1. What is the projected Compound Annual Growth Rate (CAGR) of the 409A Valuations Providers Service?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

409A Valuations Providers Service

409A Valuations Providers Service409A Valuations Providers Service by Type (Cloud-Based, Web-Based), by Application (Large Enterprises, SMEs), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

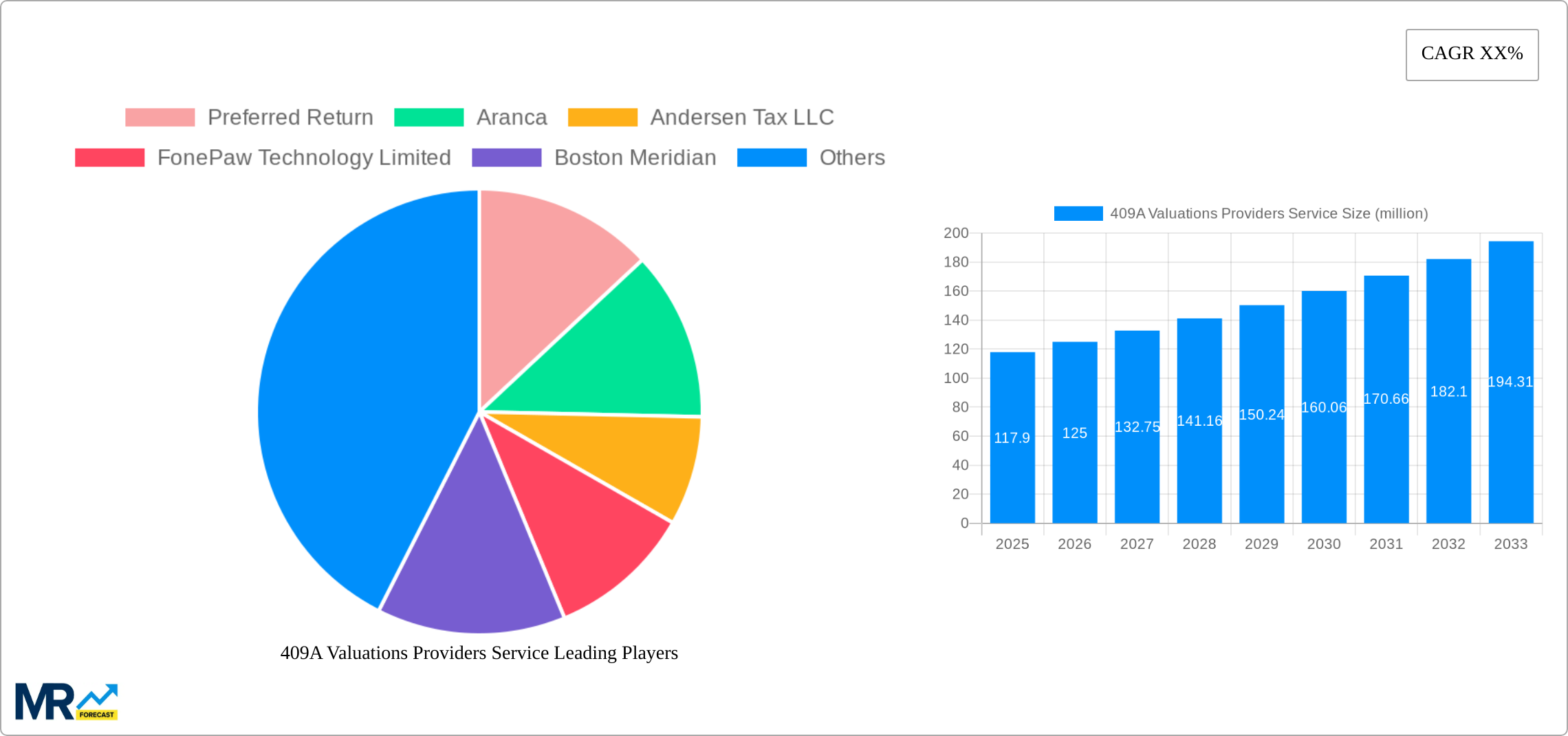

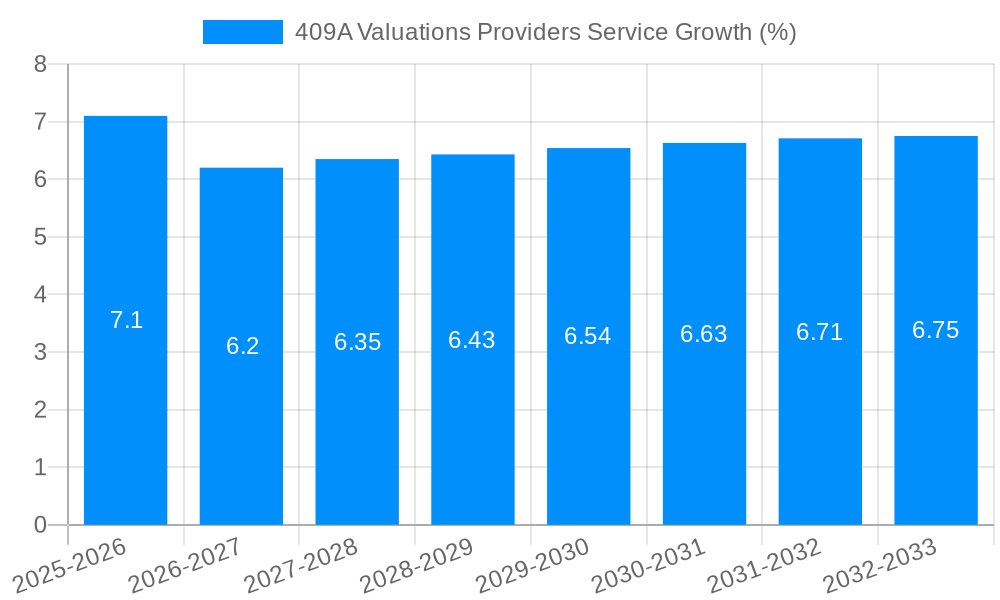

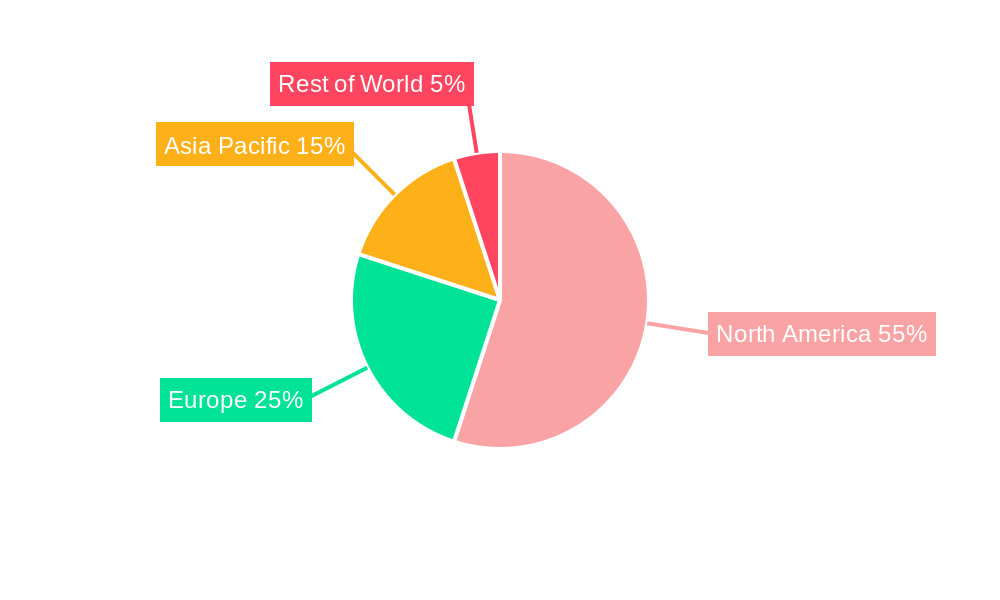

The 409A Valuations Providers Service market, valued at $117.9 million in 2025, is experiencing robust growth driven by increasing regulatory scrutiny of employee stock options and the rising need for accurate valuations among private companies. The market's expansion is fueled by a surge in venture capital funding and private equity investments, leading to a higher volume of privately held companies requiring 409A valuations for tax compliance and financial reporting. The cloud-based segment holds a significant market share, benefiting from its scalability, accessibility, and cost-effectiveness. Large enterprises contribute substantially to the overall market revenue, while the SME segment exhibits promising growth potential driven by increasing awareness and adoption of professional valuation services. Geographical distribution shows a concentration in North America, particularly the United States, due to the region's highly developed financial markets and large number of startups and privately held businesses. However, Europe and Asia-Pacific regions are also experiencing notable growth, indicating an expanding global demand for 409A valuation services. Competitive dynamics involve a mix of established firms and emerging players, with a focus on providing specialized services, advanced technology integration, and superior customer support to retain a competitive edge.

