1. What is the projected Compound Annual Growth Rate (CAGR) of the Window Films for Electronics?

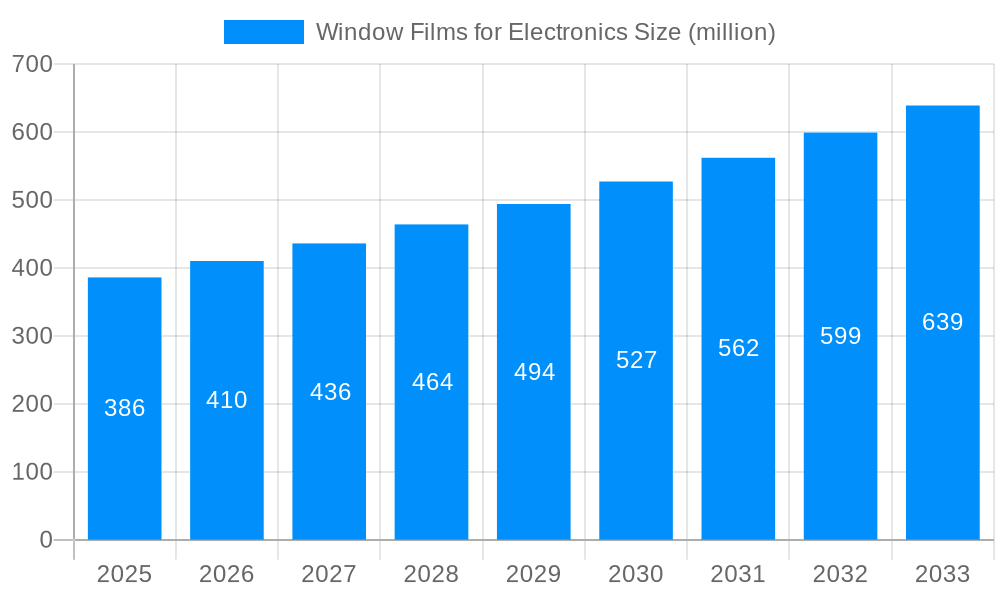

The projected CAGR is approximately 5.6%.

Window Films for Electronics

Window Films for ElectronicsWindow Films for Electronics by Type (Light Control Films, Protective Films, Others), by Application (Consumer Electronics, Automotive Electronics, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

The global market for Window Films for Electronics is poised for robust expansion, with a current valuation of USD 264.4 million and a projected Compound Annual Growth Rate (CAGR) of 5.6% during the forecast period of 2025-2033. This growth is significantly driven by the escalating demand for advanced display technologies and the increasing integration of electronics in everyday devices. Protective films are anticipated to dominate the market due to their critical role in safeguarding sensitive electronic components from physical damage, scratches, and environmental factors. Light control films are also gaining traction, particularly in applications requiring glare reduction and enhanced visual comfort, such as in automotive displays and smart windows. The proliferation of consumer electronics, including smartphones, tablets, and wearable devices, coupled with the burgeoning automotive electronics sector, are the primary engines propelling this market forward. Emerging applications in the Internet of Things (IoT) and advanced display solutions will further fuel innovation and market penetration.

