1. What is the projected Compound Annual Growth Rate (CAGR) of the Zinc Cladding Wall and Facade Systems?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Zinc Cladding Wall and Facade Systems

Zinc Cladding Wall and Facade SystemsZinc Cladding Wall and Facade Systems by Application (Commercial Use, Residential), by Type (Up to 1.5 mm, 1.5 mm to 3 mm, 3 mm to 5 mm, Above 5 mm), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

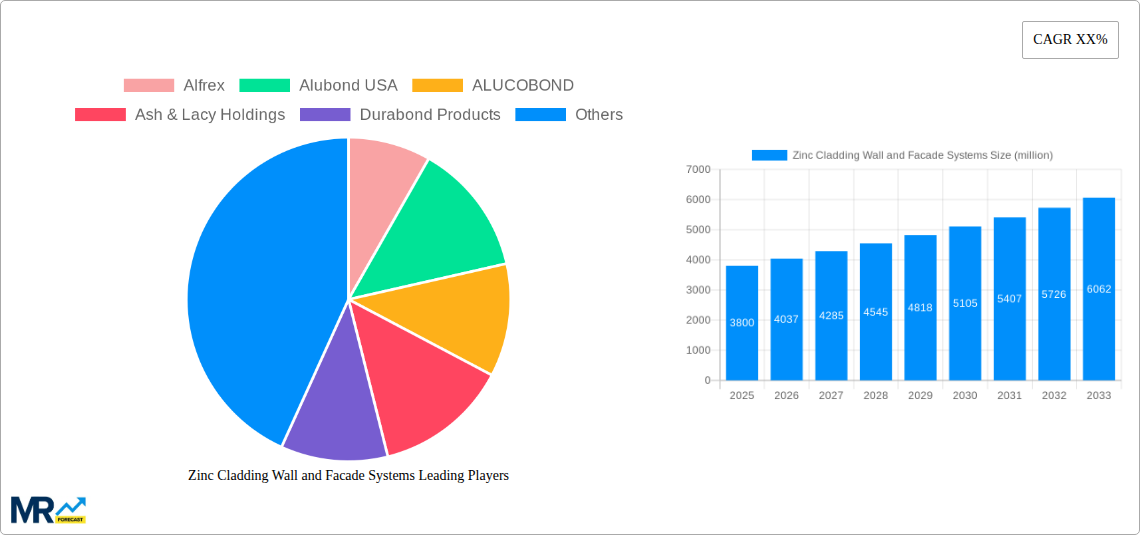

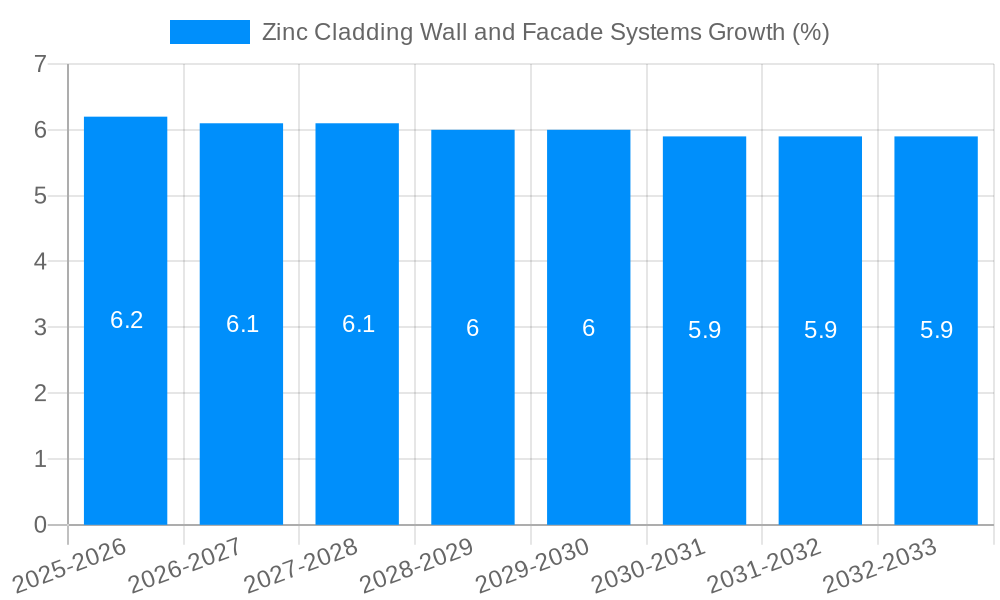

The global Zinc Cladding Wall and Facade Systems market is poised for significant expansion, with an estimated market size of approximately USD 3.8 billion in 2025. This growth is propelled by a robust Compound Annual Growth Rate (CAGR) of around 6.2% projected through 2033. The escalating demand for durable, aesthetically pleasing, and low-maintenance building materials is a primary driver. Zinc's inherent properties, such as its natural patina, corrosion resistance, and recyclability, align perfectly with the increasing emphasis on sustainable construction practices and long-term asset value. The residential sector is showing strong adoption, driven by homeowners seeking premium and visually appealing exteriors. Simultaneously, the commercial segment continues to be a major contributor, with architects and developers increasingly specifying zinc for its modern look and longevity in high-rise buildings, corporate offices, and public institutions. The