1. What is the projected Compound Annual Growth Rate (CAGR) of the Weather Risk Transfer Solution?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Weather Risk Transfer Solution

Weather Risk Transfer SolutionWeather Risk Transfer Solution by Application (Agriculture, Architecture, Transportation, Travel, Hotel, Other), by Type (Reinsurance Solutions, Weather Insurance, Financial Hedging instruments, Weather Index Insurance), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

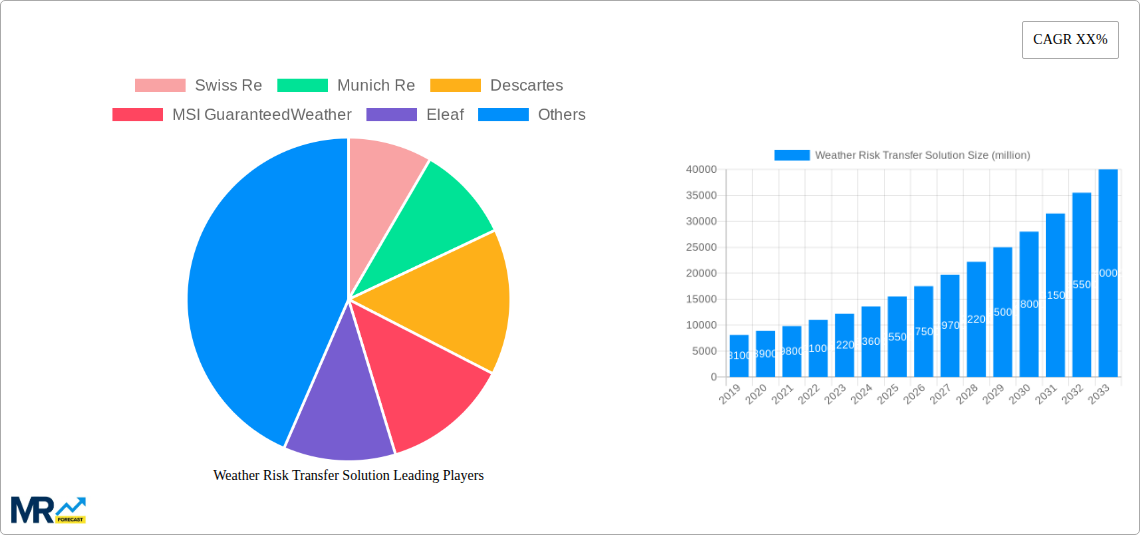

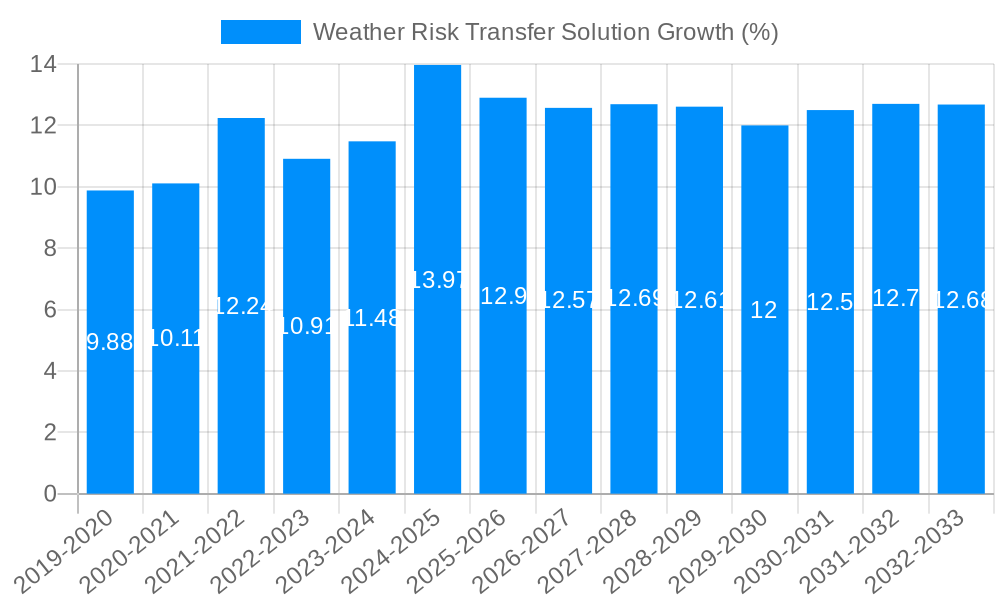

The Weather Risk Transfer Solution market is poised for substantial growth, projected to reach an estimated USD 15.5 billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of approximately 12.5% expected over the forecast period of 2025-2033. This expansion is primarily fueled by increasing awareness and the escalating frequency and intensity of extreme weather events across the globe. Industries like agriculture, which are inherently vulnerable to climatic uncertainties, are leading the charge in adopting weather risk transfer solutions to mitigate potential losses and ensure operational stability. Similarly, sectors such as architecture and transportation are actively seeking protection against disruptions caused by adverse weather, driving