1. What is the projected Compound Annual Growth Rate (CAGR) of the Women's Gym & Sport Leggings?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Women's Gym & Sport Leggings

Women's Gym & Sport LeggingsWomen's Gym & Sport Leggings by Type (High-Waisted Leggings, Cropped Athletic Leggings, Other), by Application (Online Shopping Mall, Retail Store, Brand Store, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

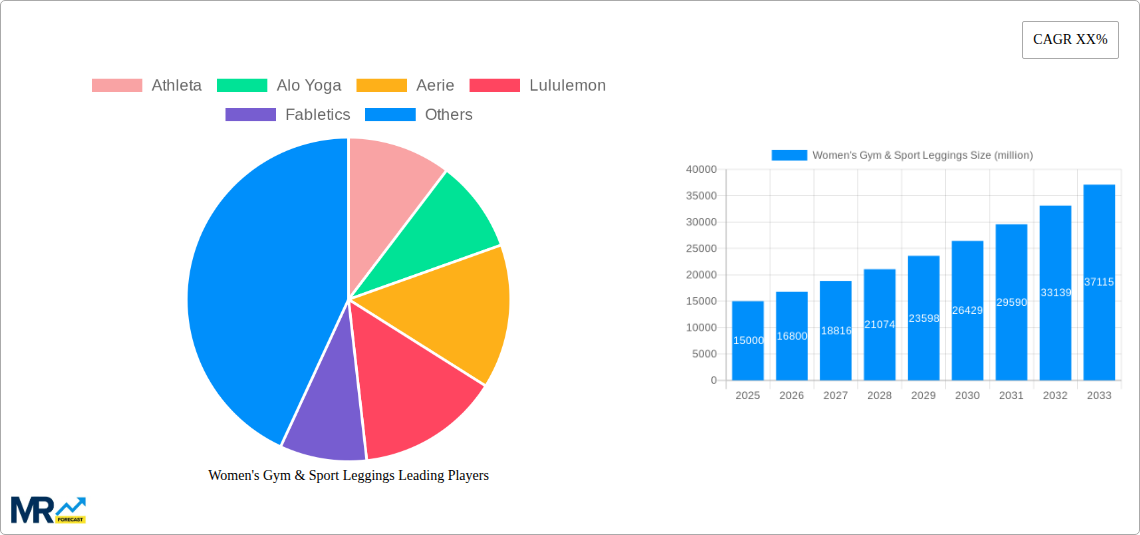

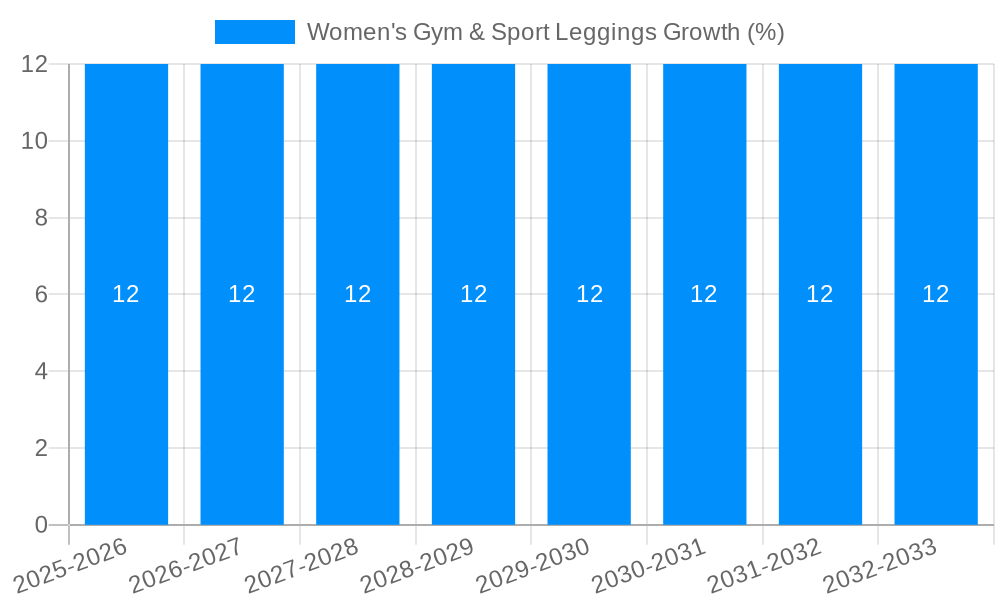

The global Women's Gym & Sport Leggings market is poised for significant expansion, projected to reach an estimated USD 15,000 million by 2025, exhibiting a robust Compound Annual Growth Rate (CAGR) of 12% during the forecast period of 2025-2033. This upward trajectory is primarily fueled by the escalating global focus on health and wellness, leading to increased participation in fitness activities and a greater demand for specialized athletic wear. The athleisure trend continues to dominate, blurring the lines between workout apparel and everyday fashion, further driving consumer spending on versatile and stylish leggings. Evolving consumer preferences for sustainable and eco-friendly materials also present a notable growth avenue, with brands increasingly incorporating recycled and organic fabrics into their collections. Moreover, technological advancements in fabric innovation, offering enhanced moisture-wicking, compression, and breathability, are contributing to product differentiation and market appeal.