market is experiencing a notable trend towards thinner zinc panels, particularly those ranging from 1.5 mm to 3 mm, due to their cost-effectiveness and ease of installation without compromising structural integrity or aesthetic appeal. This segment is expected to witness the fastest growth.

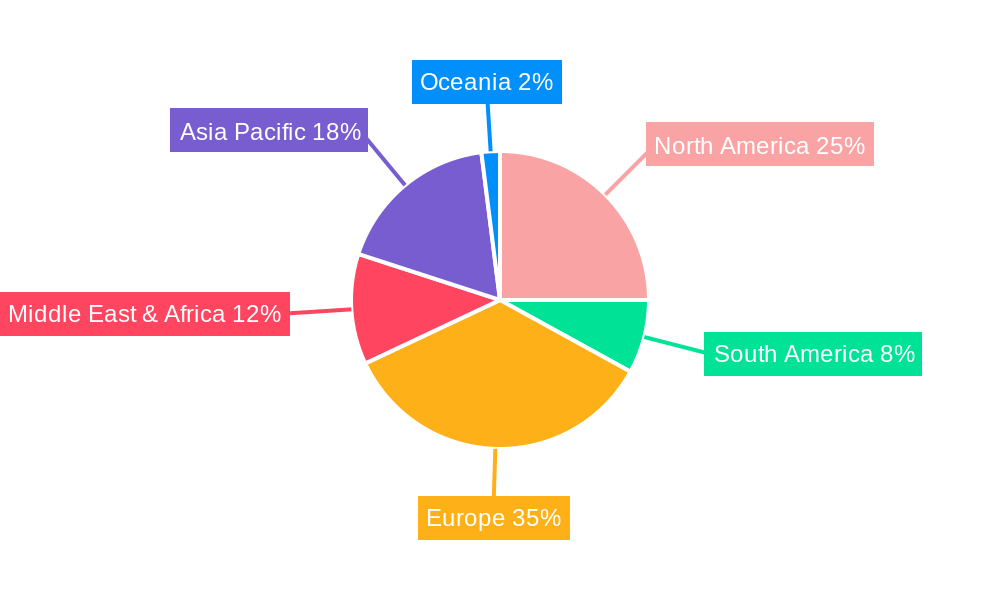

Further analysis reveals that the market's expansion is also influenced by the growing awareness of zinc's life cycle cost advantages, as it requires minimal upkeep over decades. However, the initial investment cost compared to some conventional materials can act as a restraint, particularly in cost-sensitive projects. Despite this, the long-term benefits of durability and reduced maintenance are increasingly outweighing this concern. Geographically, Europe, with its established architectural heritage and strong focus on sustainable building, is likely to maintain a dominant market share. Asia Pacific is emerging as a rapidly growing region, fueled by rapid urbanization, infrastructure development, and a burgeoning construction industry in countries like China and India. North America also presents substantial opportunities, with a steady demand for premium cladding solutions in both residential and commercial projects. The competitive landscape features a mix of established players and emerging manufacturers, all striving to innovate and cater to the evolving design and performance requirements of the global construction industry.

