1. What is the projected Compound Annual Growth Rate (CAGR) of the White Oak Substitute?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

White Oak Substitute

White Oak SubstituteWhite Oak Substitute by Type (Oak Chips, Oak Block, Others, World White Oak Substitute Production ), by Application (Wine, Whisky, Beer, Others, World White Oak Substitute Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

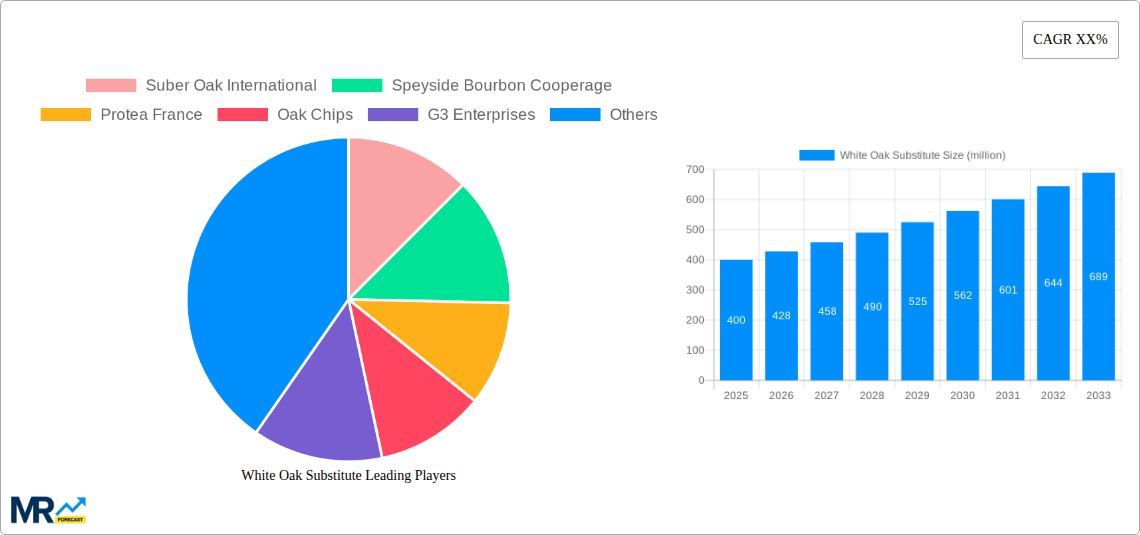

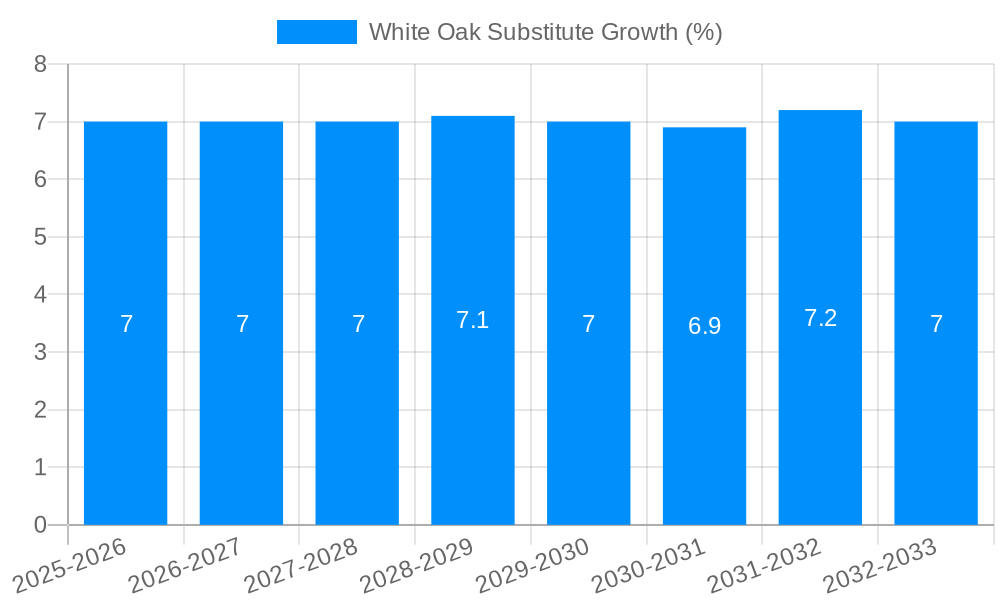

The global market for White Oak Substitutes is poised for robust expansion, driven by increasing demand for premium beverages like wine, whisky, and beer. With a current estimated market size of approximately USD 400 million and a projected Compound Annual Growth Rate (CAGR) of around 7% between 2025 and 2033, this sector is set to witness significant value creation. The primary drivers fueling this growth include the rising consumer preference for aged spirits and wines that exhibit complex flavor profiles, often achieved through traditional oak aging. However, the escalating cost and limited availability of genuine white oak, coupled with growing sustainability concerns regarding forest management, are compelling beverage producers to explore and adopt effective oak substitutes. These substitutes, ranging from oak chips and blocks to more advanced barrel inserts and staves, offer a cost-effective and environmentally conscious alternative for imparting desirable oak characteristics such as vanilla, spice, and toasted notes. The market's trajectory will be further shaped by innovations in extraction and application techniques that mimic the nuanced aging process, making premium flavor profiles accessible to a broader range of products and consumers.

