1. What is the projected Compound Annual Growth Rate (CAGR) of the 5G Base Station Filter?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

5G Base Station Filter

5G Base Station Filter5G Base Station Filter by Type (2.6GHz, 3.5GHz, Other), by Application (Macro Base Station, Small Base Station), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

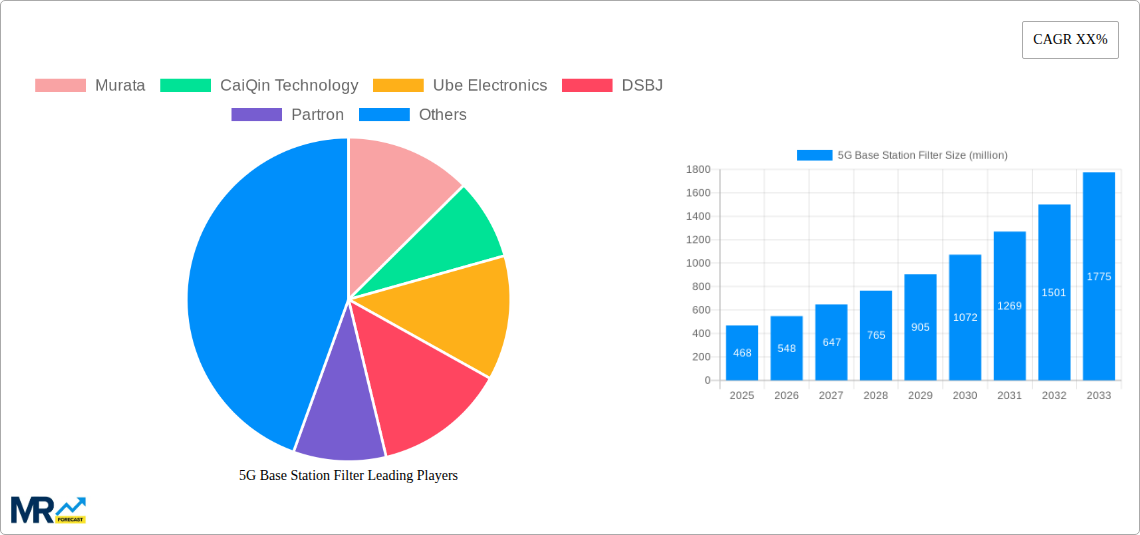

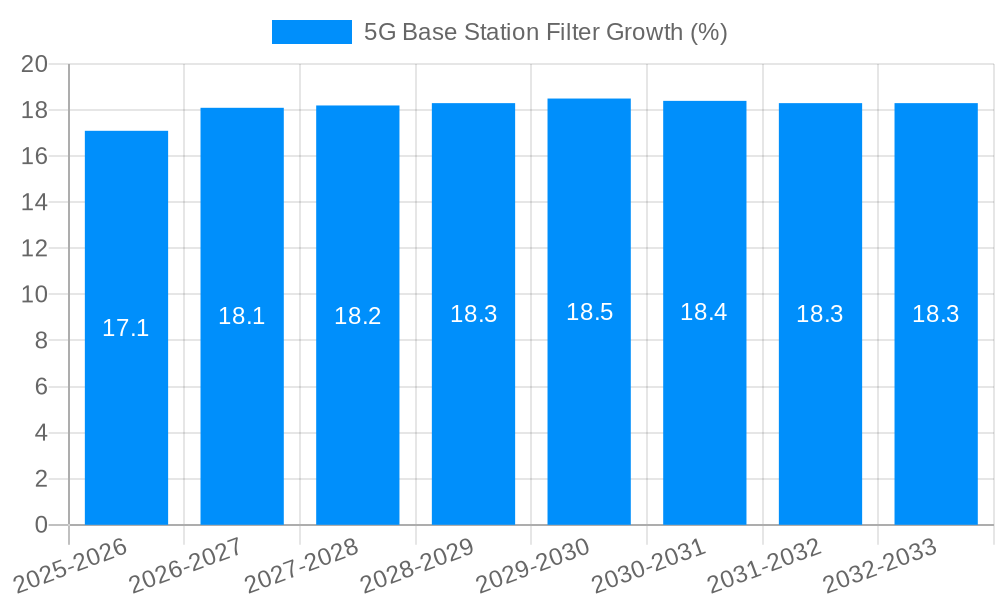

The 5G Base Station Filter market is poised for significant expansion, projected to reach \$468 million in 2025. This robust growth is fueled by the accelerating global rollout of 5G infrastructure, driven by the increasing demand for enhanced mobile broadband, low-latency communication for applications like autonomous driving and immersive gaming, and the massive connectivity requirements of the Internet of Things (IoT). The market's Compound Annual Growth Rate (CAGR) is estimated to be around 15-20%, indicating a healthy and sustained upward trajectory. Key drivers include government investments in 5G networks, technological advancements in filter design for improved performance and miniaturization, and the growing adoption of higher frequency bands like 3.5GHz for greater bandwidth and capacity. These filters are critical components, ensuring signal integrity and minimizing interference in the complex 5G ecosystem, making their role indispensable for the success of the next-generation wireless networks.

