1. What is the projected Compound Annual Growth Rate (CAGR) of the 5G Base Station?

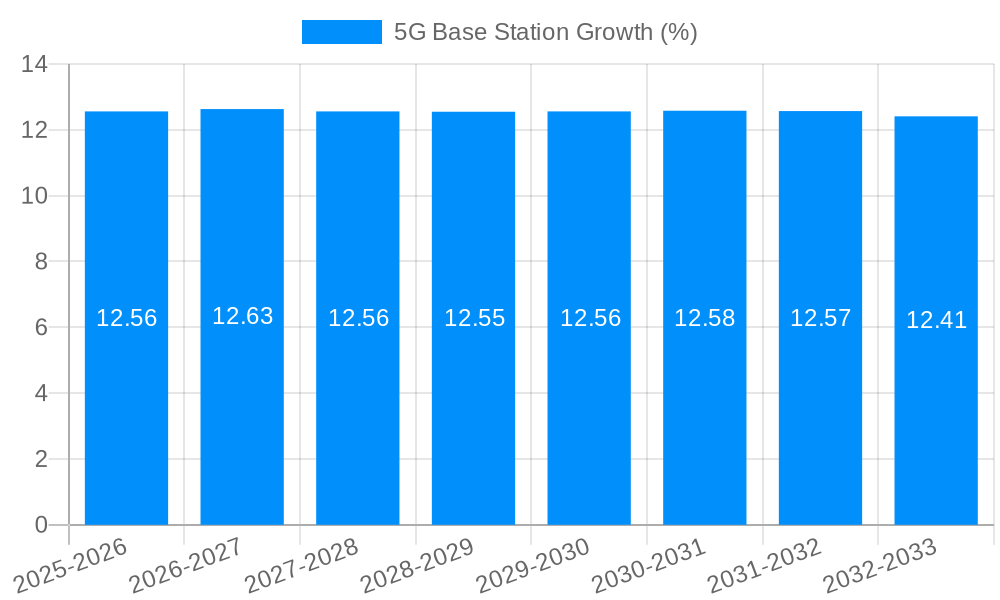

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

5G Base Station

5G Base Station5G Base Station by Type (5G Macro Base Station, 5G Small Base Station, World 5G Base Station Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

