1. What is the projected Compound Annual Growth Rate (CAGR) of the Wine Bag-in-Box?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Wine Bag-in-Box

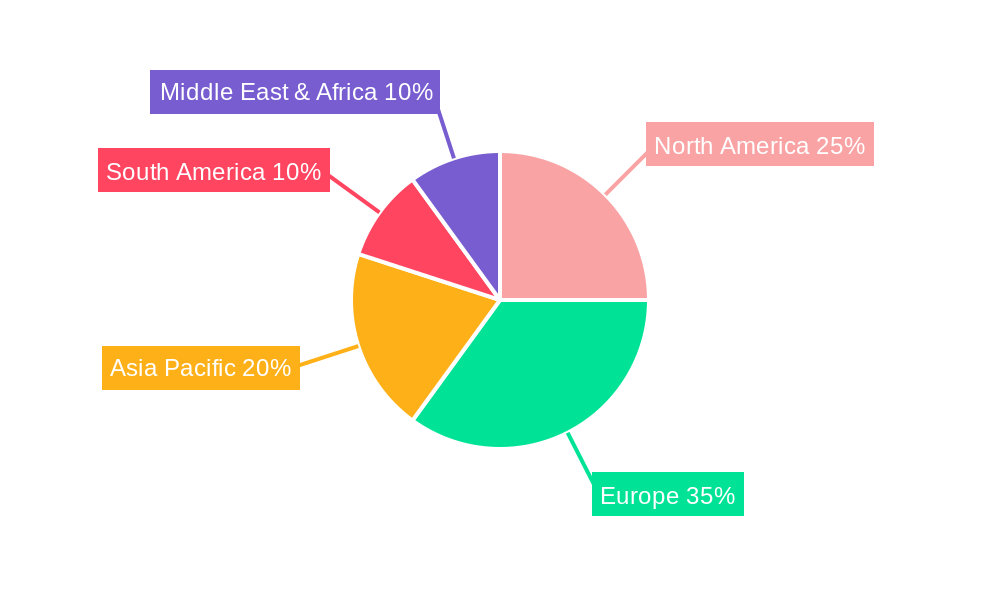

Wine Bag-in-BoxWine Bag-in-Box by Type (Less than 1 litre, 1 litre to 2 litres, 3 litre to 5 litres, 5 litre to 10 litres, More than 10 litres, World Wine Bag-in-Box Production ), by Application (Wine, Whisky, Champagne, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

