1. What is the projected Compound Annual Growth Rate (CAGR) of the Women's Non-athletic Footwear?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Women's Non-athletic Footwear

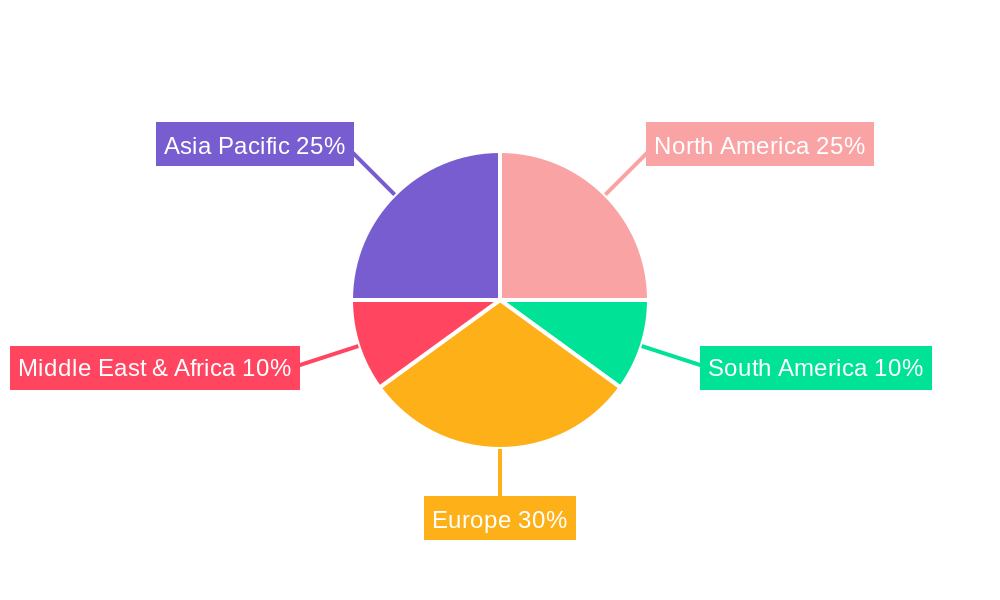

Women's Non-athletic FootwearWomen's Non-athletic Footwear by Type (Boots, High Heels, Flats Shoes, Sandals, Other), by Application (Online Sales, Offline Sales, World Women's Non-athletic Footwear Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