demand for innovative insurance products. The growing recognition of the financial implications of weather-related damages is prompting businesses and governments alike to invest in sophisticated risk management strategies, thereby stimulating market penetration.

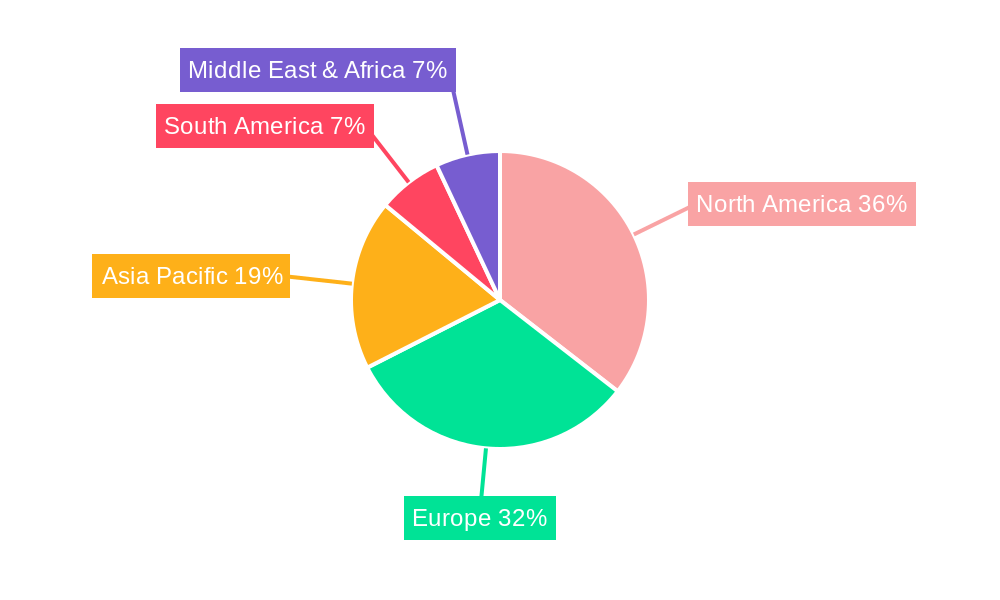

The market's trajectory is further shaped by evolving financial instruments and a heightened demand for specialized solutions. Reinsurance solutions are playing a critical role in absorbing large-scale weather-related risks, while weather index insurance offers a parametric approach to compensation, simplifying claims processes. Financial hedging instruments are also gaining traction as businesses aim to lock in predictable costs and revenues despite weather volatility. Geographically, North America and Europe are currently the dominant regions, owing to established insurance markets and proactive regulatory frameworks. However, the Asia Pacific region is expected to witness the fastest growth, driven by rapid industrialization, increasing susceptibility to natural disasters, and a burgeoning middle class demanding greater financial security. Emerging economies are increasingly recognizing the economic impact of climate change, leading to a greater adoption of these protective financial tools.

