1. What is the projected Compound Annual Growth Rate (CAGR) of the Water Blocking Tape for Optical Cable?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Water Blocking Tape for Optical Cable

Water Blocking Tape for Optical CableWater Blocking Tape for Optical Cable by Type (Tape Type Water Blocking Tape, Heat Shrinkable Water Blocking Tape, Glue-Injected Water Blocking Tape), by Application (Indoor Optical Cable, Outdoor Optical Cable), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

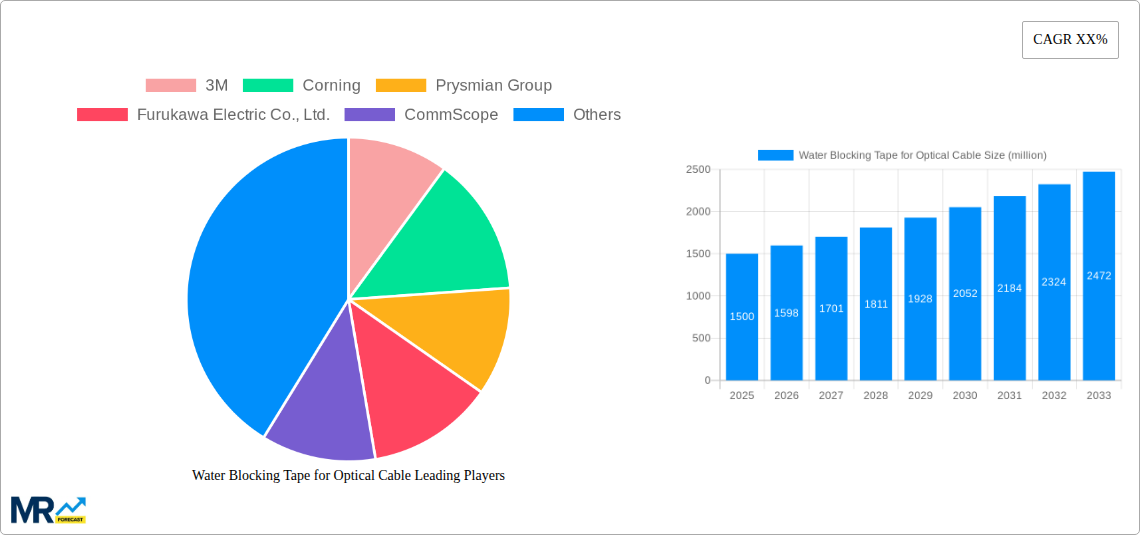

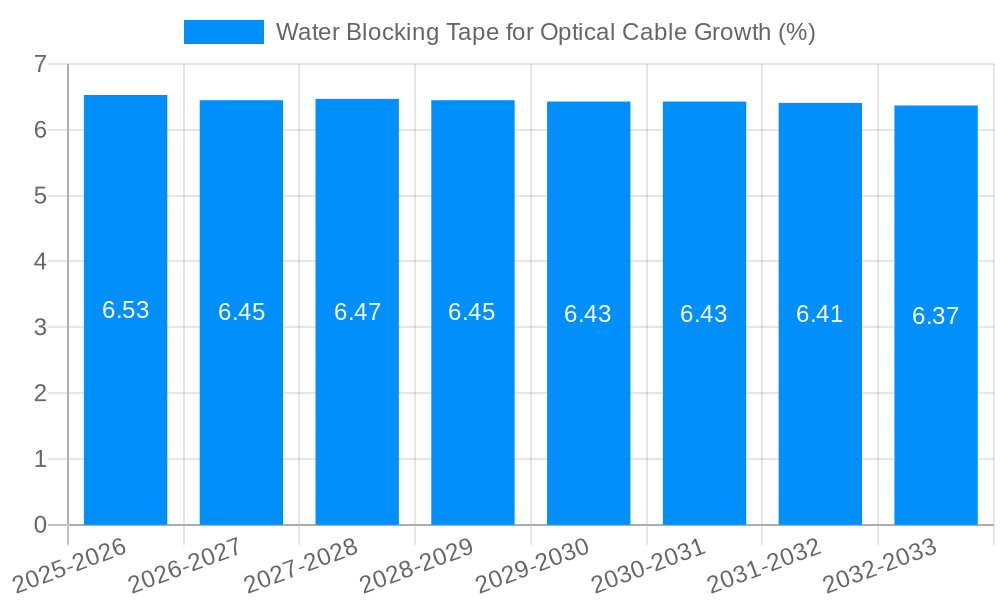

The global Water Blocking Tape for Optical Cable market is poised for robust growth, with an estimated market size of approximately USD 1.5 billion in 2025. This expansion is driven by the escalating demand for high-speed internet and data connectivity, fueled by the continuous deployment of fiber-optic networks for broadband expansion, 5G infrastructure, and data centers. The market is projected to witness a Compound Annual Growth Rate (CAGR) of around 6.5% through 2033, signifying a healthy upward trajectory. Key market drivers include government initiatives promoting digital infrastructure development, the increasing adoption of optical cables in various sectors like telecommunications, IT, and utilities, and the growing need for reliable and durable cable protection against moisture ingress. The shift towards advanced water blocking technologies, offering superior performance and longevity, is also a significant trend shaping market dynamics.