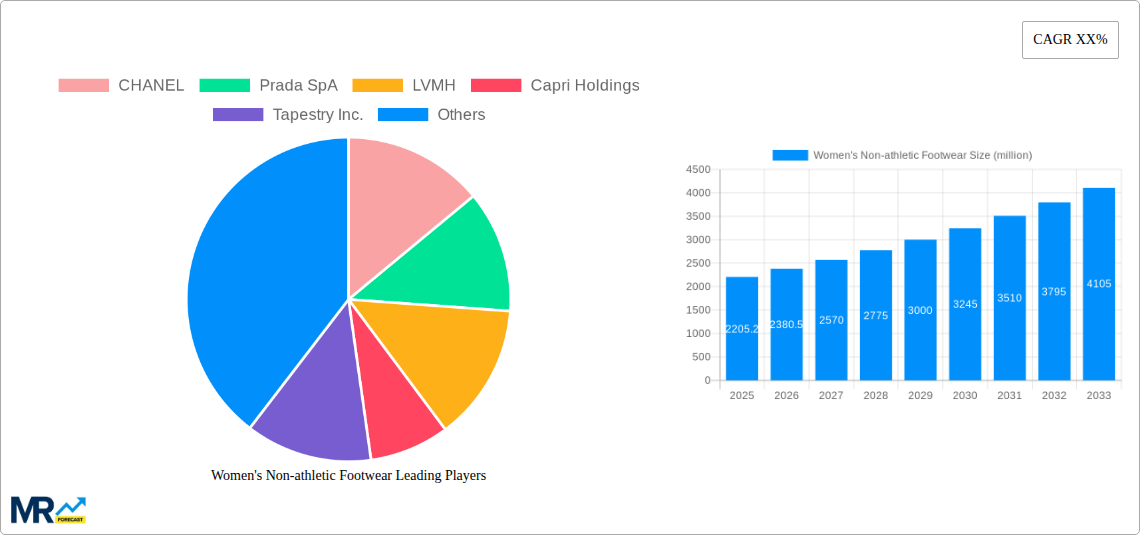

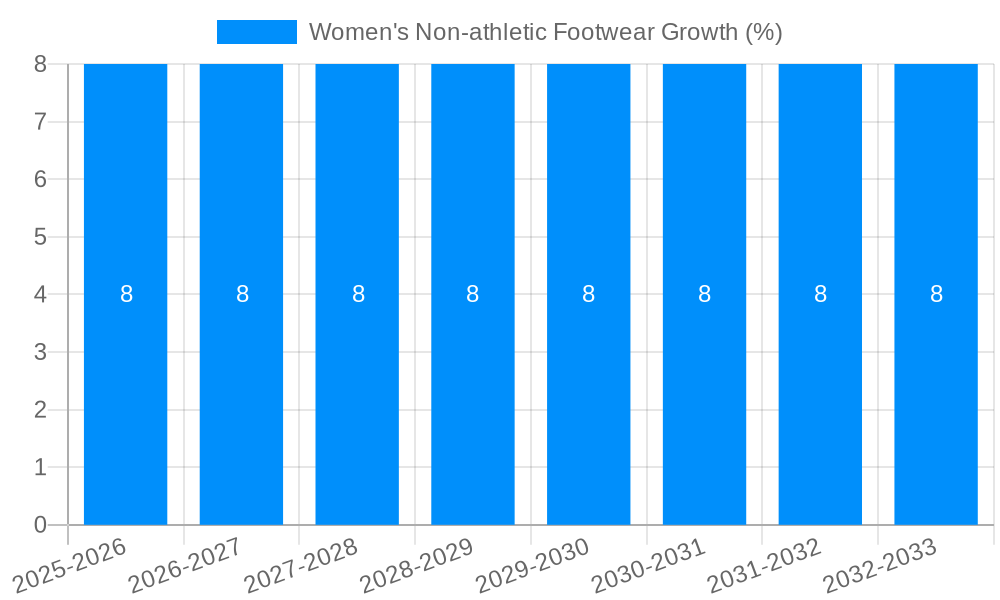

The global Women's Non-athletic Footwear market is poised for robust growth, estimated at USD 2205.2 million in 2025, and projected to expand significantly through 2033. This upward trajectory is propelled by a confluence of factors including rising disposable incomes, an increasing fashion consciousness among women, and the growing influence of social media in shaping footwear trends. The market is experiencing a substantial Compound Annual Growth Rate (CAGR), indicating a dynamic and expanding consumer base actively seeking stylish and comfortable non-athletic shoe options. Key segments like Boots and High Heels continue to dominate consumer preferences, driven by their versatility in fashion statements. Furthermore, the burgeoning e-commerce landscape, with Online Sales representing a significant channel, is democratizing access to a wider array of brands and styles, making it easier for consumers to discover and purchase their preferred footwear. This digital transformation is a critical driver, enabling brands to reach a global audience and cater to diverse fashion sensibilities.

Emerging trends such as the increasing demand for sustainable and ethically produced footwear are also shaping the market. Consumers are becoming more discerning, actively seeking brands that align with their values, leading to innovation in material sourcing and manufacturing processes. While the market presents immense opportunities, certain restraints, such as fluctuating raw material costs and intense competition among established luxury and fast-fashion brands, necessitate strategic agility from market players. Geographically, Asia Pacific, led by China and India, is emerging as a powerhouse due to its large population and rapidly growing middle class. North America and Europe remain mature yet significant markets, characterized by a strong demand for premium and designer non-athletic footwear. Companies like CHANEL, Prada SpA, and LVMH are at the forefront, leveraging their brand equity and innovative designs to capture market share. The strategic expansion of distribution channels, encompassing both online and offline sales, will be crucial for sustained growth and to cater to the evolving demands of the global women's non-athletic footwear consumer.

This comprehensive report delves into the intricate world of women's non-athletic footwear, analyzing market dynamics, key trends, and future projections from 2019 to 2033. The study employs a rigorous methodology, utilizing 2025 as the base and estimated year, with a forecast period spanning from 2025 to 2033, and a historical analysis covering 2019-2024. We will examine the global production landscape, with a particular focus on the United States and China, projecting production to reach over 1,200 million units in 2025. The report provides granular insights into various segments, including Boots, High Heels, Flats Shoes, Sandals, and Other, alongside application channels such as Online Sales and Offline Sales. Leading companies like CHANEL, Prada SpA, LVMH, Capri Holdings, Tapestry Inc., Kering, The ALDO Group Inc., VF Corporation, and Bata Corporation are meticulously profiled, offering a deep understanding of their market strategies and contributions.

