1. What is the projected Compound Annual Growth Rate (CAGR) of the White Flower Oil?

The projected CAGR is approximately 4.3%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

White Flower Oil

White Flower OilWhite Flower Oil by Type (2.5ml Per Bottle, 5ml Per Bottle, 10ml Per Bottle, 20ml Per Bottle, World White Flower Oil Production ), by Application (Hospital, Clinic, Others, World White Flower Oil Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

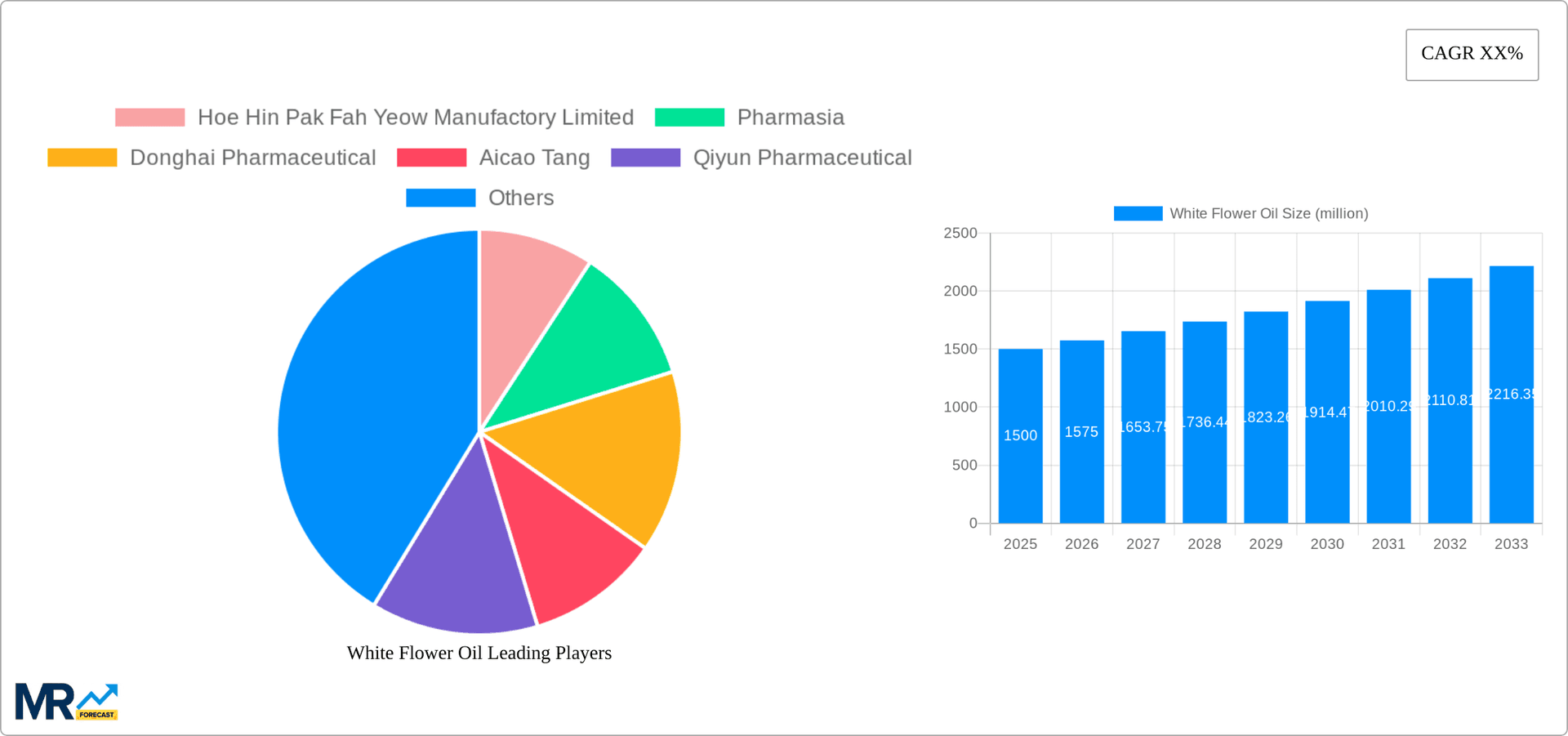

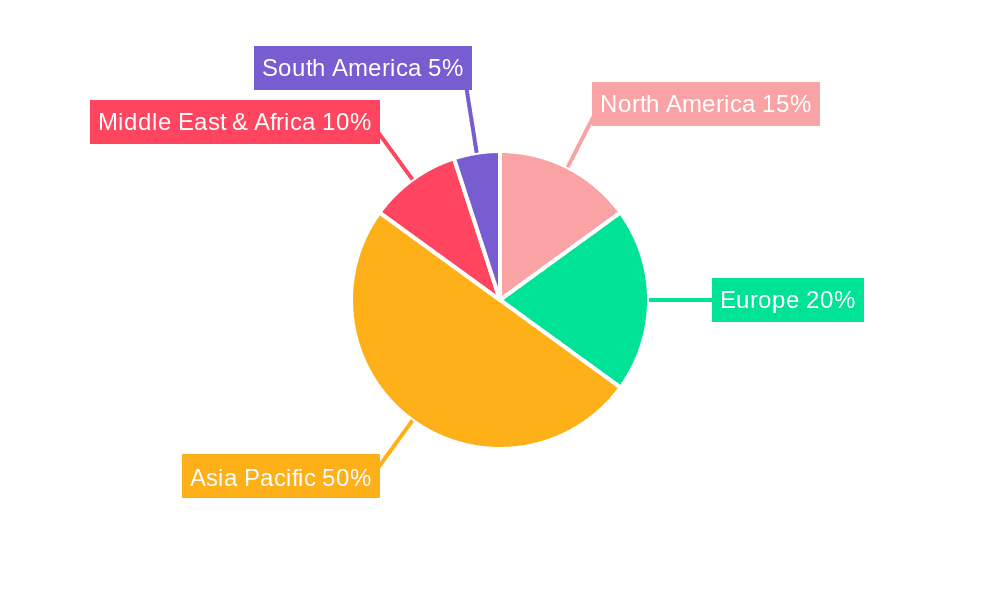

The global white flower oil market is projected for robust expansion, fueled by rising demand for natural and herbal therapeutic solutions, particularly in Asia Pacific and other regions with established traditional usage. The market is segmented by packaging size (2.5ml, 5ml, 10ml, 20ml), application (healthcare facilities, general use), and geography. Industry analysis indicates a significant market size of 2427.3 million, with a projected compound annual growth rate (CAGR) of 4.3% from a base year of 2025. This growth is driven by increasing consumer awareness of natural pain relief methods and the prevalence of conditions like muscle aches, headaches, and joint pain, for which white flower oil is traditionally employed. The market features a fragmented landscape with key manufacturers including Hoe Hin Pak Fah Yeow Manufactory Limited, Pharmasia, and Donghai Pharmaceutical. Opportunities for market expansion lie in targeted marketing campaigns emphasizing the benefits and versatility of white flower oil, and in increasing penetration into developed markets where demand for natural remedies is growing.

Additional growth catalysts include the expanding adoption of aromatherapy practices and a resurging consumer focus on holistic wellness. While positive growth is anticipated, challenges such as volatile raw material costs and competition from synthetic analgesics may present restraints. Regional growth disparities are expected, with Asia Pacific, notably China and India, continuing to be pivotal markets due to strong cultural familiarity and established usage. The future trajectory of the white flower oil market is contingent upon strategic marketing initiatives, product innovation, and successful market entry into new territories, especially among health-conscious consumers in developed economies seeking alternative health solutions. Ongoing advancements in formulations and delivery systems are crucial for sustained market expansion and competitive advantage.

