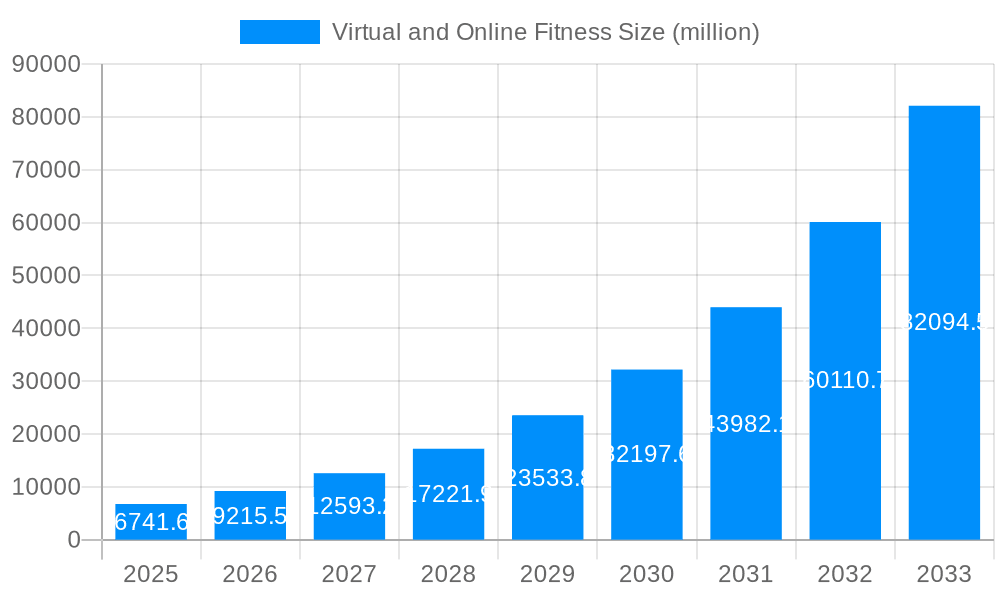

1. What is the projected Compound Annual Growth Rate (CAGR) of the Virtual and Online Fitness?

The projected CAGR is approximately 36.6%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Virtual and Online Fitness

Virtual and Online FitnessVirtual and Online Fitness by Application (Adults, Children, The Elderly), by Type (Equipment, Services), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

The global virtual and online fitness market is experiencing explosive growth, projected to reach a substantial size. The compound annual growth rate (CAGR) of 36.6% from 2019-2024 indicates a significant upward trajectory, driven by several key factors. Increased accessibility through smartphones and readily available internet access has democratized fitness, making professional training and diverse workout options available to a wider audience regardless of geographical location or socioeconomic background. The convenience factor is a major driver, allowing individuals to exercise at their own pace and schedule, eliminating the constraints of traditional gym memberships and fixed class times. Furthermore, the integration of technology, including gamification, personalized fitness tracking, and virtual instructor interaction, enhances user engagement and motivation, leading to higher retention rates. The market segmentation reveals a broad appeal across demographics, encompassing adults, children, and the elderly, each benefiting from the tailored fitness solutions offered. The market's composition, including both equipment and service providers, demonstrates its versatility and potential for continued expansion. While precise revenue figures for each segment are unavailable, it's reasonable to infer that the services segment likely holds a larger market share due to the lower barrier to entry for virtual classes and subscription-based platforms compared to the relatively higher cost of specialized fitness equipment.

