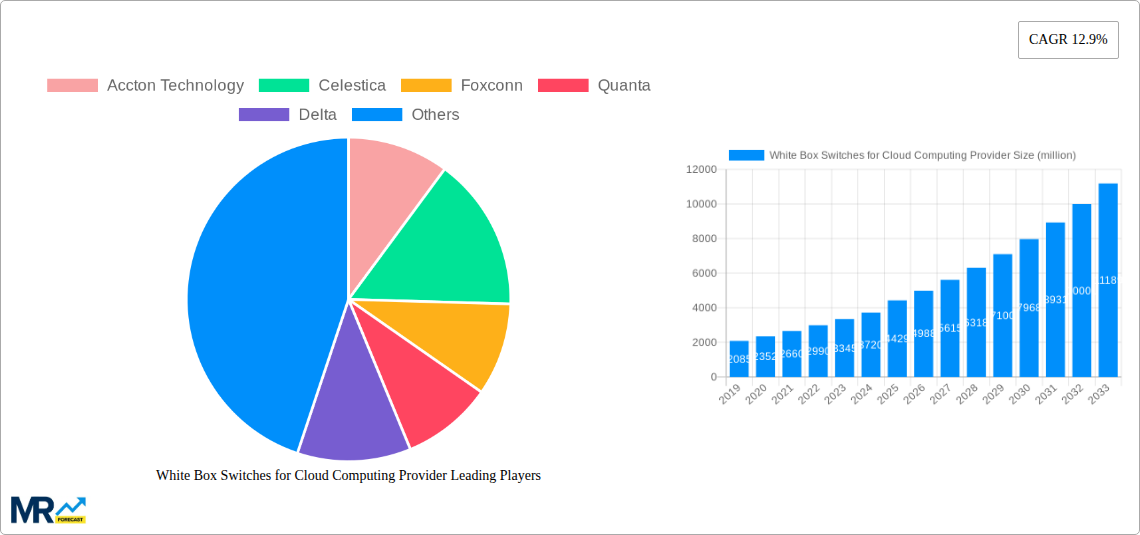

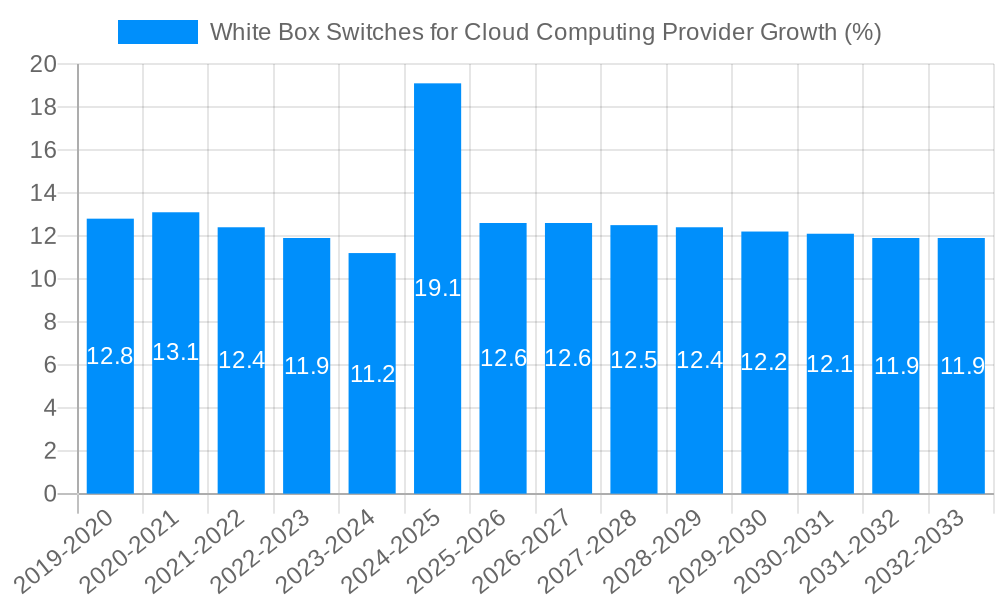

1. What is the projected Compound Annual Growth Rate (CAGR) of the White Box Switches for Cloud Computing Provider?

The projected CAGR is approximately 12.9%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