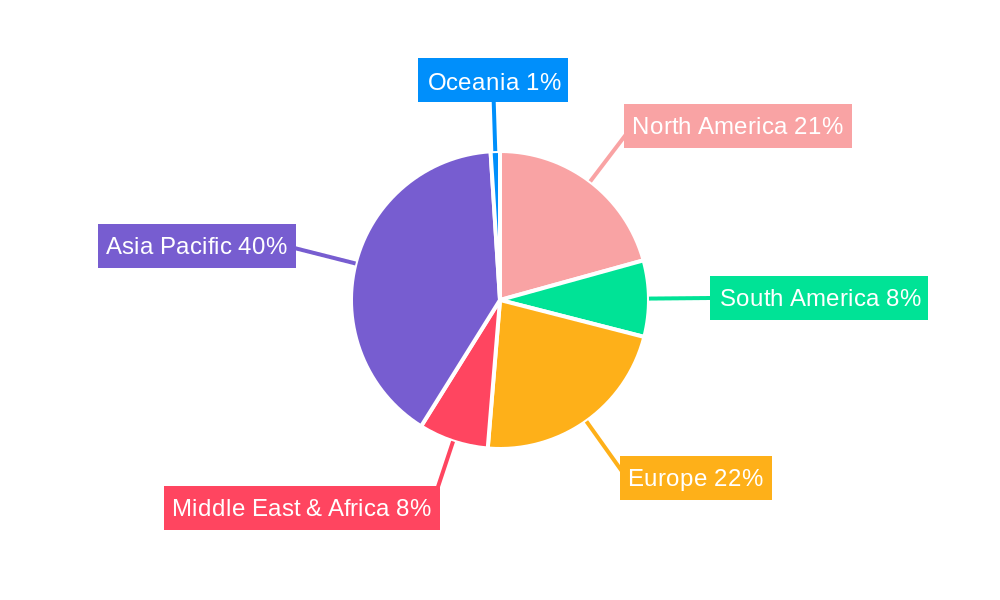

The market segmentation by type highlights the prominence of the 3.5GHz frequency band, reflecting its widespread deployment in initial 5G networks. The "Other" category likely encompasses filters for emerging frequency bands and specialized applications. In terms of application, macro base stations represent the largest segment due to the foundational role they play in network coverage. However, the rapid growth of small base stations, crucial for densifying urban areas and improving indoor coverage, presents a significant growth opportunity. Geographically, Asia Pacific, particularly China, is expected to dominate the market, driven by aggressive 5G deployment plans and a strong manufacturing base. North America and Europe are also substantial markets, with ongoing network upgrades and a growing focus on advanced wireless services. Restrains might include the high cost of advanced filter technologies and potential supply chain disruptions, but the overwhelming demand and strategic importance of 5G are expected to outweigh these challenges, propelling the market forward.