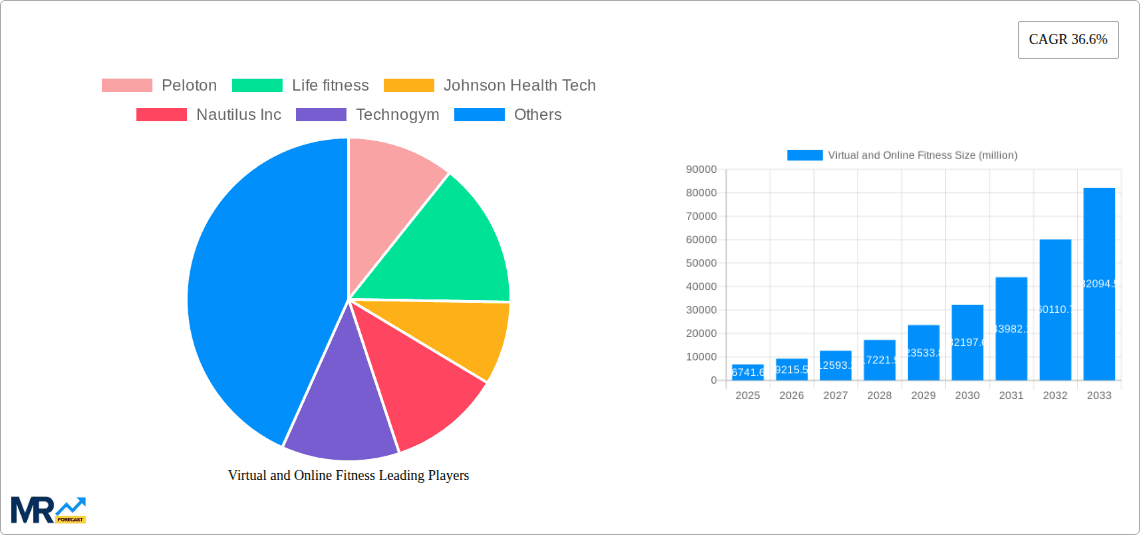

The substantial growth forecasts for the virtual and online fitness market are poised to continue through 2033. Key players such as Peloton, Technogym, and Zwift are leading the charge, constantly innovating to improve user experiences and expand their service offerings. The market is also witnessing increased competition from smaller, specialized providers, contributing to a diverse landscape that caters to various niche interests and fitness goals. Geographic distribution reveals a strong presence in North America and Europe, but the Asia-Pacific region shows significant potential for future expansion driven by rising disposable incomes and increasing internet penetration. The market's continuous evolution suggests a promising future for virtual and online fitness, with opportunities for further technological advancements and strategic partnerships to further fuel market expansion and strengthen existing players' positions. Challenges remain in addressing issues such as maintaining user motivation, overcoming technological limitations for certain demographics, and ensuring accessibility for individuals in areas with limited internet connectivity.

The virtual and online fitness market experienced explosive growth between 2019 and 2024, fueled by the COVID-19 pandemic and a broader shift towards convenient and personalized fitness solutions. This trend shows no signs of slowing, with projections indicating a market valued at several billion dollars by 2033. Key market insights reveal a strong preference for subscription-based services offering diverse workout options, from live and on-demand classes to personalized training programs. The accessibility of these services, eliminating geographical limitations and expensive gym memberships, is a major draw. Furthermore, the integration of technology, including wearables, interactive equipment, and sophisticated software, is enhancing user engagement and providing valuable data for performance tracking and improvement. The market is witnessing increasing diversification, with offerings catering to specific demographics, including children, adults, and the elderly, each with tailored programs and equipment. The demand for virtual fitness solutions extends beyond individual consumers, with corporate wellness programs increasingly adopting these platforms for employee engagement and improved health outcomes. This growing adoption by businesses further underscores the market's robust growth potential. The rise of gamified fitness experiences, incorporating elements of competition and social interaction, is also contributing to user engagement and retention. This trend reflects a deeper understanding of the psychological factors influencing long-term adherence to fitness regimes, moving beyond simple exercise to create a holistic and enjoyable experience.

Several key factors are driving the phenomenal growth of the virtual and online fitness market. The increasing prevalence of sedentary lifestyles and related health concerns is a primary driver, prompting individuals to seek convenient and accessible fitness solutions. The convenience factor itself is paramount; online platforms offer anytime, anywhere access to workouts, eliminating the need for travel and rigid gym schedules. The affordability of many virtual fitness programs, compared to traditional gym memberships or personal trainers, also plays a significant role in attracting a wide range of consumers. Furthermore, technological advancements are constantly enhancing the user experience, with high-quality video streaming, interactive features, and personalized feedback driving user engagement and satisfaction. The growing availability of specialized fitness programs tailored to diverse demographics, including children, adults, and the elderly, further expands the market's reach. Finally, the increased emphasis on preventative healthcare and corporate wellness programs is significantly bolstering demand, as companies integrate virtual fitness platforms into their employee benefit packages. This multifaceted convergence of factors ensures the sustained growth of this dynamic market sector.

Despite its rapid growth, the virtual and online fitness market faces several challenges. One significant hurdle is the maintenance of user engagement. The lack of in-person interaction and potential for distractions at home can lead to inconsistency and eventual dropout rates. Furthermore, the effectiveness of virtual training can be questioned, particularly regarding proper form and technique, potentially leading to injuries if not properly monitored. Technological limitations, such as inconsistent internet connectivity or inadequate equipment, can hinder the user experience and limit accessibility for certain populations. Data privacy and security are critical concerns, particularly with the collection and storage of sensitive user information. The market also faces competition from established brick-and-mortar gyms and fitness studios, which continue to offer traditional workout experiences appealing to some consumers. The challenge lies in providing a comparable, if not superior, experience online that overcomes these barriers. Finally, the high initial investment required for technology and content development can pose a significant barrier to entry for smaller businesses.

