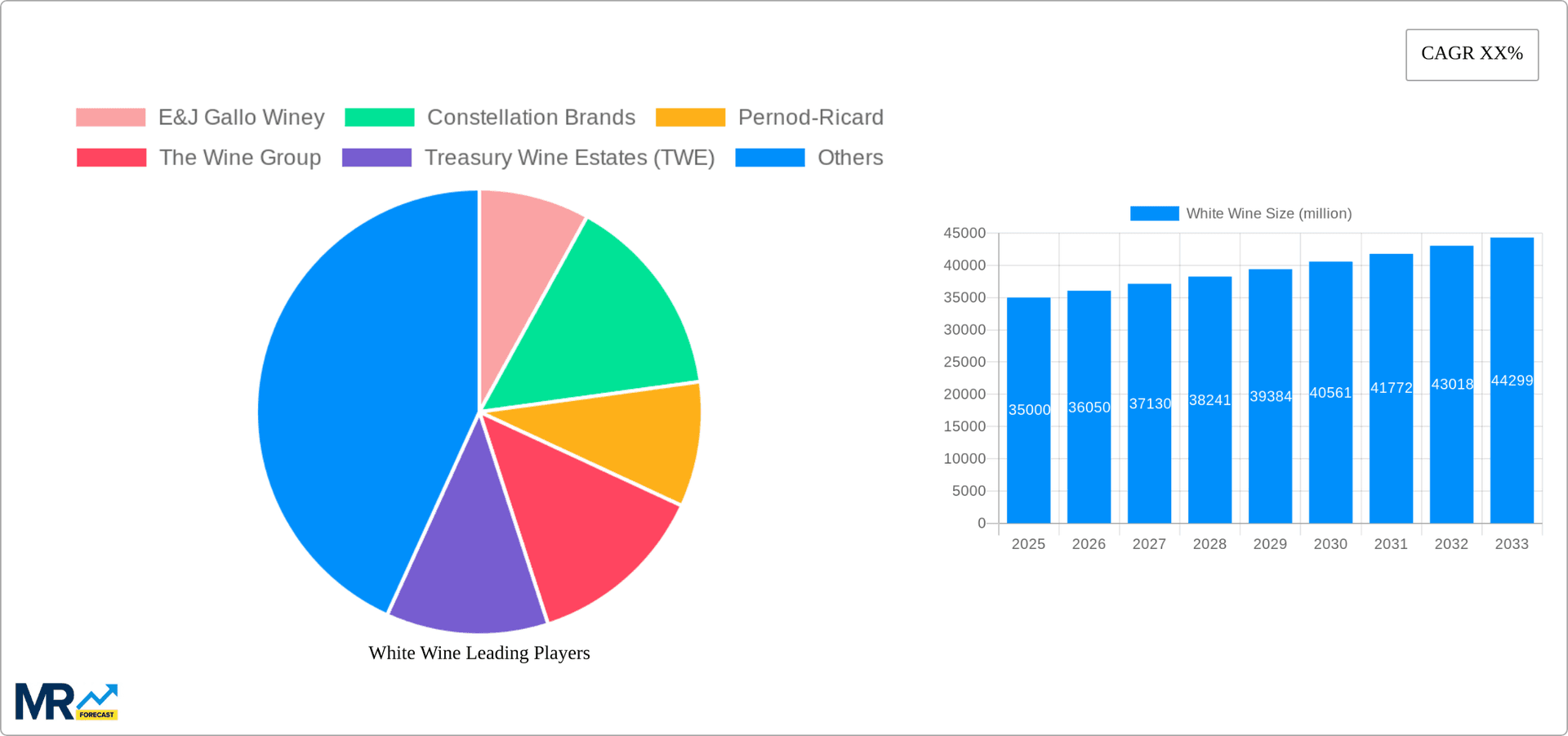

1. What is the projected Compound Annual Growth Rate (CAGR) of the White Wine?

The projected CAGR is approximately 4.3%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

White Wine

White WineWhite Wine by Application (Household, Commercial, Others), by Type (Dry White Wine, Semi-sweet White Wine, Sweet White Wine), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

The global white wine market is projected to reach $314.34 billion by 2033, exhibiting a compound annual growth rate (CAGR) of 4.3% from the base year 2025. This expansion is underpinned by rising disposable incomes in emerging economies, driving premium beverage consumption. Shifting consumer preferences towards healthier lifestyles and moderate alcohol intake also contribute positively. The versatility of white wine in culinary applications, coupled with the growing reach of e-commerce and direct-to-consumer channels, further stimulates demand. However, the market must navigate challenges such as climate-induced harvest fluctuations and competition from alternative alcoholic beverages.

