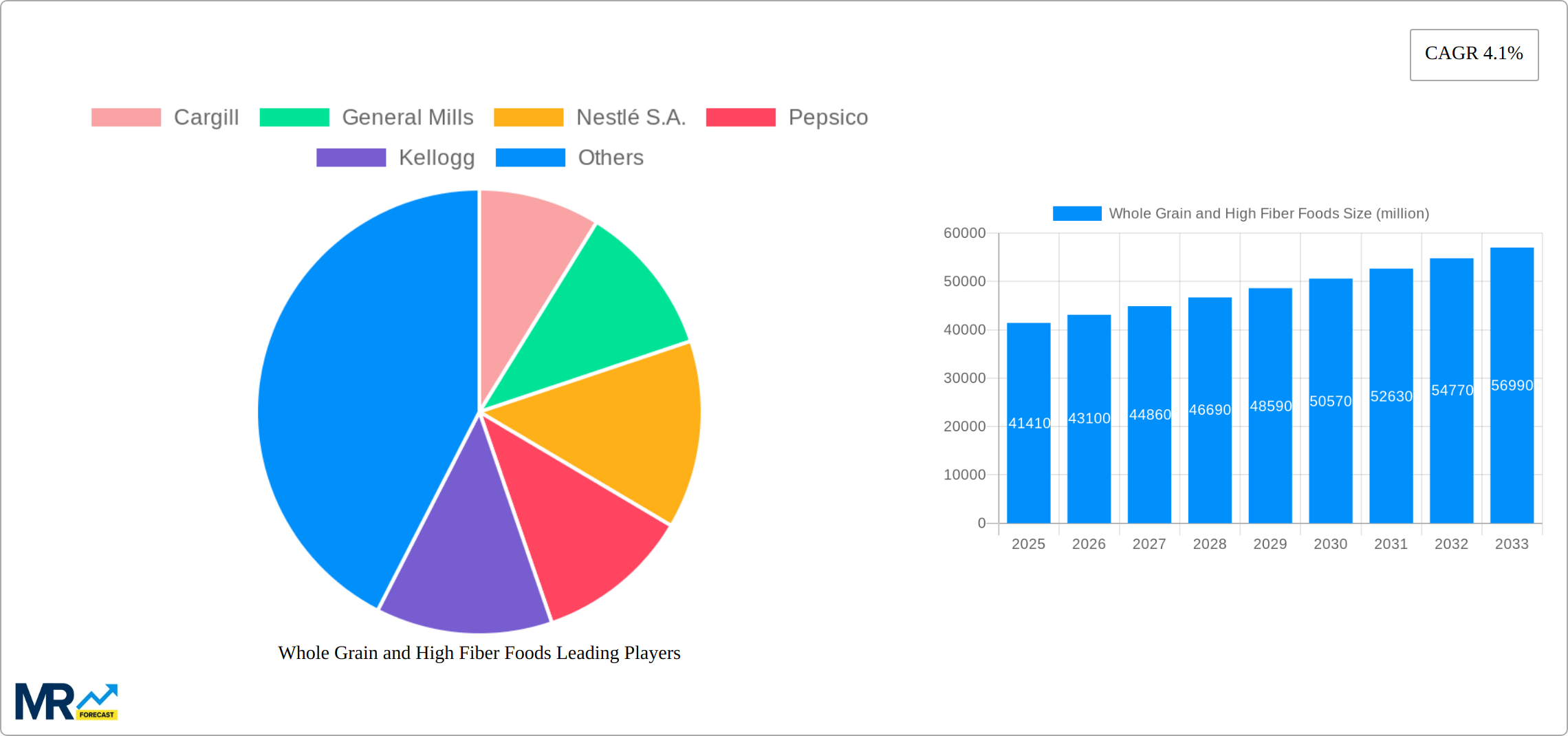

1. What is the projected Compound Annual Growth Rate (CAGR) of the Whole Grain and High Fiber Foods?

The projected CAGR is approximately 4.1%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Whole Grain and High Fiber Foods

