1. What is the projected Compound Annual Growth Rate (CAGR) of the Vulnerability Assessment and Penetration Testing?

The projected CAGR is approximately XX%.

Vulnerability Assessment and Penetration Testing

Vulnerability Assessment and Penetration TestingVulnerability Assessment and Penetration Testing by Type (Vulnerability Assessment, Penetration Testing), by Application (Government, Operator, Finance, Manufacturing, Education, Energy, Medical, Retail, Military, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

The global vulnerability assessment and penetration testing market is experiencing robust growth, driven by the increasing frequency and sophistication of cyberattacks targeting diverse sectors. The rising adoption of cloud computing, IoT devices, and digital transformation initiatives across industries like finance, government, and healthcare are significantly increasing the attack surface, making robust security assessments crucial. Furthermore, stringent regulatory compliance requirements, such as GDPR and CCPA, mandate regular security audits, further fueling market expansion. While the exact market size for 2025 is unavailable, considering a conservative estimate based on typical CAGR growth and reported market values in similar studies, we might place the market size around $15 billion. This figure, while an estimate, reflects the substantial and continuing investment in cybersecurity solutions globally.

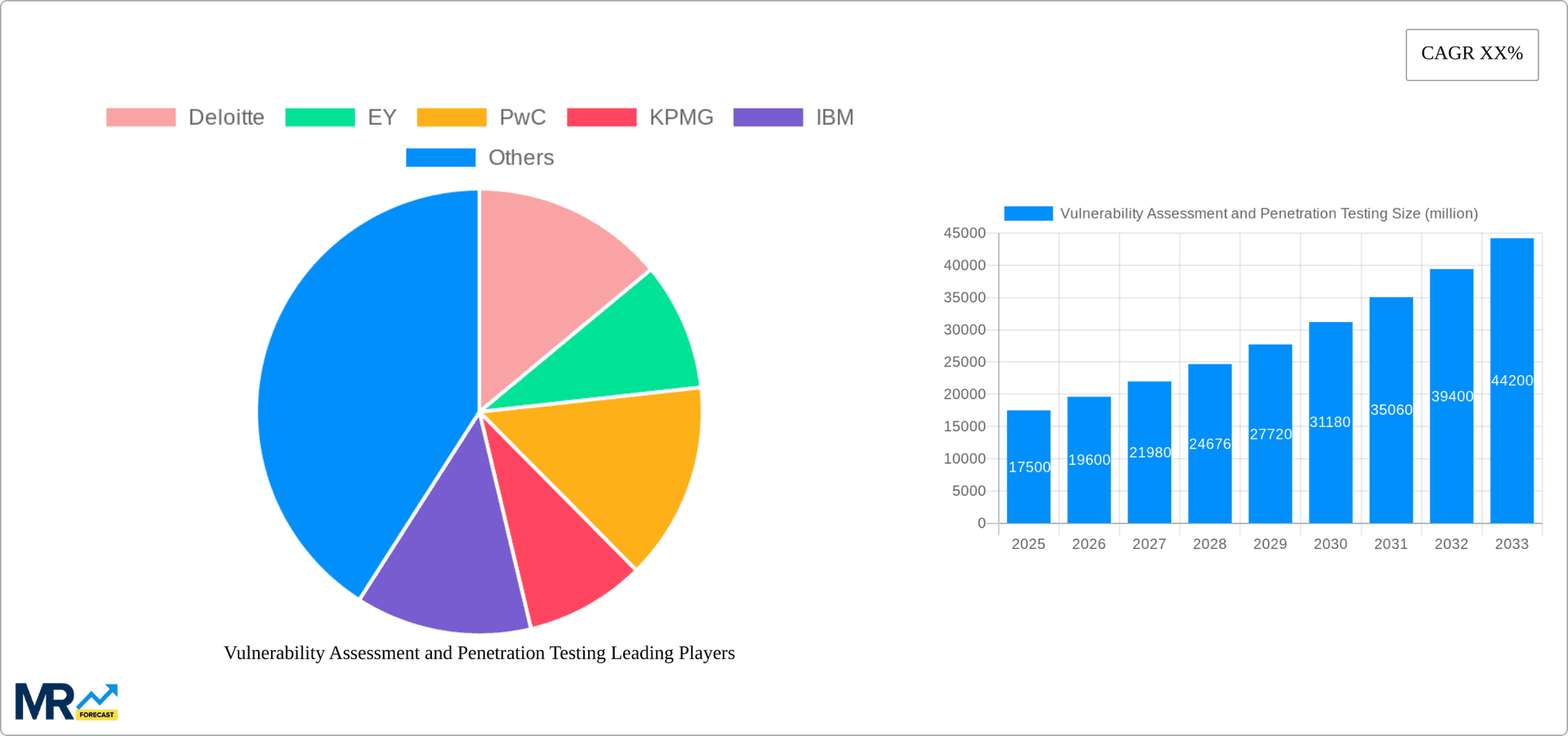

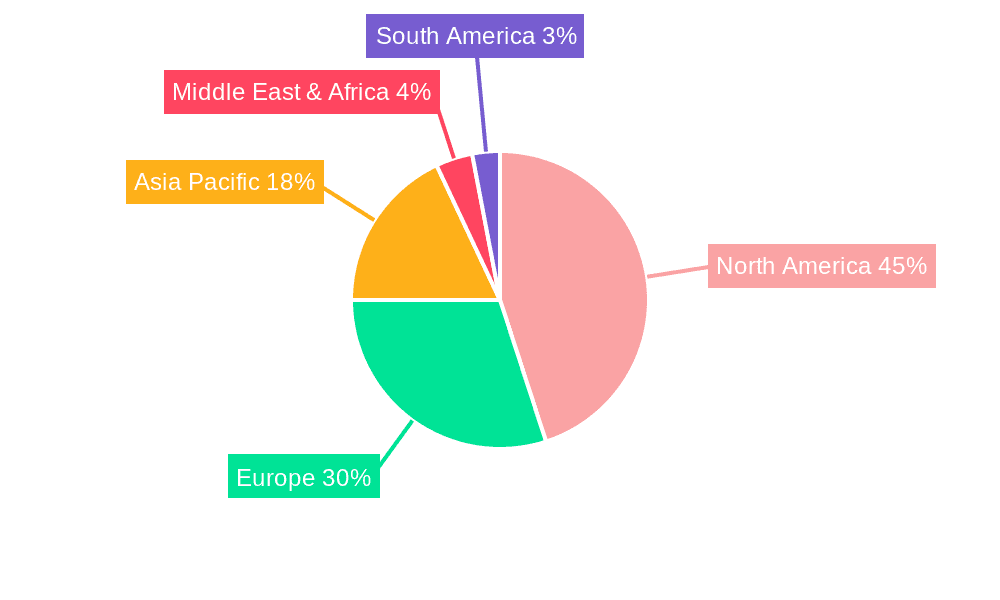

Significant growth is anticipated across all segments. The penetration testing segment holds a larger share due to its proactive nature in identifying and mitigating vulnerabilities. Among application segments, the finance and government sectors are expected to drive significant demand, owing to their heightened vulnerability and stringent security protocols. The geographical distribution shows a strong presence in North America and Europe, given their advanced technological infrastructure and heightened cybersecurity awareness. However, emerging economies in Asia-Pacific are demonstrating rapid growth, fueled by increasing digitalization and government initiatives focused on strengthening cybersecurity infrastructure. Competitive forces are strong with established players like Deloitte, EY, PwC, and IBM competing alongside specialized cybersecurity firms. This competitive landscape fosters innovation and drives prices downward, making vulnerability assessment and penetration testing solutions more accessible to a wider range of organizations.