This comprehensive report delves into the intricate world of 5G Base Station Filters, providing an in-depth analysis of market trends, driving forces, challenges, and future growth opportunities. The study encompasses a broad spectrum of frequencies, including critical bands like 2.6GHz and 3.5GHz, alongside other emerging specifications. It meticulously examines the diverse applications, from the expansive reach of Macro Base Stations to the dense deployment of Small Base Stations, and further explores the burgeoning industrial applications. The analysis spans a comprehensive Study Period from 2019 to 2033, with a detailed Base Year of 2025, and an Estimated Year also set for 2025. The Forecast Period extends from 2025 to 2033, building upon crucial insights from the Historical Period of 2019-2024.

The global market for 5G Base Station Filters is on an upward trajectory, fueled by the relentless expansion of 5G network infrastructure worldwide. The demand for higher frequency bands, particularly the 3.5GHz spectrum, is witnessing exponential growth as operators race to deploy enhanced mobile broadband (eMBB) and ultra-reliable low-latency communication (URLLC) services. This surge is directly attributable to the increasing adoption of advanced 5G devices and the subsequent need for robust filtering solutions to mitigate interference and ensure signal integrity. The historical data from 2019-2024 reveals a foundational period where early adopters established their 5G footprints, leading to an initial, albeit smaller, demand for these specialized filters. As we move into the Estimated Year of 2025 and the Forecast Period extending to 2033, the market is poised for significant expansion. The value is expected to cross the $500 million mark by the end of the study period.

Furthermore, the growing deployment of Small Base Stations, designed to enhance network capacity in dense urban areas and indoor environments, is emerging as a significant trend. These smaller, more numerous deployments require a greater volume of filters, albeit often with different form factors and performance characteristics compared to their macro counterparts. The report forecasts that the Small Base Station segment alone will contribute over $200 million to the market revenue by 2030. The "Other" frequency category is also expected to witness substantial growth as research and development unlock new spectrum opportunities for 5G deployment, potentially reaching a market share of $150 million in the latter half of the forecast period. The increasing complexity of 5G signals, with their multi-band and advanced modulation schemes, necessitates sophisticated filter designs. This drive towards higher performance and miniaturization is pushing innovation in filter technologies, including the adoption of advanced materials and manufacturing techniques. The market is projected to exceed $1 billion in value by 2033, showcasing a CAGR exceeding 15% during the forecast period.

The relentless global push towards 5G network expansion stands as the paramount driving force behind the burgeoning 5G Base Station Filter market. Governments worldwide are actively promoting 5G deployment through spectrum auctions and regulatory support, creating a fertile ground for infrastructure development. This is directly translating into a substantial demand for base station components, with filters being a critical element for ensuring optimal network performance. The increasing adoption of mobile devices capable of supporting 5G services, from smartphones to IoT devices, further amplifies this demand as operators strive to meet consumer expectations for higher speeds and lower latency. The sheer volume of base stations required, especially with the densification of networks through Small Base Stations, necessitates a continuous supply of these essential components, driving market growth.

Moreover, the growing emphasis on enhanced mobile broadband (eMBB) and the burgeoning use cases for ultra-reliable low-latency communication (URLLC) in sectors like autonomous driving, remote surgery, and industrial automation are compelling operators to invest heavily in advanced 5G infrastructure. This investment includes upgrading existing base stations and deploying new ones, all of which require high-performance filters. The need to support multiple frequency bands simultaneously within a single base station further accentuates the importance of sophisticated filtering solutions. The historical trend of increasing data consumption per user is also a significant catalyst, as 5G promises to unlock unprecedented data-intensive applications, requiring a more robust and efficient network backbone. The market value is projected to surge past $700 million by 2028, reflecting this sustained demand.

Despite the robust growth, the 5G Base Station Filter market is not without its challenges. The increasingly complex design requirements for filters that can operate across multiple, often adjacent, frequency bands while maintaining excellent insertion loss and rejection is a significant technical hurdle. This complexity translates into higher manufacturing costs and extended development cycles. The rapid evolution of 5G standards and the introduction of new frequency bands can lead to a risk of technological obsolescence, forcing manufacturers to continually invest in research and development to stay ahead of the curve. The need for miniaturization to accommodate the compact form factors of Small Base Stations adds another layer of difficulty, requiring advanced materials and fabrication techniques.

