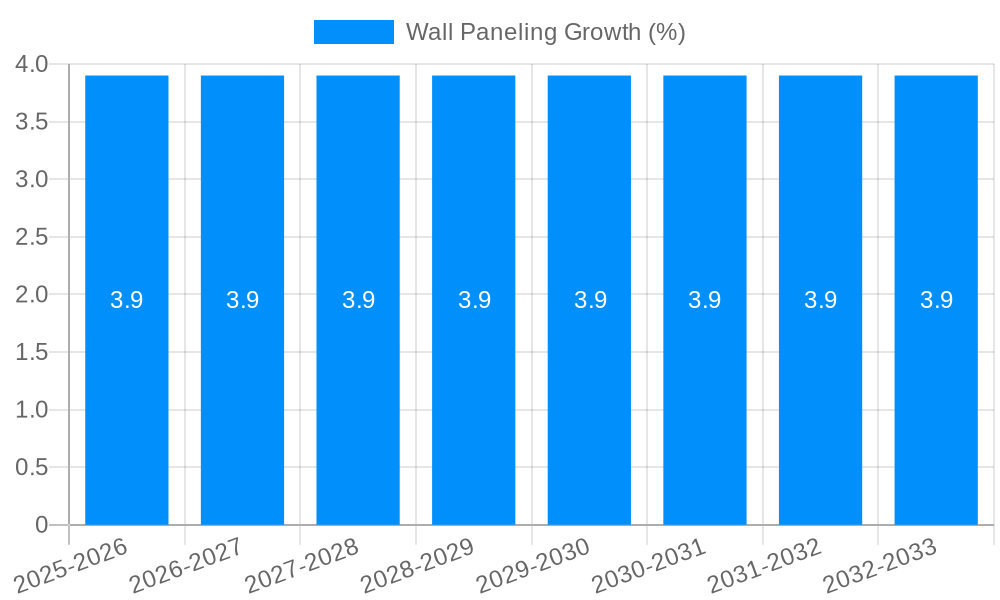

1. What is the projected Compound Annual Growth Rate (CAGR) of the Wall Paneling?

The projected CAGR is approximately 3.9%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Wall Paneling

Wall PanelingWall Paneling by Type (Metal, PVC, Wood, MDF, HDF, Acrylic, Others), by Application (Residential, Commercial, Industrial), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