Here's a unique report description for Weather Risk Transfer Solutions, incorporating your specified elements:

XXX: The global Weather Risk Transfer Solution market is poised for significant expansion, with projected growth from $1.5 million in the historical period of 2019-2024 to an estimated $5 million by 2033. This surge is driven by an increasing understanding of the pervasive impact of weather variability on businesses across diverse sectors and the growing sophistication of financial instruments designed to mitigate these risks. Historically, the market has seen steady adoption, with an estimated $2.2 million in 2025, reflecting a growing reliance on structured solutions. The forecast period of 2025-2033 anticipates a compound annual growth rate (CAGR) of approximately 12.8%, underscoring the escalating demand for robust weather risk management strategies. Key market insights reveal a pronounced shift from reactive damage control to proactive risk hedging. The base year of 2025 is crucial, as it marks a point where established players and innovative newcomers alike are solidifying their offerings. We observe a notable trend towards the development of highly customized solutions, moving beyond generic weather insurance policies to encompass parametric triggers, bespoke financial derivatives, and integrated reinsurance frameworks. The market's evolution is also characterized by a greater emphasis on data analytics and predictive modeling, allowing for more accurate pricing and tailored product development. The increasing frequency and intensity of extreme weather events globally, from droughts impacting agricultural yields to hurricanes disrupting transportation networks, have amplified the need for financial resilience. This has directly translated into increased investment in weather risk transfer, with companies seeking to protect their revenues, assets, and supply chains. The study period of 2019-2033 encompasses a dynamic period of economic fluctuations and climate change, making the insights derived from this analysis particularly relevant for strategic planning and investment decisions. The market is no longer solely the domain of large corporations; smaller enterprises are also beginning to leverage these solutions, albeit with more tailored and accessible products. The underlying principle remains consistent: safeguarding operations and financial stability against the unpredictable nature of weather.

The burgeoning growth of the weather risk transfer solution market is fueled by a confluence of powerful drivers. Primarily, the escalating frequency and severity of extreme weather events, exacerbated by climate change, are compelling businesses to seek robust financial protection. Events such as prolonged droughts, intense heatwaves, devastating floods, and powerful storms can lead to catastrophic financial losses, disrupting operations, damaging assets, and impacting supply chains. This has fostered a heightened awareness of weather-related vulnerabilities and the urgent need for effective risk mitigation strategies. Furthermore, the increasing interconnectedness of global supply chains means that a localized weather event can have far-reaching consequences, necessitating proactive hedging against such disruptions. The development and maturation of sophisticated financial instruments, including weather index insurance, financial hedging instruments, and reinsurance solutions, are also playing a pivotal role. These innovative products offer clear, pre-defined payout mechanisms triggered by specific weather parameters, providing a more predictable and efficient way to manage weather-related financial risks compared to traditional indemnity-based insurance. Advances in data analytics, meteorological forecasting, and technological capabilities are enabling the creation of more accurate and granular risk assessments, which, in turn, allow for the development of highly tailored and cost-effective solutions. This data-driven approach is crucial for pricing risk accurately and designing products that meet the specific needs of diverse industries.

Despite its promising growth trajectory, the weather risk transfer solution market encounters several significant challenges and restraints that could temper its expansion. A primary hurdle is the inherent complexity and opacity surrounding weather modeling and forecasting. While advancements have been made, accurately predicting the precise timing, location, and intensity of specific weather events remains a difficult undertaking, leading to potential discrepancies between projected losses and actual payouts. This can erode trust and adoption if not adequately managed. Another key restraint is the perceived cost and accessibility of these solutions, particularly for small and medium-sized enterprises (SMEs). The upfront investment and ongoing premiums for comprehensive weather risk transfer can be substantial, making them less feasible for businesses with tighter budgets. The intricate nature of financial hedging instruments and insurance policies can also present a barrier to understanding and adoption, requiring specialized expertise to navigate. Furthermore, regulatory hurdles and evolving legal frameworks surrounding financial instruments and insurance products can create uncertainty and compliance challenges for providers and users alike. The availability of sufficient capital and reinsurance capacity to underwrite increasingly large and complex weather risks is also a consideration. Finally, the potential for basis risk, where the trigger event (e.g., a specific temperature threshold) does not perfectly align with the actual financial loss incurred by the policyholder, can lead to dissatisfaction and limit the effectiveness of certain parametric products.