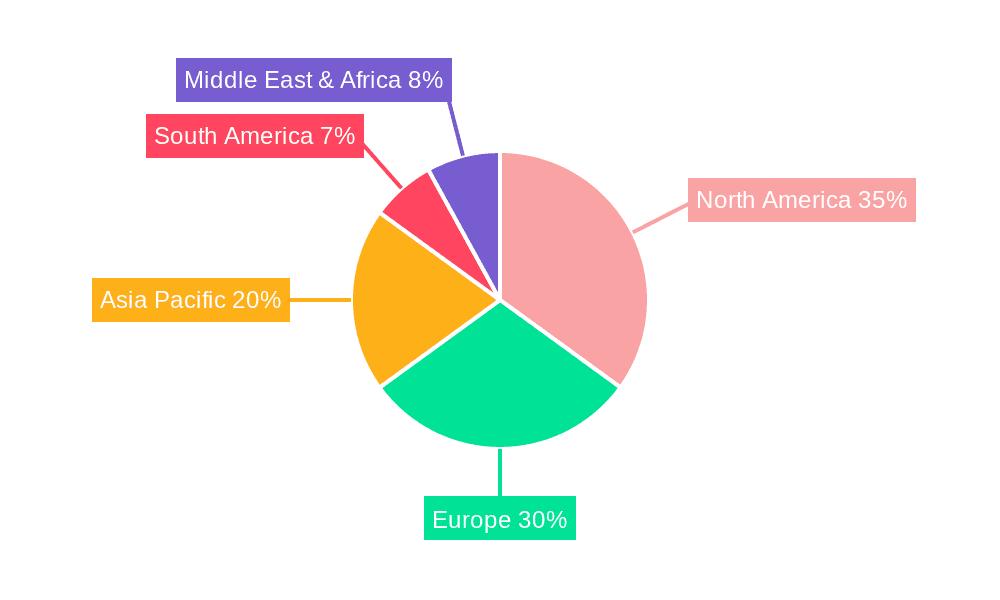

The virtual and online fitness market exhibits robust growth across various regions and segments. However, some show stronger potential than others.

Dominating Segments:

Adults: This segment constitutes the largest portion of the market. The desire for convenient and personalized fitness solutions amongst working professionals and individuals with busy schedules fuels this dominance. The availability of various programs catering to specific fitness goals (weight loss, strength training, flexibility) further drives its growth. The market value for adult-focused services is projected to exceed several billion dollars by 2033.

Services: The service segment, encompassing online classes, personal training, and subscription platforms, holds a significant market share. This preference stems from the diverse offerings, affordability, and ease of access compared to equipment-based solutions. This segment is expected to witness continued expansion driven by technological innovations and increasing user preference for virtual workout experiences.

Dominating Regions:

North America: This region consistently leads the market, largely due to high internet penetration, technological advancements, and a strong health and wellness culture. The presence of major market players and high disposable income also contribute to this dominance.

Europe: Europe follows closely behind North America, demonstrating significant growth driven by increasing health consciousness, rising adoption of digital technologies, and growing investments in the fitness sector. Many countries in Western Europe are particularly strong markets within this broader region.

The detailed market projections for these segments and regions indicate substantial growth across the forecast period (2025-2033), surpassing billions of dollars in revenue by the end of the forecast. The combination of factors such as the high demand for convenient fitness options and the increasing accessibility of affordable technology, further solidifies this prediction.

The virtual and online fitness industry is experiencing rapid growth propelled by several key catalysts. Technological advancements, including better streaming quality, interactive features, and personalized feedback mechanisms, continuously enhance the user experience. The increasing accessibility and affordability of virtual fitness programs, compared to traditional gym memberships, are major drivers of market expansion. Furthermore, the growing prevalence of corporate wellness programs and the integration of virtual fitness platforms into these programs significantly contribute to increased market penetration. The growing awareness of the importance of preventative healthcare and the desire for convenient fitness options further solidify the trajectory of growth within this industry.

This report provides a detailed analysis of the virtual and online fitness market, encompassing historical data (2019-2024), current estimations (2025), and future projections (2025-2033). It explores key market trends, driving forces, challenges, and growth catalysts, offering a comprehensive overview of the industry landscape. The report profiles major market players, analyzes key segments (adults, children, elderly, equipment, services), and identifies regions expected to dominate the market. This insightful study provides valuable information for businesses operating in, or seeking entry into, the dynamic and rapidly expanding virtual and online fitness sector.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 36.6% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 36.6%.

Key companies in the market include Peloton, Life fitness, Johnson Health Tech, Nautilus Inc, Technogym, Precor, Core Health & Fitness, Fitness First, Charter Fitness, Zwift, ClassPass Inc., eGym GmbH, Tonal, FNF, Wellbeats, Mirror, Econofitness, Tempo, Les Mills International Ltd., Fitness On Demand, .

The market segments include Application, Type.

The market size is estimated to be USD 6741.6 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Virtual and Online Fitness," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Virtual and Online Fitness, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.