The women's non-athletic footwear market is undergoing a significant transformation, driven by evolving consumer preferences, technological advancements, and a growing emphasis on sustainability and ethical production. XXX The overarching trend points towards a bifurcation of the market: on one end, there's a surge in demand for comfort-centric, versatile footwear that seamlessly transitions from casual to semi-formal settings. This is evident in the enduring popularity of elevated flats, stylish loafers, and comfortable block heels, designed with innovative cushioning and ergonomic features. On the other end, the luxury segment continues to thrive, with consumers seeking statement pieces that reflect personal style and brand prestige. Here, craftsmanship, premium materials, and unique designs are paramount. The report forecasts a substantial growth in the "Other" footwear category, encompassing everything from artisanal designs to innovative comfort solutions, which is expected to expand its market share significantly. Online sales channels are projected to dominate, driven by convenience, wider product selection, and personalized shopping experiences. The report anticipates that by 2025, online sales will account for over 650 million units in global production, demonstrating a marked shift from traditional brick-and-mortar retail. Furthermore, the influence of social media and digital marketing on consumer purchasing decisions cannot be overstated. Influencer collaborations and virtual try-on technologies are becoming integral to brand engagement and sales strategies, pushing the boundaries of traditional retail. The rise of athleisure has also subtly permeated non-athletic footwear, leading to the incorporation of sporty aesthetics and comfort-focused constructions into everyday shoes, blurring the lines between performance and fashion. Sustainability is no longer a niche concern but a mainstream expectation, with consumers actively seeking out brands that utilize recycled materials, ethical sourcing, and eco-friendly manufacturing processes. This conscious consumerism is influencing design choices, material innovation, and brand communication, creating a demand for footwear that is both stylish and responsible. The report will meticulously dissect these trends, providing quantitative data on market segmentation and consumer behavior to support these observations, with a projected overall market value of over $250 billion by the end of the forecast period.

Several potent forces are collectively propelling the growth of the women's non-athletic footwear market, painting a picture of robust expansion and evolving consumer engagement. The fundamental driver remains the persistent and increasing disposable income across a significant portion of the global female population. As economic conditions improve in emerging economies and continue to stabilize in developed nations, women have greater purchasing power to invest in quality footwear that aligns with their lifestyle and fashion aspirations. Furthermore, the pervasive influence of fashion trends, amplified by social media platforms and celebrity endorsements, acts as a constant catalyst for new purchases. The cyclical nature of fashion ensures a steady demand for updated styles and seasonal collections, encouraging consumers to refresh their wardrobes, including their footwear. The growing importance of self-expression and personal branding amongst women also contributes significantly; footwear is often viewed as a key accessory that completes an outfit and communicates an individual's style and personality. This desire for individuality fuels demand for a wider variety of styles, colors, and designs. Moreover, technological innovations in materials science and manufacturing processes are enabling brands to produce more comfortable, durable, and aesthetically appealing footwear. Lightweight materials, advanced cushioning systems, and innovative construction techniques are enhancing the wearability of non-athletic shoes, making them more attractive for everyday use. The report highlights that the global production of women's non-athletic footwear is expected to witness a compound annual growth rate (CAGR) of over 4.5% during the forecast period, underscoring the impact of these driving forces. The increasing urbanization and the rise of working women also play a crucial role, creating a demand for footwear suitable for professional environments and the daily commute.