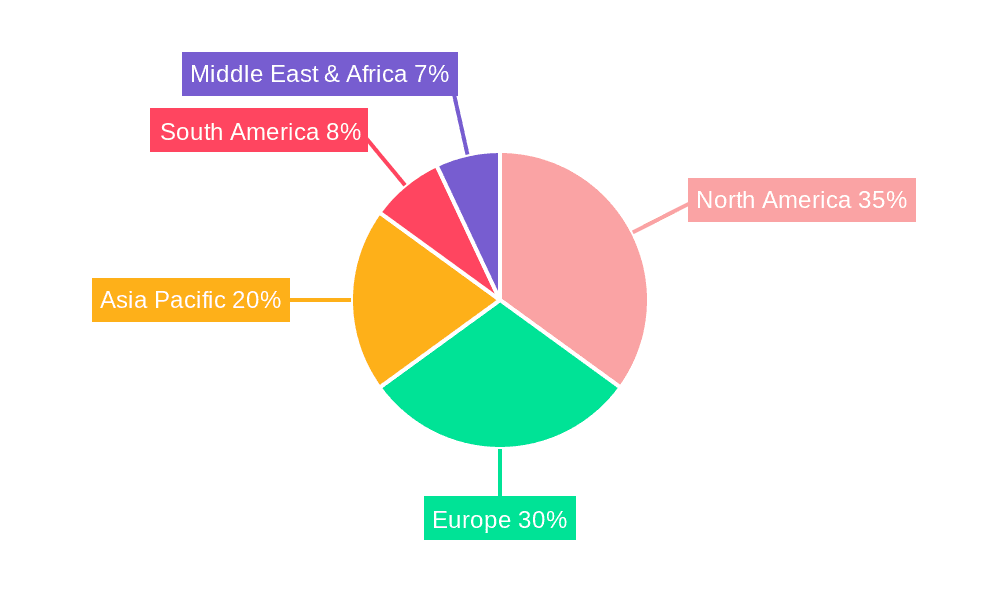

Analysis by segment indicates that dry white wines dominate, owing to their broad appeal. Semi-sweet and sweet varietals are also gaining traction, reflecting evolving consumer tastes. The household segment remains the primary application area, with the commercial sector, particularly in developed regions, also contributing significantly. North America and Europe are established leaders, while Asia Pacific presents substantial growth opportunities driven by a rising middle class and increased international brand exposure. Leading players like E&J Gallo Winery, Constellation Brands, and Pernod Ricard leverage established brands and distribution, while niche producers focus on specialized markets and direct sales. Continued growth is anticipated through 2033, contingent on economic stability, consumer behavior, and effective mitigation of industry challenges.

The global white wine market, valued at XXX million units in 2025, is poised for significant growth throughout the forecast period (2025-2033). Analysis of the historical period (2019-2024) reveals a fluctuating yet ultimately upward trajectory, influenced by several factors. Consumer preferences are shifting towards lighter, crisper wines, boosting demand for dry white wines, particularly Sauvignon Blanc and Pinot Grigio. This trend is particularly pronounced in younger demographics, who are increasingly seeking versatile wines that pair well with diverse cuisines. The growing popularity of wine-centric culinary experiences and sophisticated cocktail creations also drives market expansion. Furthermore, the rise of online wine retailers and subscription services has broadened accessibility and convenience for consumers. However, challenges remain, including fluctuating grape harvests due to climate change and increased competition from other alcoholic beverages. The market's future growth will hinge on the industry's ability to address these challenges while capitalizing on evolving consumer tastes and innovative distribution strategies. The increasing focus on sustainability and environmentally friendly practices within the wine industry also presents both opportunities and pressures for producers to meet evolving consumer demands. Premiumization is another key trend, with consumers willing to pay more for high-quality, sustainably produced white wines. This report delves deeper into these trends, analyzing market segments, competitive landscapes, and geographic variations to provide a comprehensive understanding of the white wine market's evolution. Finally, the influence of global events, like economic shifts and pandemic-related restrictions, cannot be ignored and have shaped consumer behavior and market performance over the study period (2019-2033).

