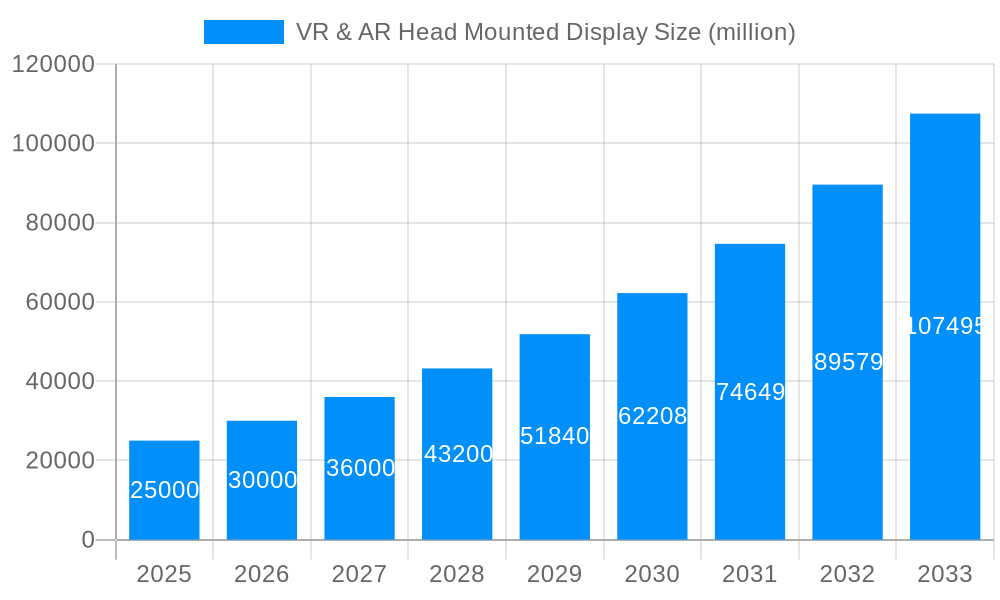

1. What is the projected Compound Annual Growth Rate (CAGR) of the VR & AR Head Mounted Display?

The projected CAGR is approximately 19.2%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

VR & AR Head Mounted Display

VR & AR Head Mounted DisplayVR & AR Head Mounted Display by Type (Mobile HMDs, PC-based HMDs, Console-based HMDs, All-in-One HMDs, World VR & AR Head Mounted Display Production ), by Application (Healthcare, Education, Construction, Military, Entertainment, World VR & AR Head Mounted Display Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