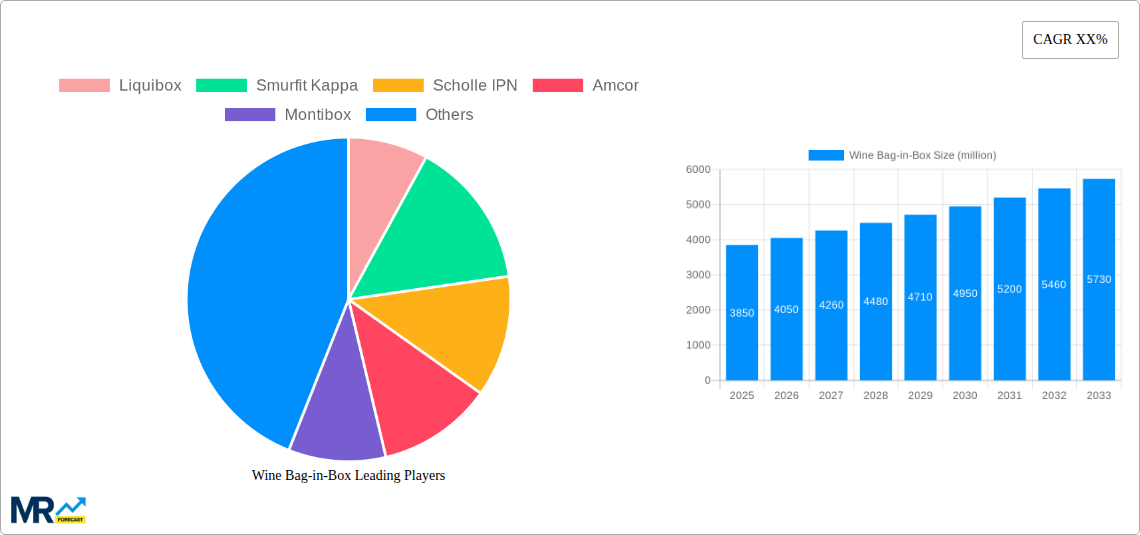

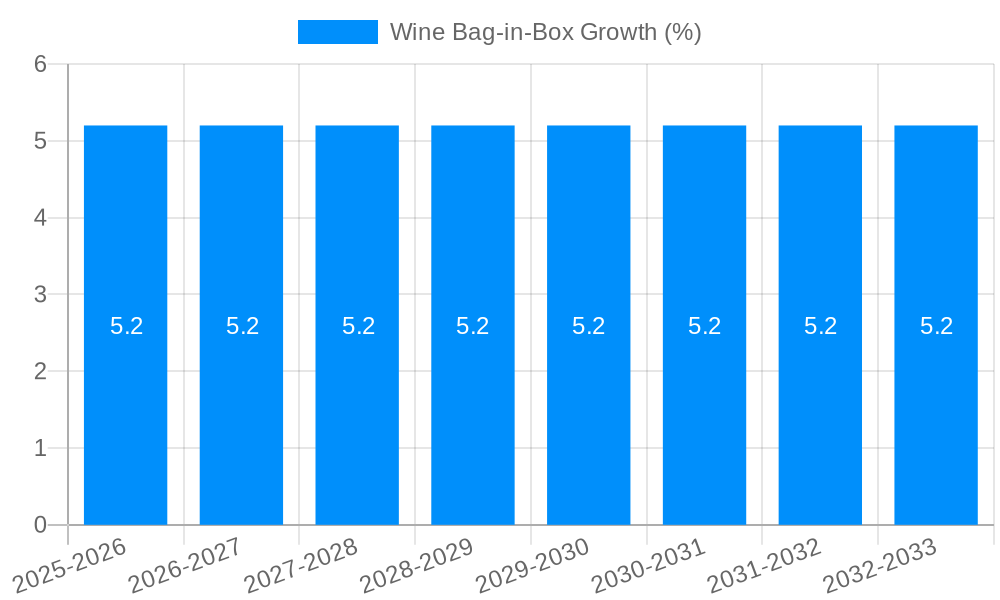

The global Wine Bag-in-Box market is experiencing robust expansion, projected to reach an estimated USD 3,850 million by 2025, with a compelling Compound Annual Growth Rate (CAGR) of 5.2% through 2033. This growth is fueled by an increasing consumer preference for convenience, sustainability, and value, particularly among younger demographics and for at-home consumption. The superior shelf life offered by bag-in-box packaging, coupled with its reduced environmental footprint compared to traditional glass bottles, are significant drivers. The market's expansion is further propelled by the growing popularity of wines sold in larger formats, catering to social gatherings and extended enjoyment. Key segments like the 5-liter to 10-liter and more than 10-liter capacities are witnessing substantial demand, reflecting this trend. Applications beyond wine, such as the packaging of spirits like whisky, are also contributing to market diversification and growth.

The competitive landscape is characterized by innovation in materials and dispensing technologies, with companies like Liquibox, Smurfit Kappa, and Scholle IPN leading the charge. These players are focusing on developing more eco-friendly and user-friendly solutions, including advanced barrier films and ergonomic tap designs. Emerging markets in Asia Pacific, particularly China and India, are presenting significant opportunities due to their rapidly growing middle class and increasing adoption of Western consumption patterns. Restraints, such as the perception of premium wine packaging in glass, are being addressed through continuous product development and marketing efforts that highlight the benefits of bag-in-box. The market's trajectory indicates a sustained period of growth, driven by evolving consumer habits and the inherent advantages of this flexible packaging solution.

The global Wine Bag-in-Box market is experiencing a significant upward trajectory, driven by evolving consumer preferences and a growing appreciation for sustainable and convenient packaging solutions. During the historical period of 2019-2024, the market demonstrated consistent growth, a trend anticipated to accelerate in the coming years. The base year of 2025 positions the market at an estimated value of over 7,500 million units, a figure projected to reach in excess of 10,000 million units by 2033, reflecting a compound annual growth rate (CAGR) of approximately 3.5% during the forecast period of 2025-2033. This expansion is largely attributable to the increasing adoption of Bag-in-Box (BiB) packaging for wine, particularly in developed markets where consumers are increasingly seeking smaller, more manageable portions and extended shelf-life for their beverages. The inherent benefits of BiB, such as reduced oxygen ingress, which preserves wine quality for significantly longer periods compared to traditional bottles, are resonating with both producers and end-users.

Furthermore, the environmental consciousness of consumers is playing a pivotal role. BiB packaging boasts a lower carbon footprint due to its lighter weight and more efficient transportation compared to glass bottles. This eco-friendly aspect is a key differentiator and a significant driver for market penetration, especially among younger demographics. The versatility of BiB format also caters to a wider range of consumption occasions, from casual home consumption to picnics and outdoor gatherings. As the market matures, we are witnessing innovative product designs and material advancements, including improved barrier films and dispensing tap technologies, further enhancing the appeal and functionality of wine BiB. The study period, spanning from 2019 to 2033, encapsulates a dynamic phase of innovation and market consolidation, with a strong focus on enhancing user experience and environmental sustainability. The estimated value for 2025 underscores the established presence and growing market share of BiB in the wine industry.

