1. What is the projected Compound Annual Growth Rate (CAGR) of the Women's Golf Drivers?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Women's Golf Drivers

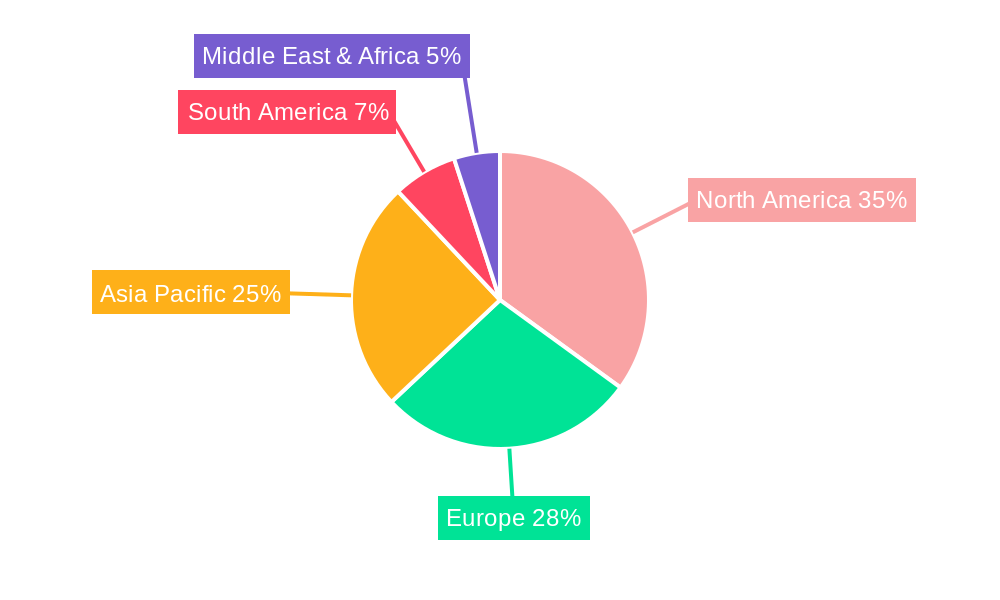

Women's Golf DriversWomen's Golf Drivers by Application (Online, Offline), by Type (Lightweight, Heavyweight), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

