1. What is the projected Compound Annual Growth Rate (CAGR) of the Voice-Based Payment System?

The projected CAGR is approximately 15.8%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Voice-Based Payment System

Voice-Based Payment SystemVoice-Based Payment System by Type (/> Hardware, Software), by Application (/> BFSI, Retail & E-commerce, Automotive, Healthcare, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

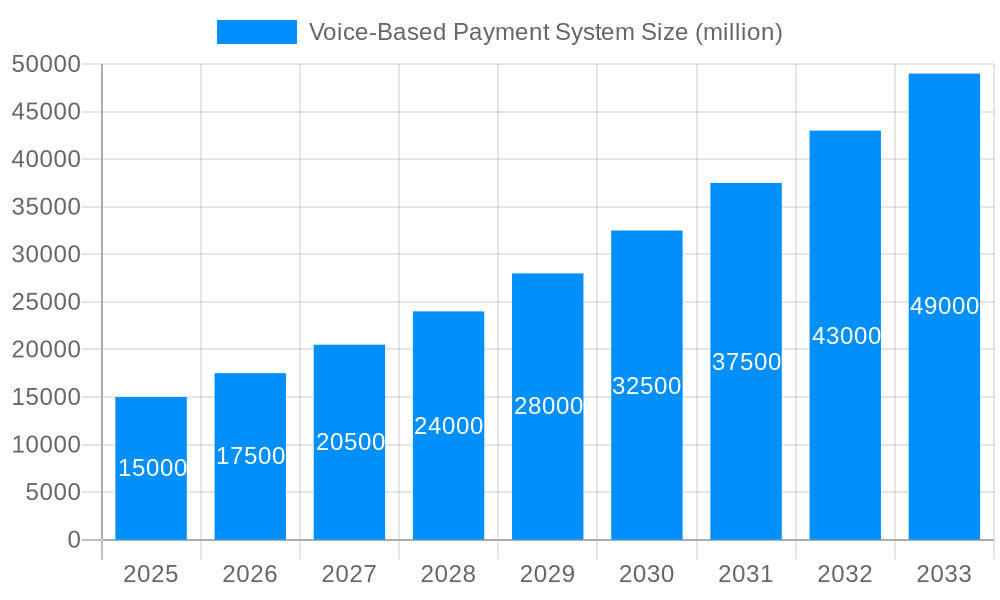

The global voice-based payment system market is experiencing significant expansion, propelled by the widespread adoption of voice assistants, the growing preference for contactless transactions, and the increasing integration of voice technology across diverse devices. The inherent convenience and speed of voice payments are primary drivers attracting both consumers and businesses. We project the market size for 2025 to be $10.94 billion, with an estimated Compound Annual Growth Rate (CAGR) of 15.8% from 2025 to 2033. This growth trajectory is underpinned by advancements in sophisticated voice recognition technology, fortified security features addressing user concerns, and the expanding deployment of voice payment capabilities in smart home ecosystems and automotive applications. While challenges persist, including potential security vulnerabilities and the imperative for broader consumer acceptance, the market outlook remains exceptionally strong.

