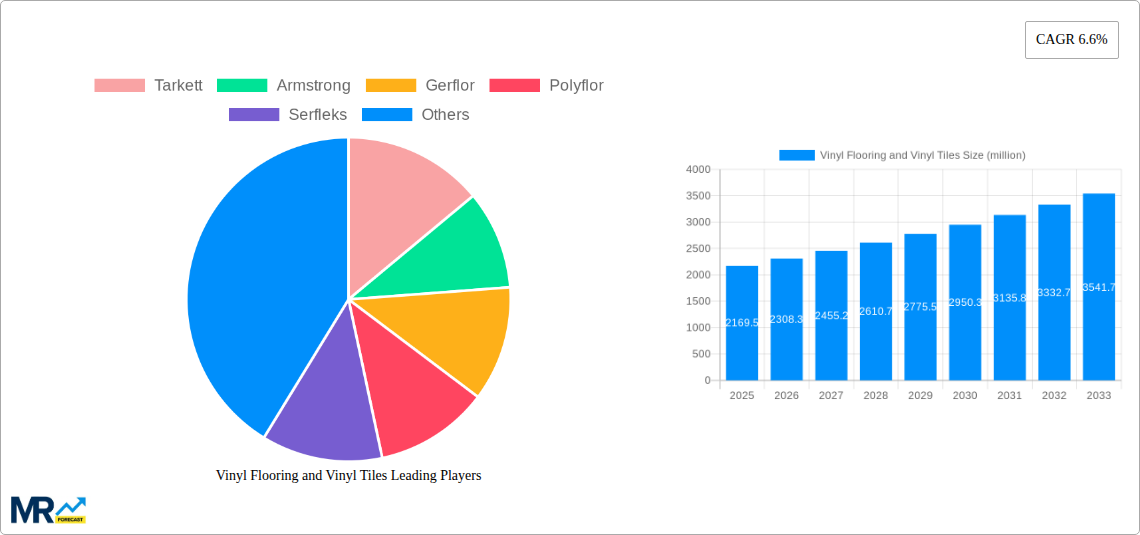

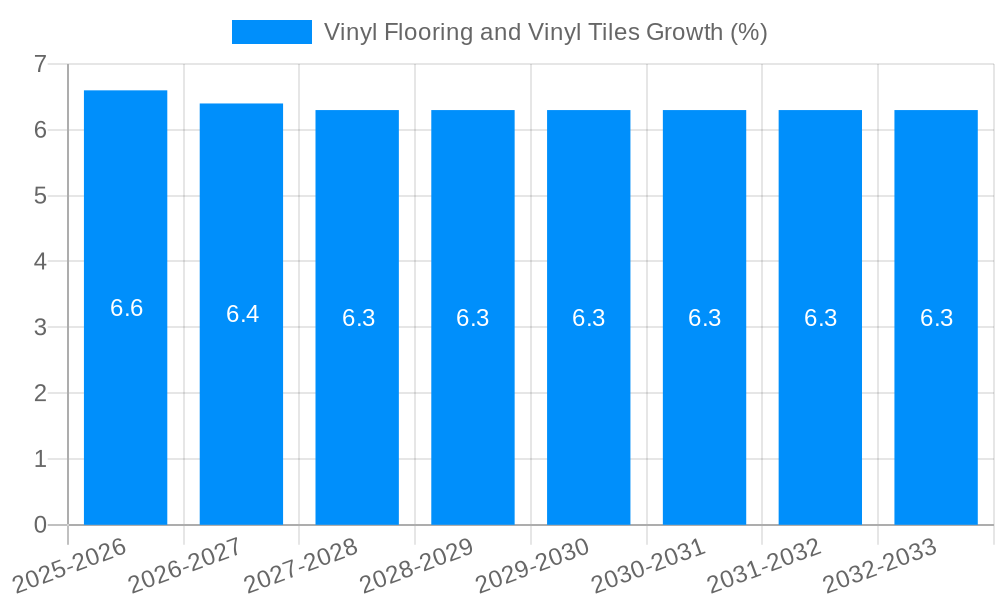

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vinyl Flooring and Vinyl Tiles?