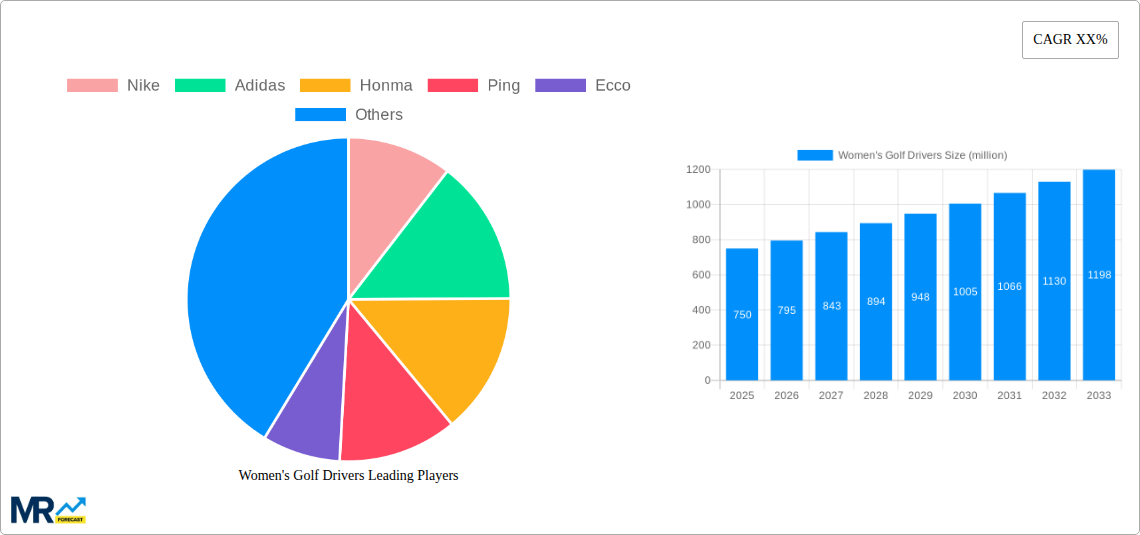

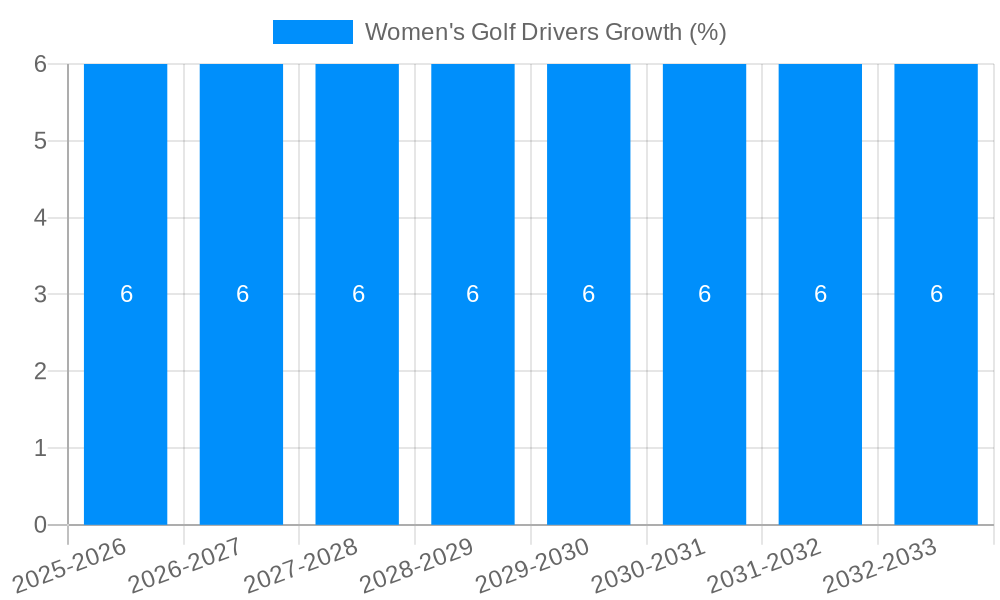

The global Women's Golf Drivers market is poised for robust growth, with a current estimated market size of approximately $750 million. This expansion is fueled by a projected Compound Annual Growth Rate (CAGR) of around 6%, indicating a healthy and sustained increase in demand over the forecast period of 2025-2033. The market's buoyancy is largely driven by several key factors, including the increasing participation of women in golf, a growing awareness of the benefits of tailored equipment for enhanced performance, and significant advancements in driver technology that prioritize lighter materials, improved aerodynamics, and customizable features. The rise of online retail channels has also made these specialized drivers more accessible to a broader consumer base, further contributing to market expansion.

The market for Women's Golf Drivers is segmented by application into Online and Offline sales, with the online segment expected to witness more dynamic growth due to convenience and wider product selection. In terms of type, both Lightweight and Heavyweight drivers cater to diverse player preferences and skill levels, though lightweight options are anticipated to gain traction among a larger demographic seeking ease of swing and greater clubhead speed. Key industry players like Nike, Adidas, Callaway Golf, and TaylorMade are actively investing in research and development to introduce innovative products that address the specific biomechanical needs of female golfers. Despite this positive outlook, the market faces potential restraints such as the high cost of premium drivers and the perceived intimidation factor of golf for some women, which could temper the pace of growth. However, ongoing efforts to promote golf inclusivity and make the sport more approachable are expected to mitigate these challenges.