Continued growth in the 409A Valuations Providers Service market is projected through 2033, driven by factors such as increasing complexity of valuation methodologies, the rise of new technological solutions that improve efficiency and accuracy, and a greater regulatory focus on ensuring compliance. While the market is fragmented, consolidation is likely as larger firms acquire smaller players to expand their service offerings and geographical reach. The increasing adoption of AI and machine learning within valuation processes is a significant trend impacting the market, leading to enhanced efficiency, cost reduction, and more precise valuations. However, challenges such as varying regulatory standards across jurisdictions and the need for skilled professionals could hinder market growth to a certain extent. Future expansion is likely to be influenced by technological innovations, regulatory changes, and evolving business models within the valuation service sector.

The 409A valuations providers service market, valued at $XXX million in 2025, is experiencing robust growth, projected to reach $XXX million by 2033, exhibiting a CAGR of XX% during the forecast period (2025-2033). This expansion is fueled by several key factors. The increasing number of privately held companies, particularly in the technology sector, necessitates frequent and accurate 409A valuations for various purposes, including employee stock option pricing, fundraising, and mergers and acquisitions. Furthermore, regulatory scrutiny and the complexities surrounding 409A compliance are driving demand for specialized professional services. The market is witnessing a shift towards cloud-based and web-based solutions, offering enhanced accessibility, scalability, and cost-effectiveness for businesses of all sizes. This trend is further amplified by the growing adoption of sophisticated valuation methodologies and the integration of advanced analytical tools within