The projected CAGR is approximately 6.6%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Vinyl Flooring and Vinyl Tiles

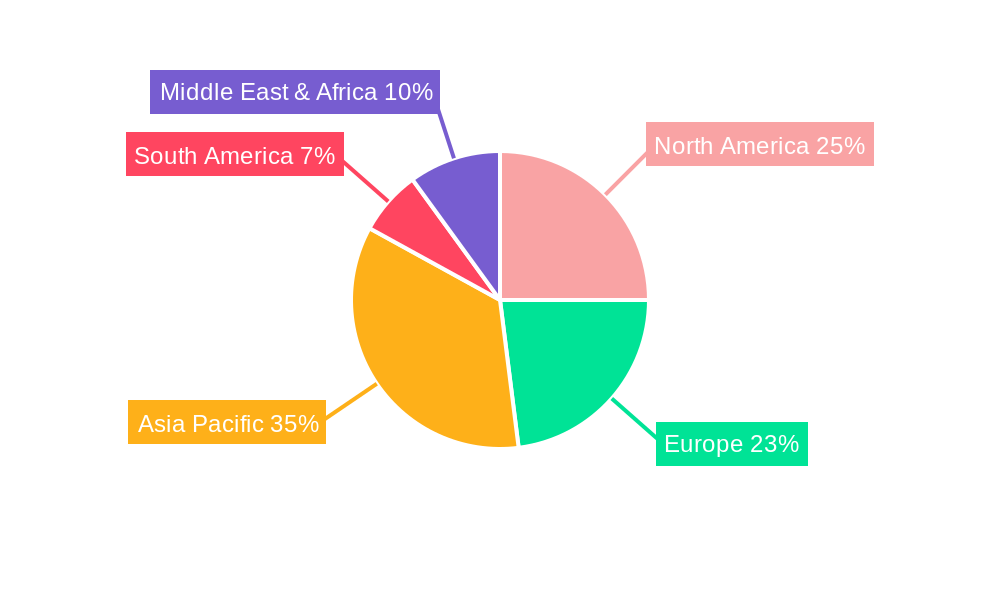

Vinyl Flooring and Vinyl TilesVinyl Flooring and Vinyl Tiles by Type (Vinyl Flooring, Vinyl Tiles), by Application (Resident, Commercial, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

The global Vinyl Flooring and Vinyl Tiles market is poised for substantial growth, projected to reach an estimated \$2169.5 million by 2025. This robust expansion is driven by a confluence of factors, including the increasing demand for durable, water-resistant, and aesthetically versatile flooring solutions across residential and commercial sectors. The market's Compound Annual Growth Rate (CAGR) of 6.6% underscores its dynamism and the strong adoption of vinyl as a preferred material. Key growth drivers include the rising trend of home renovation and interior design upgrades, particularly in emerging economies, and the expanding commercial construction activities, encompassing retail spaces, healthcare facilities, and hospitality establishments. Furthermore, advancements in manufacturing technologies have led to the development of enhanced vinyl products with improved performance characteristics, such as scratch resistance and ease of maintenance, further fueling market penetration. The inherent cost-effectiveness and broad design options, ranging from realistic wood and stone effects to modern abstract patterns, also contribute significantly to its widespread appeal.

The market's trajectory is further shaped by evolving consumer preferences towards sustainable and eco-friendly building materials. While vinyl flooring has traditionally faced some environmental scrutiny, manufacturers are increasingly focusing on sustainable production processes and offering products with reduced volatile organic compound (VOC) emissions. The market is segmented into Vinyl Flooring and Vinyl Tiles, with both segments experiencing steady demand. Applications span Residential, Commercial, and Others, with commercial applications demonstrating a particularly strong growth impetus due to rapid urbanization and infrastructure development. Geographically, the Asia Pacific region is anticipated to be a major growth engine, propelled by rapid economic development, increasing disposable incomes, and burgeoning construction projects in countries like China and India. North America and Europe remain significant markets, characterized by mature construction industries and a strong preference for high-quality, aesthetically pleasing flooring. Competitive strategies among key players like Tarkett, Armstrong, Gerflor, and Mohawk are centered around product innovation, strategic partnerships, and expanding distribution networks to capitalize on these market opportunities.