Here is a unique report description on Women's Golf Drivers, incorporating your specified values, units, and structure:

The global Women's Golf Drivers market is poised for a significant expansion, projected to reach an impressive valuation of $1,250 million by the end of the study period in 2033. This robust growth trajectory is underpinned by a confluence of evolving consumer preferences and strategic industry advancements. During the historical period of 2019-2024, the market experienced steady growth, laying a solid foundation for accelerated development in the forecast period of 2025-2033. The base year of 2025 stands as a critical benchmark, with estimations for this year suggesting a market size of approximately $700 million. XXX, a pivotal trend shaping the market, is the increasing emphasis on product personalization and customization. Manufacturers are moving beyond one-size-fits-all approaches, offering drivers with adjustable loft, lie angles, and shaft flexes specifically engineered to cater to the unique biomechanics and swing speeds of female golfers. This tailored approach not only enhances performance but also fosters a deeper connection between the golfer and their equipment, driving up adoption rates. Another significant trend is the integration of advanced materials and aerodynamic designs. Companies are investing heavily in research and development to incorporate lightweight yet durable composites, titanium alloys, and innovative clubhead geometries that promote higher launch angles and greater ball speeds with reduced effort. This technological innovation is particularly attractive to a growing demographic of younger female golfers entering the sport, who are often more tech-savvy and performance-oriented. Furthermore, there's a discernible shift towards aesthetically pleasing designs. Beyond pure performance, women golfers are increasingly seeking drivers that reflect their personal style, leading to a broader spectrum of color palettes, finishes, and branding options. This aesthetic consideration is a critical differentiator in a competitive market. The rise of e-commerce platforms has also democratized access to high-quality golf equipment, allowing consumers to research, compare, and purchase drivers from a wider array of brands and models than ever before. This ease of access, coupled with a growing awareness of the benefits of properly fitted equipment, is fueling market expansion. The market is also witnessing a segment of female golfers actively seeking out lightweight drivers to maximize swing speed and forgiveness, a trend that is contributing significantly to market dynamics.

Several compelling forces are actively propelling the growth of the Women's Golf Drivers market. Foremost among these is the substantial and ongoing increase in female participation in golf globally. As more women embrace the sport, the demand for specialized equipment designed to enhance their game naturally escalates. This demographic shift is not only expanding the consumer base but also encouraging brands to innovate and cater specifically to the needs and preferences of female golfers. Technological advancements in driver design represent another significant driver. Manufacturers are relentlessly pursuing innovations in materials science, aerodynamics, and clubhead engineering. The integration of advanced composites, lighter alloys, and optimized weighting systems allows for the creation of drivers that offer improved forgiveness, increased ball speed, and higher launch angles, all crucial for optimizing performance for female golfers. The growing emphasis on health and wellness also plays a role, with golf being recognized as an excellent recreational activity that promotes physical and mental well-being. As women seek out engaging and beneficial forms of exercise, golf's popularity as a lifestyle choice continues to rise, creating a ripple effect on equipment demand. Furthermore, the rise of social media and influencer marketing has played a pivotal role in demystifying golf and showcasing its appeal to a broader audience. Female golfers and influencers often share their experiences and highlight the benefits of using properly fitted and high-performance drivers, inspiring others to take up the sport and invest in their game. This heightened visibility and positive portrayal are instrumental in driving market growth.

Despite the promising growth, the Women's Golf Drivers market is not without its challenges and restraints. A primary concern revolves around the perception of golf as an expensive sport, which can deter potential new female entrants, particularly those from lower-income backgrounds. The initial investment in equipment, including drivers, can be a significant barrier. Another hurdle is the historical underrepresentation and lack of tailored marketing efforts by some brands in the past. While this is changing, a lingering perception of golf as a male-dominated sport can still discourage some women from fully engaging with the sport and its associated equipment. Product accessibility and the availability of fitting services can also be a constraint. While online sales are growing, the nuances of driver selection, especially for women with varying swing speeds and physical attributes, often benefit from professional fitting sessions. Limited access to skilled club fitters in certain regions can hinder optimal purchase decisions and lead to dissatisfaction. Furthermore, intense competition within the market, with numerous established brands and emerging players vying for market share, can lead to price wars and reduced profit margins for manufacturers. The need for continuous innovation to stay ahead of competitors also demands substantial R&D investments, which can be a burden for smaller companies. Lastly, economic downturns or shifts in consumer spending priorities can impact discretionary purchases like golf equipment, temporarily slowing down market expansion.