Whole Grain and High Fiber FoodsWhole Grain and High Fiber Foods by Type (Baked Foods, Cereals, Snacks, Others), by Application (Supermarkets/hypermarkets, Online/e-Commerce, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

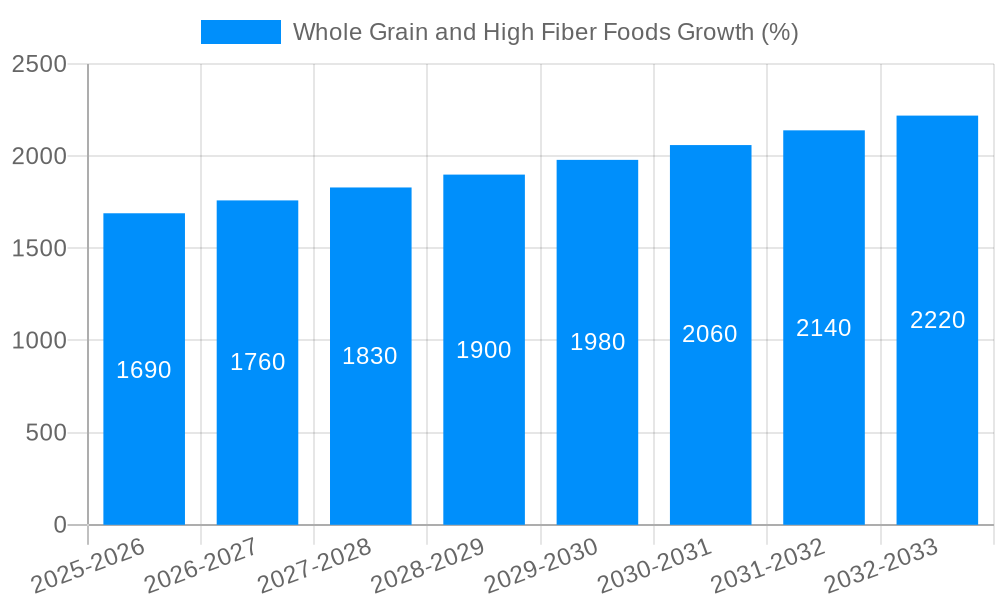

The global market for whole grain and high-fiber foods is experiencing robust growth, projected to reach $41.41 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 4.1% from 2025 to 2033. This expansion is fueled by increasing consumer awareness of the health benefits associated with high-fiber diets, including improved digestive health, weight management, and reduced risk of chronic diseases like type 2 diabetes and heart disease. The rising prevalence of these diseases globally, coupled with a growing preference for natural and minimally processed foods, is significantly driving demand. Key players like Cargill, General Mills, Nestlé, PepsiCo, and Kellogg are actively investing in product innovation and expanding their offerings within this segment to capitalize on these trends. The market is segmented by product type (bread, cereals, pasta, snacks, etc.), distribution channel (supermarkets, online retailers, etc.), and geography. While precise regional data is unavailable, it is likely that North America and Europe currently hold significant market share, given the high consumer awareness and established presence of major food companies in these regions. Future growth will likely be driven by increasing penetration in emerging markets and further innovation in product formats, catering to diverse consumer preferences.

The continued growth trajectory is further supported by the increasing adoption of plant-based diets and the growing demand for functional foods enriched with added fiber. The industry's response to these trends includes the development of products that cater to specific dietary needs and preferences, such as gluten-free and organic options. However, challenges remain, including maintaining consistent product quality and managing the cost of sourcing high-quality whole grains. Furthermore, consumer education regarding the benefits of whole grains and fiber, as well as addressing misconceptions about taste and texture, remains crucial for sustaining long-term market growth. Nevertheless, the overall outlook for the whole grain and high-fiber foods market remains positive, indicating significant opportunities for established players and new entrants alike.