The burgeoning demand for wine Bag-in-Box packaging is fueled by a confluence of compelling factors that address contemporary consumer and industry needs. A primary driver is the escalating demand for convenience and portion control. As lifestyles become more dynamic, consumers are increasingly opting for packaging that aligns with their immediate consumption needs. Wine BiB, particularly in formats between 1 and 5 liters, offers an ideal solution, allowing consumers to enjoy a glass or two without the commitment of an entire bottle, thereby reducing waste and maintaining freshness. This appeal is further amplified by the extended shelf-life offered by BiB technology. The tap mechanism effectively minimizes oxygen exposure once opened, significantly prolonging the wine's quality and taste, a stark contrast to traditional corked bottles which can degrade rapidly. This preservation aspect is highly valued by consumers who enjoy wine over several days.

Moreover, the environmental imperative is a significant propellant. The growing global awareness of sustainability has positioned BiB as an eco-friendly alternative to glass bottles. Its lightweight nature translates to reduced transportation emissions and fuel consumption, while the materials used in its construction are often recyclable. This reduced environmental footprint aligns with the purchasing decisions of an increasing segment of environmentally conscious consumers. The cost-effectiveness of BiB packaging for producers, stemming from lower production and logistics expenses, also contributes to its widespread adoption. These savings can often be passed on to consumers, making wine more accessible and affordable, thereby broadening the market appeal. The overall shift towards a more relaxed and less formal approach to wine consumption further supports the rise of BiB, as it is perceived as a more approachable and practical option for everyday enjoyment.

Despite its robust growth, the wine Bag-in-Box market is not without its challenges and restraints, which could potentially temper its expansion. A significant hurdle remains the prevailing perception of BiB packaging as being associated with lower-quality wines. For decades, the premium wine segment has been dominated by glass bottles, creating a long-standing image that BiB is primarily for mass-produced, budget-friendly wines. Overcoming this entrenched perception and convincing consumers and premium wine producers that BiB can effectively house and preserve high-quality vintages requires substantial marketing efforts and educational campaigns. This is crucial for unlocking the full market potential, particularly in regions with strong traditional wine cultures.

Another restraint stems from the relatively complex recycling infrastructure for certain BiB components. While the overall carbon footprint is lower, the multi-layered nature of the pouches and the plastic taps can sometimes pose challenges for municipal recycling facilities, leading to lower recycling rates in some areas. Efforts are underway to develop more easily recyclable materials, but widespread adoption and standardization are still in progress. Furthermore, the initial investment in specialized filling and packaging machinery can be a barrier for smaller wineries or those transitioning from traditional bottling lines. While the long-term cost savings are evident, the upfront capital expenditure can be a significant deterrent. Finally, consumer education regarding the proper disposal and recyclability of BiB pouches is still needed in many markets to ensure the full environmental benefits are realized. Addressing these challenges is vital for sustained and widespread market growth.

The 3-litre to 5-litre segment, particularly within the Wine application, is poised to be a dominant force in the global Wine Bag-in-Box market. This segment's ascendancy is underpinned by its optimal balance of volume, convenience, and affordability, catering directly to the evolving consumption patterns of a broad consumer base.

Dominant Segment: 3-litre to 5-litre (Type)

Dominant Application: Wine

Key Dominant Regions/Countries:

The interplay between the dominant 3-litre to 5-litre segment and the overarching wine application, within the context of these key regions, paints a clear picture of where the market's energy and growth are concentrated. The continuous innovation in pouch technology and dispensing systems further solidifies the dominance of these elements.

The wine Bag-in-Box industry is experiencing robust growth fueled by several key catalysts. Foremost is the accelerating consumer demand for sustainability and reduced environmental impact. BiB packaging's lower carbon footprint compared to traditional glass bottles, due to lighter weight and more efficient transportation, resonates strongly with eco-conscious consumers. Furthermore, the increasing preference for convenience and portion control, particularly among younger demographics, is a significant driver. BiB offers extended shelf-life and a tap system that allows for consumption over time without compromising quality. This addresses concerns about waste and spoilage. The cost-effectiveness of BiB for both producers and consumers, resulting in more accessible wine options, also plays a crucial role in market expansion.

This comprehensive report delves deep into the global Wine Bag-in-Box market, providing an in-depth analysis of its trends, drivers, and challenges. Covering the historical period from 2019 to 2024 and projecting forward to 2033, the report offers crucial insights for stakeholders. It examines key market segments by type, including less than 1 litre, 1 litre to 2 litres, 3 litre to 5 litres, 5 litre to 10 litres, and more than 10 litres, along with the dominant application of Wine, and explores niche areas like Whisky and Champagne. The report also highlights significant industry developments and identifies leading players such as Liquibox, Smurfit Kappa, and Scholle IPN. With detailed forecasts and strategic recommendations, this report aims to equip businesses with the knowledge needed to navigate and capitalize on the evolving landscape of the wine Bag-in-Box market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Liquibox, Smurfit Kappa, Scholle IPN, Amcor, Montibox, STI-Gustav Starbernack, DS Smith, Optopack, Parish Manufacturing, Aran Group, Rapak, Shanghai Forest Packaging Holding, Qingdao Haide Packaging, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Wine Bag-in-Box," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Wine Bag-in-Box, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.