1. What is the projected Compound Annual Growth Rate (CAGR) of the Work Class ROVs?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Work Class ROVs

Work Class ROVsWork Class ROVs by Type (Oil & Gas Industry, Scientific Research, Military & Defense, Others), by Application (Drilling Support, Construction Support, Inspection, Repair and Maintenance (IRM), Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

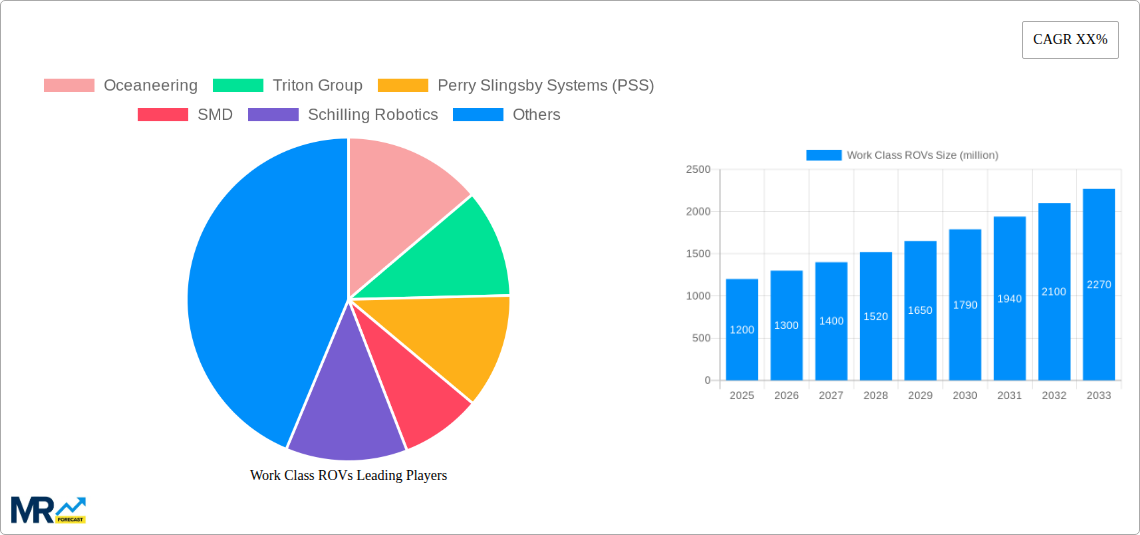

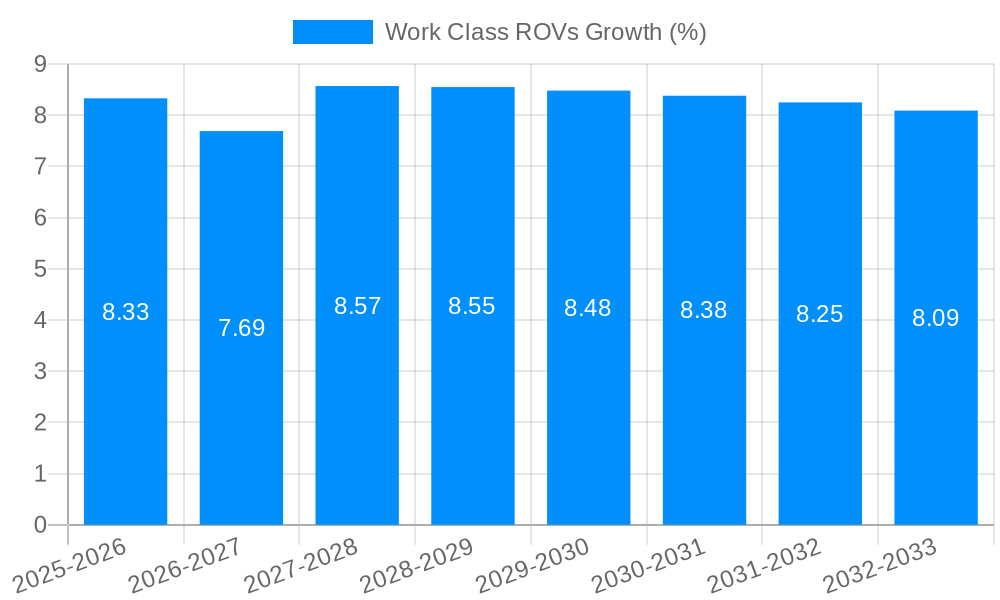

The Work Class ROV market is poised for significant expansion, projected to reach approximately $1.2 billion by 2025 and grow at a compound annual growth rate (CAGR) of around 8.5% through 2033. This robust growth is primarily fueled by the increasing demand for deep-sea exploration and production in the oil and gas sector, coupled with the rising need for sophisticated infrastructure development and maintenance. Advances in autonomous capabilities and sensor technology are further driving innovation, making these remotely operated vehicles indispensable for complex underwater operations. The "Scientific Research" segment is also a notable contributor, as organizations increasingly rely on ROVs for oceanographic studies, environmental monitoring, and the exploration of marine biodiversity.