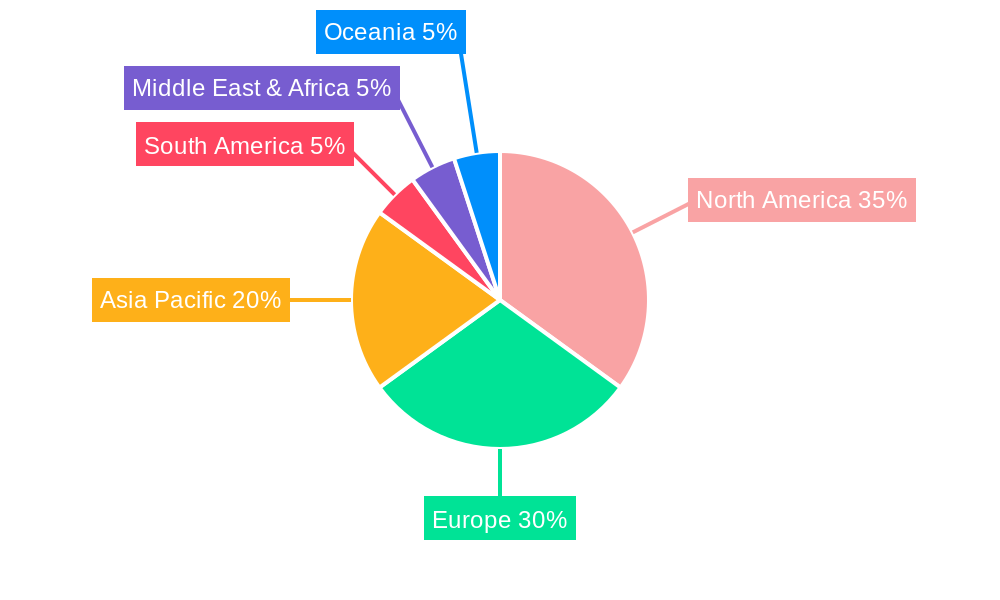

The market is segmented into key types such as High-Waisted Leggings and Cropped Athletic Leggings, with each segment catering to specific consumer needs and athletic preferences. Application-wise, Online Shopping Malls are emerging as the dominant channel, owing to their convenience, wider product selection, and personalized shopping experiences. However, traditional Retail Stores and Brand Stores continue to hold relevance, offering tangible product interaction and brand immersion. Geographically, North America and Europe currently lead the market share, driven by established fitness cultures and high disposable incomes. The Asia Pacific region, however, is anticipated to witness the fastest growth, propelled by a burgeoning middle class, increasing urbanization, and a growing awareness of fitness and healthy lifestyles. Key players like Lululemon, Nike, and Adidas are actively investing in product innovation, strategic partnerships, and expanding their global footprint to capitalize on these market dynamics, while emerging brands are carving out niches by focusing on sustainability and specialized designs.

This report offers an in-depth analysis of the global Women's Gym & Sport Leggings market, projecting its trajectory from a historical perspective (2019-2024) through the base year (2025) and into a robust forecast period (2025-2033). The study meticulously examines market dynamics, key drivers, prevailing challenges, and dominant segments, providing valuable insights for stakeholders.