Several factors contribute to the growth of the white wine market. Firstly, the rising disposable incomes in emerging economies are fueling increased demand for premium alcoholic beverages, including white wines. Secondly, the increasing popularity of health-conscious lifestyles is pushing consumers towards lighter alcoholic options, with white wine being perceived as a relatively healthier choice compared to some spirits or red wines (in moderation, of course). This trend is further augmented by marketing efforts emphasizing the potential health benefits associated with moderate wine consumption. Furthermore, the expansion of the global food service industry, encompassing restaurants, bars, and hotels, significantly fuels the demand for white wine, particularly in commercial settings. The continuous innovation in white wine production techniques, including the development of new wine varietals and improved winemaking processes, contribute to market diversification and attract new consumers. Finally, the growth of e-commerce and specialized online wine retailers provides increased accessibility and convenience for consumers, facilitating market expansion.

Despite the positive growth outlook, the white wine market faces certain challenges. Climate change significantly impacts grape yields and quality, leading to unpredictable harvests and potentially increased production costs. This unpredictability affects pricing and supply chain stability. Furthermore, intense competition from other alcoholic beverages, including beer, spirits, and ready-to-drink cocktails, poses a significant threat to market share. Price fluctuations in grapes and other production inputs can directly impact profitability. Government regulations and alcohol-related taxes in various regions can restrict market growth and increase production costs for wineries. Finally, evolving consumer preferences require continuous adaptation and innovation from producers to maintain market relevance and appeal to new demographics. Successfully navigating these challenges requires strategic planning, investment in sustainable production practices, and a strong focus on adapting to changing consumer demands and market dynamics.

The dry white wine segment is projected to hold the largest market share within the Type segment throughout the forecast period. This is driven by the increasing preference for lighter, crisper wines among consumers globally. Regions like Europe (particularly France, Italy, and Spain) and North America (primarily the United States and Canada) are expected to remain key contributors to the market's overall growth. However, emerging markets in Asia-Pacific (China, Japan, and Australia) and South America (particularly Chile and Argentina) show significant potential for expansion due to increasing disposable incomes and growing awareness of white wine as a premium alcoholic beverage.

In summary, the combination of consumer preference for dry white wines and the robust markets in Europe and North America makes them the key drivers of market growth. However, emerging markets in Asia and South America represent promising avenues for future expansion, highlighting the global appeal and dynamic nature of the white wine sector.

The white wine industry's growth is further catalyzed by the rise of craft wineries and boutique brands that offer unique and high-quality white wines. This caters to the growing demand for artisanal and locally sourced products. Additionally, the increasing popularity of wine tourism and experiences that involve winery tours and tastings promotes the white wine market and supports its continued expansion.

This report provides a comprehensive overview of the global white wine market, examining historical trends, current market dynamics, and future projections. It offers detailed analysis of key market segments, including by type, application, and geographic region. The report also profiles major players in the industry, providing insights into their market strategies and competitive landscape. Furthermore, it identifies significant growth opportunities and potential challenges facing the white wine market, providing valuable information for businesses operating in or considering entry into this dynamic sector. The comprehensive data and analysis offered in this report facilitate informed decision-making and strategic planning within the white wine industry.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.3% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 4.3%.

Key companies in the market include E&J Gallo Winey, Constellation Brands, Pernod-Ricard, The Wine Group, Treasury Wine Estates (TWE), Diageo, Accolade Wines, Casella Family Brands, Grupo Penaflor, Caviro Distillerie, Vina Concha y Toro, Castel Group, Trinchero Family Estates, Great Wall, Yantai Changyu Group, .

The market segments include Application, Type.

The market size is estimated to be USD 314.34 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in billion and volume, measured in K.

Yes, the market keyword associated with the report is "White Wine," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the White Wine, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.