The global white flower oil market, valued at approximately 150 million units in 2024, is projected to experience substantial growth throughout the forecast period (2025-2033). This growth is driven by a confluence of factors, including increasing awareness of its therapeutic benefits, rising disposable incomes in developing economies fueling demand for convenient and affordable healthcare solutions, and a surge in popularity within traditional medicine practices. The market demonstrates a preference for smaller bottle sizes (2.5ml and 5ml), particularly in regions with higher population densities and increased consumer preference for single-use or travel-friendly packaging. However, the larger bottle sizes (10ml and 20ml) maintain a significant market share, especially in institutional settings like hospitals and clinics. While the "others" application segment currently holds the largest market share, reflecting the diverse uses of white flower oil beyond clinical settings, the hospital and clinic segments are expected to see accelerated growth, spurred by increasing adoption by healthcare professionals. The historical period (2019-2024) reveals steady growth, with notable increases in the last three years. The estimated year 2025 is poised to show a considerable jump in production, driven by the factors mentioned above and further boosted by ongoing research exploring potential new applications of white flower oil. Competition among key players is intense, with established brands and emerging players alike constantly vying for market share through product innovation, strategic partnerships, and expanding distribution networks. The market displays a regional diversity in consumption patterns, with Asian markets showing the highest per capita consumption, reflecting the deep cultural ties and long history of the product's use in these areas. This trend is further reinforced by continuous production growth in countries like China and other Southeast Asian nations. The global market for white flower oil, therefore, is on a trajectory of robust and consistent expansion throughout the study period (2019-2033).