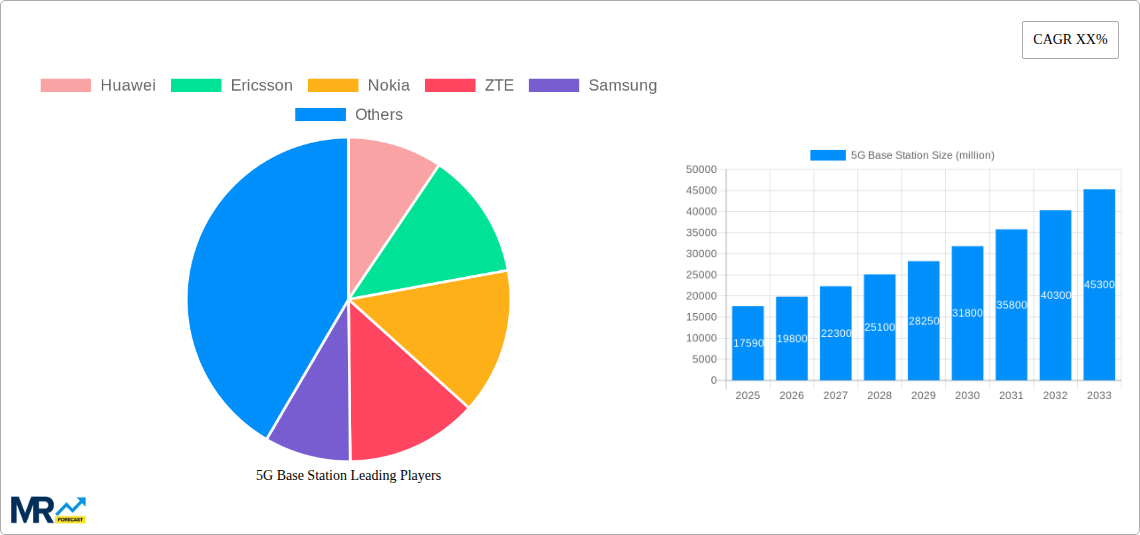

The global 5G Base Station market is poised for substantial expansion, projected to reach a market size of $17,590 million. This growth is fueled by the relentless global push for enhanced connectivity, the increasing demand for high-speed mobile data, and the critical role of 5G in enabling advanced applications like the Internet of Things (IoT), autonomous vehicles, and smart city infrastructure. The ongoing rollout of 5G networks worldwide necessitates a continuous expansion and upgrade of base station infrastructure. Key drivers include government initiatives promoting digital transformation, significant investments from telecommunication operators, and the burgeoning adoption of 5G-enabled devices by consumers and enterprises. Furthermore, the development of new use cases that leverage 5G's low latency and high bandwidth, such as enhanced mobile broadband (eMBB), ultra-reliable low-latency communication (URLLC), and massive machine-type communication (mMTC), will further accelerate market penetration. The market is segmented into 5G Macro Base Stations and 5G Small Base Stations, with both playing crucial roles in providing comprehensive network coverage.

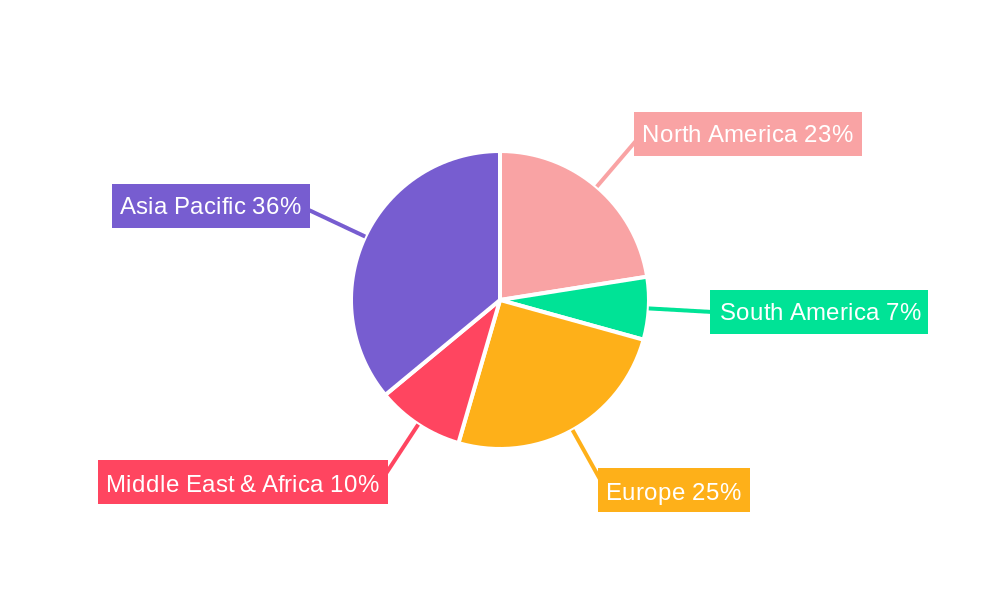

While the market exhibits robust growth, certain restraints could influence its trajectory. These may include the high cost of 5G infrastructure deployment, spectrum availability and allocation challenges in certain regions, and the need for robust cybersecurity measures to protect the increasingly complex network architecture. However, these challenges are being actively addressed through technological advancements and strategic partnerships. The competitive landscape is dominated by major players such as Huawei, Ericsson, Nokia, and ZTE, who are at the forefront of innovation in 5G base station technology. Emerging players are also contributing to the dynamic market environment. The Asia Pacific region, particularly China, is expected to lead in terms of both production and adoption due to significant government investment and rapid network deployment. North America and Europe are also key markets with substantial ongoing 5G build-outs. The forecast period anticipates sustained growth, driven by the increasing ubiquity of 5G technology and its transformative impact across various industries.

This comprehensive report provides an in-depth analysis of the global 5G Base Station market, offering critical insights and forecasts from 2019-2033, with a Base Year and Estimated Year of 2025. The Study Period encompasses both historical trends and future projections, making it an indispensable resource for stakeholders.