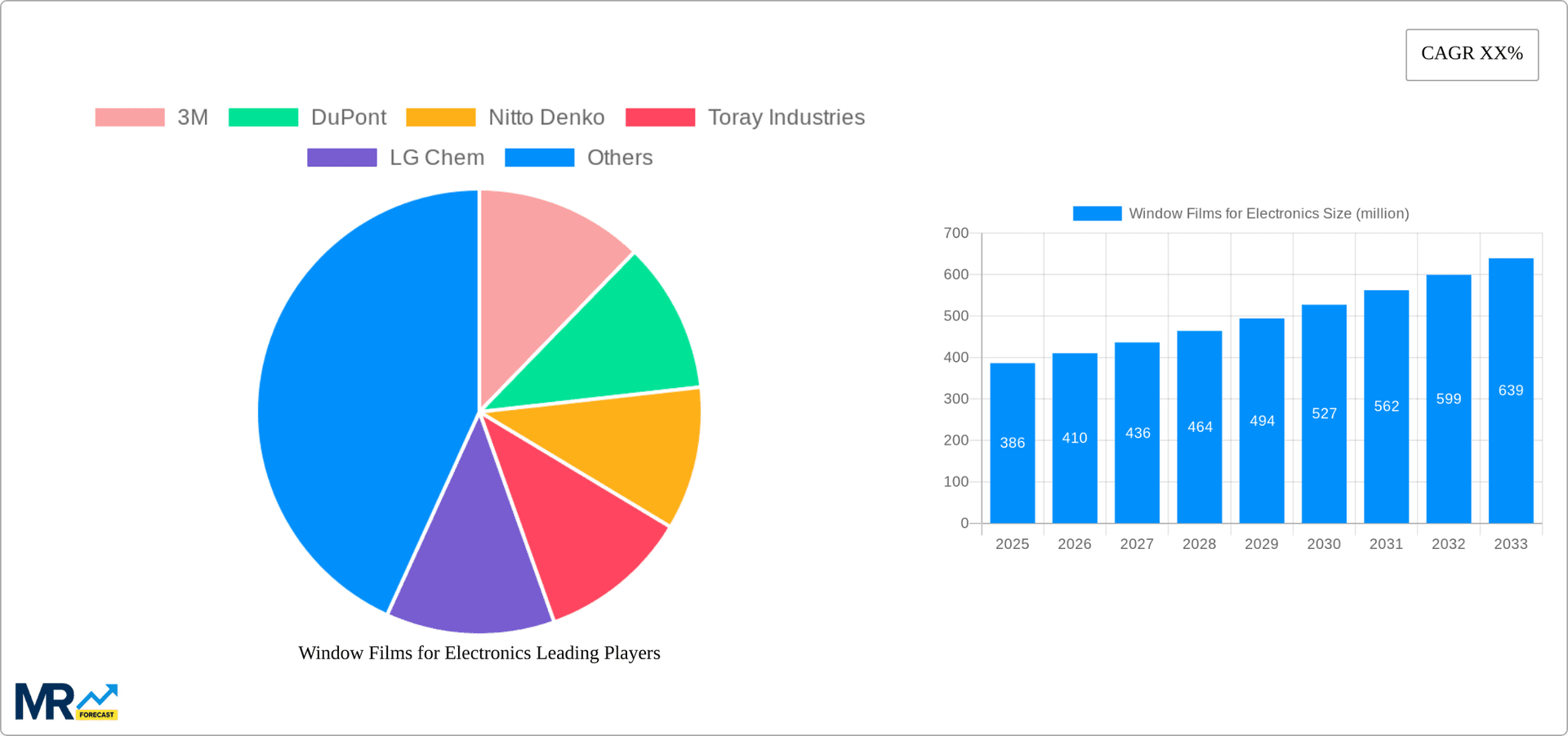

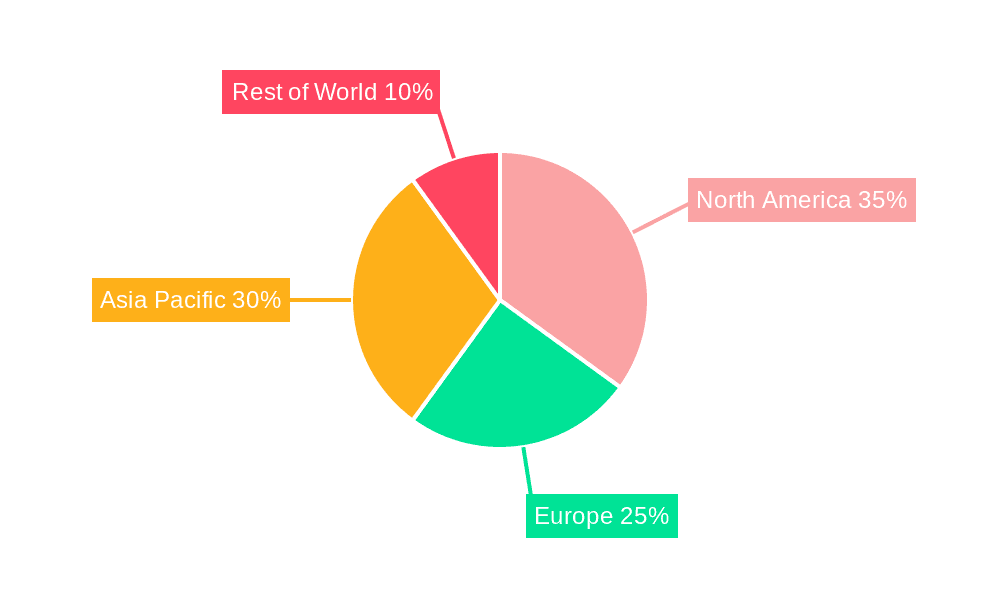

The market's trajectory is shaped by several key trends, including the growing adoption of flexible and transparent electronic displays, necessitating specialized film solutions. Innovations in material science are leading to the development of thinner, more durable, and optically superior window films. However, the market faces certain restraints, such as the high cost of advanced film manufacturing and the presence of substitute materials in specific low-end applications. Despite these challenges, the strategic focus of leading companies like 3M, DuPont, and Nitto Denko on research and development, alongside strategic partnerships and acquisitions, is expected to foster sustained growth. Asia Pacific, led by China and Japan, is projected to remain the largest and fastest-growing regional market, owing to its strong manufacturing base for electronics and a rapidly expanding consumer market. North America and Europe also represent significant markets, driven by advancements in automotive and consumer electronics.