Several factors contribute to the burgeoning white flower oil market. Firstly, its traditional medicinal applications, particularly in relieving muscle aches, headaches, and insect bites, continue to resonate with consumers seeking natural remedies. This is particularly true in regions with a strong cultural heritage connected to traditional medicine practices. Secondly, the increasing awareness of white flower oil's therapeutic benefits through word-of-mouth marketing and online platforms is driving adoption among new consumer segments. The affordability of white flower oil compared to other pain relief and topical treatments makes it a compelling choice, especially for price-sensitive consumers in developing economies. Furthermore, the convenient packaging options available in various sizes cater to diverse consumer needs, from individual travel-sized bottles to larger containers for family use. The growing global tourism sector also contributes to increased demand, as travelers often purchase white flower oil as souvenirs or for personal use, expanding its reach across international markets. Finally, the expanding healthcare infrastructure in many developing regions creates more opportunities for white flower oil's adoption within hospitals and clinics, fueling further market growth.

Despite the positive outlook, the white flower oil market faces several challenges. One significant hurdle is the lack of robust clinical evidence supporting all its claimed therapeutic effects. This limitation could deter some consumers, particularly those in developed countries accustomed to evidence-based medicine. The market is also susceptible to counterfeit products, which can damage consumer trust and affect the overall market reputation. Stringent regulatory frameworks and quality control measures are crucial to mitigating this risk. Fluctuations in the prices of raw materials used in the manufacturing process can also impact profitability and pricing strategies. Furthermore, increasing competition from synthetic pain relief and topical medications poses a challenge to maintaining market share. Lastly, evolving consumer preferences towards more sophisticated and modern formulations could potentially limit the market's appeal to certain segments. Overcoming these challenges requires a combination of investing in research to substantiate its efficacy, enhancing brand protection against counterfeiting, and adopting effective marketing strategies to emphasize its unique value proposition.

The Asia-Pacific region, particularly Southeast Asia and China, is projected to dominate the white flower oil market throughout the forecast period. This dominance is rooted in the long-standing cultural acceptance and usage of the product, coupled with high population density in the region.

Dominant Segment: The 5ml bottle size is expected to maintain a significant market share, balancing the convenience of smaller bottles with an adequate quantity for multiple uses. Its popularity is attributable to its versatility – suitable for both personal and travel use.

Geographic Dominance: China's vast population and robust production capacity contribute substantially to its regional leadership. The market is characterized by high brand loyalty among consumers and strong regional brands with extensive distribution networks.

Application Dominance: While the "Others" application segment holds the current largest market share, reflecting diverse usage, the Clinic segment is projected for the highest growth rate due to increasing adoption within healthcare settings. This is fueled by a growing understanding of white flower oil's efficacy in addressing minor ailments, combined with its low cost and ease of use. Hospitals also present a considerable potential for market expansion, albeit with slower growth compared to clinics due to the procurement processes.

In essence, the convergence of high consumer preference for the 5ml bottle size in the Asia-Pacific region, particularly China, coupled with growing adoption in the clinic and hospital sectors, positions this combination as the key driver of market dominance throughout the forecast period. The growth trajectory in these specific areas demonstrates the product's strong market fundamentals and its potential for continued expansion.

The white flower oil industry's growth is propelled by several key factors: rising disposable incomes in developing economies, increasing awareness of its therapeutic properties through both traditional and online channels, and the growing popularity of natural and traditional remedies among health-conscious consumers. These factors are synergistically driving market expansion, particularly within the Asia-Pacific region.

This report provides a comprehensive overview of the white flower oil market, analyzing its current status, growth drivers, challenges, and future prospects. It delves into key market segments (bottle sizes and applications), regional market dynamics, and profiles major players in the industry. The report offers valuable insights for businesses, investors, and researchers seeking a deeper understanding of this growing market. The report utilizes extensive data analysis, supported by market research and projections, to provide accurate and reliable information.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.3% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 4.3%.

Key companies in the market include Hoe Hin Pak Fah Yeow Manufactory Limited, Pharmasia, Donghai Pharmaceutical, Aicao Tang, Qiyun Pharmaceutical, Green Flower Pharmaceutical, Health Pharma, Huakang Pharmaceutical, Limin Pharmaceutical, Xianghe Pharmaceutical.

The market segments include Type, Application.

The market size is estimated to be USD 2427.3 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "White Flower Oil," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the White Flower Oil, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.