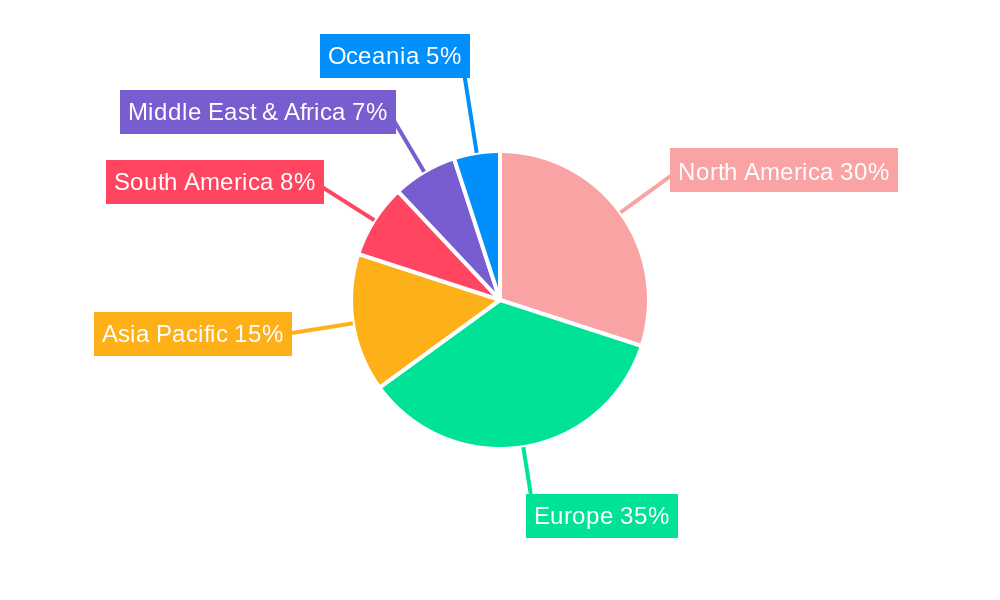

The market segmentation reveals a diverse landscape, with oak chips and blocks likely dominating in terms of volume due to their widespread adoption and versatility in various beverage applications. The "Others" category, encompassing innovative solutions like oak extracts and specialized wood pieces, is expected to experience substantial growth as producers seek enhanced control over flavor profiles and aging times. Geographically, North America and Europe are anticipated to remain the leading markets, owing to their well-established beverage industries and high consumption of aged spirits and wines. However, the Asia Pacific region, particularly China and India, is emerging as a significant growth frontier, fueled by a burgeoning middle class and an increasing appetite for Western-style beverages. Restraints, such as the need for rigorous quality control to ensure consistency in flavor and potential consumer skepticism towards non-traditional aging methods, will need to be addressed by market players. Nevertheless, the overarching trend towards premiumization, coupled with the inherent advantages of oak substitutes in terms of cost and sustainability, paints a promising picture for the future of this dynamic market.

Here's a unique report description for "White Oak Substitute," incorporating your specified elements and word counts:

The global market for white oak substitutes is experiencing a significant evolution, driven by both supply-side pressures and evolving consumer preferences, with projected production to reach 150 million liters by 2025. Throughout the study period of 2019-2033, the market has witnessed a steady upward trajectory, accelerated by the critical need for sustainable and cost-effective alternatives to traditional white oak, particularly for aging spirits and wines. The base year of 2025 marks a pivotal point, with expectations of robust growth in the forecast period (2025-2033). During the historical period (2019-2024), the scarcity and rising costs of premium white oak, coupled with an increased demand from the burgeoning spirits industry, laid the foundation for the emergence and acceptance of substitutes. Key market insights reveal a growing sophistication in substitute offerings, moving beyond simple wood chips to more innovative and controlled extraction methods. The market is characterized by a dynamic interplay between established cooperages and new entrants focusing on technological advancements. For instance, the demand for oak chips, a segment projected to reach 70 million liters in 2025, has seen substantial growth due to their versatility and quicker infusion times compared to larger oak blocks. The application in the whisky segment, which is forecast to account for 90 million liters of the total production by 2033, continues to be a primary driver. However, the wine industry's increasing interest in oak alternatives to achieve specific flavor profiles without the cost and time commitment of barrel aging is also becoming a noteworthy trend, with an estimated 30 million liters in 2025 dedicated to this application. The overall sentiment within the industry is one of cautious optimism, with a strong emphasis on ensuring that substitutes deliver comparable, if not superior, sensory profiles to traditional oak, thereby maintaining the integrity and perceived value of the final product. This continuous innovation in product development, coupled with strategic market penetration, is expected to shape the future landscape of oak aging solutions.