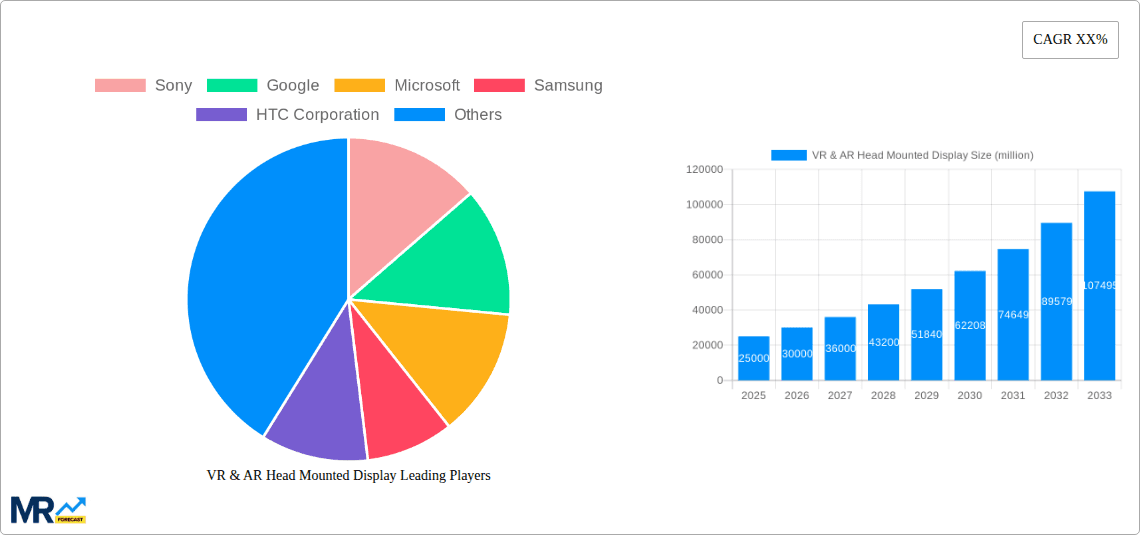

The Virtual Reality (VR) and Augmented Reality (AR) Head-Mounted Display (HMD) market is poised for significant expansion, propelled by advancements in display technology, declining hardware expenses, and expanding integration across diverse industries. Key growth drivers include escalating demand for immersive gaming, the utility of VR/AR in training and education, and its increasing application in healthcare and industrial sectors for simulations and remote collaboration. While challenges such as motion sickness and user comfort persist, ongoing technological innovation is effectively addressing these limitations. The market is segmented by device type (standalone, tethered), application (gaming, entertainment, enterprise), and region. Leading companies, including Sony, Google, Microsoft, and Meta, are making substantial investments in research and development, fostering a competitive and innovative environment. Based on observed growth trajectories and industry analysis, the market size is projected to reach $40.62 billion in 2025, with an estimated Compound Annual Growth Rate (CAGR) of 19.2% from 2025 to 2033.

The competitive arena is characterized by both established technology leaders and specialized VR/AR hardware and software providers. Market success depends on delivering superior visual fidelity, ergonomic comfort, and intuitive user experiences. Furthermore, the creation of engaging content and applications is vital for driving widespread consumer adoption. Market restraints include initial high costs, the requirement for robust computing power, and concerns regarding prolonged use. However, continuous technological progress in miniaturization, battery longevity, and content development is progressively overcoming these barriers, facilitating broader adoption across various sectors. The integration of 5G and enhanced wireless technologies will also significantly bolster the growth of the wireless VR/AR HMD segment.

The global VR & AR head-mounted display (HMD) market is experiencing explosive growth, projected to reach several million units shipped annually by 2033. The historical period (2019-2024) saw significant advancements in technology, leading to more affordable and user-friendly devices. The estimated year 2025 marks a pivotal point, showcasing a substantial increase in adoption across various sectors. This upward trajectory is fueled by several key factors, including the continuous improvement of display resolution and field of view (FOV), resulting in more immersive and realistic experiences. Furthermore, the decreasing cost of components and the increasing availability of high-quality content are lowering the barrier to entry for consumers. We are witnessing a diversification of applications beyond gaming and entertainment, with significant adoption in sectors like education, healthcare, and industrial training. The forecast period (2025-2033) anticipates sustained, robust growth driven by the convergence of technological innovation and widening market applications. This report analyzes this dynamic landscape, providing insights into the key trends driving this expansion, including the integration of advanced features like eye-tracking and haptic feedback which further enhance the immersive capabilities and user interaction. The market is evolving from primarily consumer-focused applications to encompass a wide range of business-to-business (B2B) solutions, representing significant potential for future growth. The increasing sophistication of HMDs is also a key factor, with improved ergonomics, lighter weight designs, and longer battery life making them more comfortable and practical for extended use. The report’s study period (2019-2033) provides a comprehensive view of this market’s evolution, from its nascent stages to its anticipated mature state. The base year, 2025, serves as a critical benchmark to analyze current market dynamics and project future performance.

Several powerful forces are propelling the growth of the VR & AR HMD market. Firstly, technological advancements are making these devices more accessible and affordable. Improved display technologies, such as higher resolutions and wider fields of view, deliver increasingly immersive and realistic experiences. Miniaturization of components is leading to lighter, more comfortable headsets, suitable for extended use. Secondly, the burgeoning content ecosystem plays a crucial role. The availability of high-quality VR games, interactive simulations, and AR applications caters to a wide range of user interests and needs. This expanding content library is a major driver of market expansion. Thirdly, the increasing adoption of VR and AR across diverse industries is a significant growth catalyst. Industries such as healthcare (surgical simulations, rehabilitation), education (immersive learning experiences), and manufacturing (training, design) are actively integrating VR/AR HMDs into their workflows, significantly increasing demand. Finally, the growing consumer interest in immersive entertainment and experiences fuels the market's growth. VR gaming and AR social applications are gaining significant traction, encouraging more individuals to invest in these devices. The combined effect of these driving forces ensures a robust and expanding market for VR & AR HMDs in the coming years.

Despite the considerable growth potential, the VR & AR HMD market faces several challenges. High initial costs remain a significant barrier for many consumers, especially considering the need for accompanying hardware such as powerful computers or smartphones. This price sensitivity restricts mass-market adoption, limiting growth potential. Furthermore, motion sickness and discomfort associated with extended use continue to be a hurdle. Though technological improvements are mitigating this, it remains a considerable issue for some users. The development of compelling content is also a challenge. High-quality VR and AR experiences require considerable investment in development, potentially limiting the diversity and quantity of available applications. Concerns regarding privacy and data security also persist. The collection of user data through HMDs raises privacy issues that need careful addressing through regulatory frameworks and transparent data handling practices. Lastly, the lack of standardization across platforms and technologies fragments the market and hinders the development of a unified ecosystem. Addressing these challenges requires collaborative efforts from manufacturers, developers, and policymakers to unlock the full potential of VR and AR HMDs.