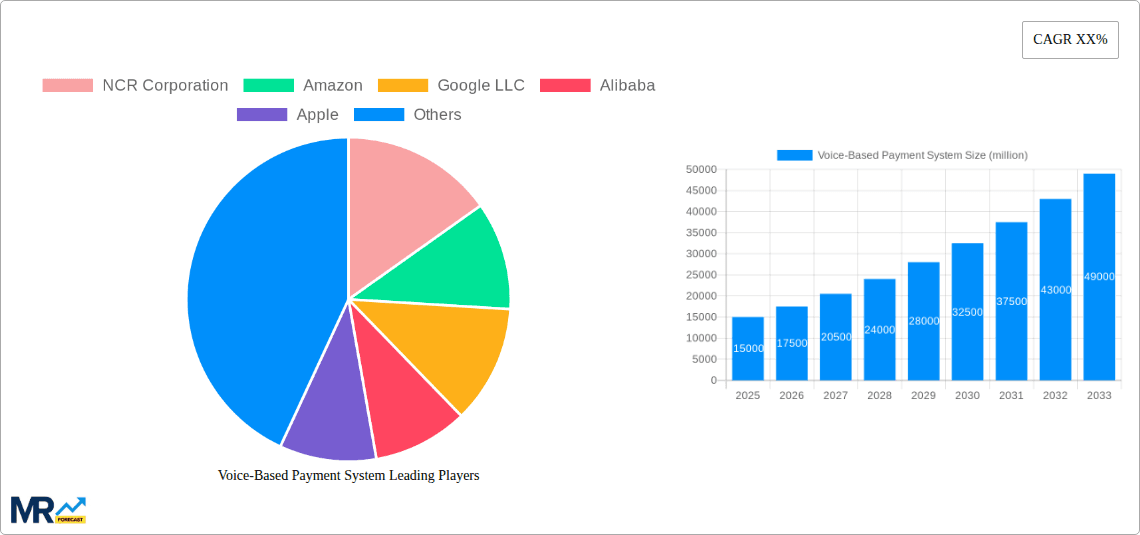

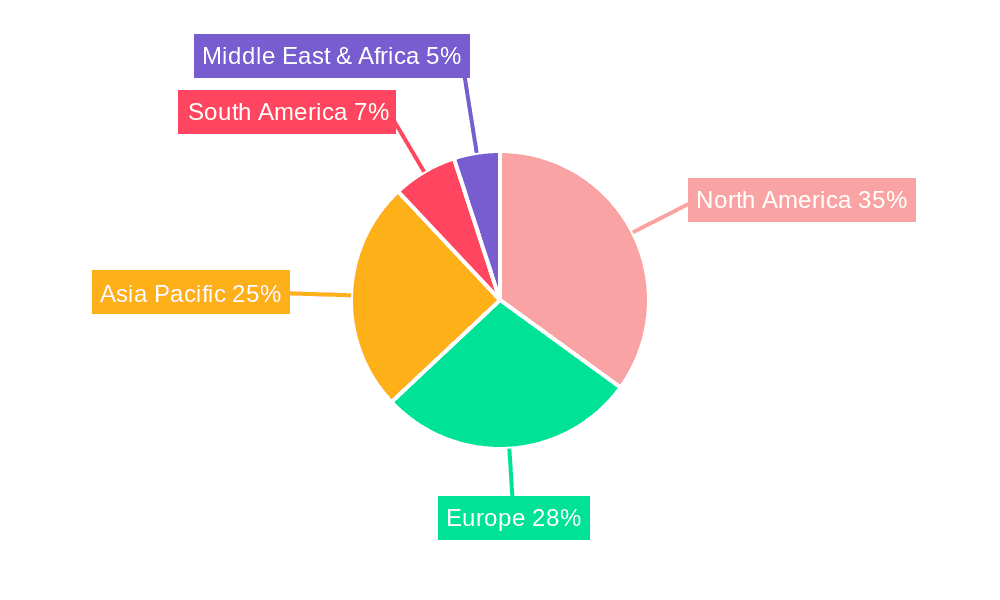

Key stakeholders in the voice-based payment system market encompass established technology giants, prominent financial institutions, and leading automotive manufacturers. Companies such as Amazon, Google, Apple, and PayPal are strategically integrating voice payment solutions within their existing platforms. Automotive industry leaders, including Toyota and Volkswagen, are actively incorporating voice payment functionalities into their in-car infotainment systems. The competitive environment is characterized by continuous innovation in voice recognition accuracy, robust security protocols, and intuitive user interface design. The market is segmented by payment method (e.g., credit card, debit card, mobile wallet), device type (e.g., smartphones, smart speakers, in-car systems), and geographical region. North America and Europe currently command substantial market share, while the Asia-Pacific region is anticipated to witness accelerated growth due to escalating smartphone penetration and rising disposable incomes. Market restraints include persistent concerns regarding data privacy and security, alongside the necessity for continued technological advancements to enhance the precision and dependability of voice recognition systems.

The global voice-based payment system market is experiencing explosive growth, projected to reach multi-billion dollar valuations by 2033. The study period of 2019-2033 reveals a consistent upward trajectory, driven by increasing smartphone penetration, advancements in voice recognition technology, and the rising adoption of smart speakers and virtual assistants. The estimated market value in 2025 (our base year) already signifies substantial market penetration, setting the stage for robust expansion during the forecast period (2025-2033). Analysis of the historical period (2019-2024) highlights the accelerating pace of adoption, particularly in developed economies. This trend is further fueled by the convenience and ease of use offered by voice payments, particularly appealing to an aging population and those with disabilities. The integration of voice payments into various platforms, from e-commerce websites to in-car systems, is expanding the market’s reach and scope significantly. Moreover, the increasing emphasis on contactless payment solutions, further accelerated by the COVID-19 pandemic, has significantly boosted the demand for voice-based payment systems. The market isn’t just growing in volume; it’s evolving in sophistication, with innovations in security protocols and integration with broader fintech ecosystems driving market expansion. The seamless integration with other services, such as online shopping and bill payments, enhances user experience and further contributes to the market's expansion. Competition among key players is also fostering innovation and pushing down costs, making voice-based payments accessible to a wider user base. Ultimately, the convergence of technological advancements and shifting consumer preferences positions the voice-based payment system market for continued and substantial growth.