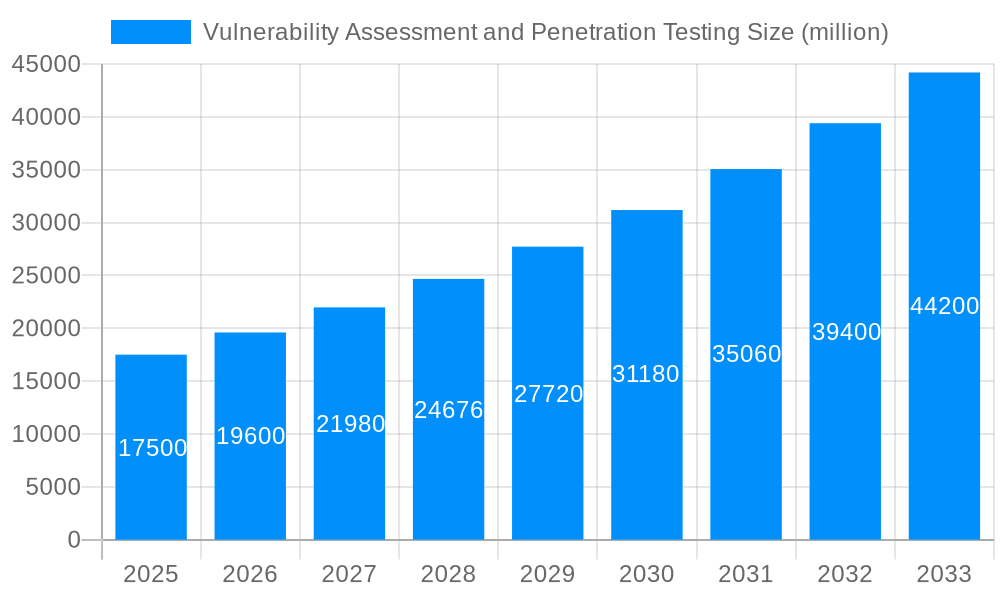

The global vulnerability assessment and penetration testing market is experiencing explosive growth, projected to reach hundreds of millions of dollars by 2033. This surge is driven by the increasingly sophisticated cyber threats facing organizations across all sectors. From 2019 to 2024 (the historical period), the market witnessed significant expansion, fueled by rising awareness of data breaches and regulatory compliance mandates like GDPR and CCPA. The estimated market value for 2025 is already in the hundreds of millions, with continued robust growth expected throughout the forecast period (2025-2033). Key market insights reveal a strong preference for integrated solutions that combine vulnerability assessment and penetration testing capabilities. Organizations are increasingly recognizing the importance of proactive security measures, shifting from reactive responses to incidents to a more preventative approach. This is evident in the growing adoption of automated vulnerability scanning tools and the demand for skilled professionals capable of conducting comprehensive penetration tests. Furthermore, the market is witnessing a rising demand for specialized services tailored to specific industry verticals, like healthcare and finance, reflecting the unique vulnerabilities each sector faces. The increasing complexity of IT infrastructure, the proliferation of IoT devices, and the rise of cloud computing are all contributing factors to the market's sustained expansion. The shift towards cloud-based security solutions is also a noteworthy trend, offering scalability and cost-effectiveness to organizations of varying sizes. Finally, the growth of managed security service providers (MSSPs) is facilitating the accessibility of vulnerability assessment and penetration testing services for smaller companies that may lack internal expertise. This trend is expected to further accelerate market growth in the coming years. The base year for this analysis is 2025, providing a solid foundation for forecasting future market trends.

