-2033).

North America, with its advanced technological infrastructure and strong presence of major telecommunications players like Verizon and AT&T, has been at the forefront of 5G adoption. The region's commitment to innovation, coupled with substantial government backing and a high demand for enhanced mobile broadband and enterprise solutions, makes it a prime market. The deployment of 5G RAN, encompassing base stations, antennas, and small cells, is a critical component of this expansion. The competitive landscape in North America includes companies like American Tower, Crown Castle, and SBA Communications, who are actively involved in tower infrastructure and site acquisition essential for RAN deployment. Verizon and AT&T are themselves major investors and deployers of 5G RAN, driving demand for equipment and services from vendors like Ericsson, Nokia, and Huawei. The push for network densification, especially in urban areas, further amplifies the importance of RAN deployments.

Asia-Pacific, particularly China, South Korea, and Japan, represents another colossal market for 5G RAN deployment. These countries have aggressively pursued 5G as a national priority, driven by a desire to enhance economic competitiveness, foster digital transformation, and support a burgeoning population of tech-savvy consumers. The sheer scale of population density in many of these countries necessitates widespread and rapid deployment of 5G RAN infrastructure. Companies like Huawei, a global leader in telecommunications equipment, play a significant role in this region, alongside Ericsson and Nokia. The demand for advanced RAN solutions, including Massive MIMO and beamforming technologies, is exceptionally high to cater to the massive data traffic generated by these nations. The rapid uptake of 5G for various applications, from enhanced mobile broadband for consumers to industrial IoT and smart city initiatives, further fuels the demand for sophisticated RAN deployments. The investment in these regions is projected to be in the tens, if not hundreds, of millions of dollars annually, underscoring their dominance in the 5G Network Deployment Service market, with RAN serving as the primary battleground for service providers and equipment vendors. The integration of advanced RAN architectures, including Open RAN initiatives, is also gaining traction in these regions, fostering a more diverse and competitive ecosystem.

Several key growth catalysts are accelerating the expansion of the 5G Network Deployment Service industry. The increasing adoption of enterprise-grade 5G applications, such as private networks for industrial automation, logistics, and smart manufacturing, is creating a robust demand for specialized deployment services. The growing need for ultra-reliable low-latency communication (URLLC) for critical services like remote surgery, autonomous vehicles, and public safety applications is a significant driver. Furthermore, the development and commercialization of compelling 5G-enabled consumer experiences, including immersive AR/VR applications, cloud gaming, and advanced video streaming, are compelling users to upgrade and fueling network expansion. The ongoing diversification of network infrastructure with the adoption of Open RAN principles is fostering innovation and cost efficiencies, encouraging further investment.

This report provides an unparalleled and comprehensive analysis of the 5G Network Deployment Service market, offering deep insights across the entire value chain. From the foundational infrastructure development, including the deployment of the Radio Access Network and 5G Mobile Core Network, to the specialized delivery of Small Cells, the report meticulously examines market segmentation by application, catering to Business Broadband Users, Residential Broadband Users, and other emerging sectors. It delves into the crucial industry developments shaping the future of 5G, supported by extensive historical data from 2019-2024 and forward-looking projections up to 2033, with a dedicated focus on the base year of 2025. The report thoroughly investigates the driving forces, challenges, key regional dominance, and vital growth catalysts, providing a robust understanding of the multi-million dollar market landscape. Through meticulous research and detailed analysis, this report equips stakeholders with the knowledge necessary to navigate this transformative technology and capitalize on the immense opportunities within the 5G ecosystem.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.6% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 7.6%.

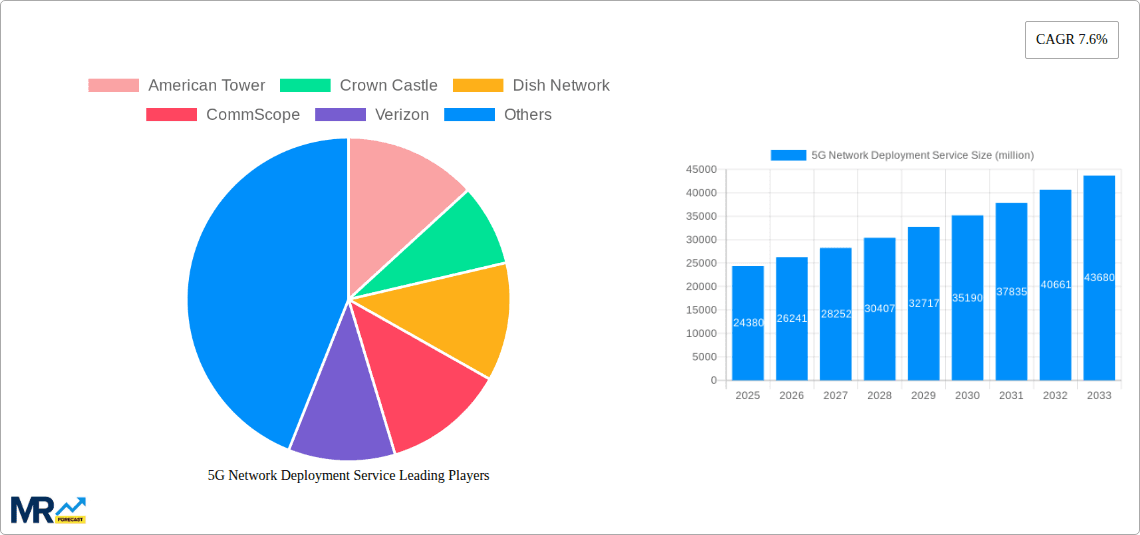

Key companies in the market include American Tower, Crown Castle, Dish Network, CommScope, Verizon, AT&T, Qualcomm Technologies, SBA Communications, Mavenir, Phoenix Tower International LLC, Nokia, Ericsson, Huawei, Viavi Solutions, Celona Inc, .

The market segments include Type, Application.

The market size is estimated to be USD 24380 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "5G Network Deployment Service," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the 5G Network Deployment Service, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.