The global Women's Gym & Sport Leggings market is experiencing a transformative evolution, driven by a confluence of lifestyle shifts, technological advancements, and evolving consumer preferences. During the study period of 2019-2033, the market has witnessed substantial growth, with projections indicating a continued upward trend. A key insight from the historical period (2019-2024) is the undeniable surge in athleisure wear's adoption, blurring the lines between athletic performance and everyday fashion. This trend has propelled leggings from specialized workout attire to a staple in women's wardrobes. The estimated year of 2025 sees this momentum firmly in place, with the market valued in the tens of millions of dollars. Furthermore, sustainability and ethical production are no longer niche concerns but significant market differentiators. Consumers are increasingly seeking leggings made from recycled materials and produced with fair labor practices, influencing brand strategies and product development. Innovation in fabric technology is another critical trend, with brands investing heavily in moisture-wicking, compression, and temperature-regulating materials that enhance comfort and performance. The rise of online shopping malls and direct-to-consumer (DTC) brand stores has also democratized access, allowing smaller, specialized brands to gain traction. The market is also witnessing a diversification of styles beyond basic black, with bold prints, vibrant colors, and unique textures gaining popularity. This reflects a growing desire for self-expression and personalization within the activewear space. The overall market size, estimated to be in the hundreds of millions of dollars by the end of the forecast period in 2033, underscores the enduring appeal and expanding utility of women's gym and sport leggings. The focus on inclusivity, with brands offering a wider range of sizes and styles catering to diverse body types, is also a significant and positive trend shaping the market's future.

The remarkable growth trajectory of the Women's Gym & Sport Leggings market is fueled by a potent combination of interconnected factors. Foremost among these is the escalating global awareness and adoption of health and wellness lifestyles. As more women prioritize physical activity, from regular gym visits and yoga sessions to outdoor adventures, the demand for comfortable, functional, and stylish activewear, particularly leggings, has skyrocketed. This trend is further amplified by the continued mainstreaming of athleisure, where the aesthetic appeal and comfort of gym wear have seamlessly integrated into daily casual wear. Consequently, women are investing in versatile leggings that can transition effortlessly from a workout to running errands or meeting friends. Technological advancements in fabric innovation play a crucial role. Manufacturers are continuously developing and incorporating advanced materials that offer enhanced performance features such as superior moisture-wicking capabilities, breathability, targeted compression for muscle support, and improved durability. These innovations directly translate into a more comfortable and effective exercise experience, driving repeat purchases and brand loyalty. The proliferation of social media platforms has also been instrumental, serving as powerful visual showcases for active lifestyles and fashion trends. Influencers and everyday users alike are constantly sharing their fitness journeys and outfits, creating aspirational content that inspires purchases and exposes consumers to a wider array of brands and styles. The increasing availability and convenience of online shopping malls and brand stores, especially DTC models, have made it easier than ever for consumers to discover, compare, and purchase gym and sport leggings from a global marketplace. This accessibility not only broadens consumer choice but also fosters a competitive environment that encourages brands to innovate and differentiate their offerings. The market value, estimated in the hundreds of millions of dollars by 2025, is a testament to these combined driving forces.

Despite its robust growth, the Women's Gym & Sport Leggings market is not without its hurdles and limitations. One of the primary challenges lies in the intense competition within the sector. With numerous established brands and a constant influx of new entrants, the market is highly saturated. This necessitates significant investment in marketing and product differentiation to capture and retain consumer attention. Brands face the perpetual pressure to innovate in terms of design, fabric technology, and sustainability to stand out from the crowd. The rising cost of raw materials, particularly high-performance synthetic fabrics and sustainable alternatives, can impact profit margins and potentially lead to increased retail prices, which may deter some price-sensitive consumers. Furthermore, the global supply chain disruptions, as witnessed in recent years, can affect production timelines and inventory management, posing a significant operational challenge for manufacturers and retailers alike. Evolving consumer perceptions and the potential for "athleisure fatigue" also represent a subtle restraint. As trends shift, the sustained demand for leggings as a primary casual wear item could be subject to change, requiring brands to adapt their product lines accordingly. Maintaining consistent quality across a wide range of products and sizes is another critical aspect. Negative reviews or experiences related to durability, fit, or fabric performance can quickly damage a brand's reputation in the highly interconnected digital marketplace. The need for substantial capital investment in research and development for advanced materials and sustainable production methods can also be a barrier for smaller companies looking to scale. The market value, estimated to be in the hundreds of millions of dollars by 2025, will need to navigate these challenges to achieve its full potential.