Here is a comprehensive report description on Zinc Cladding Wall and Facade Systems, incorporating your specified elements:

The global zinc cladding wall and facade systems market is poised for significant expansion, driven by an increasing demand for sustainable, durable, and aesthetically versatile building materials. During the historical period of 2019-2024, the market demonstrated steady growth, with the base year of 2025 serving as a pivotal point for projected accelerations. The study period, encompassing 2019-2033, forecasts a robust CAGR, indicating a market value that could reach well into the tens of millions by the end of the forecast period. Key market insights reveal a pronounced shift towards modern architectural designs that leverage the unique properties of zinc, such as its natural patina formation, which offers a distinctive and evolving aesthetic appeal. This trend is particularly evident in urban regeneration projects and the construction of high-end residential and commercial buildings.

The increasing awareness and stringent regulations surrounding building energy efficiency and environmental impact are also contributing significantly to the adoption of zinc cladding. Its inherent recyclability and longevity align perfectly with green building initiatives. Furthermore, advancements in manufacturing technologies have led to the development of thinner yet stronger zinc panels, catering to a wider spectrum of design requirements and cost considerations. The market is witnessing a growing preference for zinc facade systems that offer superior weather resistance, low maintenance, and fire retardancy, making them a compelling choice for architects and developers seeking long-term value and performance. The "up to 1.5 mm" and "1.5 mm to 3 mm" thickness segments are expected to lead in volume due to their cost-effectiveness and ease of installation in many applications, while thicker panels will continue to be favored for applications demanding exceptional structural integrity and impact resistance. The overall market trajectory suggests a highly dynamic landscape where innovation in material science and design application will continue to shape the future of zinc cladding.

The escalating demand for sustainable and eco-friendly building materials stands as a primary driver for the zinc cladding wall and facade systems market. Zinc is a naturally occurring element with a high recycling rate, contributing to a reduced environmental footprint throughout its lifecycle. This resonates strongly with global efforts to promote green building practices and reduce carbon emissions in the construction sector. Furthermore, the inherent durability and longevity of zinc cladding are significant selling points. Unlike many other facade materials, zinc weathers gracefully, developing a protective patina that enhances its resistance to corrosion and extends its service life considerably. This translates to lower maintenance costs and a reduced need for frequent replacements, offering a compelling long-term economic advantage for building owners.

Architectural innovation also plays a crucial role. The malleable nature of zinc allows architects and designers to achieve complex curves, intricate patterns, and a variety of finishes, enabling the creation of visually striking and distinctive building envelopes. This design flexibility is particularly valuable in the commercial and high-end residential segments, where unique aesthetics are highly sought after. The increasing trend towards modern and minimalist architectural styles further favors the use of zinc due to its clean lines and sophisticated appearance. As building codes in many regions are being updated to emphasize energy efficiency and fire safety, zinc's inherent fire-retardant properties and its ability to be integrated into insulated facade systems are becoming increasingly attractive. This confluence of environmental consciousness, long-term economic benefits, design versatility, and enhanced safety features is powerfully propelling the growth of the zinc cladding market.

Despite its promising growth trajectory, the zinc cladding wall and facade systems market faces certain challenges that could potentially temper its expansion. One of the most significant restraints is the initial cost of zinc compared to more conventional facade materials like aluminum composite panels or certain types of stone. While the long-term benefits of durability and low maintenance often outweigh this initial investment, the upfront cost can be a deterrent for budget-conscious developers, particularly in price-sensitive markets or for large-scale residential projects. This price differential can limit its adoption in certain market segments, especially where cost is the primary decision-making factor.

The perceived complexity of installation and the need for specialized skills can also pose a hurdle. While zinc is a versatile material, proper installation is critical to ensure its long-term performance and aesthetic appeal. This requires experienced fabricators and installers who are familiar with the unique properties of zinc and its specific fastening and sealing techniques. A lack of trained professionals in certain regions might lead to increased labor costs or suboptimal installations, thereby deterring potential adopters. Furthermore, market fluctuations in the price of raw zinc can introduce volatility into the material costs, making it challenging for manufacturers and installers to provide stable pricing for their systems. Economic downturns or geopolitical events that impact global commodity prices can therefore directly influence the demand and affordability of zinc cladding. Finally, competition from other established and emerging facade materials, which may offer lower initial costs or different sets of performance characteristics, also represents a constant challenge that the zinc cladding market needs to actively address through continuous innovation and effective value proposition communication.