these platforms. The historical period (2019-2024) showed a steady increase in demand, setting the stage for the significant expansion expected in the coming years. Competition is intensifying, with established players and new entrants vying for market share through strategic partnerships, technological innovation, and the expansion of service offerings. The market is also witnessing a significant focus on enhancing the accuracy and efficiency of valuation processes, leveraging data analytics and machine learning to minimize errors and improve turnaround times. This focus on streamlining workflows and leveraging technology is crucial in managing the increasingly complex regulatory landscape.

Several key factors are propelling the growth of the 409A valuations providers service market. The rise of venture capital funding and private equity investments in startups and technology companies has led to a surge in demand for accurate 409A valuations to determine the fair market value of equity for various transactions. Furthermore, increasing regulatory scrutiny and a heightened awareness of compliance requirements are pressuring companies to engage professional services to ensure accurate and defensible valuations. The complexity inherent in 409A valuations, which necessitates a deep understanding of financial modeling, tax regulations, and industry-specific benchmarks, is also a significant driver of market growth. The expanding use of sophisticated valuation models and analytical tools, along with the adoption of cloud-based solutions which offer enhanced efficiency and cost-effectiveness, are further boosting demand. Finally, the trend of increasing employee stock option plans as a significant component of compensation packages necessitates the consistent and accurate assessment of equity value. This combined effect creates a strong and growing need for specialized expertise in the 409A valuation space.