This comprehensive report delves into the dynamic and rapidly evolving global market for Window Films for Electronics. Spanning a detailed Study Period of 2019-2033, the analysis encompasses a robust Historical Period from 2019-2024, a precise Base Year and Estimated Year of 2025, and an extensive Forecast Period from 2025-2033. The market is meticulously segmented by Type into Light Control Films, Protective Films, and Others, and by Application into Consumer Electronics, Automotive Electronics, and Others. We project significant market expansion, with the global market size poised to reach an impressive XXX million units by 2033.

The global market for Window Films for Electronics is experiencing a transformative surge, driven by an insatiable demand for advanced display technologies and enhanced user experiences across a multitude of electronic devices. A key trend observed is the escalating adoption of sophisticated Light Control Films, particularly those incorporating functionalities like anti-glare, anti-reflection, and polarization. These films are crucial for improving visual clarity and reducing eye strain in high-ambient light conditions, making them indispensable for smartphones, tablets, laptops, and outdoor displays. The market is also witnessing a pronounced shift towards the integration of smart functionalities within these films. This includes the development and commercialization of electrochromic and thermochromic films that can dynamically adjust their light transmission properties, catering to user preferences and energy efficiency goals. For instance, applications in automotive displays and smart windows are rapidly gaining traction, promising a more adaptive and personalized visual environment.

Furthermore, the relentless pursuit of durability and protection in electronic devices fuels the growth of Protective Films. These films are engineered to withstand scratches, impacts, and environmental degradation, ensuring the longevity and aesthetic appeal of sensitive electronic components. The increasing miniaturization and fragility of modern electronics, from wearable devices to high-end automotive infotainment systems, necessitate robust protective solutions. Manufacturers are investing heavily in research and development to create thinner, more transparent, and highly resilient protective films that do not compromise touchscreen sensitivity or visual fidelity. The "Others" category is also dynamic, encompassing specialized films for applications such as privacy enhancement, electromagnetic interference (EMI) shielding, and thermal management, all of which are critical for the performance and security of advanced electronic systems. The market is characterized by an ongoing innovation cycle, with continuous advancements in material science, manufacturing processes, and functional integration, ensuring that window films remain a critical enabler of next-generation electronics. The projected market value signifies a substantial growth trajectory, underscoring the indispensable role these films play in the modern electronic landscape, with a projected XXX million units in market volume.

Several potent forces are collaboratively propelling the global Window Films for Electronics market towards significant growth. The paramount driver is the exponential expansion of the Consumer Electronics sector. The ubiquitous presence of smartphones, tablets, smartwatches, and advanced televisions, all featuring sophisticated display technologies, creates a continuous and substantial demand for high-performance window films. As consumers increasingly prioritize immersive visual experiences and device durability, manufacturers are compelled to integrate superior light control and protective film solutions. Concurrently, the burgeoning Automotive Electronics segment presents another powerful growth engine. Modern vehicles are transforming into connected, intelligent platforms, replete with advanced infotainment systems, digital dashboards, and augmented reality displays. The integration of dynamic and highly responsive window films is crucial for enhancing driver visibility, reducing glare, and ensuring the longevity of these complex electronic components, especially as autonomous driving technologies mature.

Moreover, the relentless pace of technological innovation within the electronics industry itself acts as a significant catalyst. The development of flexible displays, foldable screens, and micro-LED technology necessitates novel film solutions that can adapt to new form factors and performance requirements. The drive for energy efficiency also plays a crucial role, with advancements in electrochromic and smart window technologies offering solutions for optimizing light and heat management in both consumer and automotive applications. This confluence of expanding end-user markets, technological advancements, and a growing emphasis on performance and user experience paints a robust picture for the future of window films in electronics, with a projected market volume reaching XXX million units.

Despite the promising growth trajectory, the Window Films for Electronics market is not without its inherent challenges and restraints. One of the primary hurdles is the high cost of research and development (R&D) associated with creating advanced and specialized films. Developing novel materials with unique properties like enhanced scratch resistance, superior optical clarity, and dynamic light control requires substantial investment in cutting-edge technology and scientific expertise. This can limit the market entry for smaller players and create a significant barrier to rapid innovation adoption. Furthermore, the complexity of manufacturing processes for highly engineered window films can also pose a significant challenge. Achieving consistent quality, precise adhesion, and defect-free production at scale requires sophisticated machinery and stringent quality control measures, which can translate to higher manufacturing costs and longer lead times.