White Box Switches for Cloud Computing Provider

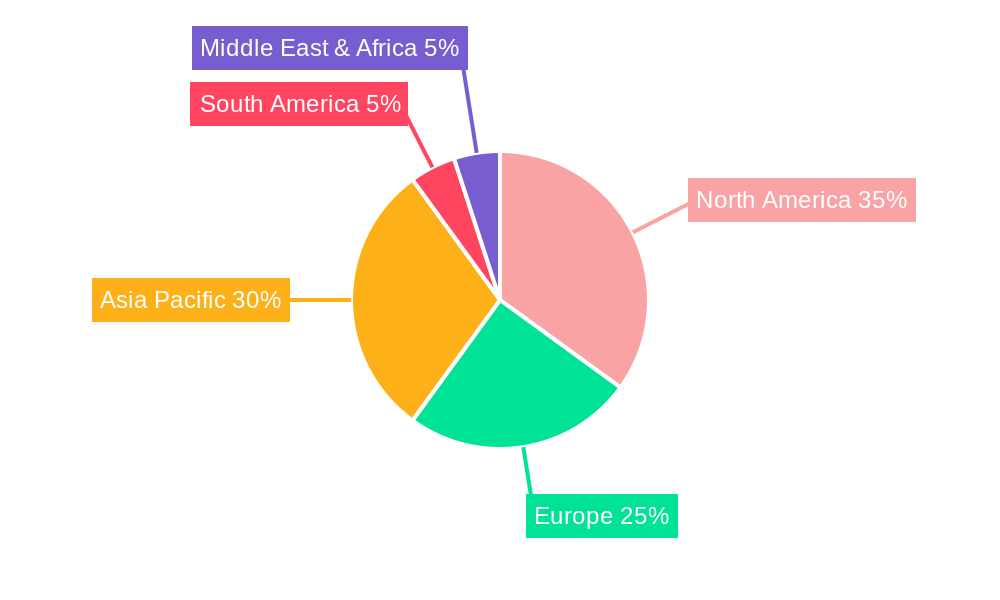

White Box Switches for Cloud Computing ProviderWhite Box Switches for Cloud Computing Provider by Type (25 GbE, 100 GbE, 200/400 GbE, Others), by Application (IaaS, PaaS, SaaS, Serverless), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

The white box switches market for cloud computing providers is experiencing robust growth, projected to reach an impressive USD 4429 million by 2025, driven by a compound annual growth rate (CAGR) of 12.9% throughout the forecast period of 2019-2033. This substantial expansion is primarily fueled by the escalating demand for scalable, cost-effective, and highly customizable networking solutions within the rapidly evolving cloud infrastructure landscape. Cloud providers are increasingly adopting open networking principles and white box hardware to gain greater control over their network architecture, reduce vendor lock-in, and optimize operational expenditures. The market is witnessing a significant shift towards higher bandwidth speeds, with 100 GbE, 200/400 GbE technologies becoming dominant, catering to the ever-increasing data traffic generated by hyperscale data centers and emerging cloud services. The rise of Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS) models further accentuates the need for flexible and high-performance networking, making white box switches an indispensable component of modern cloud deployments.

Key market drivers include the relentless pursuit of lower total cost of ownership (TCO) by cloud service providers, alongside the growing trend of disaggregation of network hardware and software. This allows for greater innovation and faster deployment cycles, essential in the competitive cloud market. Emerging trends such as the adoption of Network Function Virtualization (NFV) and Software-Defined Networking (SDN) align perfectly with the flexible nature of white box solutions, enabling dynamic network configurations and automated management. While the market is largely propelled by these positive factors, certain restraints like the need for specialized technical expertise for deployment and management, and potential interoperability challenges, are being addressed through evolving open-source communities and vendor support. Major players like Accton Technology, Celestica, Foxconn, Quanta, Delta, and Alpha Networks are at the forefront, offering a diverse range of white box switch solutions tailored to the specific needs of cloud computing providers across key regions including North America, Europe, and Asia Pacific.

Here is a comprehensive report description on White Box Switches for Cloud Computing Providers, incorporating your specified requirements:

The global market for White Box Switches in Cloud Computing Providers is undergoing a significant transformation, driven by the relentless pursuit of agility, scalability, and cost-efficiency within hyperscale data centers. XXX. As cloud infrastructure matures, the demand for highly programmable and disaggregated networking solutions is escalating. The study period, spanning from 2019 to 2033, with a base and estimated year of 2025, highlights a robust growth trajectory. In 2025, the market is projected to reach approximately $5,500 million, underscoring the increasing adoption of these open-source-driven networking hardware. This trend is particularly pronounced in the 200/400 GbE segment, which is rapidly becoming the standard for high-throughput interconnectivity in modern cloud environments. Furthermore, the rise of specialized cloud applications, including Serverless computing, is demanding even greater flexibility and performance from the underlying network fabric, pushing the boundaries of what white box switches can offer. The shift from proprietary, monolithic network appliances to modular, software-defined architectures is a defining characteristic of this market. This evolution empowers cloud providers to customize their networks precisely to their evolving application needs, leading to optimized resource utilization and reduced operational expenditures. The increasing influence of Software-Defined Networking (SDN) and Network Functions Virtualization (NFV) principles further solidifies the position of white box switches as the foundational element for the next generation of cloud infrastructure. The historical period (2019-2024) has laid the groundwork for this accelerated growth, with early adopters demonstrating the viability and benefits of this approach, paving the way for widespread market acceptance and innovation in the forecast period (2025-2033).