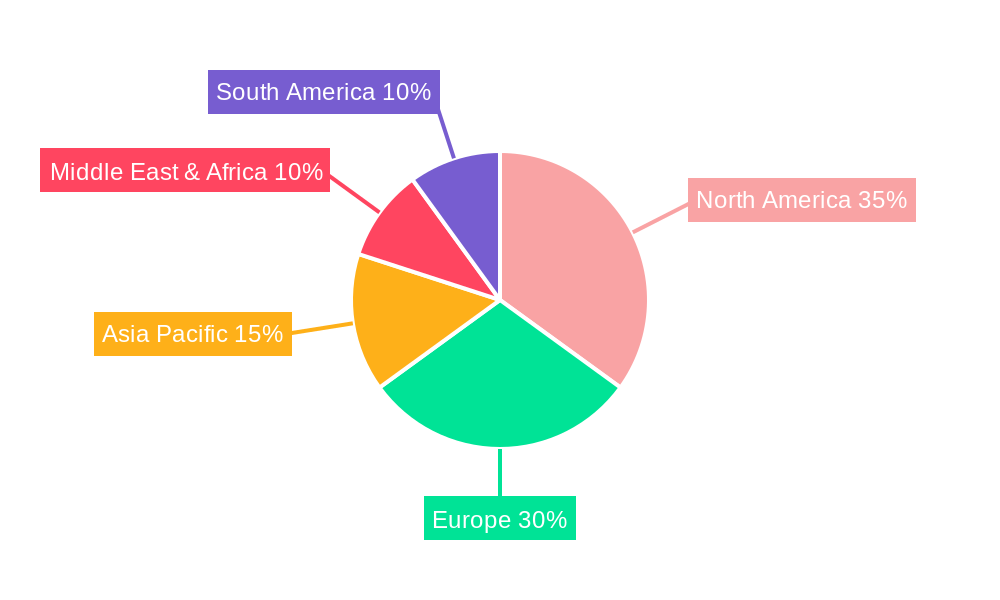

The market is further propelled by the growing emphasis on safety and efficiency in offshore operations, particularly in demanding environments like the deep sea. The "Construction Support" and "Inspection, Repair and Maintenance (IRM)" applications are experiencing sustained demand, as operators seek to minimize human risk and maximize operational uptime. While the "Military & Defense" sector represents a consistent, albeit more niche, area of application, its technological advancements often spill over into commercial applications. Geographically, North America and Europe are expected to continue leading the market due to their established offshore oil and gas infrastructure and significant investments in marine research. However, the Asia Pacific region is anticipated to exhibit the highest growth rate, driven by expanding offshore energy projects and burgeoning maritime research initiatives. Key players such as Oceaneering and Triton Group are at the forefront of technological development and market expansion, catering to the evolving needs of these diverse end-user industries.

Here's a unique report description on Work Class ROVs, incorporating your specified requirements:

The global Work Class Remotely Operated Vehicle (ROV) market is poised for substantial expansion, driven by an escalating demand for subsea exploration and infrastructure maintenance across diverse industries. Our comprehensive market analysis forecasts a robust Compound Annual Growth Rate (CAGR) of X.X% from 2025 to 2033, propelling the market value from an estimated USD XXX million in the base year of 2025 to a projected USD YYY million by the end of the forecast period. This growth trajectory is underpinned by significant investments in offshore oil and gas fields, the increasing complexity of deep-sea scientific endeavors, and the evolving needs of defense and security operations. During the historical period of 2019-2024, the market demonstrated resilience and steady growth, laying a strong foundation for future advancements. Key market insights reveal a pronounced shift towards highly sophisticated ROVs equipped with advanced sensor technologies, artificial intelligence (AI) capabilities for autonomous operations, and enhanced payload capacities. The Oil & Gas industry remains a dominant segment, particularly for drilling support and Inspection, Repair, and Maintenance (IRM) applications, where the cost-efficiency and safety benefits of ROVs over manned missions are increasingly recognized. However, the scientific research sector is witnessing accelerated adoption, driven by the exploration of uncharted marine territories and the need for precise data acquisition in challenging environments. Furthermore, the military and defense segment is investing heavily in advanced ROVs for surveillance, mine countermeasures, and special operations, contributing significantly to market diversification. The integration of advanced robotic arms, high-definition imaging systems, and real-time data transmission capabilities are becoming standard features, allowing for more intricate tasks to be performed with greater accuracy and reduced human risk. The market is also experiencing a trend towards customized ROV solutions tailored to specific client requirements and operational environments, fostering innovation and specialized product development.