Despite the promising growth trajectory, the women's non-athletic footwear market is not without its challenges and restraints, which could potentially impede its full potential. A primary concern is the intensifying competition within the market. With a plethora of established brands and new entrants vying for consumer attention, companies face pressure to differentiate themselves through innovation, branding, and pricing strategies. This can lead to price wars and reduced profit margins for some players. Economic volatility and inflation can also pose a significant restraint. Fluctuations in currency exchange rates, rising raw material costs, and increased shipping expenses can impact the overall cost of production and, subsequently, the final retail price of footwear, potentially affecting consumer affordability and demand. Furthermore, changing consumer tastes and fashion cycles can be unpredictable. A trend that gains rapid traction can quickly fade, leaving brands with excess inventory of outdated styles, leading to significant financial losses. The sustainability movement, while a growth driver, also presents challenges. Meeting increasingly stringent environmental regulations and consumer expectations for eco-friendly products requires substantial investment in research and development, sourcing of sustainable materials, and ethical manufacturing practices, which can be costly for many companies. The report estimates that approximately 200 million units of footwear production might be impacted by supply chain disruptions and fluctuating raw material costs within the forecast period. Moreover, the counterfeiting of popular footwear designs remains a persistent issue, particularly in the luxury segment, undermining brand value and sales. Geopolitical instability and trade disputes can also disrupt global supply chains and affect market access for certain regions, adding another layer of complexity to market operations.

The global women's non-athletic footwear market is poised for significant dominance by specific regions and segments, driven by a confluence of economic, cultural, and demographic factors. Within the Type segment, Flats Shoes are projected to emerge as a dominant force, accounting for an estimated 35% of the global market share by 2025. This dominance stems from their unparalleled versatility, comfort, and enduring fashion appeal. Flats seamlessly transition from casual wear to more formal settings, catering to the modern woman's need for practical yet stylish footwear. Their inherent comfort makes them ideal for prolonged wear, whether for commuting, working, or leisurely activities. The report forecasts the production of flats shoes to exceed 420 million units in 2025, a testament to their widespread appeal.

In terms of application, Online Sales are set to unequivocally dominate the market. The convenience, vast product selection, and ease of comparison offered by e-commerce platforms have fundamentally reshaped consumer purchasing habits. By 2025, online sales are expected to represent over 65% of the total market revenue, translating to a production volume of approximately 800 million units. This trend is further amplified by the increasing digital literacy and smartphone penetration across all demographics.

Geographically, Asia Pacific, particularly China, is positioned to be a leading region in terms of production and, increasingly, consumption. China's robust manufacturing capabilities, coupled with a rapidly growing middle class and an increasing fashion consciousness among its female population, make it a powerhouse in both production and demand. The report projects China to contribute over 600 million units to the global production of women's non-athletic footwear by 2025. North America, especially the United States, will continue to be a major consumption market, driven by high disposable incomes and a strong affinity for fashion trends. Europe, with its established luxury brands and discerning consumer base, will remain a significant contributor, particularly in the high-end segment. The report will further detail the intricate interplay of these segments and regions, providing detailed market share analyses and production forecasts, including the projected production of High Heels to reach over 250 million units and Sandals to surpass 200 million units by 2025, further illustrating the diversified yet segment-specific growth patterns.

Several key catalysts are igniting significant growth within the women's non-athletic footwear industry. The burgeoning disposable income in emerging economies, coupled with a rising aspirational lifestyle, is a primary driver. Women are increasingly investing in quality footwear that reflects their personal style and social standing. Furthermore, the persistent influence of social media and fashion influencers continues to shape consumer trends, driving demand for new and innovative designs. The integration of advanced technologies in footwear manufacturing, leading to enhanced comfort, durability, and aesthetic appeal, is another crucial growth catalyst. The growing emphasis on sustainability and ethical production practices is also opening new market avenues as consumers actively seek out eco-conscious brands.

This report offers a granular and exhaustive exploration of the women's non-athletic footwear market. Beyond the quantitative analysis of production volumes and market share, it delves into the qualitative aspects that shape consumer choices and industry evolution. The report meticulously examines the impact of evolving fashion trends, celebrity endorsements, and the pervasive influence of social media platforms on purchasing decisions. It also critically assesses the growing consumer demand for sustainable and ethically sourced footwear, providing insights into how brands are responding to these expectations. Furthermore, the report investigates the role of technological advancements, from innovative material science to the integration of digital technologies, in enhancing product offerings and the overall consumer experience. This holistic approach ensures a comprehensive understanding of the market's present landscape and its future trajectory.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include CHANEL, Prada SpA, LVMH, Capri Holdings, Tapestry Inc., Kering, The ALDO Group Inc., VF Corporation, Bata Corporation, .

The market segments include Type, Application.

The market size is estimated to be USD 2205.2 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Women's Non-athletic Footwear," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Women's Non-athletic Footwear, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.