The Online segment, in terms of application, is projected to exhibit the most significant dominance and rapid growth within the Women's Golf Drivers market throughout the forecast period of 2025-2033. This ascendancy is driven by a multitude of factors that align perfectly with the purchasing behaviors and preferences of modern consumers, particularly within the female demographic. The convenience offered by online platforms is unparalleled. Women golfers, often balancing busy schedules with professional, family, and social commitments, find the ability to research, compare, and purchase golf drivers at any time of day or night from the comfort of their homes to be a highly attractive proposition. This eliminates the need for dedicated shopping trips, which can be time-consuming and may not always align with individual availability. Furthermore, the digital landscape provides an unprecedented level of transparency and accessibility to information. Online retailers and manufacturer websites offer detailed product specifications, customer reviews, expert opinions, and even virtual fitting tools. This wealth of information empowers female golfers to make more informed purchasing decisions, comparing different models, brands like Callaway Golf, TaylorMade, and Titleist, and specifications without direct pressure from a salesperson. The competitive pricing often found on e-commerce platforms is another significant draw. Online retailers typically have lower overhead costs compared to brick-and-mortar stores, allowing them to offer more competitive prices and attractive discounts. This is particularly appealing in a market where cost can be a factor for some consumers. The curated experience of online shopping is also becoming increasingly sophisticated. Websites are designed to be user-friendly, with advanced search filters and recommendation engines that help users narrow down their choices based on specific criteria such as swing speed, handicap, and desired shot shape. This personalized approach enhances the shopping experience and reduces the likelihood of overwhelming consumers with too many options. Moreover, the global reach of online platforms means that even consumers in remote or underserved areas can access a wide range of Women's Golf Drivers from leading companies such as XXIO, Cleveland, and PING. The increasing trust in online transactions and the robust logistics networks that facilitate timely delivery further solidify the online segment's dominance. Brands like Nike, Adidas, Honma, Eson, and Sunny haha are actively investing in their e-commerce strategies, recognizing the immense potential of this channel. Even niche brands like Sunview GOLF, Number golf, and Eson can reach a broader audience through online marketplaces. While offline channels will continue to hold importance, especially for those who prefer a hands-on experience and professional fitting, the sheer convenience, affordability, and informational depth of online purchasing are undeniably positioning it as the leading segment for Women's Golf Drivers.

The Women's Golf Drivers industry is experiencing robust growth fueled by increasing female participation in golf worldwide. This demographic shift is a primary catalyst, creating a larger and more engaged consumer base. Technological advancements, such as the integration of lighter materials and enhanced aerodynamic designs in drivers, are making the sport more accessible and enjoyable for women, further stimulating demand. The growing focus on women's sports globally, coupled with increased media coverage and the rise of female golf influencers, is also inspiring more women to take up the game and invest in quality equipment.

This report offers a comprehensive analysis of the Women's Golf Drivers market, delving into key trends, driving forces, and challenges shaping its trajectory. It provides a granular examination of market segmentation, with a particular focus on the dominance of the online application segment and the growing preference for lightweight drivers. The report leverages extensive market research and data analysis, incorporating both historical trends from 2019-2024 and future projections up to 2033, with a detailed breakdown for the base and estimated year of 2025. Key industry developments, significant market players, and regional market landscapes are meticulously covered.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Nike, Adidas, Honma, Ping, Ecco, Footjoy, XXIO, Cleveland, Sunview GOLF, FJ, Number golf, Eson, Sunny haha, Callaway Golf, TaylorMade, Titleist, PING, .

The market segments include Application, Type.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Women's Golf Drivers," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Women's Golf Drivers, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.