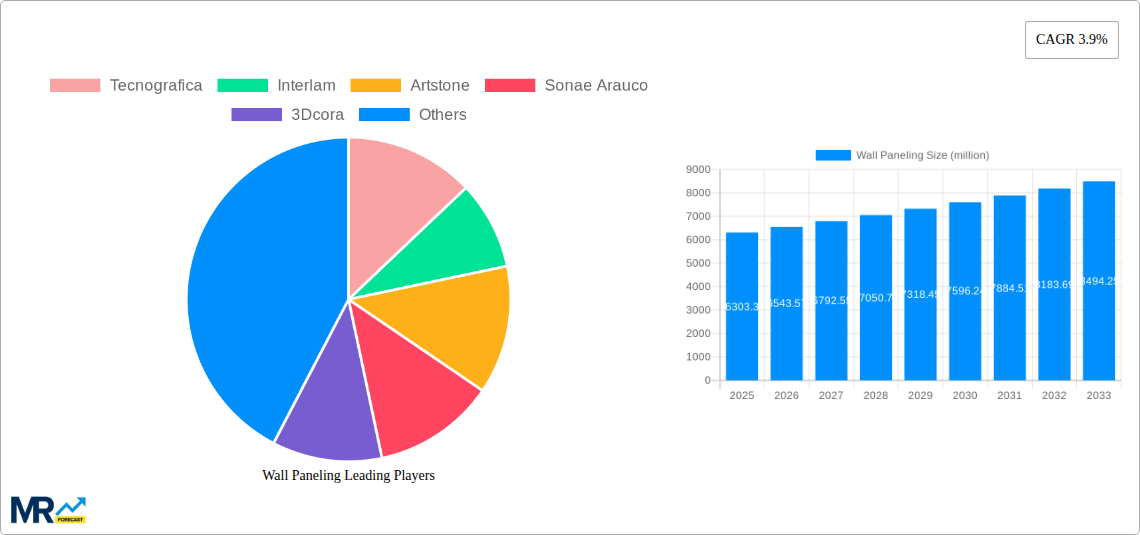

The global wall paneling market is poised for steady expansion, projected to reach a valuation of approximately USD 6,303.3 million by 2025. This growth is underpinned by a projected Compound Annual Growth Rate (CAGR) of 3.9% over the forecast period from 2025 to 2033. The market's buoyancy can be attributed to a confluence of factors, including the increasing demand for aesthetic and functional interior design solutions across residential, commercial, and industrial sectors. Growing urbanization and a rising disposable income further fuel the need for durable and visually appealing wall coverings that enhance living and working spaces. The versatility of wall panels, offering benefits such as insulation, soundproofing, and ease of installation, makes them a preferred choice for architects, designers, and homeowners alike.

The wall paneling market's trajectory is shaped by evolving consumer preferences and advancements in material science and manufacturing. Key drivers include the sustained interest in interior renovations and new construction projects, coupled with a growing emphasis on sustainable and eco-friendly building materials. The increasing adoption of modern design aesthetics, which often incorporate textured and visually striking wall panels, is also contributing significantly to market growth. While the market benefits from these positive trends, it also faces certain restraints. Fluctuations in raw material prices, particularly for wood and metal components, can impact manufacturing costs and subsequently influence pricing strategies. Additionally, the availability of alternative wall finishing solutions and the initial investment cost for some premium paneling options might present challenges. Nonetheless, the market's robust growth potential is expected to persist, driven by innovation and a consistent demand for enhanced interior environments.

This comprehensive report offers an in-depth analysis of the global Wall Paneling market, spanning a detailed study period from 2019 to 2033. With the base year set at 2025, the report meticulously examines historical trends from 2019-2024 and provides robust forecasts for the estimated year 2025 and the subsequent forecast period of 2025-2033. The global market size is projected to reach an impressive value in the millions of USD during the forecast period, driven by evolving design aesthetics, advancements in material science, and the increasing demand for functional and aesthetically pleasing interior and exterior finishes across residential, commercial, and industrial applications. The report delves into the diverse range of wall paneling types, including Metal, PVC, Wood, MDF, HDF, Acrylic, and Others, as well as their adoption within various end-use segments.

XXX The global wall paneling market is experiencing a dynamic evolution, moving beyond purely functional applications to embrace sophisticated aesthetic solutions and innovative material integration. During the study period of 2019-2033, with a base year of 2025, a significant shift is observable towards panels that offer enhanced durability, sustainability, and bespoke design capabilities. The estimated market value in the millions of USD highlights the growing consumer and industry investment in this sector. A key trend is the surge in demand for eco-friendly and sustainable materials, prompting manufacturers to increasingly utilize recycled content, rapidly renewable resources like bamboo, and low-VOC finishes. This aligns with global sustainability initiatives and growing consumer awareness. The rise of biophilic design principles is also influencing the market, with an increased preference for wood-based panels and those incorporating natural textures and patterns that mimic organic elements, bringing the outdoors in.

Furthermore, technological advancements are revolutionizing the production and application of wall paneling. Digital printing technologies allow for an unprecedented range of customizable designs, from photorealistic imagery and intricate patterns to bespoke branding solutions for commercial spaces. This has opened up new avenues for personalization, enabling architects and interior designers to create unique environments tailored to specific project requirements. The integration of smart functionalities is another emerging trend. While still nascent, the development of panels with embedded lighting, acoustic control, or even self-healing properties signifies a future where wall paneling is not just decorative but also an active contributor to the building's performance.

