1. What is the projected Compound Annual Growth Rate (CAGR) of the Vulnerability Scanning?

The projected CAGR is approximately 14.2%.

Vulnerability Scanning

Vulnerability ScanningVulnerability Scanning by Type (/> Software Type, Hardware Type), by Application (/> Government, Education, Enterprise, Financial, Medical, Aerospace, Defense and Intelligence, Telecommunication, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

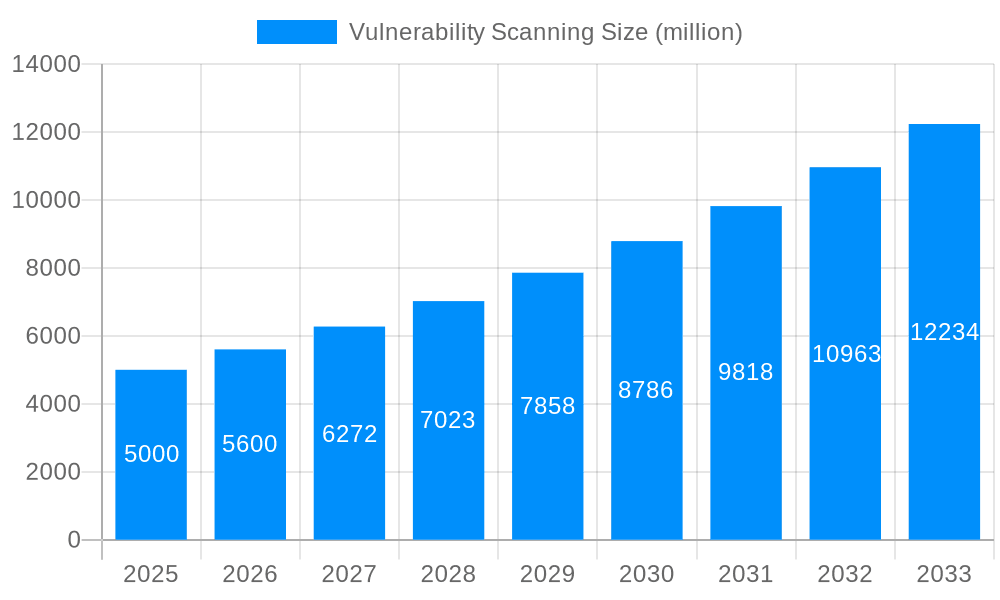

The vulnerability scanning market is experiencing robust growth, driven by the escalating frequency and severity of cyberattacks targeting businesses and organizations globally. The increasing reliance on interconnected systems and the expanding attack surface created by cloud adoption, IoT devices, and remote workforces are key factors fueling this expansion. While precise market sizing data was not provided, considering the presence of major players like Symantec, IBM, and Cisco, along with the consistent need for robust security measures, a conservative estimate places the 2025 market value at approximately $5 billion. A Compound Annual Growth Rate (CAGR) of 12% is reasonable, reflecting the ongoing demand for advanced vulnerability management solutions. This growth is further propelled by evolving threats like ransomware and sophisticated zero-day exploits, demanding more sophisticated scanning technologies. Market segments include network vulnerability scanning, application vulnerability scanning, and database vulnerability scanning, each experiencing varying degrees of growth based on technological advancements and industry adoption rates.

Growth is expected to continue throughout the forecast period (2025-2033), although the rate may slightly moderate as the market matures. Restraining factors include the high cost of implementation and maintenance for some advanced solutions, as well as the potential for false positives leading to alert fatigue. However, these challenges are likely to be mitigated by continuous innovation in the field, leading to more efficient and accurate scanning technologies, and improved integration with other security tools. The competitive landscape is highly fragmented, with established players like Symantec and IBM facing competition from emerging vendors offering specialized solutions. The market is witnessing increased adoption of AI and machine learning to automate vulnerability detection and remediation, further boosting market growth in the long term.