The global Women's Gym & Sport Leggings market is characterized by significant regional variations and segment dominance, with specific areas and product categories poised for substantial growth.

Dominant Segments:

Type: High-Waisted Leggings: This style has emerged as a clear leader, driven by its combination of comfort, support, and flattering silhouette. High-waisted leggings offer superior coverage and a secure fit, making them ideal for a wide range of physical activities, from intense workouts to yoga and Pilates. Their versatility extends to casual wear, further boosting their appeal. The estimated market share for high-waisted leggings is projected to remain strong throughout the forecast period. Companies like Lululemon, Athleta, and Alo Yoga have been particularly successful in popularizing and refining this style, contributing to its market dominance. The estimated value for this segment alone could reach tens of millions of dollars by 2025.

Application: Online Shopping Mall: The shift towards e-commerce has profoundly impacted the distribution of women's gym and sport leggings. Online shopping malls, encompassing both large e-commerce platforms and dedicated brand websites (Brand Store), have become the primary purchasing channel for a significant portion of consumers. The convenience of browsing, comparing prices, and having products delivered directly to their doorstep is a major draw. Furthermore, online platforms facilitate the reach of niche and specialized brands, allowing them to connect with a global customer base. This segment is expected to continue its dominance, with projections indicating a market value in the hundreds of millions of dollars for online sales by 2025.

Key Region to Dominate the Market:

While other regions like Europe and Asia-Pacific are experiencing robust growth, North America is projected to maintain its leading position due to the synergy of consumer behavior, economic factors, and brand presence. The synergy between the dominance of high-waisted leggings and the online shopping mall application, coupled with the driving force of North American consumer habits, solidifies these as the key market drivers for the forecast period.

The Women's Gym & Sport Leggings industry is propelled by several key growth catalysts. The persistent and growing global emphasis on health, fitness, and overall well-being significantly boosts demand for athletic apparel. The sustained popularity of the athleisure trend, where comfort and style blend seamlessly, continues to drive adoption for everyday wear. Technological advancements in fabric innovation, leading to enhanced performance, comfort, and sustainability features, encourage consumers to upgrade their activewear. The increasing participation of women in sports and fitness activities across all age groups also acts as a major catalyst. Finally, the expansion of e-commerce and direct-to-consumer (DTC) channels provides greater accessibility and wider product selection, making it easier for consumers to purchase leggings and fueling market growth, projected to reach hundreds of millions of dollars by 2033.

This comprehensive report provides an exhaustive examination of the Women's Gym & Sport Leggings market, spanning the historical period of 2019-2024 and extending through the forecast period of 2025-2033, with 2025 serving as the base and estimated year. It delves into the intricate market trends, dissecting the key insights that have shaped the industry's trajectory, valued in the tens of millions of dollars for specific sub-segments. The report meticulously analyzes the driving forces behind market expansion, illuminating the factors propelling demand and the challenges that may hinder growth, estimated to be in the hundreds of millions of dollars by 2033. Furthermore, it identifies and elaborates on the dominant regions and critical market segments, such as high-waisted leggings and online shopping malls, that are poised for substantial market share. The report also highlights the significant growth catalysts that are expected to fuel future expansion and provides a comprehensive overview of the leading players and their strategic developments. This in-depth analysis is crucial for stakeholders seeking to understand the current landscape and future opportunities within the dynamic Women's Gym & Sport Leggings market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Athleta, Alo Yoga, Aerie, Lululemon, Fabletics, Evolve, Nordstrom, Outdoor Voices, Spanx, Localised, Girlfriend Collective, Tommy John, Summersalt, HATCH Collection, Nike, Stitch Fix and Fix, LAmade Clothing, Li-Ning, Under Armour, Adidas, Gymshark, Decathlon, Anta Sport, CSP Cycling, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Women's Gym & Sport Leggings," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Women's Gym & Sport Leggings, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.