Another notable restraint is the increasing commoditization of basic protective films. As the market matures, competition intensifies, leading to price pressures on standard protective film offerings. Manufacturers are constantly challenged to differentiate their products through value-added features and innovative functionalities to escape this commoditization trap. Supply chain disruptions, a persistent concern in the global manufacturing landscape, can also impact the availability and cost of raw materials essential for window film production. Geopolitical instability, natural disasters, and logistical bottlenecks can lead to production delays and price volatility, affecting market stability. Finally, evolving regulatory landscapes and environmental concerns regarding material sourcing, disposal, and chemical content can necessitate costly adaptations and compliance efforts, potentially slowing down market expansion in certain regions. These factors, while not insurmountable, demand strategic planning and continuous adaptation from market participants to ensure sustained growth and profitability within the XXX million units market.

The global Window Films for Electronics market is poised for significant growth, with certain regions and segments exhibiting dominant potential. Among the key regions, Asia-Pacific is anticipated to emerge as the leading force, driven by its robust manufacturing capabilities, burgeoning consumer electronics industry, and significant advancements in automotive production. Countries like China, South Korea, and Japan are at the forefront of electronic device manufacturing, acting as major hubs for the production and consumption of window films. The sheer volume of smartphones, televisions, and wearable devices produced in this region, coupled with a rapidly growing middle class demanding premium electronic products, underpins this dominance. Furthermore, the aggressive expansion of the automotive sector in countries like China, with a strong focus on integrating advanced in-car electronics and displays, further solidifies Asia-Pacific's leadership.

Within the segments, Consumer Electronics stands out as the most dominant application. The ever-present demand for smartphones, tablets, laptops, and other personal electronic devices creates a continuous and substantial market for both protective and light control films. The rapid product refresh cycles in this sector, driven by consumer desire for the latest technology and features, ensure a consistent need for high-quality window films that enhance visual experience and protect against daily wear and tear. The evolution towards larger, brighter, and more immersive displays in televisions and monitors further amplifies this demand.

In terms of film Type, Protective Films are expected to maintain a strong market share due to their fundamental necessity across virtually all electronic devices. The increasing fragility and aesthetic sensitivity of modern electronics, coupled with the desire for product longevity, make robust protective solutions indispensable. This includes films offering scratch resistance, impact protection, and anti-fingerprint properties. However, Light Control Films are projected to witness the most significant growth rate. As display technologies advance and the demand for enhanced visual comfort and energy efficiency rises, films with advanced functionalities like anti-glare, anti-reflection, polarization, and even dynamic tinting are becoming increasingly sought after. The automotive sector's adoption of these films for driver displays and smart windows will be a key growth catalyst for this segment. The combined dominance of the Asia-Pacific region and the Consumer Electronics application, supported by the foundational role of Protective Films and the rapid expansion of Light Control Films, will shape the market landscape, contributing significantly to the projected XXX million units market size.

The Window Films for Electronics industry is fueled by several potent growth catalysts. The relentless innovation in display technologies, including OLED, micro-LED, and flexible screens, necessitates the development of specialized films that can enhance performance and durability. The increasing integration of electronics in the automotive sector, with a growing demand for advanced infotainment systems and digital dashboards, is a significant driver. Furthermore, the rising consumer preference for premium electronic devices that offer enhanced visual clarity, protection, and aesthetic appeal directly translates to higher demand for advanced window films. The ongoing shift towards smart devices and the Internet of Things (IoT) also opens up new avenues for functional films with features like EMI shielding and privacy control.

This report provides an in-depth and holistic examination of the global Window Films for Electronics market, offering invaluable insights for stakeholders. It meticulously analyzes market dynamics, including historical trends, current scenarios, and future projections. The report delves into the key drivers, challenges, and opportunities shaping the market landscape. Detailed segmentation by type and application, coupled with regional analysis, allows for a granular understanding of market performance. Furthermore, the report provides a comprehensive overview of the competitive landscape, profiling leading manufacturers and their strategic initiatives. The inclusion of industry developments, growth catalysts, and a robust forecast period ensures that readers are equipped with the most current and forward-looking information available, making it an indispensable resource for strategic decision-making within the XXX million units market.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.6% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 5.6%.

Key companies in the market include 3M, DuPont, Nitto Denko, Toray Industries, LG Chem, OIKE, Shin-Etsu Polymer, DNP Group, Avery Dennison, Kimoto, Chiefway, .

The market segments include Type, Application.

The market size is estimated to be USD 264.4 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Window Films for Electronics," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Window Films for Electronics, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.