The global vinyl flooring and vinyl tiles market is poised for substantial growth, driven by a confluence of aesthetic appeal, functional benefits, and evolving consumer preferences. Our comprehensive analysis, spanning the Study Period 2019-2033, with a Base Year of 2025 and an Estimated Year also of 2025, and a Forecast Period from 2025-2033, reveals a market dynamic characterized by innovation and increasing adoption across diverse sectors. During the Historical Period 2019-2024, the market demonstrated resilience and steady expansion, laying a strong foundation for future gains. A key insight from our research is the escalating demand for Luxury Vinyl Tile (LVT) and Luxury Vinyl Plank (LVP) formats, which offer realistic wood and stone aesthetics coupled with superior durability and water resistance. These products are increasingly favored over traditional materials in both residential and commercial spaces due to their cost-effectiveness and ease of maintenance. The market is also witnessing a significant trend towards eco-friendly and sustainable vinyl solutions, with manufacturers investing heavily in recyclable materials and low-VOC (Volatile Organic Compound) formulations. This aligns with a global push for greener building practices and healthier indoor environments. Furthermore, advancements in printing and embossing technologies are enabling manufacturers to create vinyl products that are virtually indistinguishable from natural materials, offering a wider range of design possibilities to architects, interior designers, and end-users. The integration of antimicrobial properties and enhanced scratch resistance in newer vinyl products is another significant trend, particularly relevant for high-traffic commercial areas such as healthcare facilities, educational institutions, and retail spaces. The market's trajectory is further shaped by the growing popularity of DIY installations, facilitated by click-lock and peel-and-stick vinyl solutions, which appeal to homeowners seeking cost-effective renovation options. This trend is particularly prominent in the residential segment. The increasing urbanization and the subsequent demand for new construction and renovation projects, especially in emerging economies, will continue to fuel market expansion. The versatility of vinyl, available in various forms from sheets to tiles and planks, caters to a broad spectrum of design requirements and budget constraints, ensuring its continued relevance and dominance in the flooring industry. The projected market size is expected to reach billions of units within the forecast period, underscoring its significant economic impact and potential for sustained growth.

Several powerful forces are actively propelling the global vinyl flooring and vinyl tiles market towards sustained expansion. Foremost among these is the escalating demand for aesthetically pleasing and versatile flooring options. Modern vinyl products, especially Luxury Vinyl Tile (LVT) and Luxury Vinyl Plank (LVP), offer an unparalleled range of realistic wood, stone, and tile designs, catering to diverse interior design trends and consumer preferences. This ability to mimic the look of premium materials at a fraction of the cost is a significant draw. Secondly, the inherent durability and low maintenance requirements of vinyl are crucial drivers, particularly in high-traffic residential and commercial environments. Its resistance to moisture, scratches, and stains makes it an ideal choice for kitchens, bathrooms, hallways, and busy public spaces, reducing the need for frequent replacements and costly upkeep. The growing awareness and demand for sustainable and eco-friendly building materials also play a vital role. Manufacturers are increasingly investing in the development of vinyl products that are recyclable, made from recycled content, and emit low levels of VOCs, aligning with stricter environmental regulations and consumer consciousness. Furthermore, the cost-effectiveness of vinyl flooring compared to traditional materials like hardwood, natural stone, or even high-quality laminate, makes it an attractive option for budget-conscious consumers and developers. The ease of installation, with many LVT and LVP products featuring click-lock or peel-and-stick systems, further democratizes its use, encouraging both professional installers and DIY enthusiasts. Economic factors, including ongoing urbanization, a steady stream of new construction projects, and a robust renovation market, provide a consistent demand base for flooring solutions, with vinyl being a leading contender. The sheer versatility of vinyl, available in sheets, tiles, and planks, allows it to be adapted to a vast array of applications, from residential homes to complex commercial settings, thereby broadening its market penetration.