Despite the significant growth potential, several challenges and restraints could hinder the market's expansion. The inherent complexity and subjectivity involved in 409A valuations can lead to discrepancies and disputes between companies and valuation providers. Maintaining the accuracy and defensibility of valuations in the face of constantly evolving market conditions and regulatory changes also poses a significant challenge. The competitive landscape, with numerous firms offering similar services, necessitates continuous innovation and differentiation to maintain market share. Cost considerations can also limit the adoption of professional valuation services for smaller companies with limited budgets. The need for specialized expertise and the ongoing requirement for professionals to stay abreast of changes in regulations, methodologies, and market trends represent a continuous operational challenge for both providers and clients. Finally, the potential for legal and regulatory challenges associated with inaccurate or improperly conducted valuations introduces a significant risk factor for all parties involved.

The Large Enterprises segment is projected to dominate the 409A valuations providers service market during the forecast period.

High Valuation Needs: Large enterprises, particularly those in high-growth sectors like technology and finance, frequently undertake complex transactions requiring accurate and robust 409A valuations. These transactions include funding rounds, mergers and acquisitions, and employee stock option plans on a much larger scale than SMEs.

Internal Resources & Expertise: While some large enterprises may have internal financial teams capable of performing aspects of 409A valuation, the complexity and the regulatory requirements often lead them to seek external expertise to ensure compliance and accuracy. The risk of miscalculation is significantly higher for a large enterprise and the financial consequences of an error are much more substantial.

Strategic Importance: 409A valuations are strategically crucial for large enterprises, informing their investment decisions, employee compensation strategies, and overall financial planning. The accuracy of these valuations directly impacts their financial reporting, investor relations, and overall operational efficiency.

Geographic Focus: North America (particularly the United States) is expected to remain a dominant region, driven by its large number of publicly traded and privately held companies, stringent regulatory environment, and the prevalence of venture capital and private equity activity. However, growth is expected in other regions as well, particularly in Europe and Asia-Pacific, due to the increasing number of startups and growing adoption of employee stock option plans.

In summary, the combination of a high volume of complex transactions, the need for regulatory compliance, and the significant strategic implications of accurate valuation make the Large Enterprises segment the primary driver of growth in the 409A valuations providers service market.

Several factors are acting as growth catalysts for this industry. The increasing adoption of cloud-based solutions simplifies access and enhances efficiency. Furthermore, the development of sophisticated analytical tools and AI-powered platforms improves the speed and accuracy of valuations. The increasing prevalence of employee stock option plans across various industries drives consistent demand. Finally, stricter regulatory compliance requirements mandate professional valuations, ensuring accuracy and defensibility.

This report provides a comprehensive analysis of the 409A valuations providers service market, covering market size, trends, drivers, challenges, key players, and future projections. It offers valuable insights for stakeholders, including valuation providers, businesses seeking valuation services, investors, and regulatory bodies. The data-driven analysis presented, encompassing historical and forecast data, allows for informed decision-making and strategic planning within the dynamic landscape of 409A valuations.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Preferred Return, Aranca, Andersen Tax LLC, FonePaw Technology Limited, Boston Meridian, Cabrillo Advisors, Capital Clarity, Capshare, Concept Analytics LLC, Economics Partners, Long-Term Stock Exchange, Frank, Rimerman + Co., IPOhub, Kruze Consulting, Meld Valuation, Mirus Capital Advisors, Scalar Decisions Inc., Tower59 LLC, Teknos Associates, Windeye Partners, .

The market segments include Type, Application.

The market size is estimated to be USD 117.9 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "409A Valuations Providers Service," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the 409A Valuations Providers Service, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.