The global whole grain and high-fiber foods market is experiencing robust growth, projected to reach XXX million units by 2033. This expansion is fueled by a confluence of factors, including a heightened consumer awareness of the health benefits associated with these foods. The historical period (2019-2024) witnessed a steady increase in demand, driven by the rising prevalence of lifestyle diseases like obesity, diabetes, and heart disease. Consumers are actively seeking dietary solutions to mitigate these risks, leading to a significant shift towards healthier food choices. This trend is particularly evident in developed nations, where health consciousness is high and disposable incomes allow for premium food purchases. However, growth is not limited to developed markets. Developing countries are also seeing increased adoption of whole grain and high-fiber foods, driven by rising middle classes and increased access to information regarding nutrition. The estimated year 2025 shows a market value of XXX million units, representing a substantial increase compared to previous years. This growth is anticipated to continue throughout the forecast period (2025-2033), with consistent year-on-year increases driven by ongoing health awareness campaigns, product innovation, and the introduction of convenient and palatable whole grain and high-fiber options. The market is witnessing increased diversification in product offerings, including whole-grain breads, cereals, pastas, and snacks, catering to diverse consumer preferences and dietary needs. Furthermore, the increasing integration of these ingredients into ready-to-eat meals and processed foods indicates a broader market penetration and acceptance. The industry is also embracing sustainable sourcing and production practices, further enhancing the appeal of these products to environmentally conscious consumers. This multifaceted approach, encompassing health, convenience, and sustainability, ensures a strong and sustained trajectory for the whole grain and high-fiber foods market in the coming years.

Several key factors are driving the expansion of the whole grain and high-fiber foods market. The escalating prevalence of chronic diseases, such as obesity, type 2 diabetes, and cardiovascular diseases, is a significant driver. Consumers are increasingly aware of the link between diet and these health issues, leading to a greater demand for foods that promote digestive health, regulate blood sugar levels, and lower cholesterol. This is further amplified by government initiatives and public health campaigns promoting healthier diets, which raise awareness of the nutritional benefits of whole grains and fiber. The growing popularity of plant-based diets and flexitarian lifestyles also contributes significantly to market growth. Many plant-based foods are naturally high in fiber and whole grains, appealing to consumers adopting these dietary patterns. Furthermore, the rise of health and wellness trends, including mindful eating and functional foods, further supports the market's expansion. Consumers are actively seeking foods that provide added health benefits beyond basic nutrition, making whole grain and high-fiber options attractive choices. Innovation within the food industry plays a crucial role, with manufacturers continuously developing new products that are both nutritious and palatable. This includes incorporating whole grains and fiber into diverse food categories, such as snacks, baked goods, and ready-to-eat meals, thus broadening the market appeal and making healthy eating more accessible.

Despite the positive growth trajectory, the whole grain and high-fiber foods market faces several challenges. One major hurdle is the perception of whole grain products as less palatable or less convenient compared to refined grain alternatives. Many consumers associate whole grains with a coarser texture and less appealing taste, which can hinder adoption. Furthermore, the higher cost of whole grain and high-fiber ingredients can limit their accessibility, particularly for budget-conscious consumers. The production and processing of whole grains can also be more complex and expensive than refined grains, impacting the final product's price. Maintaining the quality and freshness of whole grain products can be challenging due to their higher susceptibility to spoilage compared to refined counterparts. This requires meticulous handling, storage, and preservation techniques, which add to the production costs. Moreover, the development of new products needs to overcome sensory challenges, ensuring products are appealing and meet consumer expectations regarding taste, texture, and shelf life. Finally, fluctuating raw material prices, particularly for grains, can also affect profitability and pricing strategies within the industry.