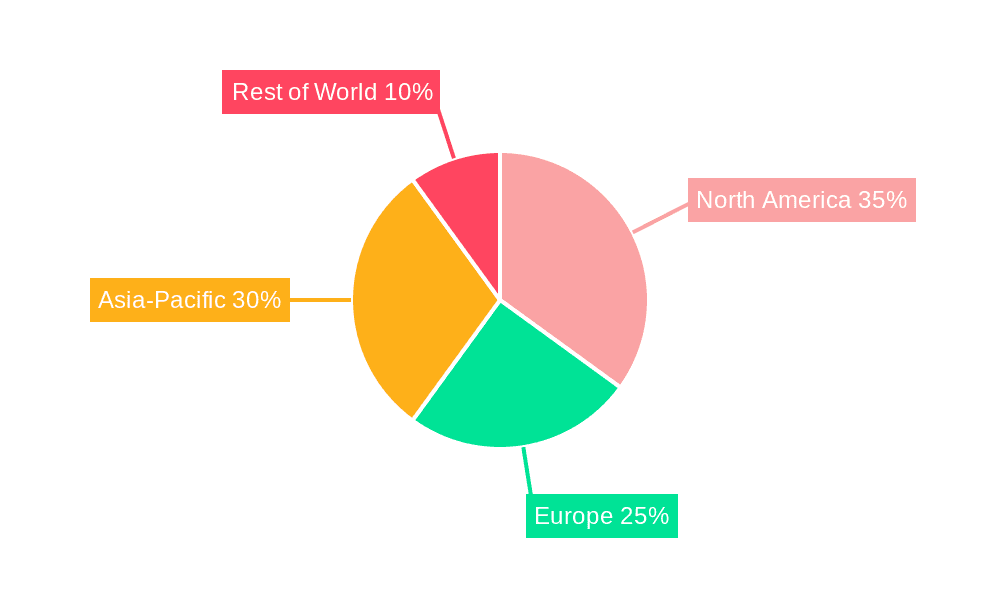

The North American and Asian markets are currently leading in VR & AR HMD adoption, driven by strong technological infrastructure, high consumer spending, and a burgeoning gaming industry. Within these regions, specific countries like the United States, Japan, South Korea and China are showcasing significant growth.

Segments: The gaming segment currently holds the largest market share, driven by the popularity of immersive gaming experiences. However, the enterprise segment is experiencing rapid growth as industries increasingly adopt VR/AR for training, design, and other applications.

The forecast indicates that both the North American and Asian markets, along with the enterprise and gaming segments, will continue to dominate the market throughout the forecast period (2025-2033), fueled by sustained technological advancements and increasing industry adoption. This growth will be underpinned by continued investment in research and development, expansion of content libraries, and decreasing hardware costs.

The VR & AR HMD industry is experiencing significant growth fueled by several key factors: the continuous improvement in display technology leading to more immersive experiences; a rapidly expanding library of high-quality content, including games and applications in various sectors; and the rising adoption of VR/AR solutions across numerous industries, including healthcare, education, and manufacturing for enhanced training and design processes. These factors, combined with decreasing hardware costs, make VR/AR HMDs more accessible and attractive to consumers and businesses alike.

This report provides a comprehensive analysis of the VR & AR HMD market, offering invaluable insights into market trends, driving forces, challenges, and key players. It covers historical data (2019-2024), an estimated year (2025), and a forecast period (2025-2033), providing a holistic view of the market’s evolution. The report also delves into key regions, segments, and growth catalysts, empowering businesses to make informed strategic decisions within this dynamic and rapidly expanding sector.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 19.2% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 19.2%.

Key companies in the market include Sony, Google, Microsoft, Samsung, HTC Corporation, Oculus (Facebook), Leap Motion (Ultrahaptics), CyberGlove Systems, Vuzix, EON Reality, STMicroelectronics, Pico, 3Glasses.

The market segments include Type, Application.

The market size is estimated to be USD 40.62 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in billion and volume, measured in K.

Yes, the market keyword associated with the report is "VR & AR Head Mounted Display," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the VR & AR Head Mounted Display, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.