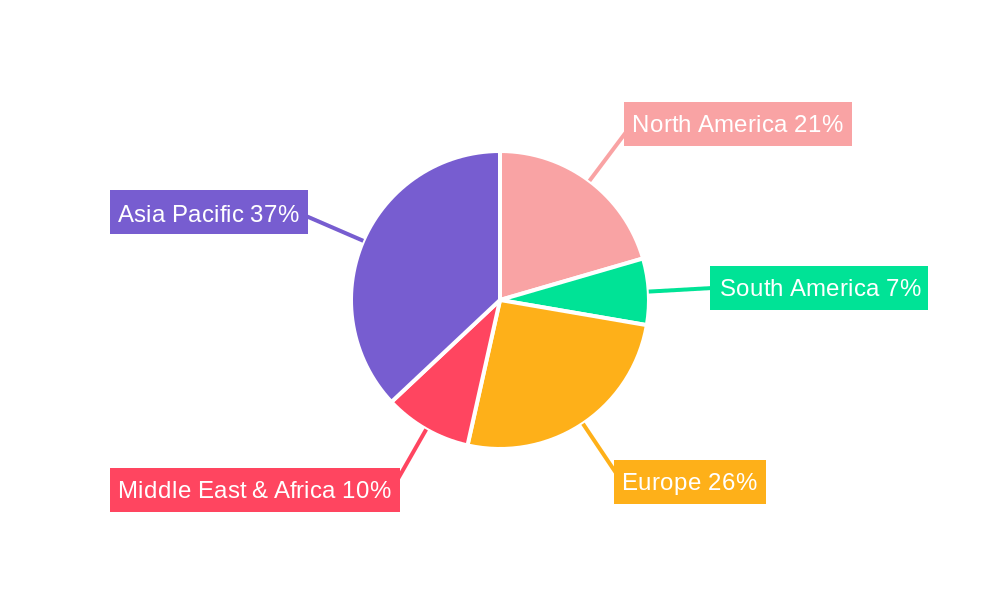

The market segmentation reveals a healthy distribution across different tape types, with Heat Shrinkable Water Blocking Tape and Glue-Injected Water Blocking Tape anticipated to lead the pack due to their enhanced performance characteristics and ease of application. The application segment is predominantly driven by Indoor Optical Cables, closely followed by Outdoor Optical Cables, as both require robust moisture protection for uninterrupted data transmission. Geographically, Asia Pacific is expected to dominate the market share, owing to the rapid expansion of telecommunication networks in countries like China and India. North America and Europe also represent significant markets, driven by network upgrades and the deployment of advanced communication technologies. While the market enjoys strong growth, potential restraints include the fluctuating raw material prices and the availability of alternative water blocking solutions. However, the ongoing innovation in material science and the strategic collaborations among key players like 3M, Corning, and Prysmian Group are expected to further accelerate market expansion and solidify its position in the telecommunications infrastructure landscape.