The global 5G Base Station market is poised for substantial growth, driven by an insatiable demand for enhanced mobile broadband, ultra-reliable low-latency communication, and massive machine-type communication. Over the Study Period of 2019-2033, the market is expected to witness a significant transformation, evolving from its nascent stages to a mature and indispensable component of global digital infrastructure. By 2025, we estimate the market to be valued in the hundreds of millions of US dollars, with projections indicating a continued upward trajectory. Key trends include the increasing adoption of Massive MIMO (Multiple-Input Multiple-Output) technology, which significantly boosts spectral efficiency and capacity, allowing for higher data throughput and a more robust user experience. The proliferation of cloud-native architectures and Open RAN (Radio Access Network) initiatives is another major trend, fostering greater flexibility, vendor diversity, and cost optimization in 5G network deployments. Furthermore, the integration of artificial intelligence (AI) and machine learning (ML) into base station operations is becoming paramount, enabling intelligent network management, predictive maintenance, and dynamic resource allocation, thereby optimizing performance and reducing operational expenses. The report highlights the growing importance of energy efficiency in base station design and operation, as the sheer density of 5G infrastructure necessitates sustainable solutions. This trend is driven by both environmental concerns and the escalating operational costs associated with powering a vast network of base stations. The market is also observing a diversification in deployment strategies, moving beyond traditional macro cells to encompass a dense network of small cells, particularly in urban environments, to ensure ubiquitous coverage and capacity. The anticipated market size by the end of the Forecast Period (2025-2033) is expected to reach multi-billion dollar valuations, underscoring the critical role 5G base stations will play in enabling a connected future. The increasing investment in private 5G networks by enterprises across various sectors, including manufacturing, logistics, and healthcare, is also a significant trend, further expanding the market scope beyond traditional telecommunications. The report delves into the nuanced evolution of these trends, providing granular data and expert analysis to guide strategic decision-making within the dynamic 5G ecosystem.

The explosive growth of the 5G Base Station market is underpinned by a confluence of powerful driving forces, fundamentally reshaping how we communicate and interact with the digital world. The primary catalyst is the ever-increasing demand for higher data speeds and lower latency, essential for supporting a new generation of applications. These include immersive augmented reality (AR) and virtual reality (VR) experiences, real-time gaming, autonomous driving systems, and advanced industrial automation. The expansion of the Internet of Things (IoT) ecosystem, with billions of connected devices generating vast amounts of data, necessitates the robust capacity and connectivity that 5G base stations provide. Furthermore, governments worldwide are recognizing 5G as a critical national infrastructure for economic competitiveness and digital transformation, leading to substantial investments and supportive policies that accelerate deployment. The ongoing digital transformation across various industries, from smart manufacturing and precision agriculture to telemedicine and smart cities, relies heavily on the reliable and high-performance connectivity offered by 5G networks, thus creating a sustained demand for base station infrastructure. The competitive landscape among mobile network operators (MNOs) also plays a pivotal role, as they strive to be at the forefront of 5G deployment to attract and retain subscribers, leading to aggressive expansion plans. The report meticulously details how these interconnected forces are creating a fertile ground for the 5G Base Station market to flourish throughout the Study Period.

Despite the immense growth potential, the 5G Base Station market faces several significant challenges and restraints that can temper its pace and trajectory. The high cost of infrastructure deployment, including the acquisition of spectrum licenses and the installation of new base stations and fiber optic backhaul, remains a substantial barrier, particularly for smaller operators and in less developed regions. Regulatory hurdles and the complex process of obtaining permits for site acquisition and deployment can also lead to significant delays. Security concerns surrounding the potential vulnerabilities of new 5G networks and the vast attack surface created by a multitude of connected devices are also a major area of focus and investment, adding to the overall cost and complexity. The shortage of skilled labor required for the installation, maintenance, and management of these advanced networks is another critical restraint. Furthermore, public perception and concerns regarding the health effects of radiofrequency (RF) emissions, though largely unsubstantiated by scientific consensus, can lead to local opposition and further complicate deployment efforts. The ongoing geopolitical tensions and supply chain disruptions can also impact the availability and cost of essential components, posing a risk to timely deployment. The report critically examines how these factors influence market dynamics and offers strategies for mitigation.