The Commercial Use application segment is projected to be a dominant force in the zinc cladding wall and facade systems market, both in terms of volume and value, across key regions such as Europe and North America. This dominance is underpinned by several factors that align perfectly with the inherent advantages of zinc cladding.

Europe: This region has a long-standing appreciation for high-quality, durable, and aesthetically refined building materials. The strong emphasis on sustainable architecture, stringent energy efficiency regulations, and a mature construction industry make Europe a prime market for zinc cladding. Countries like Germany, France, the United Kingdom, and the Nordic nations are leading the charge in adopting zinc for commercial buildings, including office towers, retail complexes, and public institutions. The presence of established manufacturers and a skilled workforce proficient in working with zinc further bolsters its market penetration. The historical period of 2019-2024 saw significant growth here, and the forecast period of 2025-2033 is expected to continue this upward trend, with the market value reaching into the tens of millions annually within this region alone.

North America: The North American market, particularly the United States and Canada, is also witnessing a rapid rise in the adoption of zinc cladding for commercial applications. Driven by increasing urban development, a growing demand for modern and premium building facades, and a heightened awareness of sustainability, developers are increasingly turning to zinc. The "up to 1.5 mm" and "1.5 mm to 3 mm" thickness categories are particularly popular in this segment due to their versatility and cost-effectiveness for a wide range of commercial facades, from sleek office buildings to educational institutions and healthcare facilities. The base year of 2025 marks a point where the market is expected to see even greater acceleration, fueled by innovative architectural designs and a growing preference for low-maintenance, long-lasting exterior solutions.

Within the Commercial Use segment, the application on office buildings, corporate headquarters, and mixed-use developments are significant contributors. Architects are increasingly specifying zinc for its ability to create a sophisticated and contemporary aesthetic, while building owners benefit from its durability, low maintenance requirements, and the long-term value it adds to their properties. The inherent fire-retardant properties of zinc are also a crucial consideration in commercial construction, where safety standards are paramount. The market for zinc cladding in commercial buildings is expected to outpace residential applications due to larger project scales and a greater willingness to invest in premium, long-term facade solutions. The ability of zinc to withstand harsh weather conditions, resist corrosion, and maintain its appearance for decades makes it an ideal choice for high-visibility commercial structures. The study period of 2019-2033 will likely see the commercial segment consistently account for over 50% of the total market share, with its value projected to reach tens of millions of dollars globally.

The zinc cladding wall and facade systems industry is propelled by several key growth catalysts. The burgeoning global demand for sustainable and energy-efficient building materials, directly fueled by environmental regulations and increasing consumer awareness, is a primary driver. Zinc's high recyclability and long lifespan contribute significantly to its eco-friendly profile. Furthermore, advancements in manufacturing technologies are enabling the production of lighter, more adaptable zinc panels, expanding their application scope. The aesthetic versatility of zinc, allowing for diverse finishes and complex designs, caters to the rising trend of modern and unique architectural expressions. Finally, the growing recognition of zinc's superior durability, low maintenance, and inherent fire-retardant properties is making it an increasingly attractive choice for developers seeking long-term value and safety in their construction projects.

The comprehensive coverage of the zinc cladding wall and facade systems report will delve into a granular analysis of market dynamics, providing invaluable insights for stakeholders. It will meticulously examine market size and forecast, with projections extending from the base year of 2025 through to 2033, building upon historical data from 2019-2024. The report will detail the market segmentation by application (Commercial Use, Residential), type (Up to 1.5 mm, 1.5 mm to 3 mm, 3 mm to 5 mm, Above 5 mm), and will also highlight key industry developments and the driving forces behind market evolution. Furthermore, it will identify and assess the challenges and restraints impacting growth, alongside regional market analysis. The report will also feature a detailed overview of the leading market players and their strategic initiatives. This extensive coverage ensures a holistic understanding of the market's current standing and its future potential, offering a robust foundation for strategic decision-making.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Alfrex, Alubond USA, ALUCOBOND, Ash & Lacy Holdings, Durabond Products, Fairview Architectural North America, Fundermax GmbH, Metl-Span, Qora Cladding, ROCKWOOL, .

The market segments include Application, Type.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Zinc Cladding Wall and Facade Systems," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Zinc Cladding Wall and Facade Systems, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.