The global market for Water Blocking Tape for Optical Cable is poised for substantial expansion, projected to reach USD 2,800 million by 2025 and surge to USD 3,950 million by 2033, exhibiting a compound annual growth rate (CAGR) of 3.5% during the forecast period of 2025-2033. This upward trajectory is underpinned by the ever-increasing demand for robust and reliable optical fiber infrastructure across diverse sectors. The historical period from 2019-2024 witnessed steady growth, driven by the initial rollout of 5G networks and the expansion of broadband services. The base year of 2025 serves as a crucial benchmark, highlighting the market's current robust health and its capacity for sustained advancement. Key trends shaping this market include a growing emphasis on high-performance materials capable of withstanding extreme environmental conditions, such as moisture, temperature fluctuations, and mechanical stress. Manufacturers are investing heavily in research and development to innovate advanced water-blocking solutions that offer enhanced swell rates, faster blocking times, and improved long-term durability. The increasing adoption of aerial and buried cable installations, particularly in challenging geographical terrains, further amplifies the need for effective water ingress prevention. Furthermore, the evolving regulatory landscape, mandating stricter standards for network reliability and longevity, is a significant catalyst for the adoption of superior water-blocking technologies. The market is also experiencing a gradual shift towards more sustainable and eco-friendly material formulations, aligning with global environmental initiatives. The continued proliferation of data centers, the growth of the Internet of Things (IoT), and the expanding reach of telecommunication networks worldwide are collectively fueling the demand for advanced optical cable protection solutions, with water blocking tape playing a pivotal role. The market's dynamism is further characterized by strategic collaborations and mergers among key players to leverage synergistic capabilities and expand their geographical footprints. The study period of 2019-2033 encompasses both past performance and future projections, providing a holistic view of the market's evolution.

The relentless expansion of global telecommunications infrastructure serves as the primary engine driving the growth of the water blocking tape for optical cable market. The widespread deployment of 5G networks, characterized by their higher bandwidth and lower latency requirements, necessitates denser fiber optic deployments, both in urban and rural areas. This increased cabling infrastructure, often exposed to various environmental elements, demands superior protection against moisture ingress, which can lead to signal degradation and premature cable failure. Furthermore, the burgeoning demand for high-speed internet connectivity for residential and commercial users, fueled by the increasing adoption of data-intensive applications such as video streaming, online gaming, and cloud computing, is spurring significant investments in fiber-to-the-home (FTTH) and fiber-to-the-building (FTTB) projects. These projects, often involving extensive outdoor cable installations, directly translate into a greater need for effective water blocking solutions. The increasing digitalization across various industries, including healthcare, finance, manufacturing, and education, further underscores the criticality of reliable and uninterrupted data transmission, making robust cable protection paramount. The continuous innovation in optical cable designs, aiming for smaller diameters and higher fiber counts, also presents a unique challenge where effective water blocking becomes even more crucial to maintain the integrity of the densely packed fibers. The global push for digital transformation and the growing reliance on digital services are thus creating an enduring demand for solutions that ensure the longevity and performance of optical networks, with water blocking tape at the forefront of this protective ecosystem.

Despite the promising growth prospects, the water blocking tape for optical cable market faces certain challenges and restraints that could temper its expansion. One significant hurdle is the cost sensitivity associated with certain high-performance water blocking materials, which can impact the overall cost-effectiveness of cable manufacturing, especially for large-scale deployments. While advancements in material science are continuously striving to reduce these costs, the initial investment for premium solutions can be a deterrent for some manufacturers and end-users, particularly in price-sensitive markets. Another challenge lies in the variability of environmental conditions across different geographical regions. Water blocking tapes need to perform optimally under a wide spectrum of temperatures, humidity levels, and potential exposure to chemicals or corrosive substances. Developing a single product that excels in all these diverse scenarios can be technically demanding and resource-intensive. Furthermore, the complexity of cable manufacturing processes can also pose a restraint. Integrating water blocking tapes seamlessly into existing cable extrusion and jacketing lines requires precise process control and compatibility with other cable components. Any disruption or inefficiency in this integration can lead to increased production costs and potential quality issues. The evolving standards and regulations related to cable safety and performance, while ultimately beneficial for market growth, can also present a challenge. Manufacturers need to constantly adapt their products and manufacturing processes to meet these evolving requirements, which necessitates ongoing research, development, and testing. Finally, the availability of alternative water blocking technologies, though not as prevalent for tape applications, could also pose a minor restraint in specific niche segments, requiring continuous innovation to maintain competitive advantage.

The global Water Blocking Tape for Optical Cable market exhibits a strong regional dominance, with Asia Pacific emerging as the leading region, projected to hold a significant market share by 2025 and maintain its trajectory throughout the forecast period of 2025-2033. This dominance is primarily driven by several converging factors.