The market is also witnessing a diversification of panel types. While traditional materials like wood and MDF remain dominant, there's a growing interest in high-performance materials like advanced composites and specialized PVC formulations offering superior fire resistance, moisture resistance, and impact strength, particularly crucial for commercial and industrial applications. The increasing urbanization and the need for rapid construction solutions are also boosting the adoption of prefabricated and modular wall paneling systems, which offer faster installation times and reduced labor costs. The interplay between these trends, from sustainability and customization to technological integration and material innovation, is shaping a vibrant and expanding wall paneling market projected to reach significant figures in the millions of USD by 2033.

The global wall paneling market is experiencing robust growth, with an estimated market size reaching millions of USD by 2033, propelled by a confluence of compelling driving forces. A primary catalyst is the escalating demand for aesthetic enhancement and interior design customization across both residential and commercial sectors. As consumers and businesses alike place greater emphasis on creating visually appealing and personalized spaces, wall paneling offers a versatile solution to achieve diverse design objectives, from modern minimalism to luxurious traditional styles. The ability to incorporate unique textures, colors, patterns, and even digital prints allows for unparalleled design flexibility, directly fueling market expansion.

Furthermore, the increasing focus on sustainability and environmental consciousness is a significant driver. The development and adoption of eco-friendly wall paneling materials, such as those made from recycled content, rapidly renewable resources like bamboo, and wood sourced from sustainably managed forests, are gaining traction. This aligns with stringent building regulations and growing consumer preference for green building solutions. Additionally, advancements in material science and manufacturing technologies have led to the development of wall panels with enhanced functional properties. These include improved durability, moisture resistance, fire retardancy, acoustic insulation, and thermal efficiency. Such benefits are particularly attractive for commercial and industrial applications where performance and longevity are paramount. The growth of the construction industry globally, fueled by urbanization, infrastructure development, and renovation activities, inherently translates into a higher demand for construction materials, including wall paneling.

Despite the promising growth trajectory, the wall paneling market faces several challenges and restraints that can impact its expansion. One significant hurdle is the initial cost of premium or specialized wall paneling materials. While offering superior aesthetics and performance, materials like high-end wood veneers, advanced composites, or panels with intricate custom designs can be considerably more expensive than conventional paint or wallpaper, thus limiting their adoption in budget-constrained projects. This price sensitivity can be a major restraint, particularly in price-conscious residential segments or for large-scale commercial developments.

Another challenge lies in installation complexity and associated labor costs. While some paneling systems are designed for ease of installation, others, especially those requiring specialized tools, expertise, or extensive preparation of the underlying wall surface, can lead to higher labor expenses. This can deter potential customers who opt for simpler and more cost-effective wall finishing solutions. The perception of durability and maintenance requirements can also pose a challenge. Some consumers may hold outdated perceptions about certain paneling materials, fearing that they are prone to damage, difficult to clean, or require constant upkeep. Educating the market about the advancements in material technology and the low-maintenance nature of modern paneling is crucial to overcoming these misconceptions.

Furthermore, stringent building codes and regulations in certain regions regarding fire safety, material composition, and environmental impact can pose a barrier for some manufacturers and product types. Adapting to and meeting these diverse regulatory requirements across different geographies can be complex and costly. Finally, intense competition from alternative wall finishing solutions, such as traditional paints, wallpapers, tile, and decorative plaster, presents an ongoing challenge. These established alternatives often offer a lower entry price point and a broader familiarity among consumers, requiring wall paneling manufacturers to continuously innovate and clearly articulate their unique value proposition to gain market share.