Several powerful forces are collectively propelling the Work Class ROV market forward. The insatiable global demand for energy continues to fuel exploration and production activities in increasingly challenging offshore environments, necessitating the deployment of advanced subsea technologies like ROVs for drilling support and infrastructure maintenance. As oil and gas reserves become more geographically dispersed and lie at greater depths, the inherent safety and cost-effectiveness of utilizing ROVs over manned missions becomes undeniably attractive. Beyond energy, the burgeoning scientific research community is pushing the boundaries of oceanographic exploration, requiring sophisticated ROVs capable of detailed environmental monitoring, sample collection, and the deployment of complex sensor arrays in remote and extreme conditions. This expansion of scientific inquiry directly translates into a growing demand for high-performance ROVs. Furthermore, the evolving geopolitical landscape and heightened security concerns are driving significant investment in military and defense applications. Work Class ROVs are increasingly being utilized for a range of critical tasks, including underwater surveillance, mine warfare, seabed mapping for strategic advantage, and the deployment of specialized payloads. The inherent ability of these vehicles to operate in hazardous or inaccessible areas without risking human lives makes them indispensable assets in modern defense strategies. The synergy of these driving forces, from energy needs to scientific curiosity and national security imperatives, creates a powerful impetus for the continued development and adoption of advanced Work Class ROVs.

Despite the promising growth trajectory, the Work Class ROV market faces certain inherent challenges and restraints that can temper its full potential. One of the primary hurdles is the substantial capital investment required for the acquisition and deployment of these sophisticated systems. The initial cost of a Work Class ROV, coupled with the necessary support infrastructure such as specialized vessels and trained personnel, can be a significant barrier to entry, particularly for smaller companies or emerging markets. Furthermore, the complex operational environments in which these ROVs function often present significant technical challenges. Extreme pressures, corrosive seawater, strong currents, and the potential for entanglement can lead to downtime and necessitate costly repairs, impacting operational efficiency. The skilled workforce required to operate and maintain these advanced systems is also a constraint. A shortage of highly trained ROV pilots, technicians, and engineers can lead to operational delays and increased labor costs. Regulatory compliance, particularly in environmentally sensitive areas, can also add layers of complexity and cost to ROV operations, requiring adherence to stringent guidelines and permitting processes. Finally, the rapid pace of technological advancement, while a driver of innovation, can also lead to rapid obsolescence of older systems, prompting continuous investment in upgrades and replacements to remain competitive. Addressing these challenges through technological innovation, cost-reduction strategies, and workforce development will be crucial for sustained market expansion.

The Work Class ROV market's dominance is intricately linked to specific regions and segments driven by their unique operational demands and investment capacities.

Key Regions/Countries:

Key Segments:

The interplay between these dominant regions and segments, driven by substantial investments and critical operational needs, will shape the future landscape of the Work Class ROV market. The Oil & Gas industry's continued reliance on subsea infrastructure and the increasing strategic importance of underwater capabilities in the Military & Defense sector are particularly poised to drive significant market value, estimated to be in the hundreds of millions of dollars annually during the forecast period.

The Work Class ROV industry is experiencing robust growth catalyzed by several key factors. The relentless pursuit of hydrocarbon exploration in deeper and more challenging offshore environments necessitates advanced subsea technologies, with ROVs playing a pivotal role in ensuring safety and operational efficiency. The expanding renewable energy sector, particularly offshore wind farms, requires specialized ROVs for foundation installation and ongoing maintenance, unlocking new revenue streams. Furthermore, advancements in AI and automation are enabling ROVs to perform more complex tasks autonomously, reducing human intervention and operational costs. The increasing emphasis on subsea infrastructure integrity and lifespan extension is driving demand for sophisticated inspection, repair, and maintenance services, all of which are heavily reliant on ROVs.

This report offers an exhaustive examination of the Work Class ROV market, providing invaluable insights for stakeholders across various industries. The analysis encompasses a detailed historical overview from 2019 to 2024, establishing a baseline for understanding market dynamics. Our extensive forecast, spanning from 2025 to 2033 with a base year of 2025, projects significant market growth, estimating the market to reach USD YYY million by the end of the forecast period. We delve into the key market trends, identifying the technological innovations and evolving operational requirements that are shaping the sector. The report meticulously analyzes the driving forces, such as the escalating demand in the Oil & Gas industry and the burgeoning needs of scientific research and military applications, alongside the inherent challenges and restraints that may influence market expansion. A comprehensive regional and segment analysis highlights the dominant areas of growth and application, offering strategic perspectives. Furthermore, the report identifies crucial growth catalysts and profiles the leading players, providing a 360-degree view of the Work Class ROV ecosystem. This comprehensive coverage is designed to equip businesses with the knowledge necessary to navigate the complexities and capitalize on the opportunities within this dynamic and rapidly evolving market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Oceaneering, Triton Group, Perry Slingsby Systems (PSS), SMD, Schilling Robotics, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Work Class ROVs," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Work Class ROVs, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.