Several factors are driving the rapid expansion of the voice-based payment system market. The increasing prevalence of smart devices equipped with advanced voice recognition capabilities, such as smartphones and smart speakers, forms a crucial foundation. This widespread availability lowers the barrier to entry for consumers. Furthermore, the convenience and speed offered by voice payments are undeniable advantages over traditional methods. Consumers appreciate the hands-free nature, especially during multitasking or when mobility is limited. The rising adoption of virtual assistants like Siri, Alexa, and Google Assistant is seamlessly integrating voice payments into daily routines. Businesses are also recognizing the benefits, from streamlined checkout processes and reduced operational costs to enhanced customer experience. The growing demand for contactless payment options, fueled by health concerns and technological advancements, further propels the market. The continuous improvement in voice recognition accuracy and security features, addressing initial concerns about fraud and data breaches, instills greater consumer trust. The integration of voice payments into diverse platforms and applications, expanding beyond simple online transactions to encompass in-car systems and other smart home devices, significantly broadens the market's potential.

Despite its promising growth trajectory, the voice-based payment system market faces several challenges. Security concerns remain paramount. The potential for unauthorized access and fraudulent transactions necessitates robust security protocols and encryption methods to ensure consumer trust. Data privacy is another critical concern. The collection and use of voice data raise ethical and regulatory questions, demanding strict compliance with data protection regulations. Interoperability issues across different platforms and devices also represent a barrier. The lack of standardization could hinder seamless transactions between various systems. Technical glitches and inaccuracies in voice recognition can lead to frustrating user experiences and hamper widespread adoption. The need for reliable internet connectivity to execute voice payments poses a limitation in areas with poor infrastructure. Furthermore, the adoption of voice payments varies across demographics and geographies, with some user groups displaying higher resistance to new technologies than others. Addressing these challenges requires collaborative efforts among developers, regulators, and stakeholders to build a secure, reliable, and user-friendly ecosystem.

North America: The region is expected to dominate the market due to early adoption of innovative technologies, high smartphone penetration, and a robust digital infrastructure. The high disposable incomes in the US and Canada also contribute to this dominance.

Europe: While slightly behind North America, Europe shows significant potential, driven by a growing demand for contactless payment methods and increasing government support for digital initiatives. The UK and Germany are anticipated to be key markets within the region.

Asia-Pacific: This region is witnessing rapid growth, particularly in countries like China and India, owing to a massive population base and rising smartphone ownership. However, infrastructure limitations and varying levels of technological adoption across the region present certain challenges.

Segments: The e-commerce segment is projected to dominate due to the convenience and speed of voice-based payments during online purchases. The in-car payment segment is also experiencing significant growth, particularly with the increasing integration of voice assistants in vehicles. Growth in smart home voice payments is also expected, reflecting the rising use of smart speakers and voice-controlled devices.

The overall market is highly fragmented, with several niche players catering to specific industry verticals and geographic regions. The competition among players drives innovation and offers consumers a variety of choices, shaping the market's dynamics and further fueling growth. The competitive landscape is expected to become even more intense in the years to come, leading to further market expansion and refinement of services.

The voice-based payment system industry is fueled by a convergence of factors: increased smartphone penetration, advancements in voice recognition technology, rising consumer demand for contactless payment options, and continuous innovation by major players. The integration of voice payments into various platforms and the development of robust security protocols further contribute to its expansion. This synergy of technological progress and evolving consumer preferences ensures continued growth in this dynamic market segment.

This report provides a comprehensive analysis of the voice-based payment system market, covering historical trends, current market dynamics, and future growth projections. It includes detailed insights into key market drivers, challenges, and opportunities, along with regional and segment-specific analyses. The report also profiles leading players in the industry, offering a detailed competitive landscape and future growth projections. This in-depth analysis provides valuable insights for businesses, investors, and stakeholders looking to navigate the rapidly evolving voice-based payment landscape.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.8% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 15.8%.

Key companies in the market include NCR Corporation, Amazon, Google LLC, Alibaba, Apple, PayPal, Paysafe Holdings UK Limited, PCI Pal, Vibe Pay, Cerence, Kasisto, Toyota, URO Vehículos Especiales S.A., Volkswagen AG, HUAWEI.

The market segments include Type, Application.

The market size is estimated to be USD 10.94 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in billion.

Yes, the market keyword associated with the report is "Voice-Based Payment System," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Voice-Based Payment System, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.