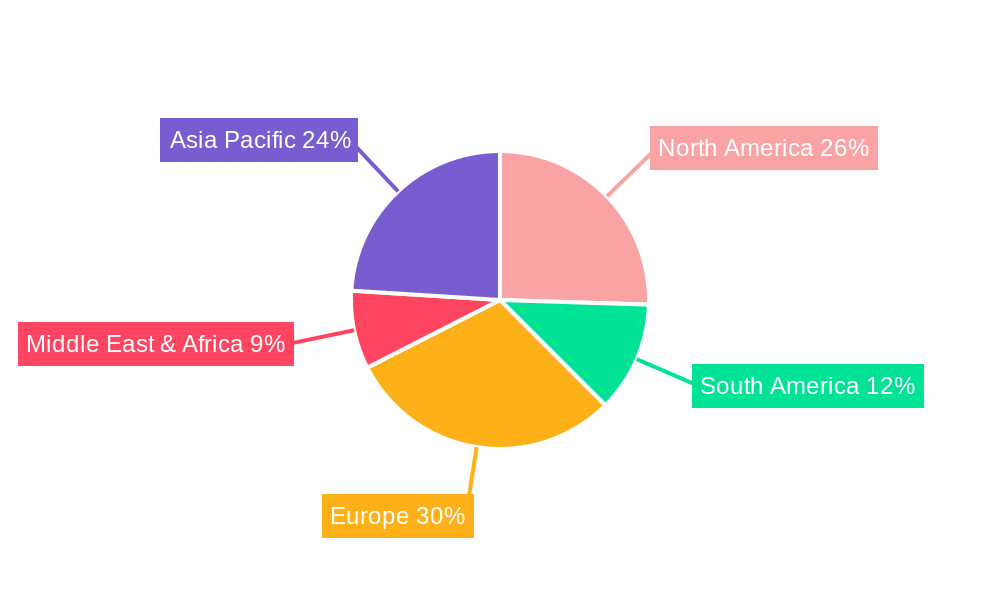

The Wood and MDF/HDF segments, particularly within the Residential and Commercial applications, are projected to dominate the global wall paneling market in terms of value and volume. This dominance is expected to be most pronounced in regions with strong established construction industries and a high propensity for interior design investment.

Dominant Segments:

Dominant Regions/Countries:

The synergy between the material properties of wood, MDF, and HDF and their widespread application in the aesthetically driven residential and commercially focused sectors, combined with the robust construction activities in regions like North America, Europe, and Asia-Pacific, firmly establishes these as the dominant forces in the global wall paneling market.

The wall paneling industry is poised for significant growth, driven by several key catalysts. The escalating demand for aesthetic upgrades and personalized interior design solutions is a primary driver, as consumers and businesses seek to enhance the visual appeal and functionality of their spaces. Furthermore, a growing global consciousness towards sustainability is spurring the adoption of eco-friendly and recycled materials. Technological advancements in manufacturing, enabling customization and improved material performance, are also playing a crucial role. Finally, the continued expansion of the construction sector, fueled by urbanization and infrastructure development worldwide, provides a fundamental impetus for increased wall paneling demand.

This report provides an exhaustive examination of the global wall paneling market, offering detailed insights into its various facets. It delves into the key trends shaping the industry, such as the increasing demand for sustainable materials, customizable designs, and the integration of smart technologies. The report meticulously analyzes the driving forces, including the pursuit of aesthetic enhancement, functional benefits, and the growth of the construction sector. It also addresses the challenges and restraints that the market faces, such as cost concerns and installation complexities. A significant portion of the report is dedicated to identifying the dominant regions and segments, particularly the strong performance of Wood, MDF, and HDF in Residential and Commercial applications across North America, Europe, and Asia-Pacific. Furthermore, it highlights crucial growth catalysts and provides an overview of the leading players and significant market developments. This comprehensive coverage ensures stakeholders have a deep understanding of the market's present landscape and future trajectory.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.9% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 3.9%.

Key companies in the market include Tecnografica, Interlam, Artstone, Sonae Arauco, 3Dcora, SWISS KRONO Group, StoneLeaf, BeautyWalls LLC, Trespa International BV, Unilin Panels, Gustafs Scandinavia AB, 3Form, Laminam, Ekena Millwork, .

The market segments include Type, Application.

The market size is estimated to be USD 6303.3 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Wall Paneling," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Wall Paneling, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.