Rapid Infrastructure Development: Countries like China, India, and South Korea are at the forefront of massive telecommunications infrastructure development. The extensive rollout of 5G networks, expansion of broadband connectivity, and a strong push towards digital transformation in these nations are creating an insatiable demand for optical cables and, consequently, for their protective components like water blocking tape. The sheer scale of fiber optic deployments for both backbone networks and last-mile connectivity in this region is unprecedented.

Government Initiatives and Investments: Governments across the Asia Pacific region are actively promoting digital infrastructure development through substantial investments and supportive policies. Initiatives aimed at bridging the digital divide and enhancing connectivity for both urban and rural populations directly translate into increased consumption of optical cable materials.

Growing Manufacturing Hub: Asia Pacific, particularly China, serves as a global manufacturing hub for telecommunications equipment. This concentration of manufacturing facilities leads to a high demand for raw materials, including water blocking tapes, to cater to both domestic consumption and export markets. The presence of major cable manufacturers in the region further amplifies this demand.

Increasing Adoption of Outdoor Optical Cables: The majority of telecommunication infrastructure in Asia Pacific is deployed outdoors, involving aerial and buried cable installations. These outdoor environments are inherently susceptible to moisture ingress, making robust water blocking solutions indispensable. As such, Outdoor Optical Cable applications are expected to be the dominant segment within this region and globally. The harsh environmental conditions, including monsoon seasons and varying temperatures, necessitate highly effective water blocking tapes that can withstand prolonged exposure to moisture and environmental stressors.

In terms of segments, Tape Type Water Blocking Tape is anticipated to hold the largest market share. This type of water blocking tape is characterized by its ease of application during the optical cable manufacturing process and its cost-effectiveness for large-scale production. Its flexibility and ability to conform to cable structures make it ideal for a wide range of cable designs. The ability to be manufactured in continuous rolls and seamlessly integrated into existing cable production lines makes it a preferred choice for mass production. Furthermore, advancements in the material science of tape-type water blocking tapes, leading to improved swelling capabilities and long-term performance, further solidify its market dominance. While Heat Shrinkable Water Blocking Tape and Glue-Injected Water Blocking Tape cater to specific niche applications requiring enhanced sealing or specialized protection, the sheer volume of standard optical cable production favors the widespread adoption of tape-type solutions. The continuous demand for reliable and cost-efficient water protection in outdoor cable deployments, where the risk of water ingress is highest, will continue to fuel the dominance of tape-type water blocking tapes in the Outdoor Optical Cable segment within the leading Asia Pacific region.

The Water Blocking Tape for Optical Cable industry is experiencing robust growth fueled by several key catalysts. The accelerated deployment of 5G networks globally is a primary driver, demanding denser and more resilient optical infrastructure. Increased investment in FTTH projects to bridge the digital divide and enhance broadband penetration is also significantly boosting demand. Furthermore, the growing adoption of IoT devices and smart city initiatives necessitates a reliable and uninterrupted data flow, underscoring the importance of effective cable protection. The continuous expansion of data centers to support the ever-increasing data traffic and cloud computing services further adds to the demand for high-performance optical cables and their protective components.

This comprehensive report offers an in-depth analysis of the global Water Blocking Tape for Optical Cable market, covering the study period from 2019-2033, with 2025 serving as the base and estimated year. It meticulously examines market trends, driving forces, and challenges, providing critical insights for stakeholders. The report details regional dynamics, with a particular focus on the dominance of Asia Pacific, and segment analysis, highlighting the prominence of Outdoor Optical Cable applications and Tape Type Water Blocking Tape. Furthermore, it identifies key growth catalysts and presents a detailed overview of leading market players and their significant recent developments. The report aims to equip industry participants with actionable intelligence for strategic decision-making in this dynamic market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include 3M, Corning, Prysmian Group, Furukawa Electric Co., Ltd., CommScope, Nexans, Sumitomo Electric Industries, Ltd., Belden Inc., YOFC Optical Fiber and Cable Co., Ltd., Fujikura Ltd., General Cable Corporation, LS Cable System, OFS Fitel, LLC, TKH Group N.V., Sterlite Technologies Limited, Shandong Haoyue New Materials Co.LTD., .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Water Blocking Tape for Optical Cable," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Water Blocking Tape for Optical Cable, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.