The escalating cost and limited availability of genuine white oak have emerged as primary catalysts for the widespread adoption of white oak substitutes. This supply-side constraint, exacerbated by factors such as climate change impacting oak forests and sustained high demand from the spirits and wine industries, has compelled producers to seek viable alternatives. Consequently, the global white oak substitute market is on track to achieve a production volume of 150 million liters by the estimated year of 2025. Furthermore, technological advancements in processing and extraction have enabled the creation of substitutes that more effectively mimic the desired flavor compounds and aging characteristics typically imparted by traditional oak barrels. These innovations allow for greater control over the extraction of tannins, vanillin, and other desirable aromatic molecules, providing beverage producers with a more predictable and customizable aging experience. The growing demand for premium spirits and wines, particularly in emerging markets, also plays a crucial role. As these markets mature and consumer palates become more discerning, the need for consistent quality and nuanced flavor profiles becomes paramount. White oak substitutes offer a more accessible and scalable solution for producers to meet this demand, contributing to the projected growth in production to 165 million liters by 2033. This confluence of scarcity, innovation, and market demand creates a fertile ground for the continued expansion of the white oak substitute sector.

Despite the robust growth trajectory, the white oak substitute market faces several significant challenges and restraints. A primary concern revolves around consumer perception and the potential for a "lesser" or "artificial" stigma associated with substitutes compared to traditionally aged products. Many consumers and even some industry purists associate the authenticity and quality of aged beverages directly with time spent in genuine white oak barrels. Overcoming this ingrained perception requires extensive education and demonstrated efficacy of substitutes in delivering comparable or even superior sensory experiences. Furthermore, the regulatory landscape can present a hurdle. While many applications of oak substitutes are accepted, there might be specific labeling requirements or restrictions in certain regions that producers need to navigate. The need for consistent quality and replicable results remains a challenge. While technological advancements have been significant, ensuring that every batch of substitute delivers the precise desired oak influence without introducing off-flavors or undesirable characteristics requires stringent quality control measures. The initial investment in research and development for novel substitute formulations and the establishment of robust production processes can also be a barrier for smaller players, potentially leading to market concentration among larger companies. The market is projected to reach 150 million liters in 2025, but these challenges could temper even more aggressive growth if not adequately addressed.

The North American region, particularly the United States, is poised to dominate the global white oak substitute market. This dominance is underpinned by several key factors, including the sheer scale of its spirits industry, a robust wine production sector, and a well-established cooperage infrastructure that is actively exploring and implementing alternative solutions.

Key Dominating Segments:

In North America, the extensive network of distilleries and wineries, coupled with a strong culture of experimentation and innovation in beverage production, fuels the demand for white oak substitutes. The historical reliance on American white oak for bourbon aging has created a deep understanding of its characteristics, which producers are now seeking to replicate or enhance through substitutes. The presence of key players like Suber Oak International, Speyside Bourbon Cooperage, G3 Enterprises, and The Barrel Mill further solidifies North America's leading position. These companies are actively involved in developing and supplying a diverse range of oak chip, oak block, and other substitute products tailored to the specific needs of the beverage industry. The research and development efforts in the region are focused on creating cleaner flavor profiles and more sustainable sourcing of non-oak wood alternatives, which will contribute to its ongoing market dominance. The estimated growth of the market to 165 million liters by 2033 will see North America continue to set the pace.

The white oak substitute industry is experiencing significant growth catalysts, primarily driven by the escalating price and limited availability of traditional white oak barrels. This supply-side challenge is compelling beverage producers, especially in the whisky and wine sectors, to actively seek cost-effective and readily available alternatives. Technological advancements in the processing and extraction of wood compounds are also proving to be a major catalyst, enabling the creation of substitutes that more precisely mimic the desired sensory characteristics of oak aging.

This comprehensive report delves into the dynamic global white oak substitute market, forecasting production to reach 150 million liters by 2025. It meticulously analyzes the market from 2019 to 2033, with a specific focus on the forecast period of 2025-2033. The report scrutinizes driving forces, including the cost and scarcity of natural oak, and key growth catalysts like technological innovation in extraction and processing. It also addresses the challenges and restraints, such as consumer perception and regulatory hurdles. Furthermore, it identifies dominant regions, with North America anticipated to lead, and key segments like Whisky and Oak Chips. The report provides an in-depth understanding of industry developments and leading market players, offering valuable insights for strategic decision-making in this evolving sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Suber Oak International, Speyside Bourbon Cooperage, Protea France, Oak Chips, G3 Enterprises, J. RETTENMAIER & SOHNE GmbH + Co KG, Bouchard Cooperages, Innerstave, Gusmer Enterprises, Canadell SAS, The Barrel Mill, The Vintner Vault, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "White Oak Substitute," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the White Oak Substitute, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.