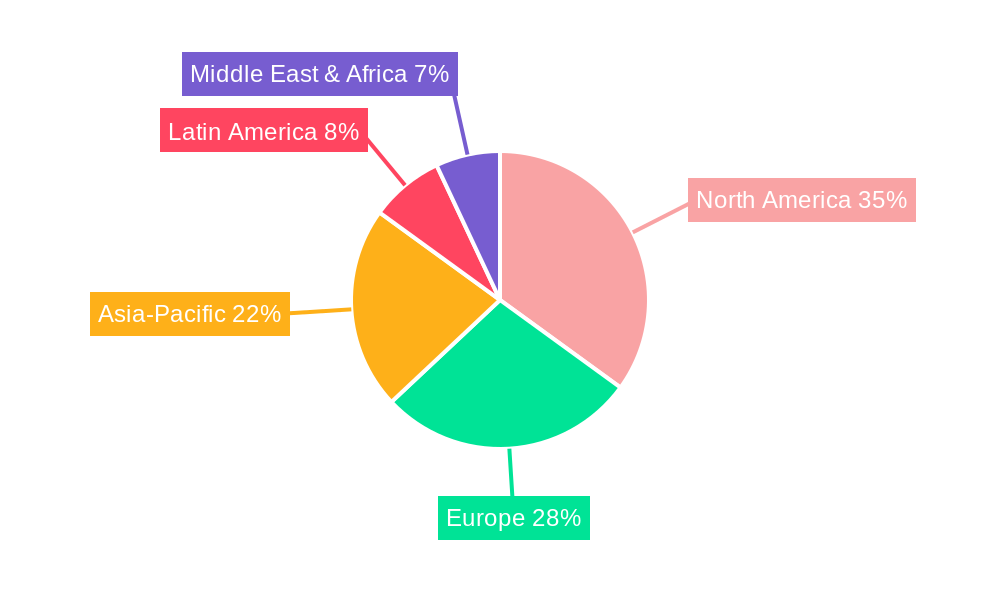

North America: This region is expected to maintain its dominance throughout the forecast period, driven by high health consciousness and strong consumer spending on premium food products. The increasing prevalence of chronic diseases and a focus on preventative healthcare further propel market growth here. The availability of a wide range of whole grain and high-fiber products, combined with strong marketing and distribution networks, also contribute to market leadership.

Europe: Europe is projected to witness significant growth, owing to increasing awareness of health benefits and a growing preference for natural and organic foods. Government regulations promoting healthy eating and initiatives supporting sustainable agriculture further stimulate market expansion in this region.

Asia-Pacific: This region exhibits high growth potential, driven by the burgeoning middle class, rising disposable incomes, and changing dietary patterns. The region's diverse food culture presents both opportunities and challenges. Adapting products to local tastes and preferences is crucial for success.

Segments: The cereals and breakfast foods segment is projected to hold a substantial market share, fueled by the high consumption of breakfast cereals and the increasing availability of whole-grain and high-fiber variants. The bakery products segment is also expected to experience robust growth due to the increasing popularity of whole-grain breads, muffins, and other baked goods. The pasta segment is witnessing a rise in demand for whole-grain pasta options, driven by the health-conscious consumer base.

The combination of strong consumer demand in North America and Europe alongside rapid growth in the Asia-Pacific region presents a diverse and promising landscape for whole grain and high-fiber food producers. The adaptability of these products to various food categories further strengthens their market position and guarantees considerable growth potential in years to come.

The whole grain and high-fiber foods industry is experiencing a surge driven by increasing health awareness, the growing prevalence of chronic diseases, and a shift towards healthier lifestyles. Product innovation, including the development of convenient and palatable whole grain products, plays a vital role. Furthermore, proactive government regulations and public health campaigns promoting whole grains and fiber reinforce consumer awareness and drive market expansion. These factors, combined with the expanding global middle class and increasing disposable incomes, create a robust and sustainable growth environment for the industry.

This report offers a comprehensive analysis of the whole grain and high-fiber foods market, providing valuable insights into market trends, growth drivers, challenges, and key players. It covers the historical period (2019-2024), the base year (2025), the estimated year (2025), and projects the market's trajectory throughout the forecast period (2025-2033). The report delves into regional and segmental analyses, highlighting key growth areas and opportunities within the industry, equipping stakeholders with a thorough understanding of the market dynamics. It also profiles leading companies, detailing their strategies and market share, providing actionable intelligence for informed decision-making.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.1% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 4.1%.

Key companies in the market include Cargill, General Mills, Nestlé S.A., Pepsico, Kellogg, Mondelez International, Flower Foods, Bob’s Red Mill, Food for Life, Grupo Bimbo, Campbell, Aunt Millie, Aryzta, Nature’s Path Foods, .

The market segments include Type, Application.

The market size is estimated to be USD 41410 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Whole Grain and High Fiber Foods," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Whole Grain and High Fiber Foods, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.