Despite the robust growth trajectory, the vinyl flooring and vinyl tiles market is not without its challenges and restraints. A primary concern revolves around the environmental perception and potential impact of PVC (polyvinyl chloride) as a raw material. Although manufacturers are increasingly focusing on sustainable practices, the production and disposal of PVC products can still raise environmental questions, leading to a preference for alternative, perceived greener materials in some segments. This can be a significant restraint, particularly in regions with stringent environmental regulations or heightened consumer awareness regarding plastic waste. Another challenge lies in the price volatility of raw materials, such as petrochemicals, which are essential for vinyl production. Fluctuations in the global oil market can directly impact manufacturing costs and, consequently, the pricing of finished vinyl flooring products, potentially affecting market competitiveness. Furthermore, the market faces intense competition from a wide array of alternative flooring solutions, including laminate, engineered wood, ceramic tiles, and even newer innovative materials. Each of these alternatives offers its own set of advantages, and a significant portion of the market share can be swayed by price, performance, or aesthetic trends favoring competing products. The long-term durability and aesthetic appeal of vinyl, while generally strong, can also be perceived as inferior to natural materials like hardwood or stone by a segment of consumers who prioritize longevity and intrinsic value over initial cost and convenience. Over time, some vinyl products may be susceptible to fading from prolonged UV exposure or significant damage from very heavy or sharp objects, which can limit their appeal in certain high-end or specialized applications. Finally, while DIY installation is a growth driver, improper installation can lead to issues like lifting, gapping, or premature wear, potentially tarnishing the reputation of vinyl flooring if widespread problems arise, thus requiring robust consumer education and quality control from manufacturers.

The Commercial application segment is poised for significant dominance within the global vinyl flooring and vinyl tiles market, driven by the unique demands and evolving trends in various commercial environments. This segment encompasses a wide array of spaces, including offices, retail stores, healthcare facilities, educational institutions, hospitality venues, and public transportation hubs. The sheer volume and recurring nature of flooring needs in these high-traffic areas contribute substantially to market demand.

Commercial Applications: Dominating Force

The dominance of the commercial segment is further amplified by several underlying factors:

The Vinyl Tiles format within the commercial application segment is expected to be a particular powerhouse. The modularity of vinyl tiles allows for easier customization of designs, quicker replacement of damaged sections without disrupting the entire floor, and greater design flexibility for complex layouts often found in commercial spaces. This segment's ability to offer both high performance and aesthetic appeal at a competitive price point firmly establishes its leading position in the global market.

The vinyl flooring and vinyl tiles industry is experiencing robust growth fueled by several key catalysts. The increasing consumer demand for aesthetically versatile and durable flooring solutions that mimic natural materials like wood and stone at a more affordable price point is a primary driver. Innovations in LVT and LVP, offering realistic designs and enhanced performance features such as water and scratch resistance, are further broadening their appeal. Growing environmental consciousness is also acting as a catalyst, with manufacturers actively developing sustainable and low-VOC vinyl products, meeting the demand for healthier and eco-friendly building materials. The ease of installation offered by many vinyl products, catering to both professional installers and the burgeoning DIY market, significantly lowers barriers to adoption. Furthermore, the continuous growth in the construction and renovation sectors globally, coupled with urbanization, creates a sustained demand for flooring solutions, with vinyl being a cost-effective and practical choice for both residential and commercial projects.

This comprehensive report delves deep into the global vinyl flooring and vinyl tiles market, offering an in-depth analysis for the Study Period 2019-2033. With a Base Year of 2025 and an Estimated Year of 2025, the report provides granular insights into market dynamics, trends, drivers, challenges, and future projections. The Forecast Period 2025-2033 details expected market growth and key developments. The report meticulously examines different Types such as Vinyl Flooring and Vinyl Tiles, and analyzes their adoption across various Applications, including Residential, Commercial, and Others. It also highlights Industry Developments and significant innovations shaping the market landscape. Through this comprehensive coverage, stakeholders will gain a clear understanding of market opportunities, competitive strategies, and the evolving consumer preferences that are dictating the future of the vinyl flooring industry. The analysis includes extensive data, market sizing in millions of units, and expert commentary to guide strategic decision-making for manufacturers, distributors, and end-users.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.6% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 6.6%.

Key companies in the market include Tarkett, Armstrong, Gerflor, Polyflor, Serfleks, Forbo, Nox, Mannington, Takiron, Congoleum, Grabo, Prolong, Mohawk(including IVC), BIG, Yihua, Windm?ller Flooring, Tinsue, Dajulong, Weilianshun, Waiming, BEIJING LITONG, Suzhou Huatai, Taoshi, Liberty, Hebei Dongxing, .

The market segments include Type, Application.

The market size is estimated to be USD 2169.5 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Vinyl Flooring and Vinyl Tiles," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Vinyl Flooring and Vinyl Tiles, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.