The proliferation of cloud computing, particularly the massive expansion of hyperscale data centers, serves as a primary propellant for the white box switches market. Cloud providers are under constant pressure to scale their infrastructure rapidly and economically to accommodate the ever-increasing demand for services like IaaS, PaaS, and SaaS. White box switches, by offering a disaggregated hardware and software model, enable cloud operators to bypass the expensive licensing and vendor lock-in associated with traditional networking solutions. This cost advantage is substantial, allowing for significant savings that can be reinvested in other critical areas of infrastructure development. Moreover, the inherent flexibility of white box switches, allowing for the installation of custom network operating systems (NOS), fuels innovation and enables cloud providers to tailor their network behavior to specific application requirements. This level of customization is crucial for supporting emerging workloads like Artificial Intelligence (AI) and Machine Learning (ML), which demand extremely low latency and high bandwidth. The open ecosystem surrounding white box hardware fosters a competitive landscape, driving continuous improvement in performance and features, ultimately benefiting the end-users of cloud services.

Despite the compelling advantages, the white box switches market for cloud computing providers faces several significant challenges and restraints. One of the foremost is the increased complexity associated with managing a disaggregated infrastructure. Unlike integrated solutions, white box deployments require a higher level of in-house expertise for network design, configuration, integration, and ongoing maintenance. This can be a barrier for providers with less mature IT organizations. Another critical factor is the perceived risk around interoperability and long-term support. While the open ecosystem is a strength, ensuring seamless integration between hardware components from various vendors and the chosen NOS can be a complex undertaking. Furthermore, the absence of a single point of accountability for the entire solution, as found in traditional vendor offerings, can create challenges in troubleshooting and resolving issues. Security concerns also play a role, as the responsibility for securing the entire network stack, from the hardware to the operating system and applications, falls squarely on the cloud provider. This necessitates robust internal security protocols and vigilance against potential vulnerabilities.

The 200/400 GbE segment, coupled with the dominance of North America as a key region, is poised to be the primary driver and dominator of the White Box Switches for Cloud Computing Provider market.

200/400 GbE Segment:

North America as a Dominant Region:

Application Integration (IaaS, PaaS, SaaS, Serverless):

The white box switches market for cloud computing providers is experiencing significant growth catalysts. The relentless expansion of cloud services, coupled with the increasing adoption of data-intensive applications such as AI and big data analytics, is creating an insatiable demand for higher bandwidth and lower latency networking. The inherent cost-effectiveness and flexibility offered by white box solutions, allowing for vendor independence and customized network operating systems, are powerful incentives for cloud providers to optimize their infrastructure spend and agility. Furthermore, the growing maturity of the open-source networking ecosystem, with readily available and robust network operating systems, is lowering the barrier to entry and increasing confidence in the reliability and manageability of these solutions.

This comprehensive report delves deep into the dynamic landscape of White Box Switches for Cloud Computing Providers, offering unparalleled insights across the study period (2019-2033). The report meticulously analyzes market size projections, with the base and estimated year of 2025 valuing the market at approximately $5,500 million. It explores the intricate interplay of market trends, identifying the increasing demand for higher bandwidth solutions like 200/400 GbE and the evolving needs of application segments such as Serverless computing. Furthermore, the report dissects the key driving forces, including cost optimization and vendor flexibility, alongside critical challenges like management complexity and interoperability concerns. The analysis extends to regional dominance, with a sharp focus on North America, and segment leadership, highlighting the pivotal role of 200/400 GbE. Growth catalysts and significant developments, meticulously documented with year-specific insights, are thoroughly examined. This report is an indispensable resource for stakeholders seeking to understand and capitalize on the transformative evolution of cloud networking infrastructure.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 12.9% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 12.9%.

Key companies in the market include Accton Technology, Celestica, Foxconn, Quanta, Delta, Alpha Networks.

The market segments include Type, Application.

The market size is estimated to be USD 4429 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "White Box Switches for Cloud Computing Provider," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the White Box Switches for Cloud Computing Provider, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.