Several factors are significantly propelling the growth of the vulnerability assessment and penetration testing market. Firstly, the escalating frequency and severity of cyberattacks are forcing organizations to prioritize cybersecurity investments. The financial and reputational damage caused by data breaches are immense, prompting companies to proactively identify and mitigate vulnerabilities. Secondly, stringent regulatory compliance requirements, such as GDPR, HIPAA, and PCI DSS, mandate regular security assessments, creating a substantial demand for vulnerability assessment and penetration testing services. Non-compliance can lead to hefty fines and legal repercussions, making these services a necessary cost of doing business. Thirdly, the increasing adoption of cloud computing and IoT technologies introduces new attack vectors and expands the attack surface, requiring organizations to adapt their security strategies and invest in comprehensive testing methodologies. The complexity of modern IT infrastructures demands sophisticated tools and expertise to effectively identify and address security flaws. Furthermore, the growth of remote work and the adoption of Bring Your Own Device (BYOD) policies have broadened the attack surface, increasing the need for robust security assessments. Finally, the expanding awareness among organizations of the importance of proactive risk management is driving the adoption of these services. Companies are increasingly recognizing that investing in preventative measures is more cost-effective than reacting to security incidents after they occur. This proactive approach is a key driver in the market's continued expansion.

Despite the significant market growth, the vulnerability assessment and penetration testing sector faces certain challenges. One key restraint is the shortage of skilled cybersecurity professionals. The demand for experienced penetration testers and vulnerability assessors far outweighs the supply, leading to high costs and potentially longer lead times for obtaining these services. This skills gap is particularly acute in specialized areas like cloud security and IoT penetration testing. Secondly, the ever-evolving nature of cyber threats presents a continuous challenge. Attack techniques and malware constantly evolve, requiring security professionals to constantly update their knowledge and tools to stay ahead of the curve. The cost of keeping abreast of these developments and maintaining up-to-date testing methodologies can be substantial. Thirdly, the complexity of modern IT infrastructures can make thorough vulnerability assessments and penetration tests time-consuming and resource-intensive. The sheer volume of assets, applications, and network configurations can make it difficult to conduct comprehensive tests efficiently. This complexity can translate to higher costs for organizations. Furthermore, there can be challenges in integrating vulnerability assessment and penetration testing tools and processes into existing security frameworks. Compatibility issues and a lack of integration can hinder efficiency and increase the overall cost of implementing security measures. Finally, maintaining a balance between thorough security testing and minimizing disruptions to business operations is a delicate challenge. Effective penetration testing requires accessing and potentially disrupting live systems, necessitating careful planning and coordination.

The North American market is expected to maintain its dominant position in the vulnerability assessment and penetration testing sector throughout the forecast period (2025-2033). This is largely due to the high concentration of technology companies, stringent regulatory requirements, and significant investments in cybersecurity infrastructure. The region has a robust ecosystem of service providers, along with advanced technology and highly skilled professionals.

Another significantly growing segment is Penetration Testing. This is because penetration testing provides a more realistic assessment of an organization's security posture compared to vulnerability assessments alone.

The Finance sector is a key application segment driving market growth. Financial institutions handle highly sensitive financial and personal data, making them prime targets for cyberattacks. Robust security measures are critical for maintaining customer trust and complying with industry regulations.

The vulnerability assessment and penetration testing industry is experiencing robust growth, catalyzed by several factors. Increased awareness of data breaches and their associated costs are driving proactive security investments. Stringent regulatory compliance mandates necessitate regular security assessments, while the proliferation of IoT devices and cloud computing expands the attack surface, demanding more sophisticated testing solutions. Furthermore, the rising adoption of managed security service providers (MSSPs) broadens access to these vital services for smaller companies.

This report provides a comprehensive overview of the vulnerability assessment and penetration testing market, analyzing key trends, driving forces, challenges, and growth opportunities. It offers detailed insights into leading market players and significant industry developments, providing valuable information for stakeholders seeking to understand and navigate this rapidly evolving landscape. The report's projections extend to 2033, offering a long-term perspective on market growth and future trends.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of XX% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Deloitte, EY, PwC, KPMG, IBM, Accenture, Booz Allen Hamilton, Mandiant, Capgemini, Protiviti (Robert Half), RSM International, Yokogawa, H3C, Venustech, Topsec, NSFOCUS, QIANXIN, Kreston, Hillstone Networks, North Laboratory, Tophant, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Vulnerability Assessment and Penetration Testing," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Vulnerability Assessment and Penetration Testing, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.