The global 5G Base Station market is characterized by regional disparities and segment preferences, with certain areas and types of base stations poised to lead the charge in adoption and deployment.

Asia-Pacific: This region, particularly China, has been an early and aggressive adopter of 5G technology, driven by strong government support, a massive population, and a highly developed manufacturing ecosystem. China's ambitious 5G rollout plans, aiming for widespread coverage and innovative applications, position it as the undisputed leader in 5G base station deployment. The country's leading telecommunications equipment manufacturers, such as Huawei and ZTE, have been instrumental in driving this growth. Beyond China, countries like South Korea and Japan are also making significant strides in 5G deployment, fueled by intense competition among operators and a strong consumer appetite for advanced mobile services. The ongoing investment in smart city initiatives and industrial 4.0 projects across the Asia-Pacific further solidifies its dominance.

North America: The United States and Canada are also key markets for 5G base stations, with operators actively deploying both macro and small cell solutions to enhance network capacity and coverage in urban and suburban areas. The focus here is on delivering enhanced mobile broadband to consumers and enabling enterprise 5G solutions for industries such as manufacturing, logistics, and healthcare. Regulatory environments and spectrum availability play crucial roles in shaping deployment strategies.

Europe: European nations are steadily advancing their 5G deployments, with a strong emphasis on using 5G to drive digital transformation across various sectors, including automotive, manufacturing, and healthcare. The European Union's digital agenda and member states' national 5G strategies are providing a framework for investment and deployment. While individual country progress varies, the collective effort is contributing to the region's significant market share.

Dominant Segments:

5G Macro Base Station: This remains the backbone of initial 5G deployments, providing broad coverage over large geographical areas. Macro base stations are crucial for establishing the foundational network infrastructure, especially in suburban and rural environments, and for providing wide-area mobile broadband. Their deployment is often the first step in expanding 5G services, and their market size is substantial due to the sheer number of cells required to cover vast territories. The increasing need for capacity in densely populated areas and for supporting mobile broadband services ensures the continued dominance of this segment.

5G Small Base Station: While macro base stations provide reach, small base stations are becoming increasingly vital for delivering high capacity and ultra-low latency in dense urban areas, indoor environments (like shopping malls and stadiums), and enterprise campuses. The "World 5G Base Station Production" as a concept reflects the global scale of manufacturing for both macro and small cells, but the growth in small cell deployments is accelerating rapidly as networks become denser and more specialized to meet the diverse demands of 5G applications. The proliferation of IoT devices and the need for localized, high-bandwidth connectivity are key drivers for the growth of this segment. The report provides detailed market share analysis for these segments by region, offering a granular view of the market landscape.

The 5G Base Station industry is experiencing significant growth due to several key catalysts. The relentless demand for enhanced mobile broadband (eMBB) services, enabling faster download speeds and seamless streaming, is a primary driver. The burgeoning Internet of Things (IoT) ecosystem, requiring robust connectivity for billions of devices, further fuels the need for expanded 5G infrastructure. Government initiatives and national digital transformation strategies globally are providing significant impetus and investment in 5G deployments, recognizing it as critical infrastructure. The increasing adoption of private 5G networks by enterprises for enhanced operational efficiency and new application development is also creating a substantial growth avenue.

This report offers a holistic view of the 5G Base Station market, covering crucial aspects from historical trends to future projections. It meticulously analyzes market dynamics, including drivers, restraints, and opportunities, providing a 360-degree perspective for stakeholders. The report details regional market landscapes, competitive strategies of leading players, and significant technological advancements. With data extending from 2019-2033, including a Base Year of 2025, it delivers robust forecasts and actionable insights, enabling informed strategic decision-making in this rapidly evolving sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Huawei, Ericsson, Nokia, ZTE, Samsung, Comba Telecom, Certusnet Corporation, CICT Mobile Communication, H3C, Ruijie Networks.

The market segments include Type.

The market size is estimated to be USD 17590 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "5G Base Station," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the 5G Base Station, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.