The Agriculture segment, particularly within the North America and Europe regions, is anticipated to be a dominant force in the weather risk transfer solution market.

Agriculture: This sector is inherently sensitive to weather fluctuations, with rainfall, temperature, and sunshine playing critical roles in crop yields, livestock health, and overall farm productivity. The economic impact of drought, frost, excessive heat, or unseasonal rainfall can be devastating for farmers, leading to significant revenue losses. Consequently, the demand for weather risk transfer solutions in agriculture is exceptionally high.

North America: The United States and Canada represent a significant market due to their vast agricultural land, extensive transportation networks susceptible to weather delays, and substantial infrastructure vulnerable to extreme weather. The developed financial markets and presence of key players like Aon and Marsh facilitate the widespread adoption of advanced risk transfer solutions. The agriculture sector in states like California and the Midwest, heavily reliant on specific weather patterns, is a prime example of a segment that actively seeks weather risk mitigation. The transportation sector, with its reliance on unimpeded movement of goods, also benefits from weather-related contingency planning and insurance solutions.

Europe: Countries like France, Germany, and Spain exhibit strong demand for weather risk transfer, driven by their significant agricultural output, reliance on tourism sensitive to weather conditions, and extensive infrastructure. The focus on sustainable agriculture and climate resilience further propels the adoption of innovative risk management tools. The tourism and hospitality sector in coastal regions, for example, is highly susceptible to adverse weather impacting travel and leisure activities, leading to demand for weather insurance products that can cover lost bookings or operational disruptions.

While other segments like Transportation and Travel also show considerable growth potential, Agriculture's direct and pervasive dependence on predictable weather patterns, coupled with the increasing impact of climate change on yields, positions it as the most prominent segment to drive market dominance. The combination of readily available parametric solutions like Weather Index Insurance and the established financial infrastructure in these key regions creates a fertile ground for the widespread adoption and continued growth of weather risk transfer solutions.

The weather risk transfer solution industry is experiencing robust growth, propelled by several key catalysts. The escalating frequency and intensity of extreme weather events globally, directly linked to climate change, are creating an urgent need for financial resilience and risk mitigation. This heightened awareness of weather-related vulnerabilities compels businesses across various sectors to seek reliable protection. Furthermore, the continuous innovation in financial instruments, such as parametric insurance and bespoke hedging strategies, offers more accessible and transparent solutions for managing weather-related financial exposures. Advancements in meteorological science and data analytics enable more accurate risk assessment and product development, further stimulating market expansion.

This comprehensive report delves into the intricacies of the weather risk transfer solution market, providing a 360-degree view of its current landscape and future trajectory. It meticulously analyzes the market size, historical trends, and future projections, with an estimated market value projected to reach $5 million by 2033, up from $1.5 million in the historical period of 2019-2024. The report details the key driving forces, including the growing impact of climate change and the evolution of financial instruments, as well as the challenges that players must navigate, such as data complexity and cost accessibility. It highlights the dominant segments, such as Agriculture, and key regions, including North America and Europe, that are shaping market demand. Furthermore, the report identifies crucial growth catalysts and profiles the leading companies actively contributing to the sector's advancement. This in-depth analysis is designed to equip stakeholders with actionable insights for strategic decision-making, investment planning, and understanding the evolving dynamics of weather risk management.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Swiss Re, Munich Re, Descartes, MSI GuaranteedWeather, Eleaf, Marsh, Risk Solutions International, Gcube, Nephila Climate, Aon, Sompo, Wx Risk Global, Weather Option, Praedictus, CQ Energy, Alesco Risk Management Services, Allianz Group, Celsius Pro, Arbol, Speedwell Climate.

The market segments include Application, Type.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Weather Risk Transfer Solution," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Weather Risk Transfer Solution, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.