The global vulnerability scanning market is experiencing explosive growth, projected to reach multi-million dollar valuations by 2033. Driven by the increasing sophistication of cyberattacks and the expanding attack surface of organizations, the demand for robust vulnerability management solutions is surging. The historical period (2019-2024) witnessed steady market expansion, laying the groundwork for the significant growth predicted during the forecast period (2025-2033). By the estimated year 2025, the market is expected to surpass several million dollars in revenue, reflecting the growing awareness among businesses of the critical need for proactive security measures. This trend is further amplified by the rising adoption of cloud computing, IoT devices, and digital transformation initiatives across various industries. The market is witnessing a shift towards automated and integrated vulnerability scanning solutions, fueled by the need for faster detection and remediation of vulnerabilities. Furthermore, the increasing regulatory compliance requirements, particularly within sectors like finance and healthcare, are significantly driving the demand for comprehensive vulnerability scanning tools and services. The evolution of attack vectors, including the rise of AI-powered threats, is also forcing organizations to adopt more advanced vulnerability management solutions capable of identifying and mitigating a wider range of risks. This continuous arms race between attackers and defenders is a key driver of market growth, fostering innovation and competition within the vulnerability scanning sector. The market is seeing increased adoption of vulnerability scanning as a service (VSaaS), providing scalable and cost-effective solutions for businesses of all sizes. This, in turn, is expanding the addressable market and fueling further growth.

Several key factors are propelling the significant expansion of the vulnerability scanning market. The escalating frequency and severity of cyberattacks, targeting businesses of all sizes and across diverse sectors, are a primary driver. Data breaches leading to substantial financial losses, reputational damage, and legal liabilities are pushing organizations to prioritize vulnerability management. The increasing complexity of IT infrastructures, coupled with the proliferation of connected devices (IoT) and the widespread adoption of cloud computing, significantly expand the attack surface, creating more opportunities for cybercriminals. This necessitates robust and comprehensive vulnerability scanning solutions capable of identifying weaknesses across diverse systems and platforms. Stringent regulatory compliance mandates, such as GDPR and HIPAA, impose strict requirements on data security, compelling organizations to invest in vulnerability scanning and management to ensure compliance and avoid hefty penalties. Furthermore, the rising awareness among businesses of the importance of proactive security measures, shifting from reactive approaches to preventive strategies, is fueling the adoption of vulnerability scanning technologies. The development and integration of AI and machine learning into vulnerability scanning tools are enhancing their effectiveness in detecting and mitigating threats, further driving market growth.

Despite the substantial growth potential, the vulnerability scanning market faces certain challenges. The sheer volume of vulnerabilities discovered, coupled with the limited resources and expertise available in many organizations, presents a significant hurdle. The complexity of managing vulnerability scans across diverse systems and platforms can be overwhelming, requiring specialized skills and tools. False positives generated by vulnerability scanners can lead to wasted time and resources, impacting the efficiency of the vulnerability management process. Keeping pace with the rapidly evolving threat landscape, characterized by new vulnerabilities emerging continuously, requires ongoing investments in updating scanning tools and security expertise. The integration of vulnerability scanning with other security solutions, such as intrusion detection and prevention systems, can be complex and challenging. Furthermore, cost can be a significant factor, especially for smaller organizations with limited budgets. The ongoing skills gap in cybersecurity, with a shortage of qualified professionals capable of managing vulnerability scanning and remediation, poses another significant challenge to market growth.

The North American market is expected to dominate the global vulnerability scanning market throughout the forecast period (2025-2033) due to factors like high technological advancements, strong cybersecurity infrastructure, stringent data privacy regulations, and the presence of major players in the cybersecurity industry. The region's early adoption of advanced security technologies and its high level of IT spending create a favorable environment for vulnerability scanning solution providers.

Key Segments:

Several factors contribute to the growth of the vulnerability scanning industry, including the increasing adoption of cloud computing and the Internet of Things (IoT), which drastically expands attack surfaces and necessitates more robust vulnerability management. Furthermore, stringent government regulations and compliance requirements are driving organizations to proactively manage and mitigate security risks, making vulnerability scanning essential. The rise of sophisticated cyberattacks and data breaches is making organizations aware of the need for better security practices, and increasing investment in vulnerability scanning to prevent future attacks.

This report provides a comprehensive analysis of the vulnerability scanning market, covering key trends, drivers, challenges, and regional dynamics. It offers insights into the leading players, significant market developments, and growth forecasts for the period 2019-2033. The report is designed to provide valuable information for businesses, investors, and researchers interested in understanding this rapidly expanding sector. The data presented is meticulously researched and analyzed to offer actionable insights for strategic decision-making.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.2% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 14.2%.

Key companies in the market include Symantec, Intel Security, IBM, Cisco, Trend Micro, Dell, Check Point, Juniper Networks, Kaspersky, Hewlett Packard, Microsoft, Huawei, Palo Alto Networks, FireEye, AT&T Cybersecurity, AVG Technologies, Fortinet, ESET, Venustech, H3C Technologies, NSFOCUS.

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in N/A.

Yes, the market keyword associated with the report is "Vulnerability Scanning," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Vulnerability Scanning, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.