Furthermore, the global supply chain for critical raw materials used in filter production can be subject to geopolitical risks and price volatility, impacting manufacturing costs and production timelines. Intense competition among a growing number of players, including both established component manufacturers and new entrants, can lead to price pressures, potentially eroding profit margins. The stringent quality control and certification processes required for telecommunications equipment also add to the cost and complexity of bringing products to market. While the market is expected to reach $1 billion by 2033, these challenges could temper the pace of growth in certain segments. The investment required for cutting-edge R&D and manufacturing facilities can also be a restraint for smaller players seeking to compete in this demanding environment.

The Asia-Pacific region is poised to be a dominant force in the 5G Base Station Filter market, driven by significant investments in 5G infrastructure by leading nations like China, South Korea, and Japan. China, in particular, has been at the forefront of 5G deployment, with its telecommunications operators rapidly expanding their network coverage across the country. This has created an immense demand for base station components, including filters, making China a cornerstone of the market. South Korea, renowned for its early adoption of advanced technologies, continues to push the boundaries of 5G capabilities, further fueling demand for sophisticated filtering solutions. Japan's commitment to developing a robust 5G ecosystem, especially for enterprise and industrial applications, also contributes significantly to the region's market dominance.

Within this dominant region, the Macro Base Station segment is expected to hold the largest market share due to the foundational nature of these deployments in establishing initial 5G coverage. Macro base stations are essential for providing wide-area network coverage and are a critical component of any 5G rollout strategy. The report estimates that Macro Base Stations will account for over $600 million of the global market revenue by 2030. However, the Small Base Station segment is projected to witness the fastest growth rate. As operators focus on densifying their networks to improve capacity and user experience in urban hotspots and indoor environments, the demand for compact and efficient small base station filters will skyrocket. This segment is projected to grow at a CAGR exceeding 20% during the forecast period. The 3.5GHz frequency band is also expected to be a key segment, as it offers a good balance between capacity and coverage, making it a primary focus for many 5G deployments worldwide. This band's versatility for both eMBB and URLLC applications will drive significant demand for filters designed for this spectrum. The combined value of Macro Base Stations and the 3.5GHz band within the Asia-Pacific region alone is estimated to surpass $800 million by 2032.

Several key factors are acting as significant growth catalysts for the 5G Base Station Filter industry. The accelerating pace of 5G network deployments globally, driven by government initiatives and increasing consumer demand for faster connectivity, is a primary catalyst. The continuous innovation in filter technologies, leading to improved performance, miniaturization, and cost-effectiveness, is enabling wider adoption. The expanding range of 5G applications beyond mobile broadband, including industrial IoT, smart cities, and autonomous vehicles, is creating new avenues for demand. The ongoing efforts to explore and utilize new spectrum bands for 5G, such as millimeter-wave frequencies, are also spurring the development and adoption of specialized filters.

This report offers an unparalleled depth of insight into the 5G Base Station Filter market. It meticulously details the historical performance and projected future trajectory, providing critical market size estimations in the millions of dollars. The analysis extends to understanding the nuanced interplay between various filter types (2.6GHz, 3.5GHz, Other) and their adoption across different base station architectures (Macro, Small). The report examines the strategic landscape, identifying key players and their market shares, while also scrutinizing the technological advancements and industry developments that are shaping the future. Furthermore, it provides an exhaustive breakdown of the driving forces, challenges, and growth catalysts that influence market dynamics, equipping stakeholders with the knowledge to navigate this complex and rapidly evolving sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Murata, CaiQin Technology, Ube Electronics, DSBJ, Partron, Tongyu Communication, Fenghua Advanced Technology, Taoglas, Wuhan Fingu Electronic, Tatfook, BDStar, MCV Technologies.

The market segments include Type, Application.

The market size is estimated to be USD 468 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "5G Base Station Filter," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the 5G Base Station Filter, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.